Please complete a general ledge, thanks

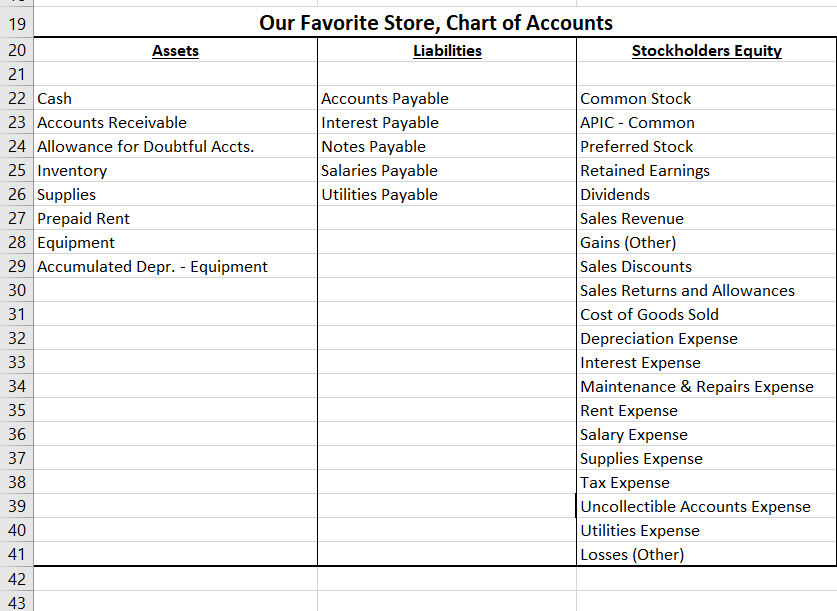

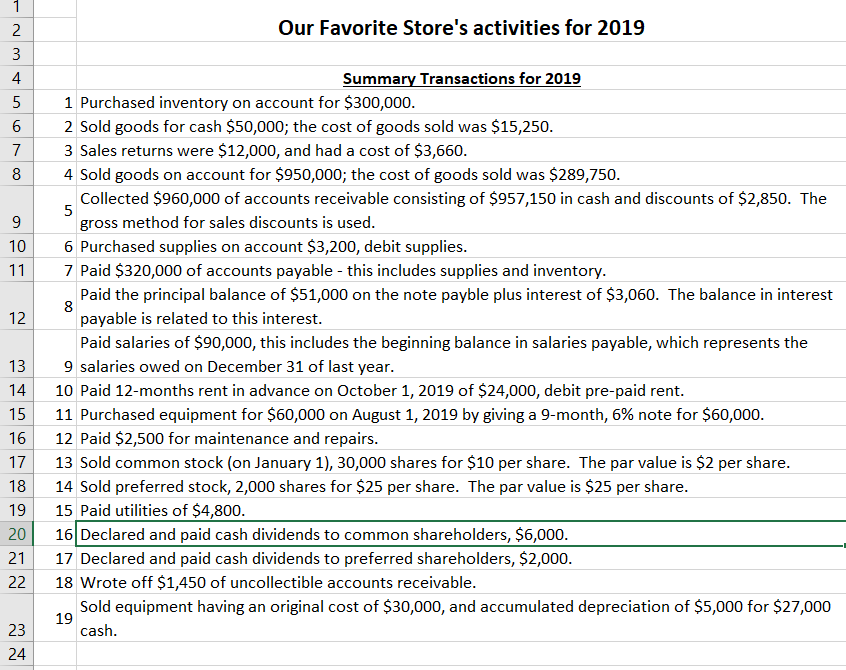

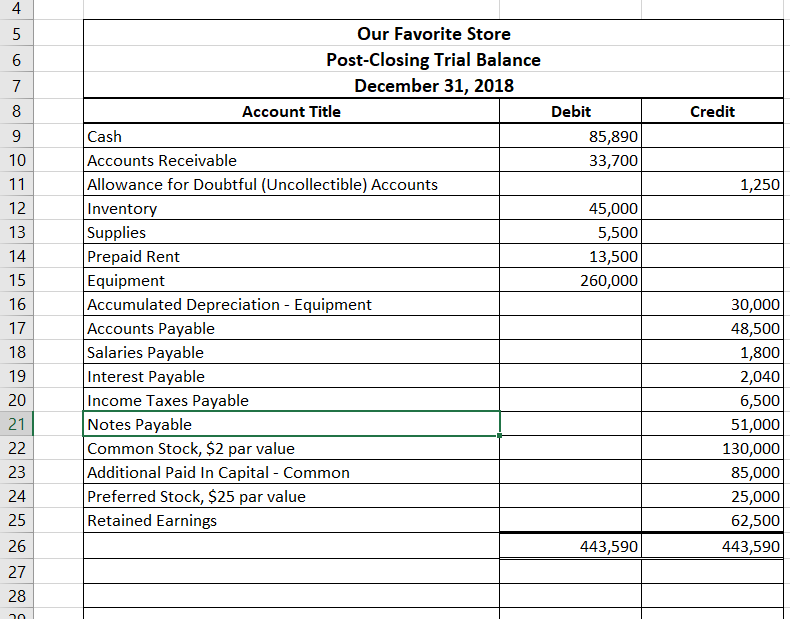

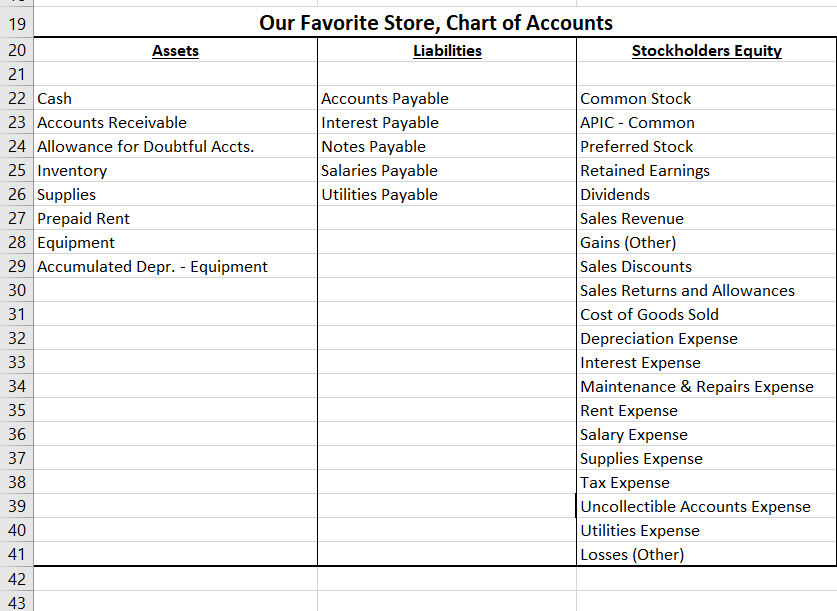

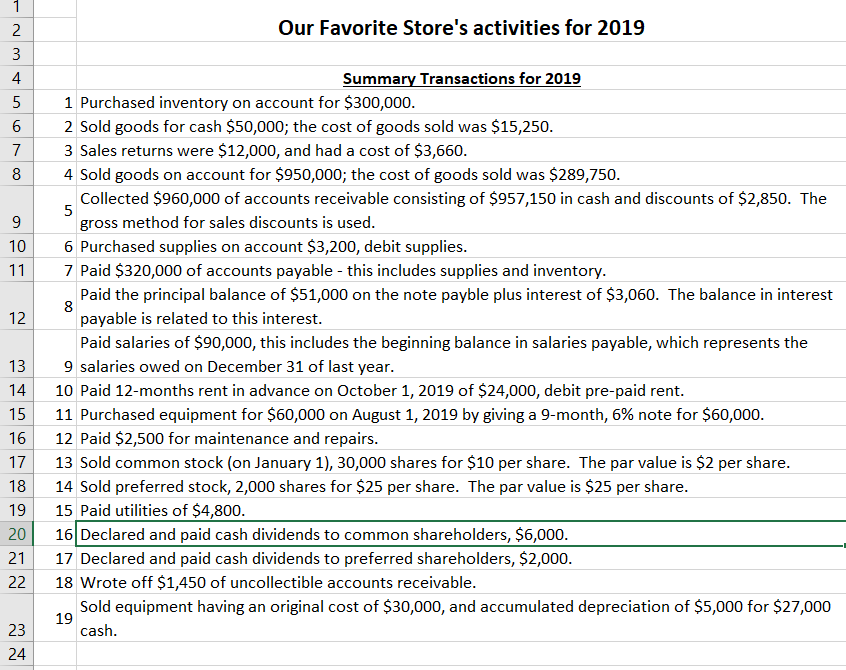

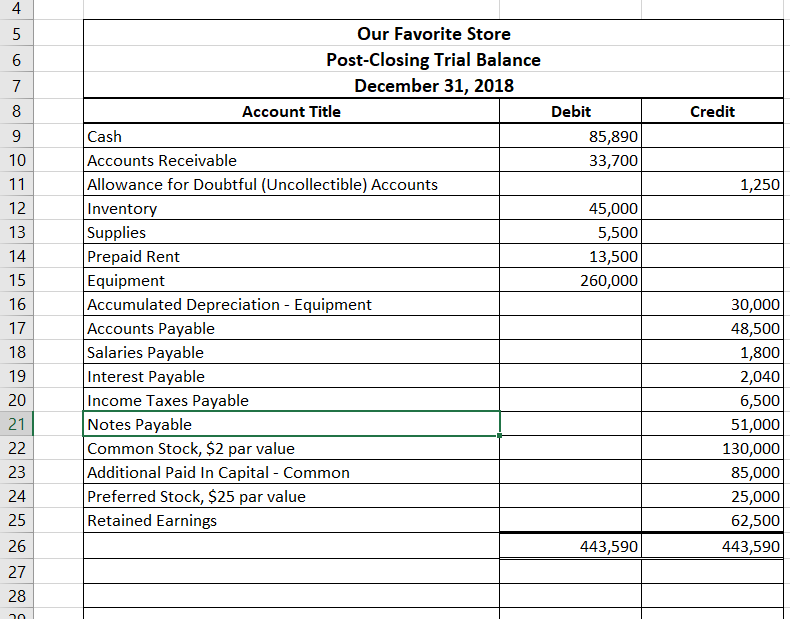

19 Our Favorite Store, Chart of Accounts 20 Assets Liabilities Stockholders Equity 21 22 Cash Accounts Payable Common Stock 23 Accounts Receivable Interest Payable APIC - Common 24 Allowance for Doubtful Accts. Notes Payable Preferred Stock 25 Inventory Salaries Payable Retained Earnings 26 Supplies Utilities Payable Dividends 27 Prepaid Rent Sales Revenue 28 Equipment Gains (Other) 29 Accumulated Depr. - Equipment Sales Discounts 30 Sales Returns and Allowances 31 Cost of Goods Sold 32 Depreciation Expense 33 Interest Expense 34 Maintenance & Repairs Expense 35 Rent Expense 36 Salary Expense 37 Supplies Expense 38 Tax Expense 39 Uncollectible Accounts Expense 40 Utilities Expense 41 Losses (Other) 42 43 Our Favorite Store's activities for 2019 1 2 3 4 5 6 7 8 6 oo 9 10 11 12 Summary Transactions for 2019 1 Purchased inventory on account for $300,000. 