please complete all requirements

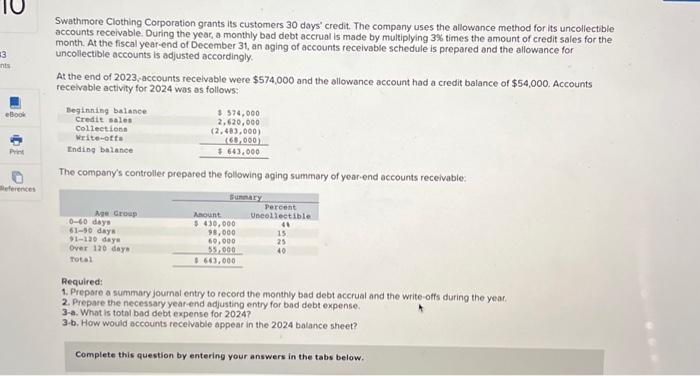

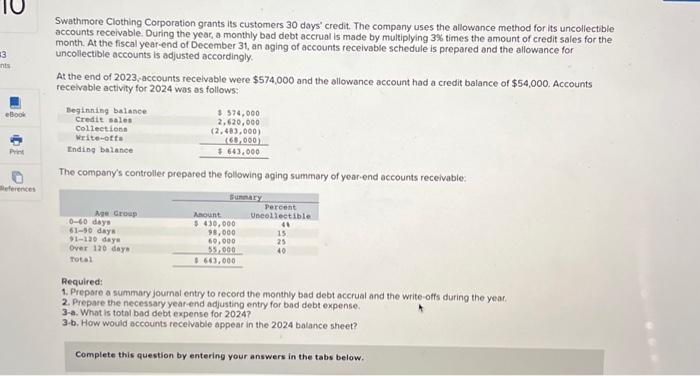

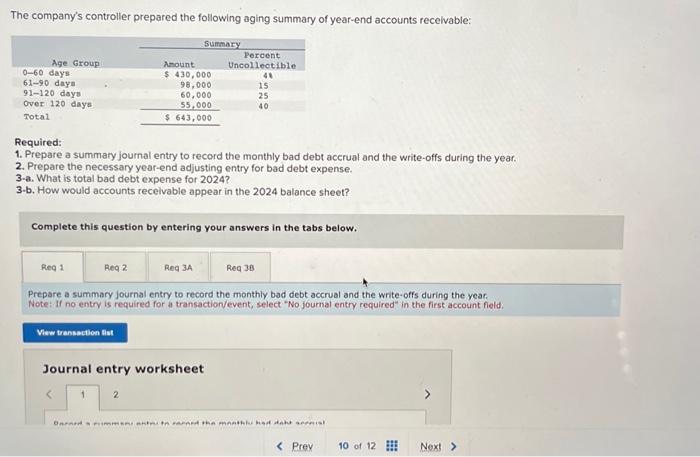

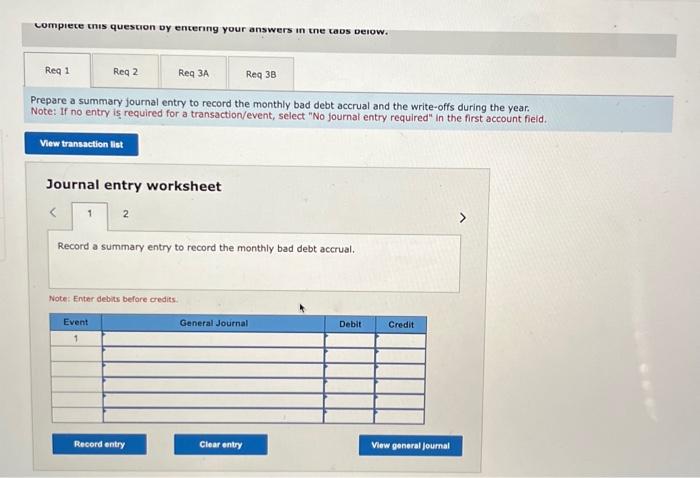

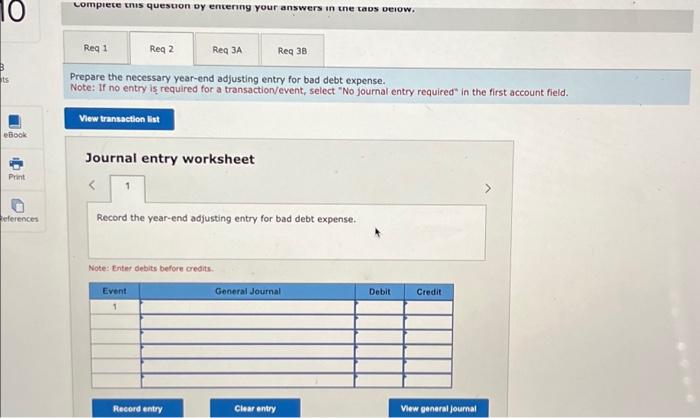

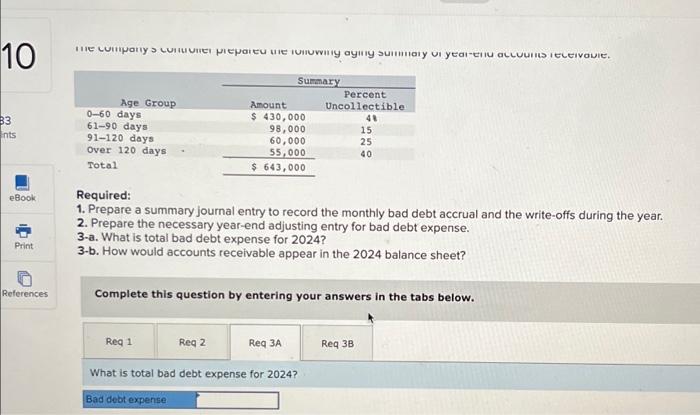

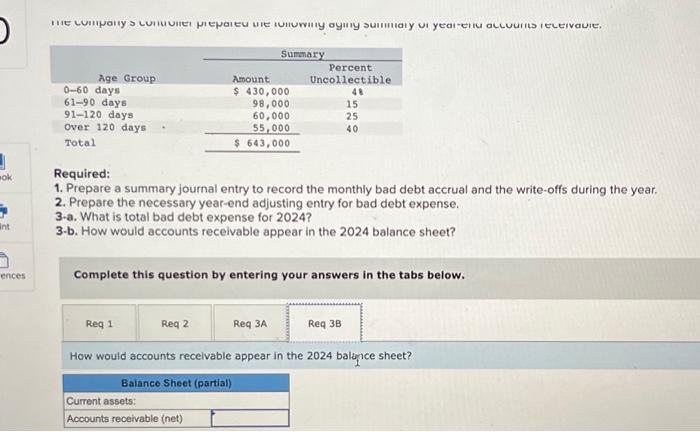

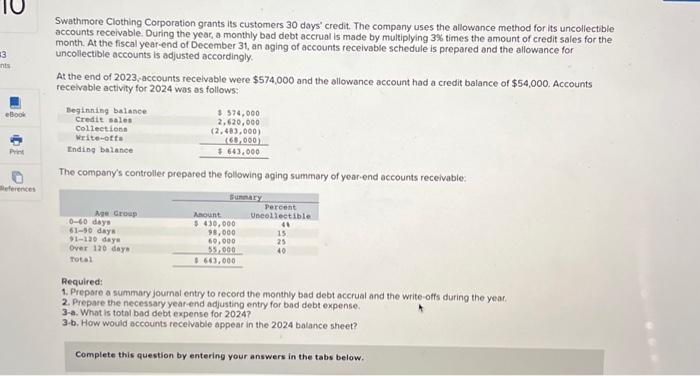

Swathmore Clothing Corporation grants its customers 30 days' credit. The company uses the allowance method for its uncollectible accounts receivable. During the year, a monthly bad debt accrual is made by multiplying 3% times the amount of credit sales for the month. At the fiscal year-end of December 31 , an aging of accounts receivable schedule is prepared and the allowance for uncollectible accounts is adjusted accordingly. At the end of 2023 , accounts recelvable were $574,000 and the allowance account had a credit balance of $54,000. Accounts recelvable activity for 2024 was as follows: The company's controller prepared the following aging summary of year-end accounts receivable: Required: 1. Prepare a summary journol entry to record the monthly bad debt accrual and the write-offs during the year. 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3-a. What is total bad debt expense for 2024 ? 3.b. How would occounts receivable appear in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3-a. What is total bad debt expense for 2024 ? 3-b. How would accounts recelvable appear in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. How would accounts recelvable appear in the 2024 balance sheet? compiece this question oy entering your answers in the caos beiow. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. Note: If no entry is required for a transaction/event, select "No journal entry required" In the first account fieid Journal entry worksheet Record a summary entry to record the monthly bad debt accrual. Note: Enter debits before credits. Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3-a. What is total bad debt expense for 2024 ? 3-b. How would accounts receivable appear in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. What is total bad debt expense for 2024? Complete tus question oy entering your answers in the tabs oetow. Prepare the necessary year-end adjusting entry for bad debt expense. Note: If no entry is required for a transactionvevent, select "No journal entry required" in the first account field. Journal entry worksheet Record the year-end adjusting entry for bad debt expense. Note: Enter debits before credits. The company's controller prepared the following aging summary of year-end accounts recelvable: Required: 1. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. 2. Prepare the necessary year-end adjusting entry for bad debt expense. 3-a. What is total bad debt expense for 2024 ? 3-b. How would accounts recelvable appear in the 2024 balance sheet? Complete this question by entering your answers in the tabs below. Prepare a summary journal entry to record the monthly bad debt accrual and the write-offs during the year. Note: if no entry is required for a transaction/ event, select "No journal entry required" in the first account field. Journal entry worksheet 2