Please Complete the FCFE table given below and just answer question 1,2 and 7.

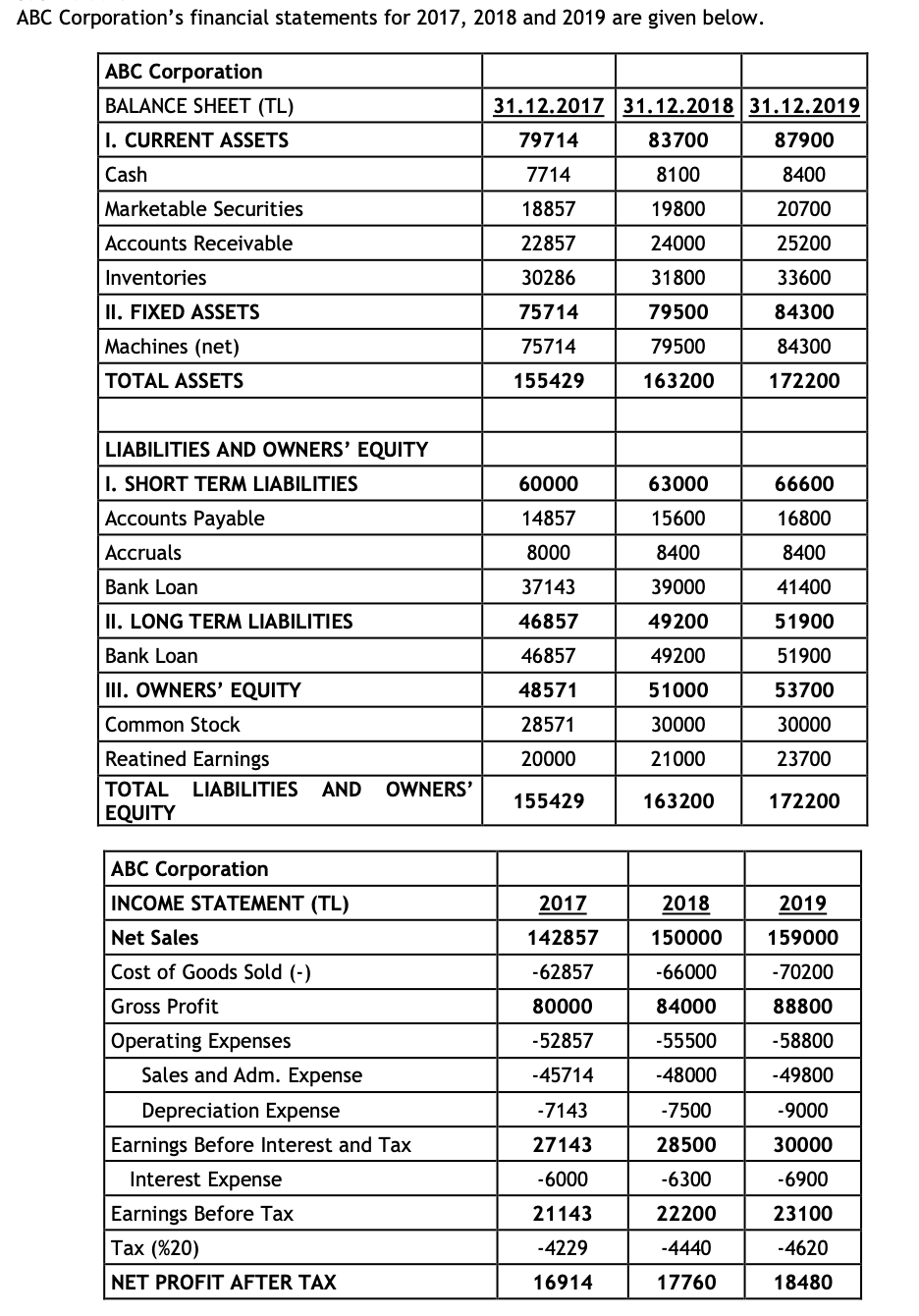

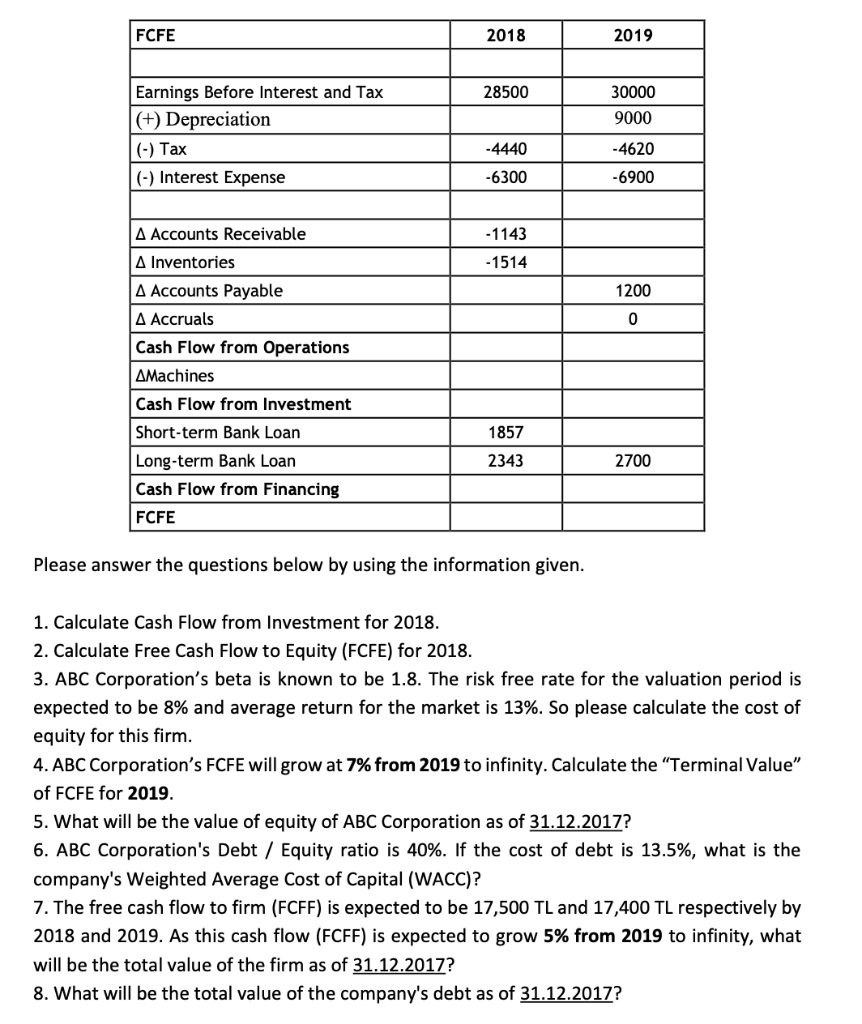

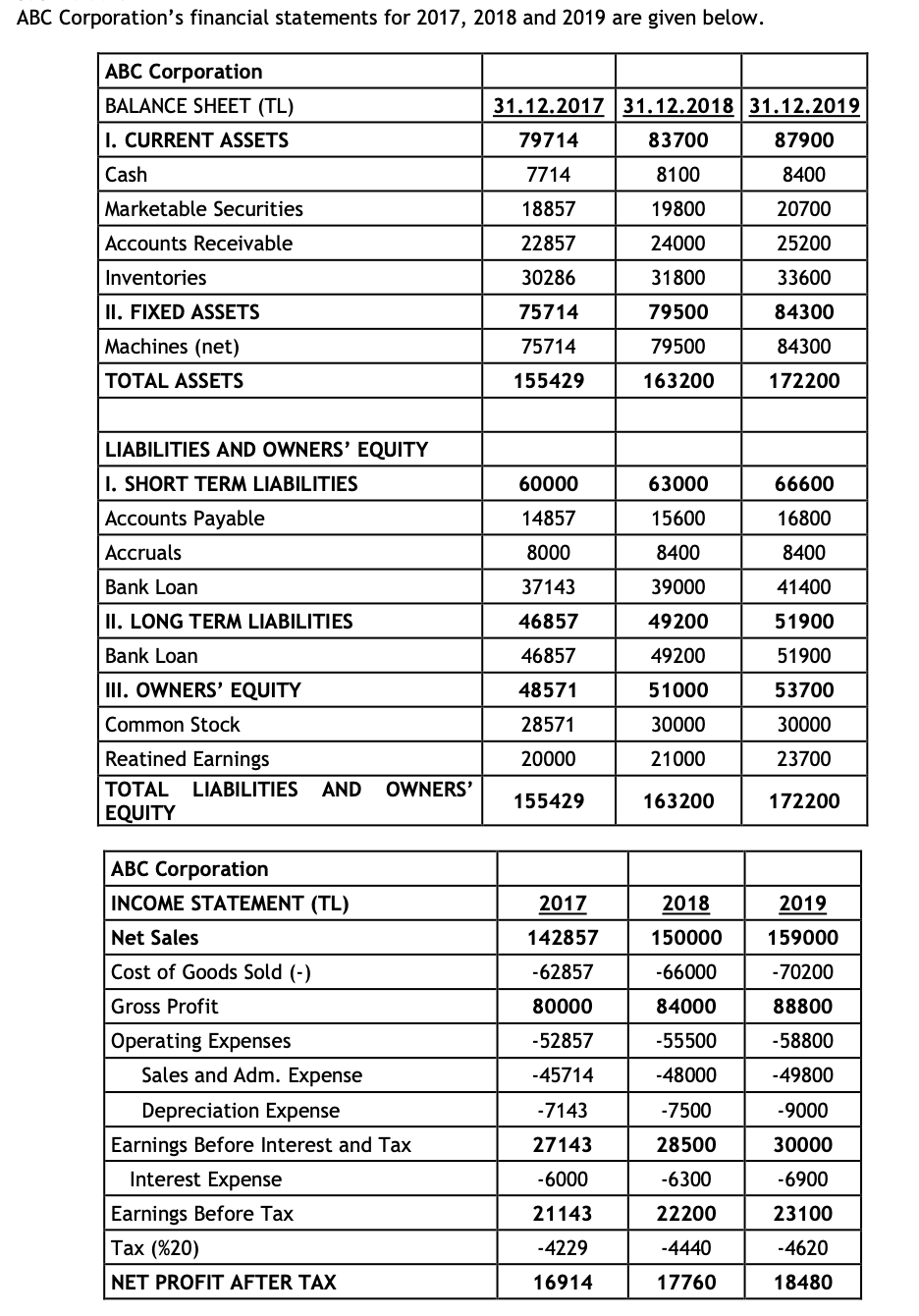

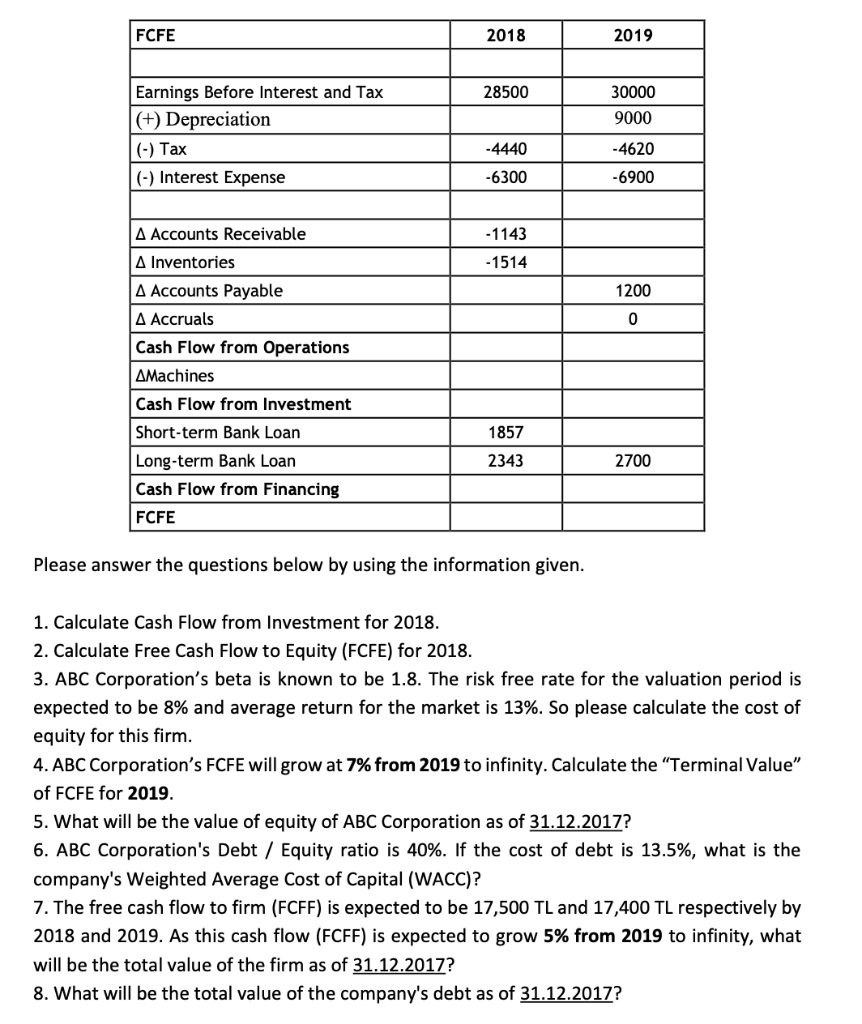

ABC Corporation's financial statements for 2017, 2018 and 2019 are given below. 31.12.2017 31.12.2018 31.12.2019 ABC Corporation BALANCE SHEET (TL) 1. CURRENT ASSETS Cash 79714 83700 87900 7714 8100 8400 Marketable Securities 18857 19800 20700 Accounts Receivable 22857 24000 25200 Inventories 30286 31800 33600 II. FIXED ASSETS 75714 79500 84300 75714 79500 84300 Machines (net) TOTAL ASSETS 155429 163200 172200 60000 63000 66600 LIABILITIES AND OWNERS' EQUITY 1. SHORT TERM