2 Sold goods for cash $50,000; the cost of goods sold was $15,250. 3 Sales returns were $12,000, and had a cost of $3,660. 4 Sold goods on account for $950,000; the cost of goods sold was $289,750. Collected $960,000 of accounts receivable consisting of $957,150 in cash and discounts of $2,850. The 5 gross method for sales discounts is used. 6 Purchased supplies on account $3,200, debit supplies. 7 Paid $320,000 of accounts payable - this includes supplies and inventory. Paid the principal balance of $51,000 on the note payble plus interest of $3,060. The balance in interest 8 payable is related to this interest. Paid salaries of $90,000, this includes the beginning balance in salaries payable, which represents the 9 salaries owed on December 31 of last year. 10 Paid 12-months rent in advance on October 1, 2019 of $24,000, debit pre-paid rent. 11 Purchased equipment for $60,000 on August 1, 2019 by giving a 9-month, 6% note for $60,000. 12 Paid $2,500 for maintenance and repairs. 13 Sold common stock (on January 1), 30,000 shares for $10 per share. The par value is $2 per share. 14 Sold preferred stock, 2,000 shares for $25 per share. The par value is $25 per share. 15 Paid utilities of $4,800. 16 Declared and paid cash dividends to common shareholders, $6,000. 17 Declared and paid cash dividends to preferred shareholders, $2,000. 18 Wrote off $1,450 of uncollectible accounts receivable. Sold equipment having an original cost of $30,000, and accumulated depreciation of $5,000 for $27,000 19 cash. 13 14 15 16 17 18 19 20 21 22 23 24 4 5 6 Credit 7 8 9 10 11 Debit 85,890 33,700 1,250 12 Our Favorite Store Post-Closing Trial Balance December 31, 2018 Account Title Cash Accounts Receivable Allowance for Doubtful (Uncollectible) Accounts Inventory Supplies Prepaid Rent Equipment Accumulated Depreciation - Equipment Accounts Payable Salaries Payable Interest Payable Income Taxes Payable Notes Payable Common Stock, $2 par value Additional Paid In Capital - Common Preferred Stock, $25 par value Retained Earnings 45,000 5,500 13,500 260,000 13 14 15 16 17 18 19 20 21 22 23 24 25 26 30,000 48,500 1,800 2,040 6,500 51,000 130,000 85,000 25,000 62,500 443,590 443,590 27 28 20