Please complete Q2 using the info from Q1

I cannot edit as it is a picture not font, are you able to please zoom in

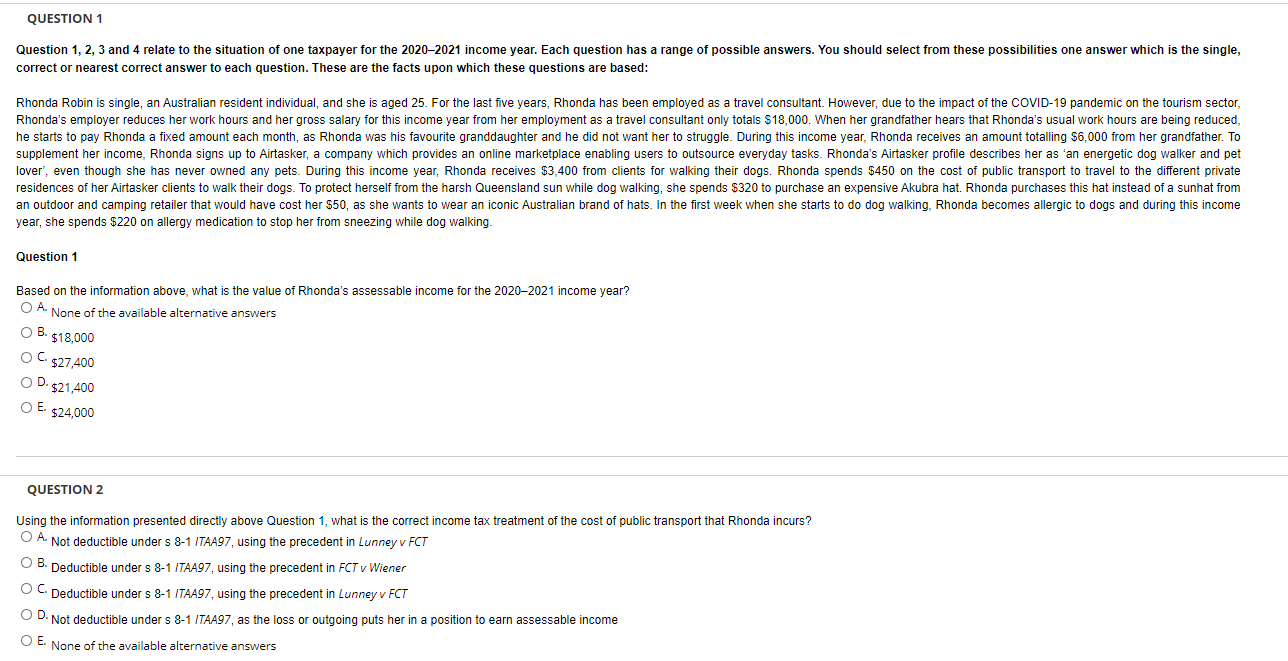

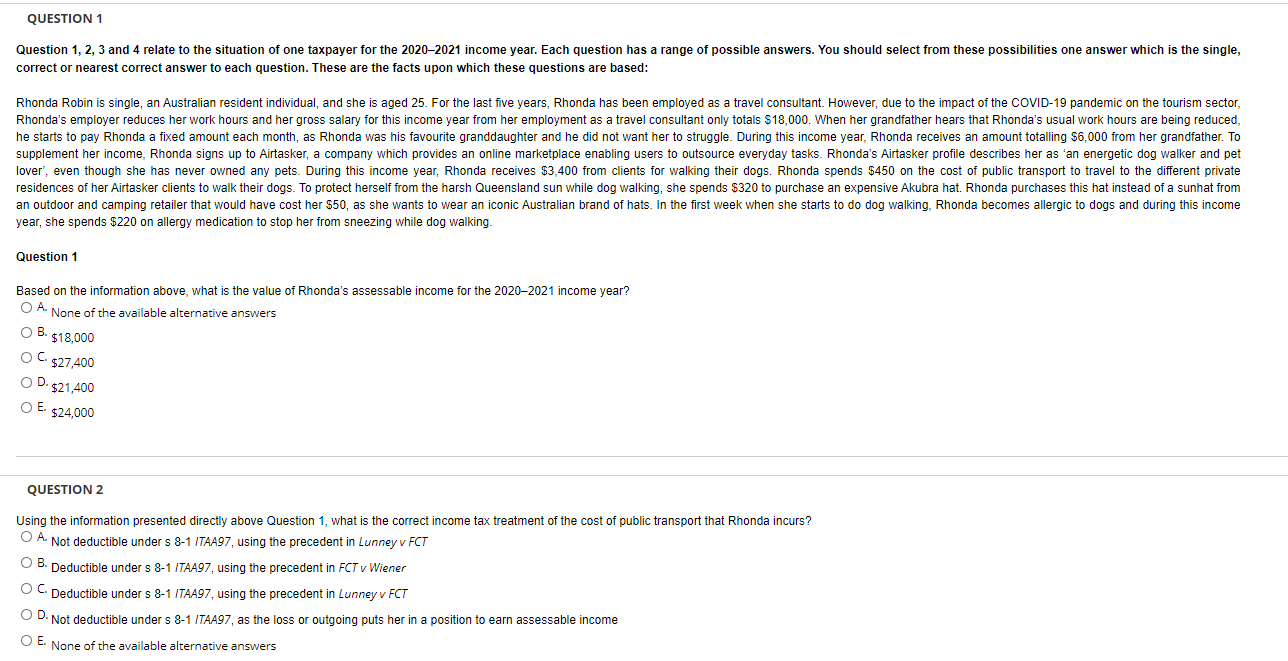

QUESTION 1 Question 1, 2, 3 and 4 relate to the situation of one taxpayer for the 2020-2021 income year. Each question has a range of possible answers. You should select from these possibilities one answer which is the single, correct or nearest correct answer to each question. These are the facts upon which these questions are based: Rhonda Robin is single, an Australian resident individual, and she is aged 25. For the last five years, Rhonda has been employed as a travel consultant. However, due to the impact of the COVID-19 pandemic on the tourism sector, Rhonda's employer reduces her work hours and her gross salary for this income year from her employment as a travel consultant only totals $18,000. When her grandfather hears that Rhonda's usual work hours are being reduced, he starts to pay Rhonda a fixed amount each month, as Rhonda was his favourite granddaughter and he did not want her to struggle. During this income year, Rhonda receives an amount totalling $6,000 from her grandfather. To supplement her income, Rhonda signs up to Airtasker, a company which provides an online marketplace enabling users to outsource everyday tasks. Rhonda's Airtasker profile describes her as 'an energetic dog walker and pet lover', even though she has never owned any pets. During this income year, Rhonda receives $3,400 from clients for walking their dogs. Rhonda spends $450 on the cost of public transport to travel to the different private residences of her Airtasker clients to walk their dogs. To protect herself from the harsh Queensland sun while dog walking, she spends $320 to purchase an expensive Akubra hat. Rhonda purchases this hat instead of a sunhat from an outdoor and camping retailer that would have cost her $50, as she wants to wear an iconic Australian brand of hats. In the first week when she starts to do dog walking, Rhonda becomes allergic to dogs and during this income year, she spends $220 on allergy medication to stop her from sneezing while dog walking Question 1 Based on the information above, what is the value of Rhonda's assessable income for the 2020-2021 income year? O A. None of the available alternative answers OB. 518,000 OC. $27,400 OD . $21,400 E $24,000 QUESTION 2 Using the information presented directly above Question 1, what is the correct income tax treatment of the cost of public transport that Rhonda incurs? O A. Not deductible under s 8-1 ITAA97, using the precedent in Lunney v FCT O B. Deductible under s 8-1 ITAA97, using the precedent in FCT v Wiener OC Deductible under s 8-1 ITAA97, using the precedent in Lunney v FCT OD. Not deductible under s 8-1 ITAA97, as the loss or