LIABILITIES Accounts Payable Accruals 14857 15600 16800 8000 8400 8400 Bank Loan 37143 39000 41400 II. LONG TERM LIABILITIES 49200 51900 46857 46857 48571 49200 51900 51000 53700 28571 30000 30000 Bank Loan III. OWNERS' EQUITY Common Stock Reatined Earnings TOTAL LIABILITIES EQUITY 20000 21000 23700 AND OWNERS' 155429 163200 172200 ABC Corporation INCOME STATEMENT (TL) 2017 2018 2019 159000 Net Sales 142857 150000 -66000 -70200 -62857 80000 84000 88800 -52857 -55500 -58800 -45714 -48000 -49800 -7143 -7500 -9000 Cost of Goods Sold (-) Gross Profit Operating Expenses Sales and Adm. Expense Depreciation Expense Earnings Before Interest and Tax Interest Expense Earnings Before Tax Tax (%20) NET PROFIT AFTER TAX 27143 28500 30000 -6000 -6300 -6900 21143 22200 23100 -4229 -4440 -4620 16914 17760 18480 FCFE 2018 2019 28500 30000 9000 Earnings Before Interest and Tax (+) Depreciation (-) Tax (-) Interest Expense -4440 -4620 -6300 -6900 A Accounts Receivable -1143 -1514 1200 0 A Inventories A Accounts Payable A Accruals Cash Flow from Operations AMachines Cash Flow from Investment Short-term Bank Loan Long-term Bank Loan Cash Flow from Financing FCFE 1857 2343 2700 Please answer the questions below by using the information given. 1. Calculate Cash Flow from Investment for 2018. 2. Calculate Free Cash Flow to Equity (FCFE) for 2018. 3. ABC Corporation's beta is known to be 1.8. The risk free rate for the valuation period is expected to be 8% and average return for the market is 13%. So please calculate the cost of equity for this firm. 4. ABC Corporation's FCFE will grow at 7% from 2019 to infinity. Calculate the Terminal Value of FCFE for 2019. 5. What will be the value of equity of ABC Corporation as of 31.12.2017? 6. ABC Corporation's Debt / Equity ratio is 40%. If the cost of debt is 13.5%, what is the company's Weighted Average Cost of Capital (WACC)? 7. The free cash flow to firm (FCFF) is expected to be 17,500 TL and 17,400 TL respectively by 2018 and 2019. As this cash flow (FCFF) is expected to grow 5% from 2019 to infinity, what will be the total value of the firm as of 31.12.2017? 8. What will be the total value of the company's debt as of 31.12.2017