please complete all required 1 2 and 3

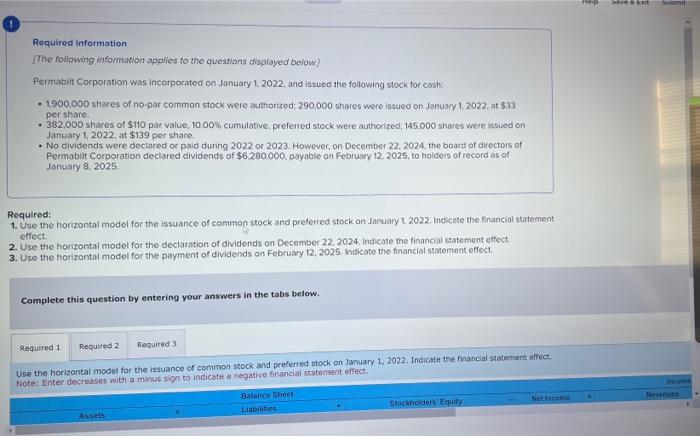

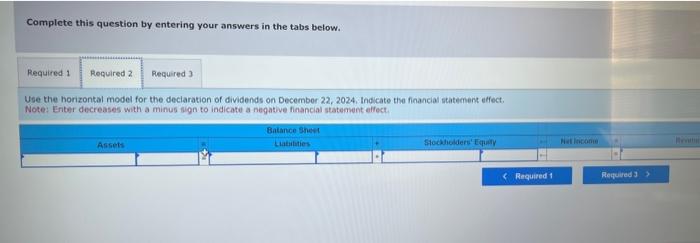

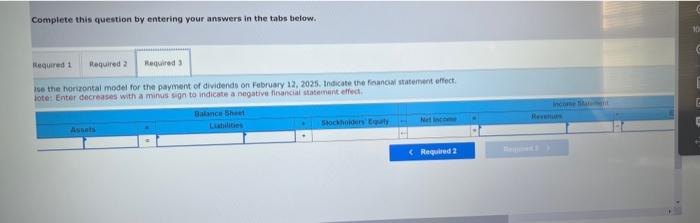

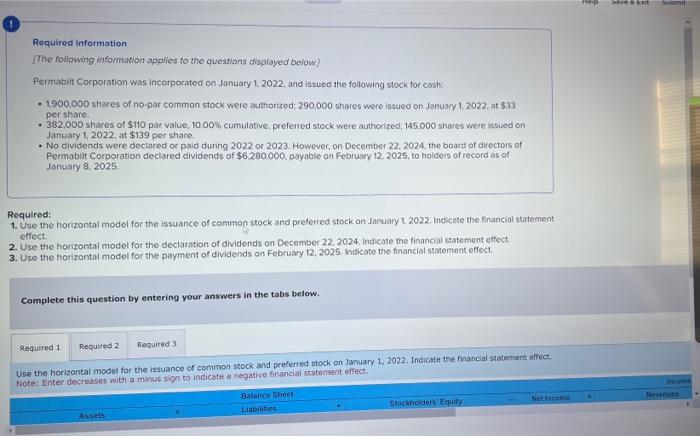

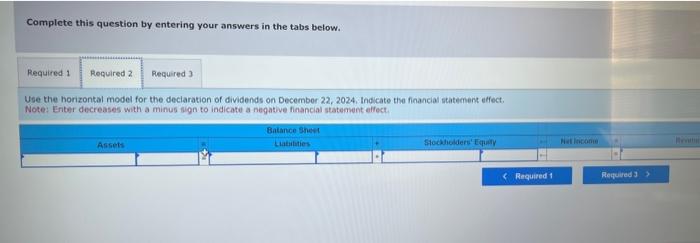

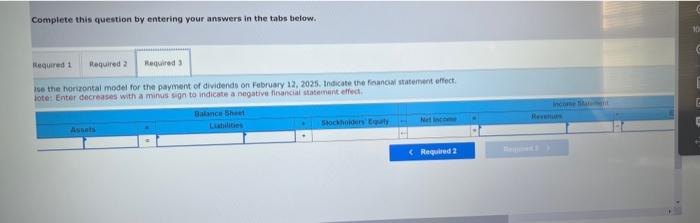

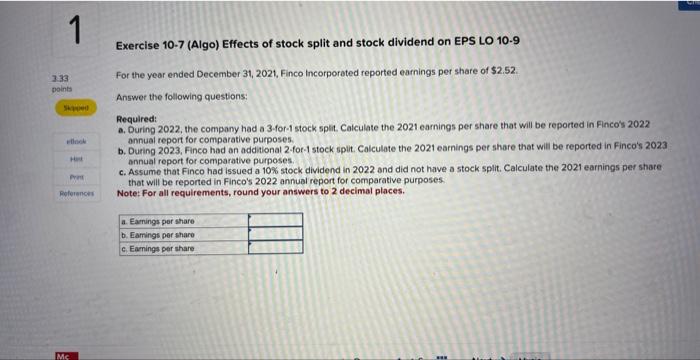

Required information [The following information applies to the questions displayed belowi] Permabit Corporation was incorporated on January 1, 2022, and issued the following stock for cash. - 1,900,000 shares of no-par common stock were authorized; 290,000 shares were issued on January 1, 2022, at $33 per share. - 382,000 shares of $110 par value, 10.00\% cumulative, preferred stock were authorized, 145.000 shases were issued on January 1, 2022, at $139 per share - No dividends were deciared or paid during 2022 or 2023 . However, on December 22,2024 , the board of directors of Permabit Corporation declared clividends of $6.280.000, oayable on February 12,2025 , to holders of record as of January 8, 2025. Requlred: 1. Use the horizontal model for the issuance of common stock and preferred stock on January 2022 , Indicote the financial statement. 2. Use the horizontal model for the deciaration of dividends on December 22, 2024. indicate the financial saatement effect. effect. 3. Use the horizontal model for the payment of dividends on February 12, 2025, hadicate the financial statement effect. Complete this question by entering your answers in the tabs below. Use the horizontal model for the issuance of common stock and preferred stock on January 1, 202z. Incicate the fatrical statement effect. Complete this question by entering your answers in the tabs below. Use the horizontal model for the deciaration of dividends on December 22, 2024, Indicate the financial statement effect. Note: Eniter decreases with a minus agn to indicate a negative financial statenvent elfect. Complete this question by entering your answers in the tabs below. Ise the horizontal model for the payment of dividends on February 12 , 2025. tndicate the fiaancal statement effect. lote: Enter decreases with a mincis sign to indicate a negative financial statement elfect. Exercise 10-7 (Algo) Effects of stock split and stock dividend on EPS LO 10.9 For the year ended December 31,2021 , Finco incorporated reported earnings per share of $2.52. Answer the following questions: Required: a. During 2022, the company had a 3-for-1 stock split. Caiculate the 2021 earnings per share that will be reported in Finco's 2022 annual report for comparative purposes. b. During 2023. Finco had an additional 2 -for-1 stock split. Calculate the 2021 earnings per share that will be reported in Finco's 2023 annual report for comparative purposes. c. Assume that Finco had issued a 10% stock dividend in 2022 and did not have a stock split. Calculate the 