Please complete part E by preparing a classified balance sheet. Thank you!

Please complete part E by preparing a classified balance sheet. Thank you!

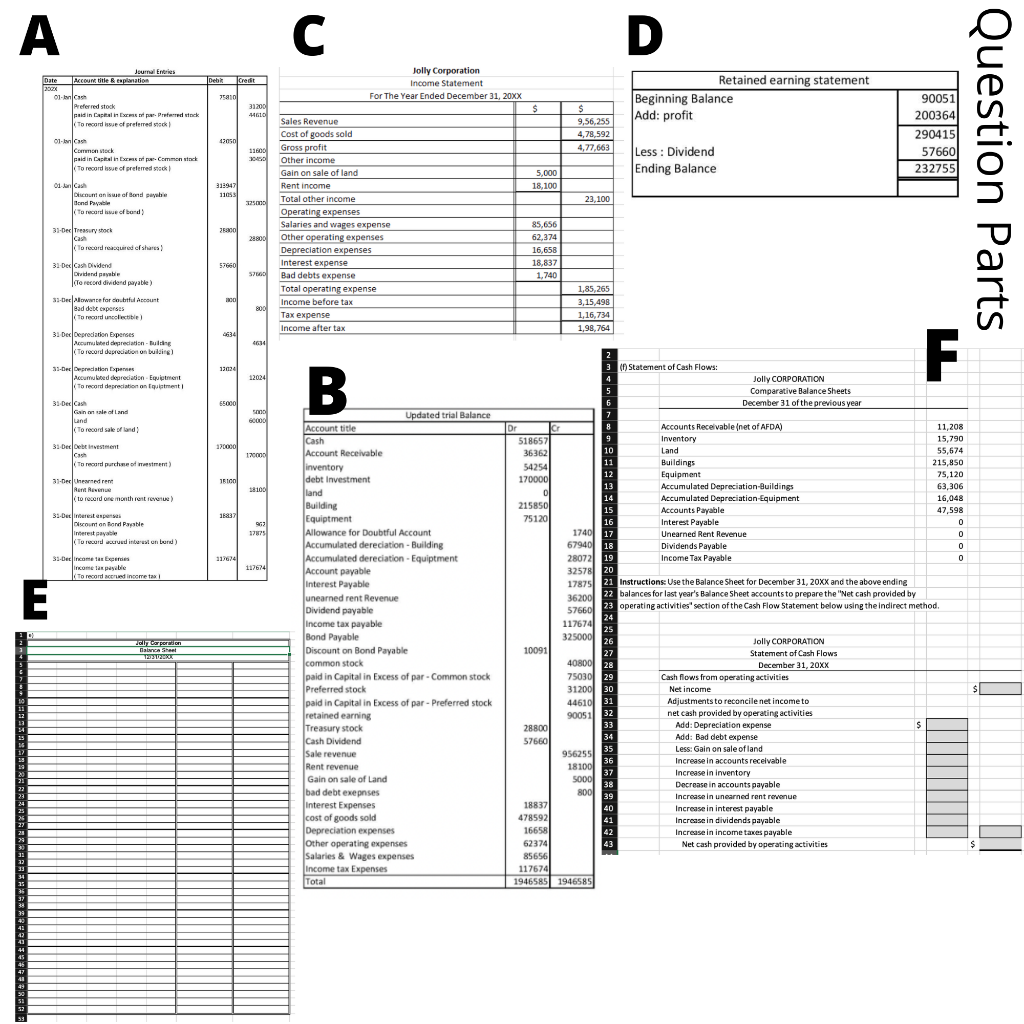

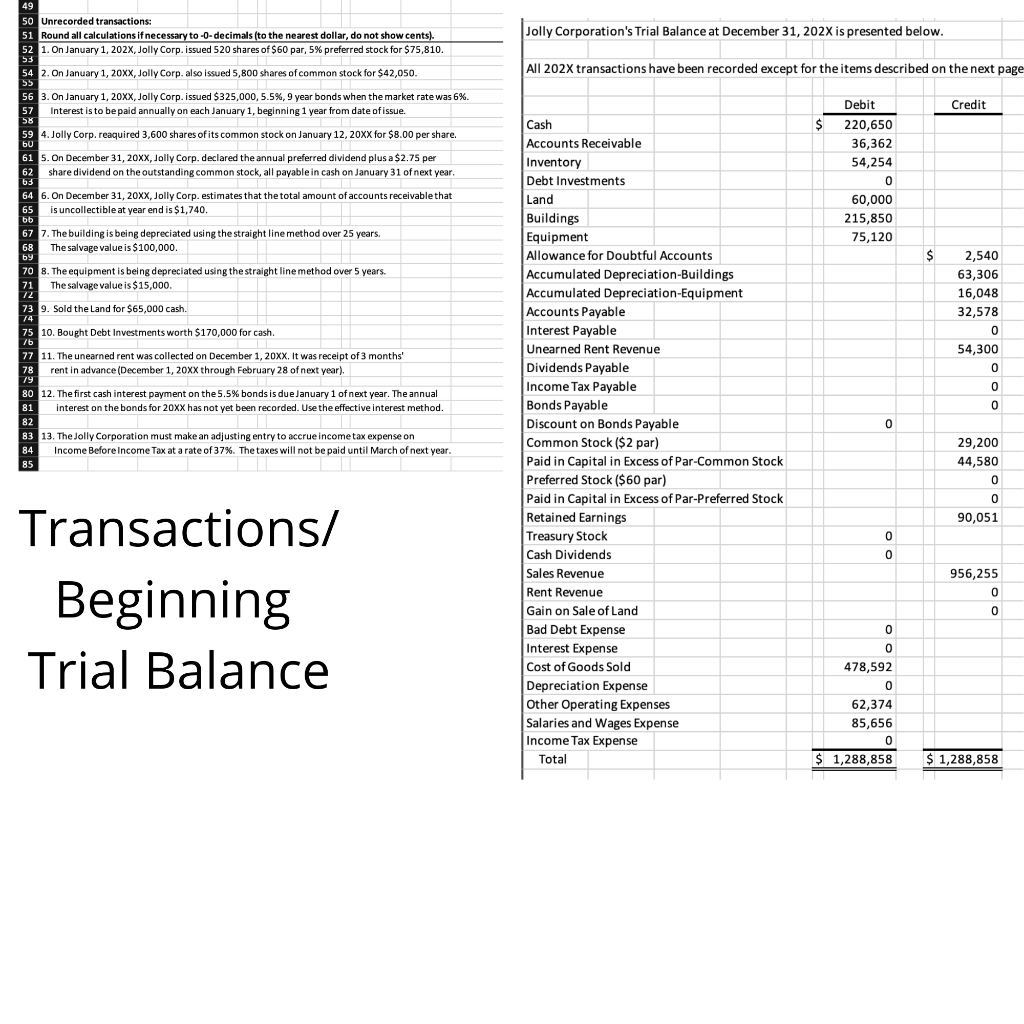

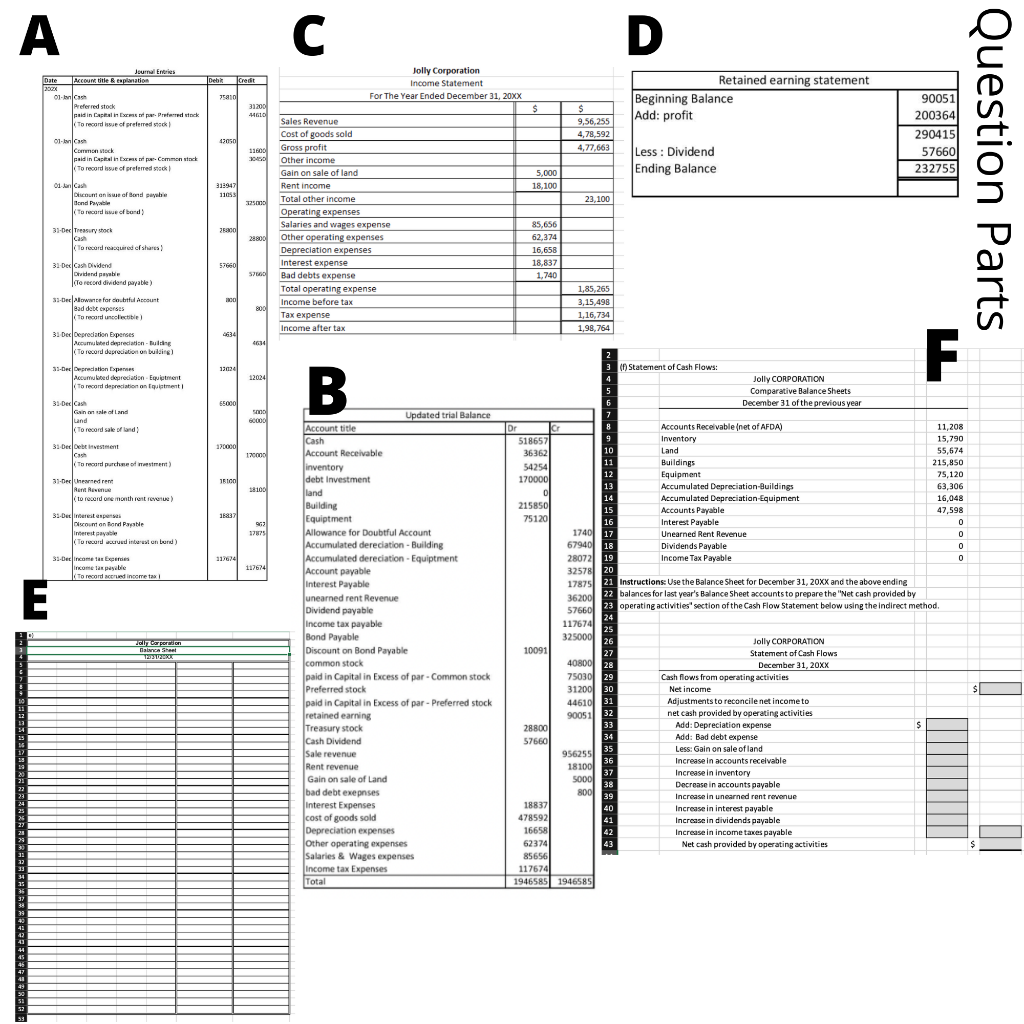

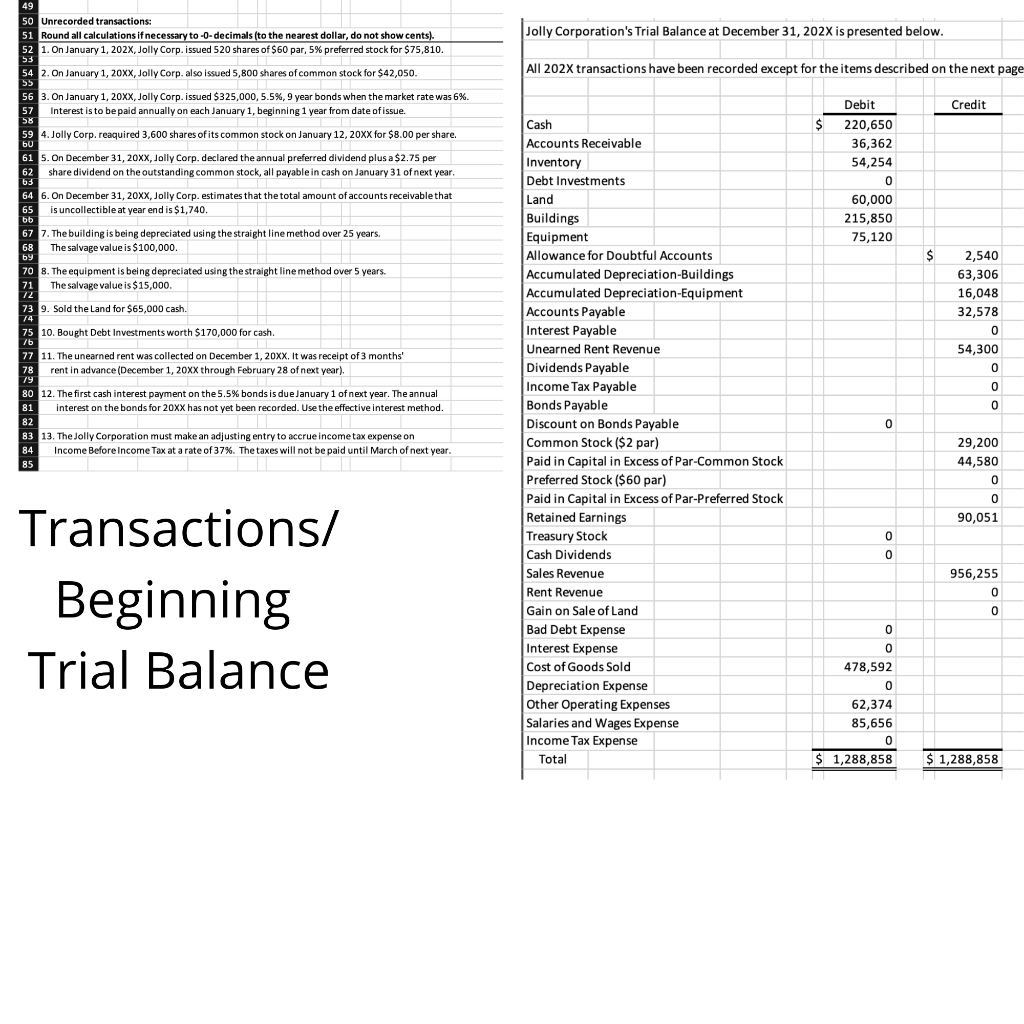

A C D Debt Credit Journal Entries Date Account title & explanation 2008 01-ban Preferred stock paldin Capital in Preferred (To record issue of preferred stock Jolly Corporation Income Statement For The Year Ended December 31, 20xx 75910 Retained earning statement Beginning Balance Add: profit 31200 -4610 $ $ 9,56,255 4,78,592 4,77,663 90051 200364 290415 57660 232755 42050 11600 1-C Common ock padin Capital in common (To record of preferred stock Less : Dividend Ending Balance 5,000 18,100 318947 11053 Question Parts 01 Lancash Discount on ise of Bond payube Bond Payable To record of band) 25000 Sales Revenue Cost of goods sold Gross profit Other income Gain on sale of land Rent income Total other income Operating expenses Salaries and wages expense Other operating expenses Depreciation expenses Interest expense Bad debts expense Total operating expense Income before tax Tax expense Income after tax 23,100 26800 31-Dec Treasury stock Cash To record required of shares 28800 85,656 62,374 16,658 18,837 1,740 57660 57660 31 Dec cash Dividend Dheidend payable (Te record dividend payable) 31-Decallowance for doubtful Account Bad dabe expenses To record unclectible) TOO 800 1,85,265 