Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please complete P5-31A, 32A, and 33A. why? 302 chapter 5 > Problems Group A Learning Objectives 1, 2, 3 For all problems, assume the perpetual

Please complete P5-31A, 32A, and 33A.

why?

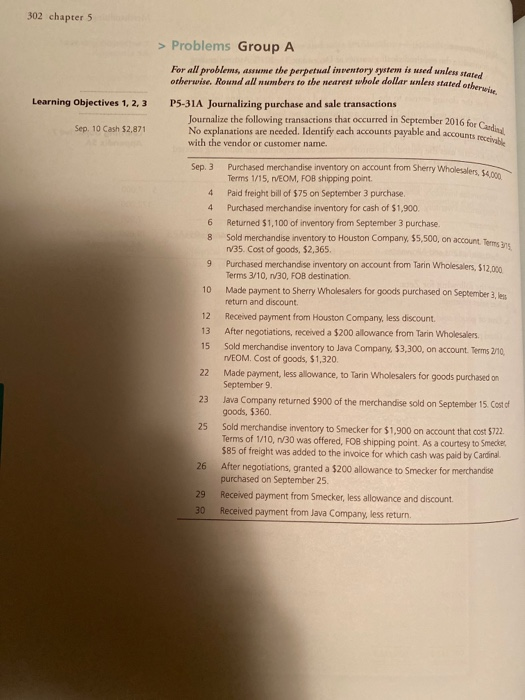

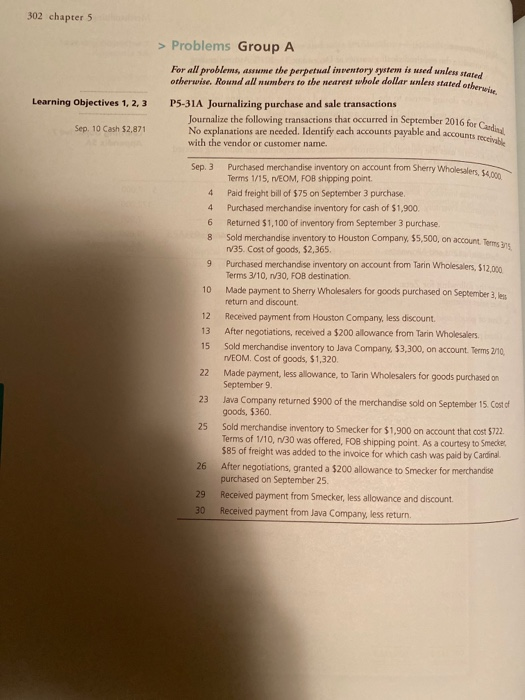

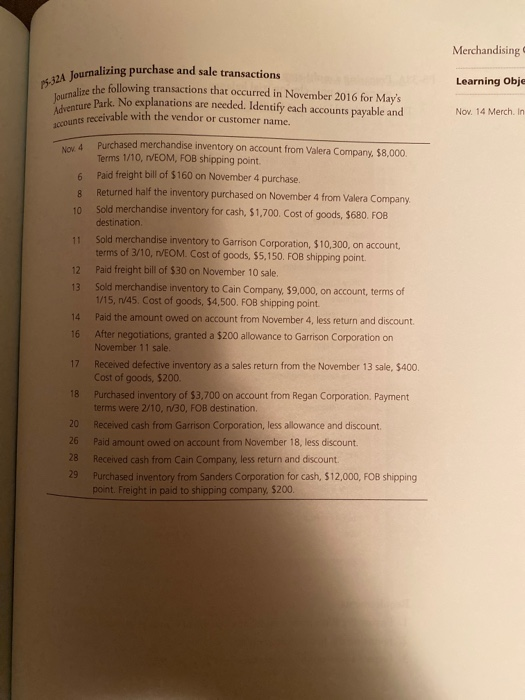

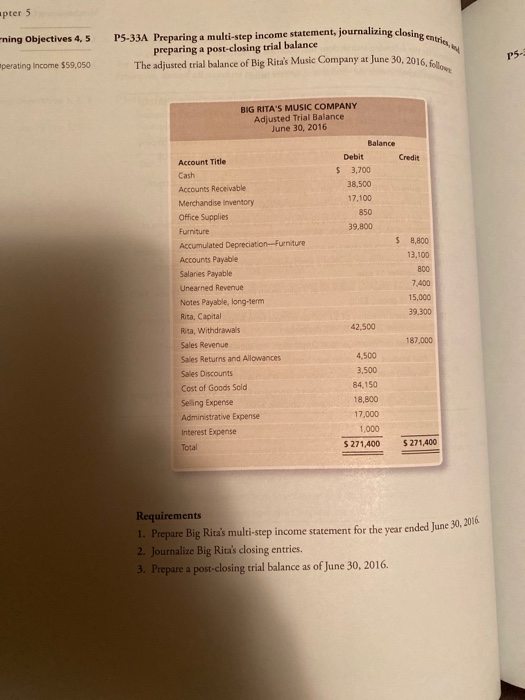

302 chapter 5 > Problems Group A Learning Objectives 1, 2, 3 For all problems, assume the perpetual inventory system is wred nless stated otherwise. Rownd all numbers to the nearest whole dollar unless stated other P5-31A Journalizing purchase and sale transactions Journalize the following transactions that occurred in September 2016 forc No explanations are needed. Identify each accounts payable and accounts with the vendor or customer name. Sep. 10 Cash $2,871 2016 for Cardin accounts receivable Sep 3 4 4 6 8 9 10 12 13 15 Purchased merchandise inventory on account from Sherry Wholesalers Terms 1/15, VEOM, FOB shipping point Paid freight bill of $75 on September 3 purchase Purchased merchandise inventory for cash of $1,900. Returned $1,100 of inventory from September 3 purchase. Sold merchandise inventory to Houston Company, 55,500, on account. Terms TV35. Cost of goods, $2,365. Purchased merchandise inventory on account from Tarin Wholesalers, $12.000 Terms 3/10, 1/30, FOB destination Made payment to Sherry Wholesalers for goods purchased on September 3, les return and discount Received payment from Houston Company, less discount. After negotiations, received a $200 allowance from Tarin Wholesalers. Sold merchandise inventory to Java Company, $3,300, on account. Terms 2/10, TVEOM. Cost of goods, $1,320 Made payment, less allowance, to Tarin Wholesalers for goods purchased on September 9. Java Company returned $900 of the merchandise sold on September 15 Cost of goods, $360. Sold merchandise inventory to Smecker for $1,900 on account that cost 5722 Terms of 1/10, 1/30 was offered, FOB shipping point. As a courtesy to Smecker $85 of freight was added to the invoice for which cash was paid by Cardinal After negotiations, granted a $200 allowance to Smecker for merchandise purchased on September 25. Received payment from Smecker, less allowance and discount Received payment from Java Company, less return 22 23 26 29 30 Merchandising 15.324 Joumali Learning Obje Journalize the follow Journalizing purchase and sale transactions te the following transactions that occurred in November 2016 for May's ure Park. No explanations are needed. Identify each accounts payable and receivable with the vendor or customer name. Nov. 14 Merch. In accounts receivable 6 8 10 11 12 13 14 16 Purchased merchandise inventory on account from Valera Company. 