Please complete all tables and show all formulas: please 1 and 2. Thanks

Continue to 250 and show formulas. Thanks!

Continue to 250 and show formulas. Thanks!

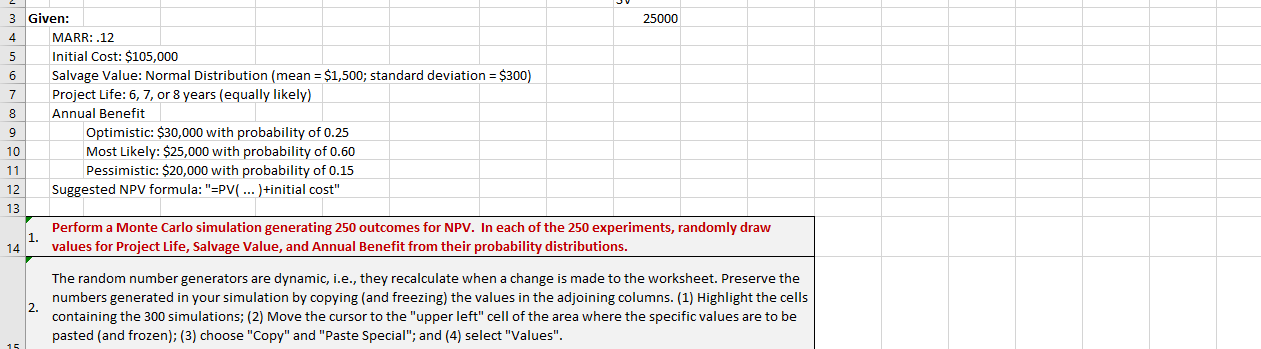

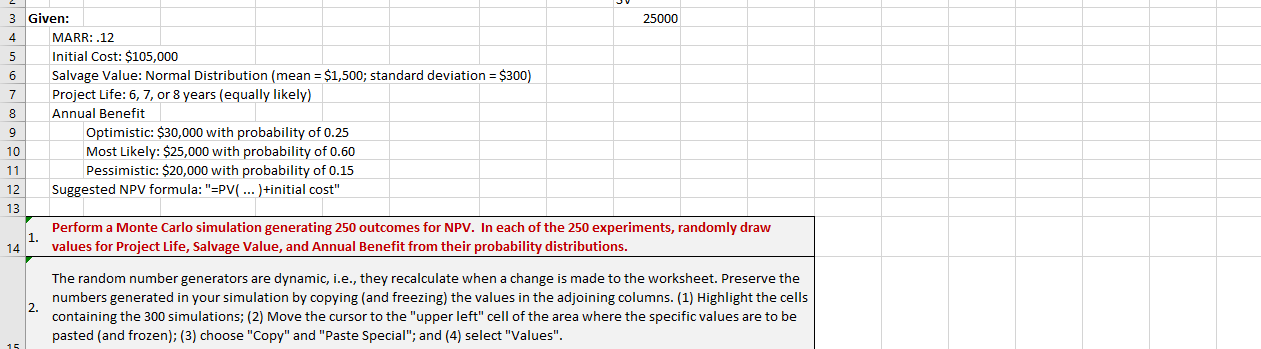

3 Given: 25000 4 MARR: .12 5 Initial Cost: $105,000 6 Salvage Value: Normal Distribution (mean = $1,500; standard deviation = $300) 7 Project Life: 6, 7, or 8 years (equally likely) 8 Annual Benefit 9 Optimistic: $30,000 with probability of 0.25 10 Most Likely: $25,000 with probability of 0.60 11 Pessimistic: $20,000 with probability of 0.15 12 Suggested NPV formula: "=PV( ... )+initial cost" 13 Perform a Monte Carlo simulation generating 250 outcomes for NPV. In each of the 250 experiments, randomly draw 14 values for Project Life, Salvage Value, and Annual Benefit from their probability distributions. 2. The random number generators are dynamic, i.e., they recalculate when a change is made to the worksheet. Preserve the numbers generated in your simulation by copying (and freezing) the values in the adjoining columns. (1) Highlight the cells containing the 300 simulations; (2) Move the cursor to the "upper left" cell of the area where the specific values are to be pasted (and frozen); (3) choose "Copy" and "Paste Special"; and (4) select "Values". Probability Cum (2) Prob 23 24 Reference Table Annual 25 Benefit 26 $20,000 27 $25,000 28 $30,000 29 30 MARR = 31 32 0.12 33 Enter Formulas Here Annual Salvage Benefit Value Paste Values Here Annual Salvage Benefit Value Initial Cost N NPV N NPV 1 2 34 35 36 37 38 39 3 4 5 6 40 41 7 42 8 9 43 44 45 10 11 46 12 47 13 14 15 16 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$ 105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105.0001 17 18 48 49 50 51 52 53 54 55 56 57 58 59 19 20 21 22 23 24 25 60 61 62 63 26 27 28 29 30 31 32 64 65 66 3 Given: 25000 4 MARR: .12 5 Initial Cost: $105,000 6 Salvage Value: Normal Distribution (mean = $1,500; standard deviation = $300) 7 Project Life: 6, 7, or 8 years (equally likely) 8 Annual Benefit 9 Optimistic: $30,000 with probability of 0.25 10 Most Likely: $25,000 with probability of 0.60 11 Pessimistic: $20,000 with probability of 0.15 12 Suggested NPV formula: "=PV( ... )+initial cost" 13 Perform a Monte Carlo simulation generating 250 outcomes for NPV. In each of the 250 experiments, randomly draw 14 values for Project Life, Salvage Value, and Annual Benefit from their probability distributions. 2. The random number generators are dynamic, i.e., they recalculate when a change is made to the worksheet. Preserve the numbers generated in your simulation by copying (and freezing) the values in the adjoining columns. (1) Highlight the cells containing the 300 simulations; (2) Move the cursor to the "upper left" cell of the area where the specific values are to be pasted (and frozen); (3) choose "Copy" and "Paste Special"; and (4) select "Values". Probability Cum (2) Prob 23 24 Reference Table Annual 25 Benefit 26 $20,000 27 $25,000 28 $30,000 29 30 MARR = 31 32 0.12 33 Enter Formulas Here Annual Salvage Benefit Value Paste Values Here Annual Salvage Benefit Value Initial Cost N NPV N NPV 1 2 34 35 36 37 38 39 3 4 5 6 40 41 7 42 8 9 43 44 45 10 11 46 12 47 13 14 15 16 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$ 105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105,000 -$105.0001 17 18 48 49 50 51 52 53 54 55 56 57 58 59 19 20 21 22 23 24 25 60 61 62 63 26 27 28 29 30 31 32 64 65 66

Continue to 250 and show formulas. Thanks!

Continue to 250 and show formulas. Thanks!