please complete all of the requirements. Thank you

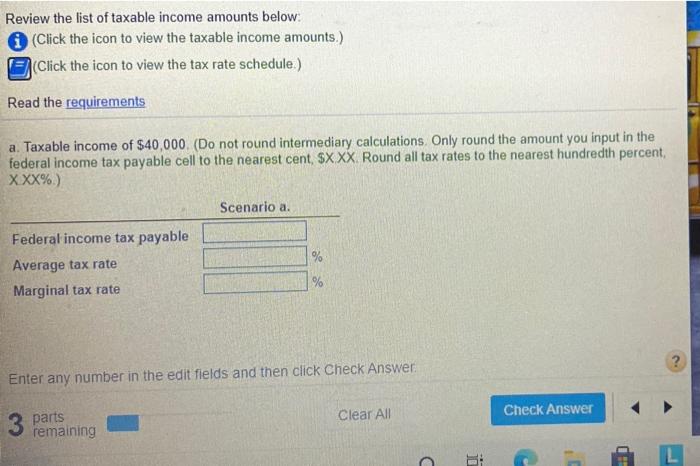

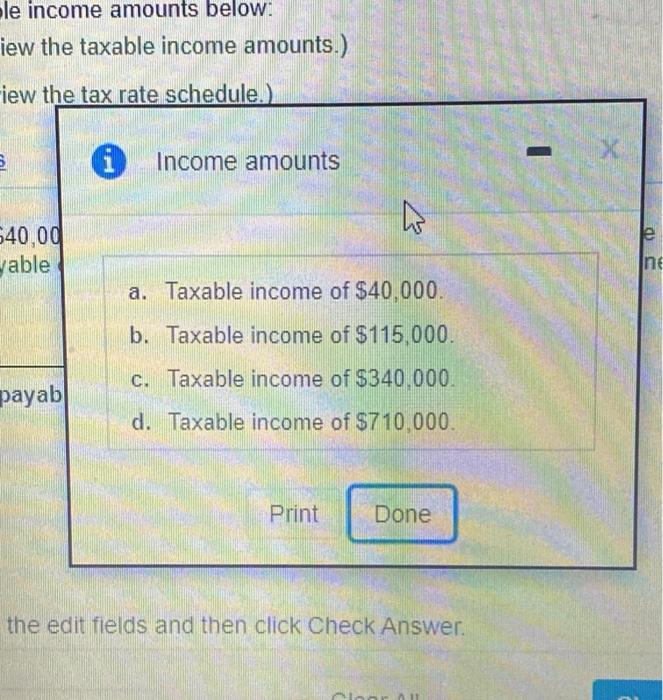

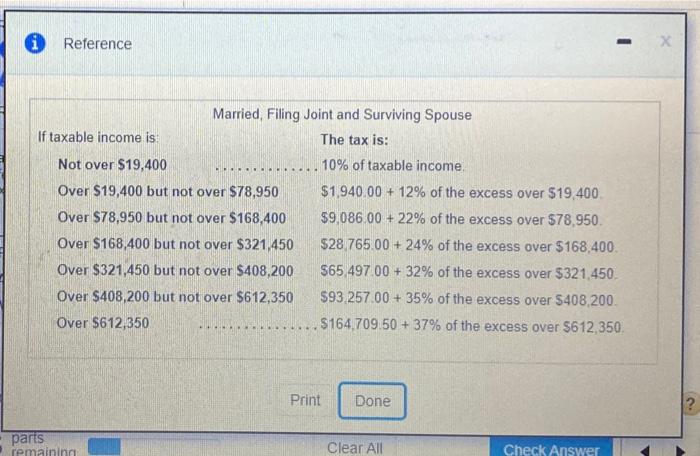

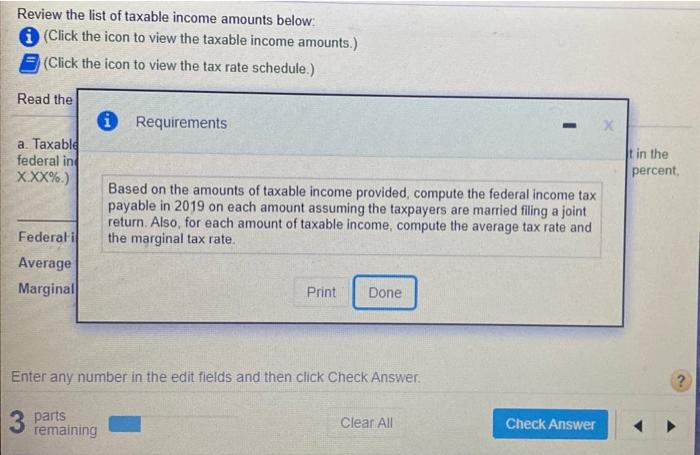

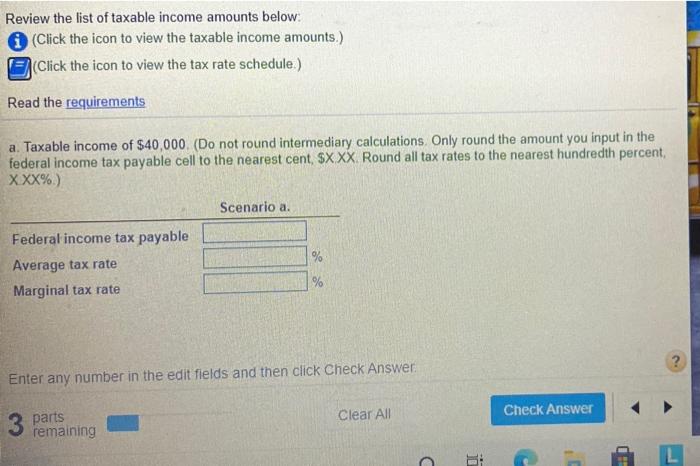

Review the list of taxable income amounts below: (Click the icon to view the taxable income amounts.) Click the icon to view the tax rate schedule.) Read the requirements a. Taxable income of $40,000. (Do not round intermediary calculations. Only round the amount you input in the federal income tax payable cell to the nearest cent, $XXX. Round all tax rates to the nearest hundredth percent, XXX%) Scenario a. % Federal income tax payable Average tax rate Marginal tax rate % ? Enter any number in the edit fields and then click Check Answer Clear All Check Answer 3 parts remaining i C ble income amounts below: iew the taxable income amounts.) Fiew the tax rate schedule.). X. Income amounts 540,00 able le Inc a. Taxable income of $40,000. b. Taxable income of $115,000. c. Taxable income of $340,000. payab d. Taxable income of $710.000. Print Done the edit fields and then click Check Answer * Reference . Married, Filing Joint and Surviving Spouse If taxable income is The tax is: Not over $19,400 10% of taxable income Over $19,400 but not over $78,950 $1,940.00 + 12% of the excess over $19,400 Over $78,950 but not over $168,400 $9,086.00 + 22% of the excess over $78,950 Over $168,400 but not over $321,450 $28,765.00 +24% of the excess over $168.400 Over $321,450 but not over $408,200 $65 497.00 + 32% of the excess over $321,450 Over $408,200 but not over $612,350 $93 257.00 + 35% of the excess over $408.200 Over $612,350 $164.709.50 + 37% of the excess over $612,350 . Print Done ? parts remaining Clear All Check Answer Review the list of taxable income amounts below: (Click the icon to view the taxable income amounts.) (Click the icon to view the tax rate schedule.) Read the Requirements a Taxable federal in X.XX%.) t in the percent Based on the amounts of taxable income provided, compute the federal income tax payable in 2019 on each amount assuming the taxpayers are married filing a joint return. Also, for each amount of taxable income, compute the average tax rate and the marginal tax rate Federali Average Marginal Print Done Enter any number in the edit fields and then click Check Answer. 3 parts remaining Clear All Check