Answered step by step

Verified Expert Solution

Question

1 Approved Answer

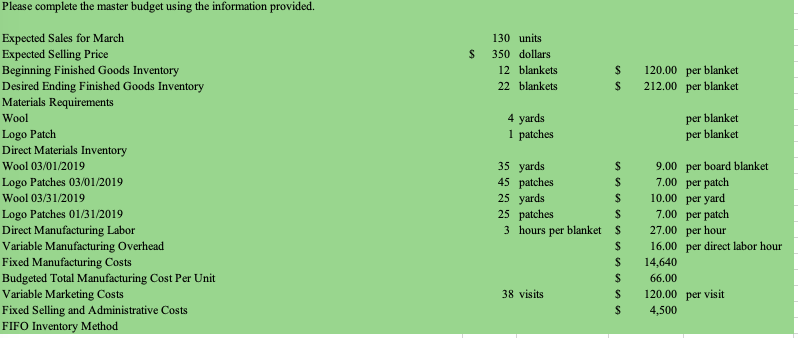

Please complete the master budget using the information provided. $ 130 units 350 dollars 12 blankets 22 blankets $ $ 120.00 per blanket 212.00 per

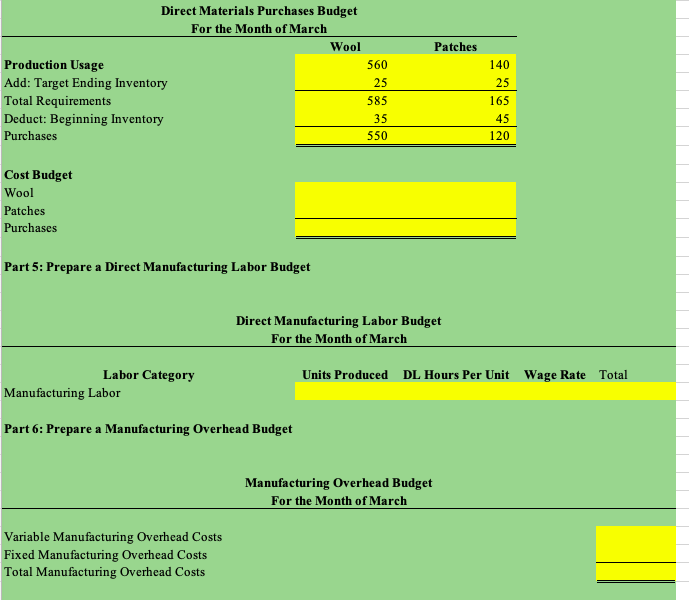

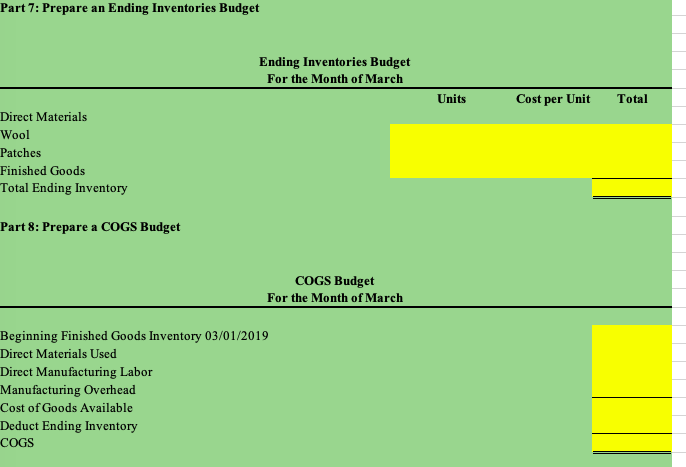

Please complete the master budget using the information provided. $ 130 units 350 dollars 12 blankets 22 blankets $ $ 120.00 per blanket 212.00 per blanket 4 yards 1 patches per blanket per blanket s Expected Sales for March Expected Selling Price Beginning Finished Goods Inventory Desired Ending Finished Goods Inventory Materials Requirements Wool Logo Patch Direct Materials Inventory Wool 03/01/2019 Logo Patches 03/01/2019 Wool 03/31/2019 Logo Patches 01/31/2019 Direct Manufacturing Labor Variable Manufacturing Overhead Fixed Manufacturing Costs Budgeted Total Manufacturing Cost Per Unit Variable Marketing Costs Fixed Selling and Administrative Costs FIFO Inventory Method 35 yards 45 patches 25 yards 25 patches 3 hours per blankets 9.00 per board blanket 7.00 per patch 10.00 per yard 7.00 per patch 27.00 per hour 16.00 per direct labor hour 14,640 66.00 120.00 per visit 4,500 38 visits S Patches Direct Materials Purchases Budget For the Month of March Wool Production Usage 560 Add: Target Ending Inventory 25 Total Requirements 585 Deduct: Beginning Inventory Purchases 550 Cost Budget Wool Patches Purchases Part 5: Prepare a Direct Manufacturing Labor Budget Direct Manufacturing Labor Budget For the Month of March Units Produced DL Hours Per Unit Wage Rate Total Labor Category Manufacturing Labor Part 6: Prepare a Manufacturing Overhead Budget Manufacturing Overhead Budget For the Month of March Variable Manufacturing Overhead Costs Fixed Manufacturing Overhead Costs Total Manufacturing Overhead Costs Part 7: Prepare an Ending Inventories Budget Ending Inventories Budget For the Month of March Units Cost per Unit Total Direct Materials Wool Patches Finished Goods Total Ending Inventory Part 8: Prepare a COGS Budget COGS Budget For the Month of March Beginning Finished Goods Inventory 03/01/2019 Direct Materials Used Direct Manufacturing Labor Manufacturing Overhead Cost of Goods Available Deduct Ending Inventory COGS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started