Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Given the following expected cash flow stream, determine the IRR of the proposed investment in an income producing property and determine whether or not

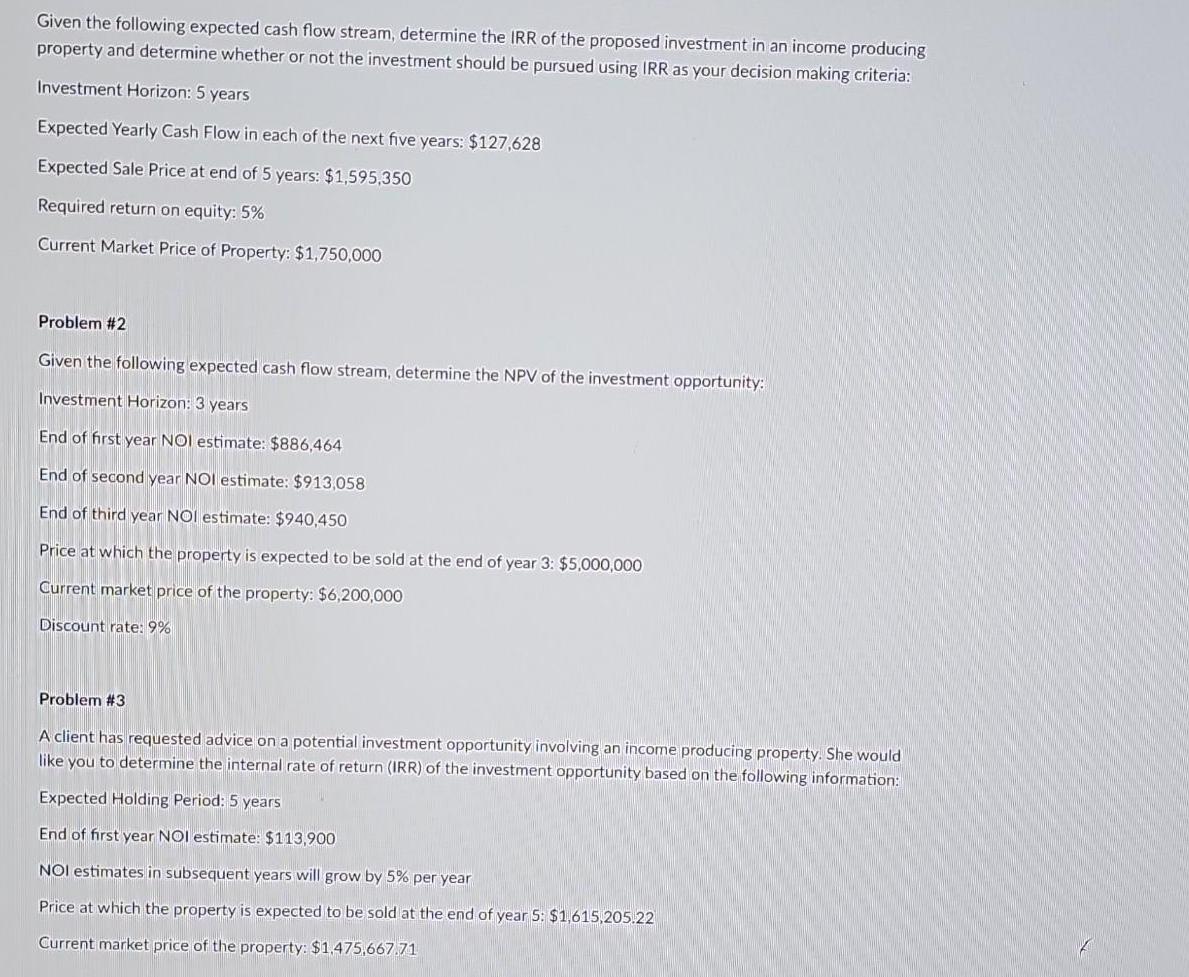

Given the following expected cash flow stream, determine the IRR of the proposed investment in an income producing property and determine whether or not the investment should be pursued using IRR as your decision making criteria: Investment Horizon: 5 years Expected Yearly Cash Flow in each of the next five years: $127,628 Expected Sale Price at end of 5 years: $1,595,350 Required return on equity: 5% Current Market Price of Property: $1,750,000 Problem #2 Given the following expected cash flow stream, determine the NPV of the investment opportunity: Investment Horizon: 3 years End of first year NOI estimate: $886,464 End of second year NOI estimate: $913,058 End of third year NOI estimate: $940,450 Price at which the property is expected to be sold at the end of year 3: $5,000,000 Current market price of the property: $6,200,000 Discount rate: 9% Problem #3 A client has requested advice on a potential investment opportunity involving an income producing property. She would like you to determine the internal rate of return (IRR) of the investment opportunity based on the following information: Expected Holding Period: 5 years End of first year NOI estimate: $113,900 NOI estimates in subsec years will grow by 5% per year Price at which the property is expected to be sold at the end of year 5: $1,615,205.22 Current market price of the property: $1,475,667.71

Step by Step Solution

★★★★★

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1 IRR Calculation The IRR for this investment is approximately 1421 You can calculate this using financial software or spreadsheets with dedic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started