outgoing puts her in a position to earn assessable income O E. None of the available alternative answers QUESTION 1 Question 1, 2, 3 and 4 relate to the situation of one taxpayer for the 2020-2021 income year. Each question has a range of possible answers. You should select from these possibilities one answer which is the single, correct or nearest correct answer to each question. These are the facts upon which these questions are based: Rhonda Robin is single, an Australian resident individual, and she is aged 25. For the last five years, Rhonda has been employed as a travel consultant. However, due to the impact of the COVID-19 pandemic on the tourism sector, Rhonda's employer reduces her work hours and her gross salary for this income year from her employment as a travel consultant only totals $18,000. When her grandfather hears that Rhonda's usual work hours are being reduced, he starts to pay Rhonda a fixed amount each month, as Rhonda was his favourite granddaughter and he did not want her to struggle. During this income year, Rhonda receives an amount totalling $6,000 from her grandfather. To supplement her income, Rhonda signs up to Airtasker, a company which provides an online marketplace enabling users to outsource everyday tasks. Rhonda's Airtasker profile describes her as 'an energetic dog walker and pet lover', even though she has never owned any pets. During this income year, Rhonda receives $3,400 from clients for walking their dogs. Rhonda spends $450 on the cost of public transport to travel to the different private residences of her Airtasker clients to walk their dogs. To protect herself from the harsh Queensland sun while dog walking, she spends $320 to purchase an expensive Akubra hat. Rhonda purchases this hat instead of a sunhat from an outdoor and camping retailer that would have cost her $50, as she wants to wear an iconic Australian brand of hats. In the first week when she starts to do dog walking, Rhonda becomes allergic to dogs and during this income year, she spends $220 on allergy medication to stop her from sneezing while dog walking Question 1 Based on the information above, what is the value of Rhonda's assessable income for the 2020-2021 income year? O A. None of the available alternative answers OB. 518,000 OC. $27,400 OD . $21,400 E $24,000 QUESTION 2 Using the information presented directly above Question 1, what is the correct income tax treatment of the cost of public transport that Rhonda incurs? O A. Not deductible under s 8-1 ITAA97, using the precedent in Lunney v FCT O B. Deductible under s 8-1 ITAA97, using the precedent in FCT v Wiener OC Deductible under s 8-1 ITAA97, using the precedent in Lunney v FCT OD. Not deductible under s 8-1 ITAA97, as the loss or outgoing puts her in a position to earn assessable income O E. None of the available alternative answers