Please complete parts A, B and C and show calculations so I can learn how to correctly solve this. The first box in A,B, and C are correct, the second box is not.

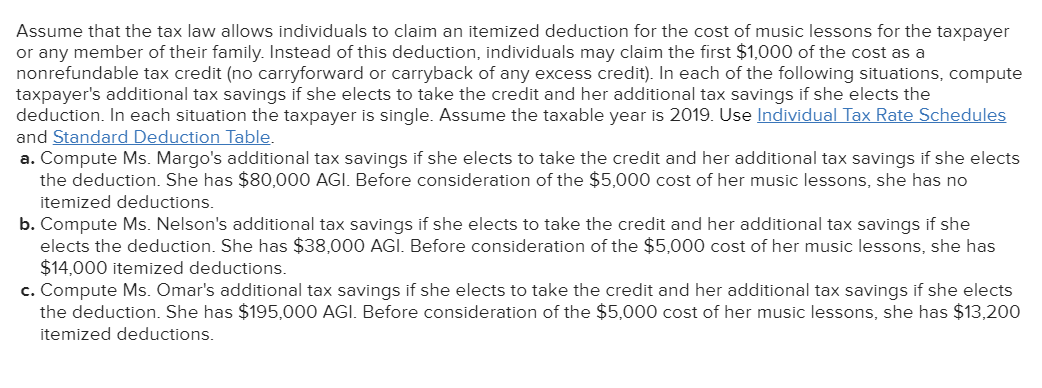

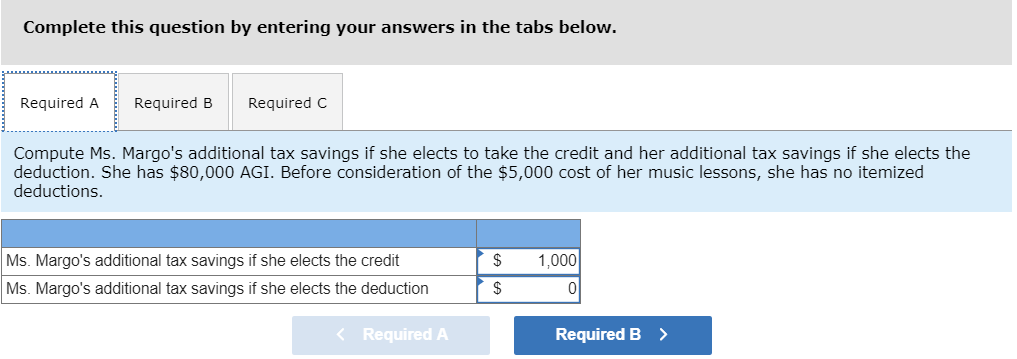

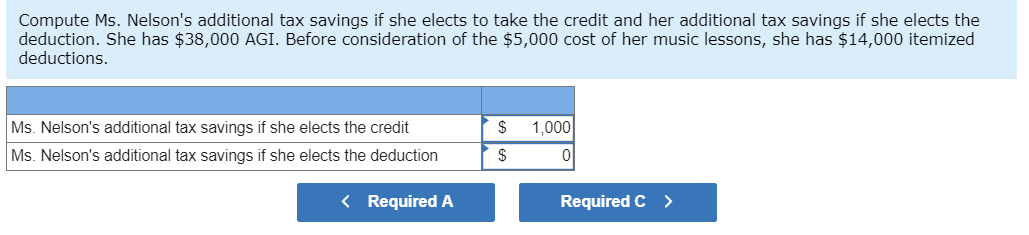

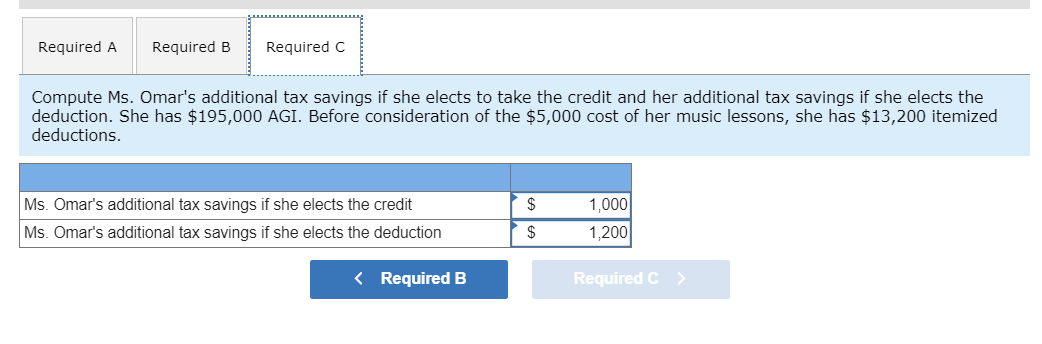

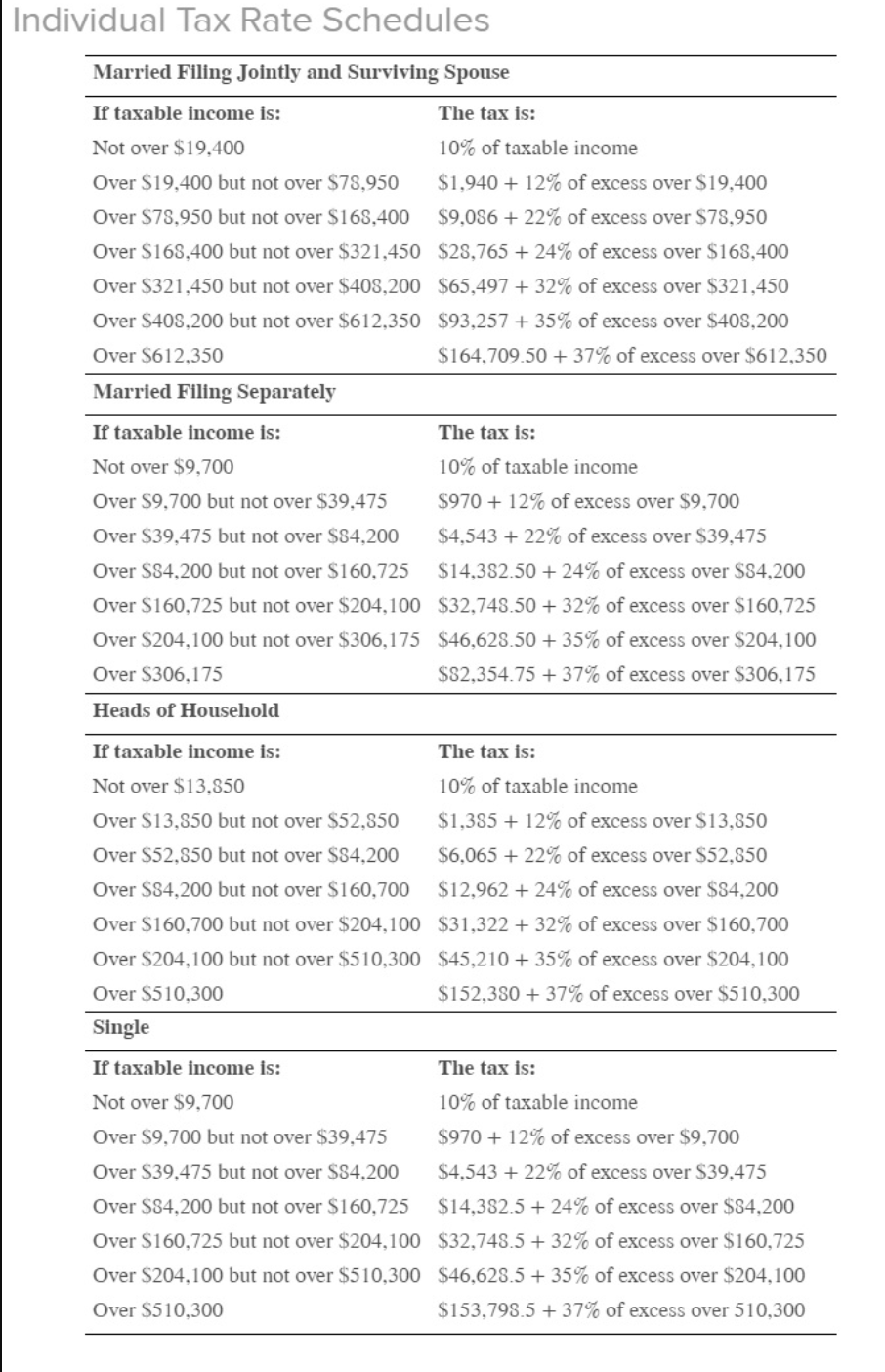

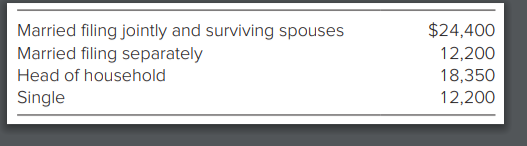

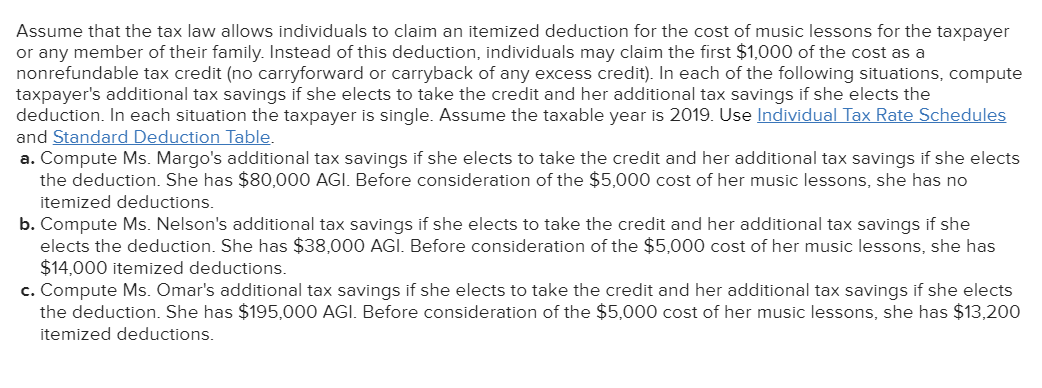

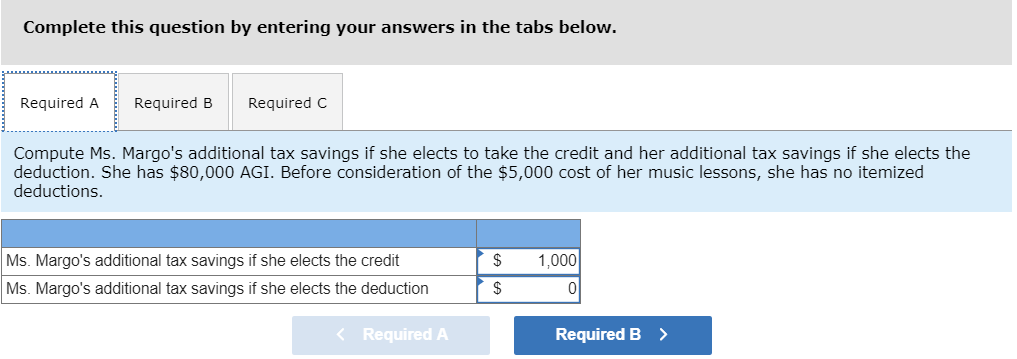

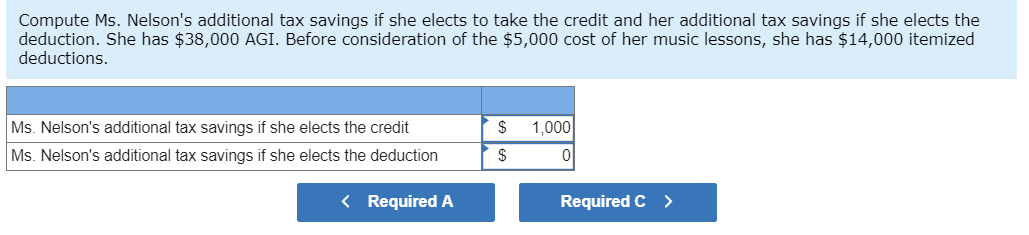

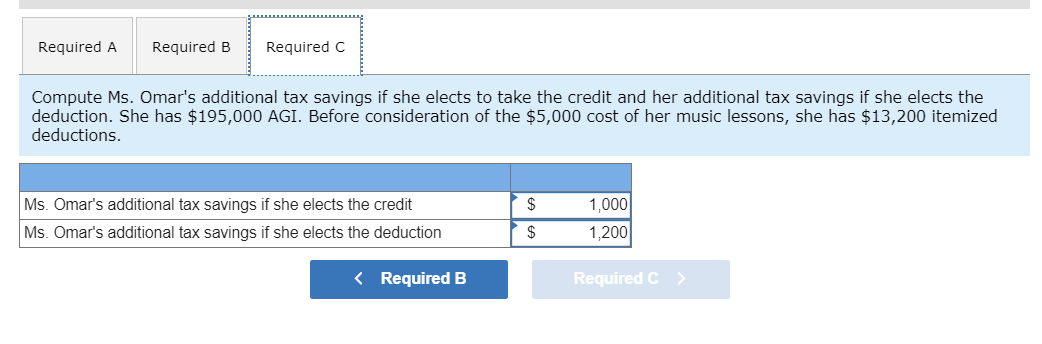

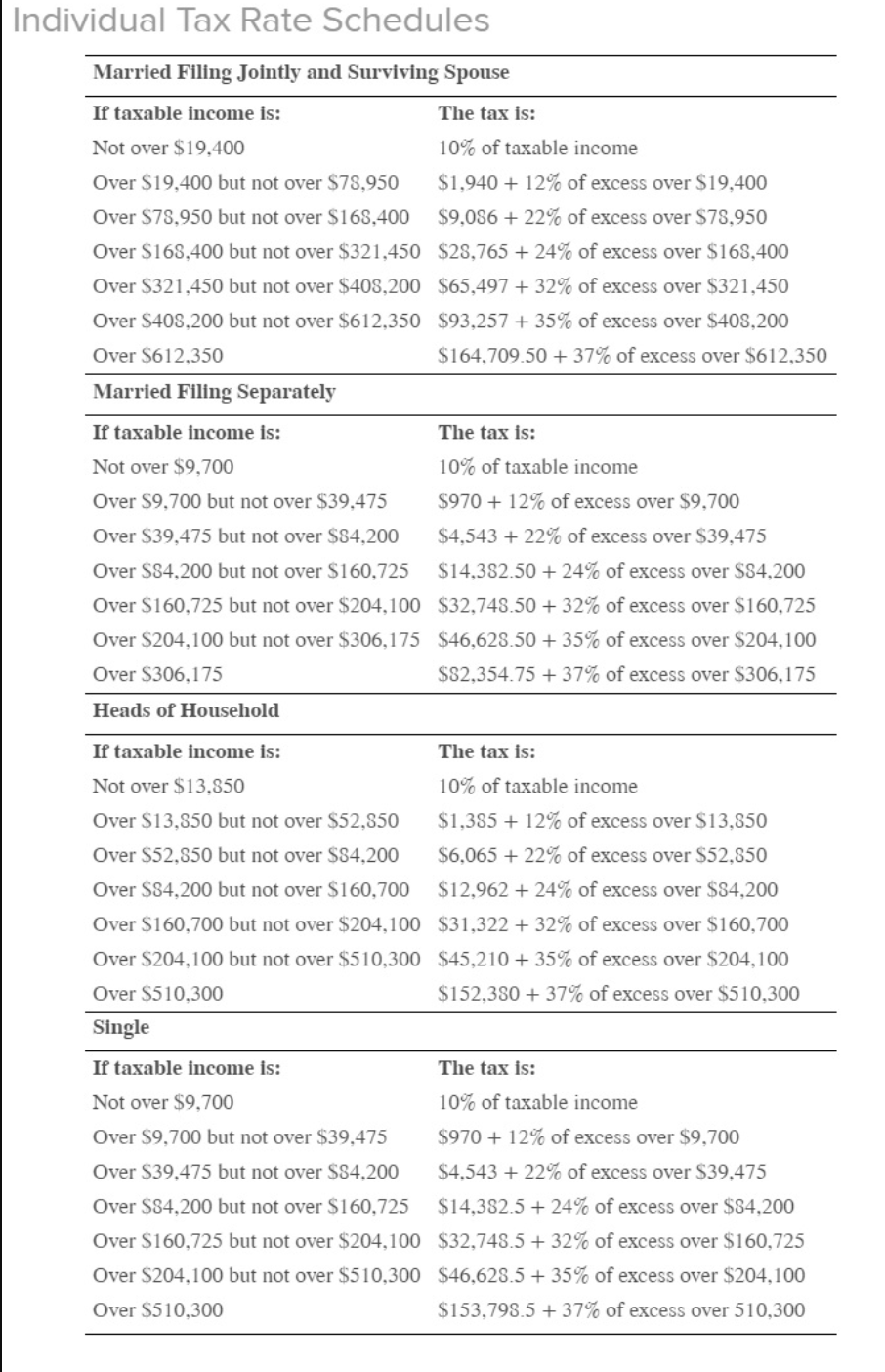

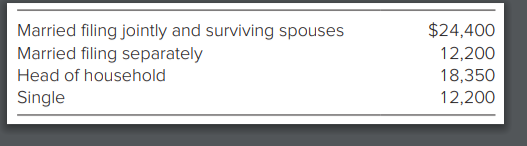

