please complete part A and B

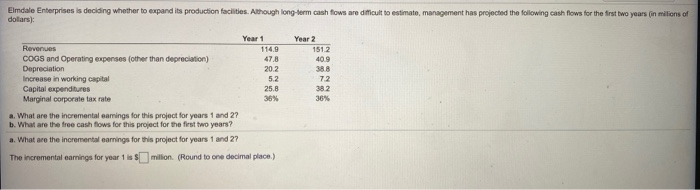

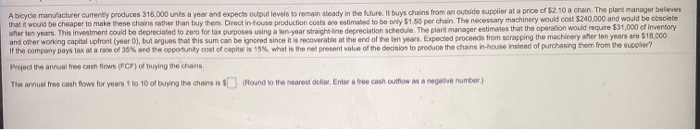

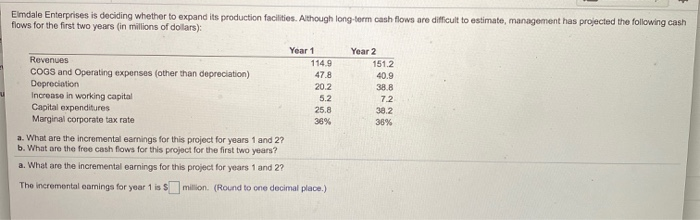

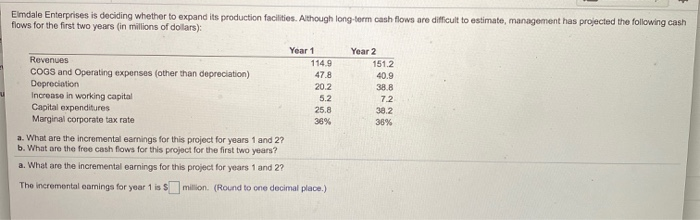

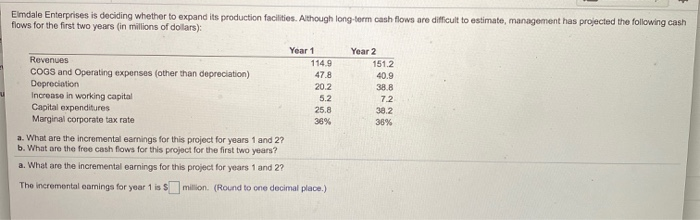

Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimato, management has projected the following cash flows for the first two years in milions of dollars): Year 2 1512 40.9 Year 1 Revenues 114.9 COGS and Operating expenses (other than depreciation) Depreciation 202 Increase in working capital 52 Capital expenditures 25.8 Marginal corporate tax rate 35% a. What are the incremental earnings for this project for years 1 and 2? b. What are the free cash flows for this project for the first two years? a. What are the incremental earnings for this project for years 1 and 2? The incremental earnings for year 1 is $million (Round to one decimal place) 72 382 36% A bicycle manufacturer currently produces 316,000 unts a year and expects output levels to remain steady in the future. It buys chains from an outside supplier at a price of $2.10 a chain. The plant manager believes that it would be cheaper to make these chains rather than buy the Direct in-house production costs are estimated to be only $1.50 per chain. The necessary machinery would cost $240.000 and would be obsolete ater ten years. This investment could be depreciated to zero for tax purposes using a ten-year straight line depreciation schedule. The plant manager estimates that the operation would require $31,000 of inventory and other working capital upfront (year), but argues that this sum can be ignored since it is recoverable at the end of the ten years. Expected proceeds from scrapping the machinery after ten years are $18,000 if the company pay tax trade of 35% and the opportunty cost of capital is 15% what is the net present value of the decision to produce the chains in-house instead of purchasing them from the supplier? Project the annual free cash flows (FC) of buying the chains The annual free onth fows for years 1 to 10 of buying the charts | Round to the nearest do inter a free cash outflow as a male number) Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in milions of dollars): Year 1 Revenues 114.9 COGS and Operating expenses (other than depreciation) 47.8 Depreciation 20.2 Increase in working capital 5.2 Capital expenditures 25.8 Marginal corporate tax rate 36% a. What are the incremental earnings for this project for years 1 and 2? b. What are the free cash flows for this project for the first two years? a. What are the incremental earnings for this project for years 1 and 2? The incremental comings for year 1 is smilion (Round to one decimal place.) Year 2 151.2 40.9 38.8 7.2 38.2 38%