58,000 Terms 1/10, VEOM, FOB shipping point. Paid freight bill of $160 on November 4 purchase. Returned half the inventory purchased on November 4 from Valera Company Sold merchandise inventory for cash, $1,700. Cost of goods, 5680. FOB destination Sold merchandise inventory to Garrison Corporation, $10,300, on account, terms of 3/10, VEOM. Cost of goods, $5.150. FOB shipping point. Paid freight bill of $30 on November 10 sale. Sold merchandise inventory to Cain Company, $9,000, on account, terms of 1/15, 1/45. Cost of goods, $4,500. FOB shipping point Paid the amount owed on account from November 4, less return and discount. After negotiations, granted a $200 allowance to Garrison Corporation on November 11 sale. Received defective inventory as a sales return from the November 13 sale, $400. Cost of goods, $200. Purchased inventory of $3,700 on account from Regan Corporation. Payment terms were 2/10, 1/30, FOB destination Received cash from Garrison Corporation, less allowance and discount. Paid amount owed on account from November 18, less discount. Received cash from Cain Company, less return and discount. Purchased inventory from Sanders Corporation for cash, $12,000, FOB shipping point. Freight in paid to shipping company. $200. 17 18 20 26 28 29 apter 5 ning Objectives 4,5 P5-33A Preparing a multi-step income statement, journalizing closine preparing a post-closing trial balance The adjusted trial balance of Big Rita's Music Company at June 30, 2016 2016, perating Income $59,050 BIG RITA'S MUSIC COMPANY Adjusted Trial Balance June 30, 2016 Balance Debit Credit $ 3.700 38,500 17.100 39,800 $ Account Title Cash Accounts Receivable Merchandise Inventory Office Supplies Furniture Accumulated Depreciation-Furniture Accounts Payable Salaries Payable Unearned Revenue Notes Payable, long-term Rita, Capital Rita, Withdrawals Sales Revenue Sales Returns and Allowances Sales Discounts Cost of Goods Sold Seling Expense Administrative Expense Interest Expense 8,800 13.100 800 7.400 15,000 39.300 42,500 187,000 4.500 3,500 84,150 18,800 17,000 1,000 $ 271,400 $ 271,400 Total Requirements 1. Prepare Big Rita's multi-step income statement for the year ended June 30,- 2. Journalize Big Rita's closing entries. 3. Prepare a post-closing trial balance as of June 30, 2016 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started