3,15,498 1,16,734 1,98,764 4614 31 Dec Depreciation Expenses med degreton Bulding To record depreciation on building) 33-Dec Depreciation Expres Accumulated depreciation Equipment To record depreciation on quatment 31-Decast Guineafland Land (To record sale of land F 13024 12024 B 65000 smo 60000 10000 170000 31 Dec Debtesten Cash (Torecard purchase of meestment) 31-Dechearned rent Rentene to record one month rostrov) 16100 18100 1683 31-Decretarp conton Bored Payable Interesse (Torud krudintuvi un bund 17875 0 31/674 31-Dec Income tax Eggers Income la pable To record and increas 117674 E (1) Statement of Cash Flows: Jolly CORPORATION Comparative Balance Sheets 6 December 31 of the previous year 7 Dr 8 Accounts Receivable (net of AFDA) 11,208 518657 Inventory 15,790 36362 10 Land 55,674 11 54254 Buildings 215,850 12 170000 Equipment 75,120 13 D 0 Accumulated Depreciation-Buildings 63,306 14 Accumulated Depreciation Equipment 16,048 215850 15 Accounts Payable 47,598 75120 16 Interest Payable 0 1740 17 Unearned Rent Revenue 6794018 Dividends Payable 0 280721 19 Income Tax Payable 0 325781 20 17875 21 Instructions: Use the Balance Sheet for December 31, 20XX and the above ending 36200 22 balances for last year's Balance Sheet accounts to prepare the "Net cash provided by 23 operating activities' section of the Cash Flow Statement below using the Indirect method. 