2021 earnings per share that will be reported in Finco's 2022 annual report for comparative purposes. Note: For all requirements, round your answers to 2 decimal places. Required information [The following information applies to the questions displayed belowi] Permabit Corporation was incorporated on January 1, 2022, and issued the following stock for cash. - 1,900,000 shares of no-par common stock were authorized; 290,000 shares were issued on January 1, 2022, at $33 per share. - 382,000 shares of $110 par value, 10.00\% cumulative, preferred stock were authorized, 145.000 shases were issued on January 1, 2022, at $139 per share - No dividends were deciared or paid during 2022 or 2023 . However, on December 22,2024 , the board of directors of Permabit Corporation declared clividends of $6.280.000, oayable on February 12,2025 , to holders of record as of January 8, 2025. Requlred: 1. Use the horizontal model for the issuance of common stock and preferred stock on January 2022 , Indicote the financial statement. 2. Use the horizontal model for the deciaration of dividends on December 22, 2024. indicate the financial saatement effect. effect. 3. Use the horizontal model for the payment of dividends on February 12, 2025, hadicate the financial statement effect. Complete this question by entering your answers in the tabs below. Use the horizontal model for the issuance of common stock and preferred stock on January 1, 202z. Incicate the fatrical statement effect. Complete this question by entering your answers in the tabs below. Use the horizontal model for the deciaration of dividends on December 22, 2024, Indicate the financial statement effect. Note: Eniter decreases with a minus agn to indicate a negative financial statenvent elfect. Complete this question by entering your answers in the tabs below. Ise the horizontal model for the payment of dividends on February 12 , 2025. tndicate the fiaancal statement effect. lote: Enter decreases with a mincis sign to indicate a negative financial statement elfect. Exercise 10-7 (Algo) Effects of stock split and stock dividend on EPS LO 10.9 For the year ended December 31,2021 , Finco incorporated reported earnings per share of $2.52. Answer the following questions: Required: a. During 2022, the company had a 3-for-1 stock split. Caiculate the 2021 earnings per share that will be reported in Finco's 2022 annual report for comparative purposes. b. During 2023. Finco had an additional 2 -for-1 stock split. Calculate the 2021 earnings per share that will be reported in Finco's 2023 annual report for comparative purposes. c. Assume that Finco had issued a 10% stock dividend in 2022 and did not have a stock split. Calculate the 2021 earnings per share that will be reported in Finco's 2022 annual report for comparative purposes. Note: For all requirements, round your answers to 2 decimal places