Assume that the tax law allows individuals to claim an itemized deduction for the cost of music lessons for the taxpayer or any member of their family. Instead of this deduction, individuals may claim the first $1,000 of the cost as a nonrefundable tax credit (no carryforward or carryback of any excess credit). In each of the following situations, compute taxpayer's additional tax savings if she elects to take the credit and her additional tax savings if she elects the deduction. In each situation the taxpayer is single. Assume the taxable year is 2019. Use Individual Tax Rate Schedules and Standard Deduction Table. a. Compute Ms. Margo's additional tax savings if she elects to take the credit and her additional tax savings if she elects the deduction. She has $80,000 AGI. Before consideration of the $5,000 cost of her music lessons, she has no itemized deductions. b. Compute Ms. Nelson's additional tax savings if she elects to take the credit and her additional tax savings if she elects the deduction. She has $38,000 AGI. Before consideration of the $5,000 cost of her music lessons, she has $14,000 itemized deductions. c. Compute Ms. Omar's additional tax savings if she elects to take the credit and her additional tax savings if she elects the deduction. She has $195,000 AGI. Before consideration of the $5,000 cost of her music lessons, she has $13,200 itemized deductions. Complete this question by entering your answers in the tabs below. Required A Required B Required c Compute Ms. Margo's additional tax savings if she elects to take the credit and her additional tax savings if she elects the deduction. She has $80,000 AGI. Before consideration of the $5,000 cost of her music lessons, she has no itemized deductions. $ 1,000 Ms. Margo's additional tax savings if she elects the credit Ms. Margo's additional tax savings if she elects the deduction $ 0 Compute Ms. Nelson's additional tax savings if she elects to take the credit and her additional tax savings if she elects the deduction. She has $38,000 AGI. Before consideration of the $5,000 cost of her music lessons, she has $14,000 itemized deductions. 1,000 Ms. Nelson's additional tax savings if she elects the credit Ms. Nelson's additional tax savings if she elects the deduction $ $ 0 Required A Required B Required c Compute Ms. Omar's additional tax savings if she elects to take the credit and her additional tax savings if she elects the deduction. She has $195,000 AGI. Before consideration of the $5,000 cost of her music lessons, she has $13,200 itemized deductions. $ Ms. Omar's additional tax savings if she elects the credit Ms. Omar's additional tax savings if she elects the deduction 1,000 1,2001 $