57660 24 1176741 25 325000 26 Jolly CORPORATION 10091 27 Statement of Cash Flows December 31, 20XX 75030 29 Cash flows from operating activities 31200 30 Net income 44610 31 Adjustments to reconcile net income to net cash provided by operating activities 33 28800 Add: Depreciation expense $ 34 57660 AddBad debt expense 35 956255 Less: Gain on sale of land 36 18100 Increase in accounts receivable 37 SOOD Increase in inventory 38 Decrease in accounts payable 800 39 Increase in unearned rent revenue 18837 40 Increase in interest payable 478592 41 Increase in dividends payable 16658 42 Increase in income taxes payable 62374 43 Net cash provided by operating activities 85656 1176741 1946585 1946585 Updated trial Balance Account title Cash Account Receivable inventory debt investment land Building Equipment Allowance for Doubtful Account Accumulated dereciation - Building Accumulated dereciation Equipment Account payable Interest Payable unearned rent Revenue Dividend payable Income tax payable Bond Payable Discount on Bond Payable common stock paid in Capital in Excess of par - Common stock Preferred stock paid in Capital in Excess of par - Preferred stock - retained earning Treasury stock Cash Dividend Sale revenue Rent revenue Gain on sale of Land bad debt exeprises Interest Expenses cost of goods sold Depreciation expenses Other operating expenses Salaries & Wages expenses Income tax Expenses Total 2017 Balance Sheet 12312 40800 28 $ 10 90051/ 32 12 14 16 17 13 20 21 22 23 24 25 27 23 24 31 22 33 4 25 25 34 39 49 41 12 41 44 45 45 47 4 33 Jolly Corporation's Trial Balance at December 31, 202X is presented below. All 202X transactions have been recorded except for the items described on the next page Credit 49 50 Unrecorded transactions: 51 Round all calculations if necessary to -o-decimals (to the nearest dollar, do not show cents). 