please complete question 2, thanks

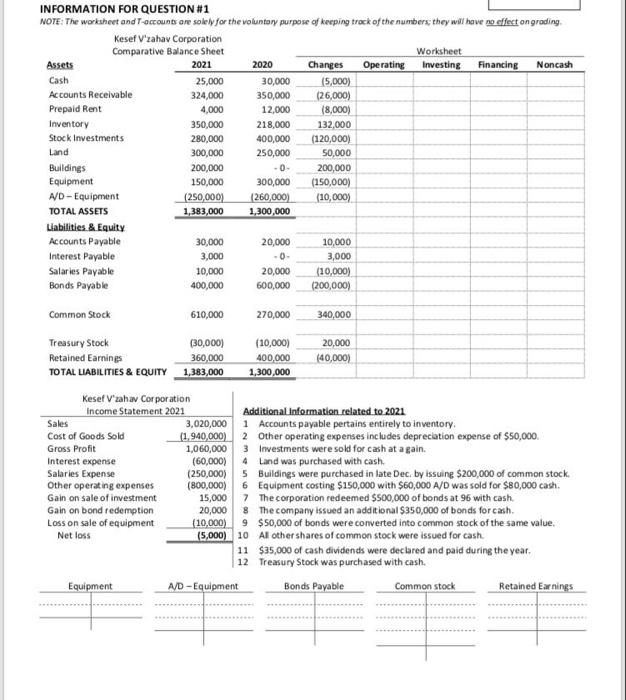

2) Referring to the "Additional Information supplied for the cash flow statement in question #1 prepare the journal entries for each of the following items: 3, 5, 7, 8, 9, 10, 11 (which han two foumal entres), and 12. Ako, prepare the journal entry to record the dosing of net loss total of 10 journal entries) (no puntu DEBIT CREDIT DEBIT CREDIT 2021 INFORMATION FOR QUESTION #1 NOTE: The worksheet and T-occounts are solely for the voluntary purpose of keeping track of the numbers they will have no effect on grading Kesef V'zahav Corporation Comparative Balance Sheet Worksheet Assets 2020 Changes Operating Investing Financing Noncash Cash 25,000 30,000 (5,000) Accounts Receivable 324,000 350,000 (26,000) Prepaid Rent 4,000 12,000 (8,000) Inventory 350,000 218,000 132,000 Stock Investments 280,000 400,000 (120,000) Land 300,000 250,000 50,000 Buildings 200,000 -0- 200,000 Equipment 150,000 300,000 (150,000) A/D-Equipment (250,000) 260,000 (10,000) TOTAL ASSETS 1,383,000 1,300,000 Liabilities & Equity Accounts Payable 30,000 20,000 10,000 Interest Payable 3,000 -0- 3,000 Salaries Payable 10,000 20,000 (10,000) Bonds Payable 400,000 600,000 (200,000) Common Stock 610,000 270,000 340,000 Treasury Stock (30,000) (10,000) 20,000 Retained Earnings 360,000 400,000 (40,000) TOTAL LIABILITIES & EQUITY 1,383,000 1,300,000 Kesef V zahav Corporation income Statement 2021 Additional Information related to 2021 Sales 3,020,000 1 Accounts payable pertains entirely to inventory Cost of Goods Sold (1.940,000) 2 Other operating expenses includes depreciation expense of $50,000 Gross Profit 1,060,000 3 Investments were sold for cash at a gain. Interest expense (60,000) 4 Land was purchased with cash Salaries Expense (250,000) 5 Buildings were purchased in late Dec. by issuing $200,000 of common stock Other operating expenses (800,000) 6 Equipment costing $150,000 with $60,000 A/D was sold for $80,000 cash. Gain on sale of investment 15,000 7 The corporation redeemed $500,000 of bonds at 96 with cash Gain on bond redemption 20,000 8 The company issued an additional $350,000 of bonds for cash. Loss on sale of equipment (10,000) 9 $50,000 of bonds were converted into common stock of the same value Net loss (5,000) 10 Al other shares of common stock were issued for cash. 11 $35,000 of cash dividends were declared and paid during the year. 12 Treasury Stock was purchased with cash. Equipment A/D - Equipment Bonds Payable Common stock Retained Earnings