Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please complete part 1,2,3,4 everthhing is provided buddy Kunden Corporation has theee divisions: pulp, paper, and fibers. Kunderis new controlor, Until now, Kunden Corporation has

please complete part 1,2,3,4

everthhing is provided buddy

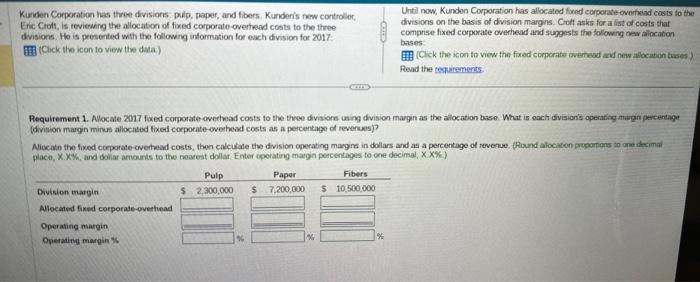

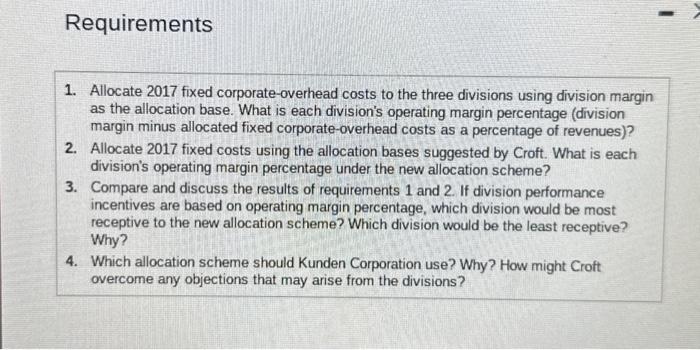

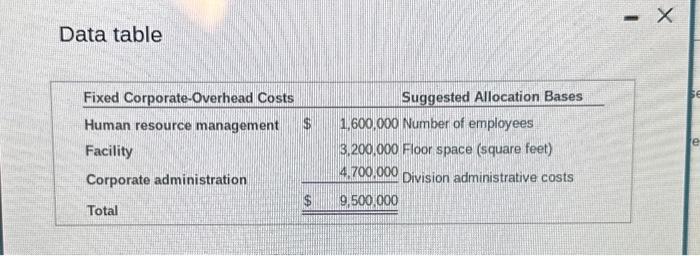

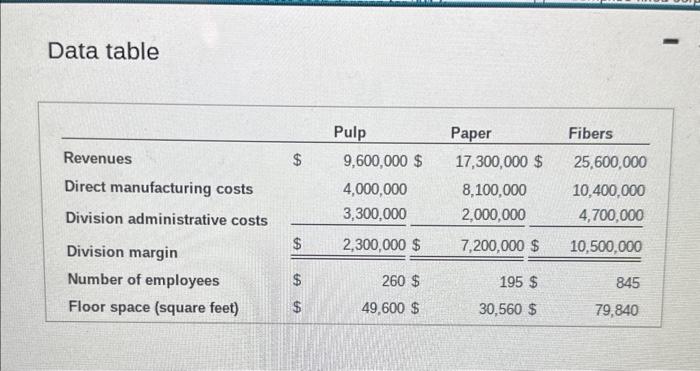

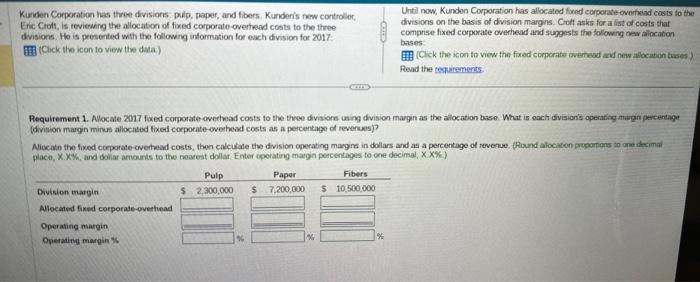

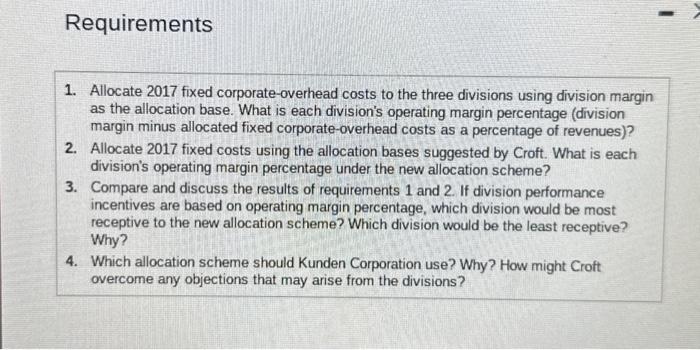

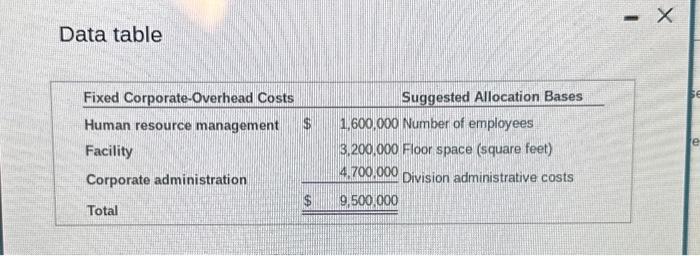

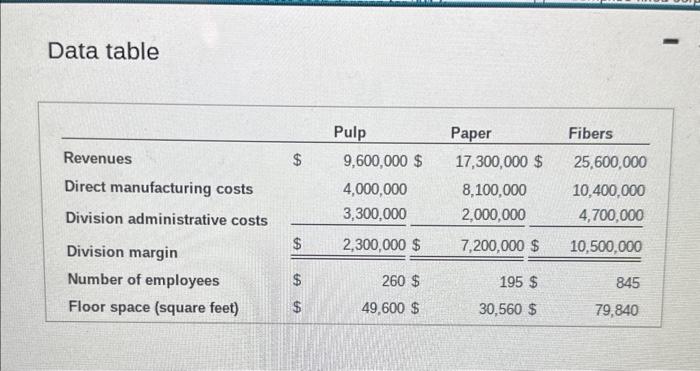

Kunden Corporation has theee divisions: pulp, paper, and fibers. Kunderis new controlor, Until now, Kunden Corporation has allocated frred corponateoverticind costs to the Eric Ciols, is reviewing the allocatoon of foxed corporate-overtead costs to the three divisions on the basis of division margins. Colt asks for a list of costs that dvisions. Ho is presented with the folioweng indormation for each division for 2017 comprise fixed corporate overhead and suggests the following new allocation beses (Cick the icon to view the data) F7A (Cick the icon to view the fixed corporate mvertead and new alocanion tuses) Read the Requirement 1. Allocate 2017 foxed corporate-overtead costs to the thee divisions using division margin as the allocation basse What is oach divisionis operabing maigin percentage (division margin mines allocited fixed corpocate-ovehead costs as a percentage of revenues)? Niocate the fixed corporate-ovethead costs, then calculale the division operating maxgme in dollars and as a percentage of reverue. (Round alociton propenons to one decimal Requirements 1. Allocate 2017 fixed corporate-overhead costs to the three divisions using division margin as the allocation base. What is each division's operating margin percentage (division margin minus allocated fixed corporate-overhead costs as a percentage of revenues)? 2. Allocate 2017 fixed costs using the allocation bases suggested by Croft. What is each division's operating margin percentage under the new allocation scheme? 3. Compare and discuss the results of requirements 1 and 2 . If division performance incentives are based on operating margin percentage, which division would be most receptive to the new allocation scheme? Which division would be the least receptive? Why? 4. Which allocation scheme should Kunden Corporation use? Why? How might Croft overcome any objections that may arise from the divisions? Data table Data table Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started