52 1. On January 1, 202X, Jolly Corp. issued 520 shares of $60 par, 5% preferred stock for $75,810. 53 54 2. On January 1, 20XX, Jolly Corp. also issued 5,800 shares of common stock for $42,050. 55 56 3. On January 1, 20XX, Jolly Corp. issued $325,000,5.5%, 9 year bonds when the market rate was 6%. 57 Interest is to be paid annually on each January 1, beginning 1 year from date of issue. 5 58 59 4. Jolly Corp.reaquired 3,600 shares of its common stock on January 12, 20XX for $8.00 per share. 60 61 5. On December 31, 20xx, Jolly Corp. declared the annual preferred dividend plus a $2.75 per 62 share dividend on the outstanding common stock, all payable in cash on January 31 of next year. 63 64 6. On December 31, 20xx, Jolly Corp. estimates that the total amount of accounts receivable that is uncollectible at year end is $1,740. . bb 67 7. The building is being depreciated using the straight line method over 25 years. The salvage value is $100,000. 69 70 8. The equipment is being depreciated using the straight line method over 5 years. 71 The salvage value is $15,000. 72 73 9. Sold the Land for $65,000 cash. 74 75 10. Bought Debt Investments worth $170,000 for cash. | 76 77 11. The unearned rent was collected on December 1, 20XX. It was receipt of 3 months' 78 rent in advance (December 1, 20xx through February 28 of next year) 79 80 12. The first cash interest payment on the 5.5% bonds is due January 1 of next year. The annual 81 interest on the bonds for 20XX has not yet been recorded. Use the effective interest method. 82 83 13. The Jolly Corporation must make an adjusting entry to accrue income tax expense on 84 Income Before Income Tax at a rate of 37%. The taxes will not be paid until March of next year. 85 Debit $ 220,650 36,362 54,254 0 60,000 215,850 75,120 65 68 $ 2,540 63,306 16,048 32,578 0 54,300 0 0 0 0 Cash Accounts Receivable Inventory Debt Investments Land Buildings Equipment Allowance for Doubtful Accounts Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accounts Payable Interest Payable Unearned Rent Revenue Dividends Payable Income Tax Payable Bonds Payable Discount on Bonds Payable Common Stock ($2 par) Paid in Capital in Excess of Par-Common Stock Preferred Stock ($60 par) Paid in Capital in Excess of Par-Preferred Stock Retained Earnings Treasury Stock Cash Dividends Sales Revenue Rent Revenue Gain on Sale of Land Bad Debt Expense Interest Expense Cost of Goods Sold Depreciation Expense Other Operating Expenses Salaries and Wages Expense Income Tax Expense Total 29,200 44,580 0 0 90,051 0 0 956,255 0 Transactions/ Beginning Trial Balance 0 0 0 478,592 0 62,374 85,656 0 $ 1,288,858 $ 1,288,858

Please complete part E by preparing a classified balance sheet. Thank you!

Please complete part E by preparing a classified balance sheet. Thank you!