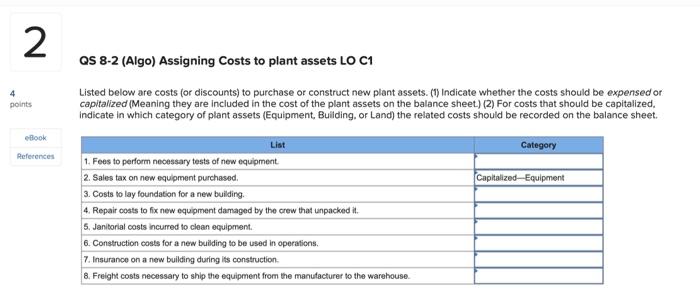

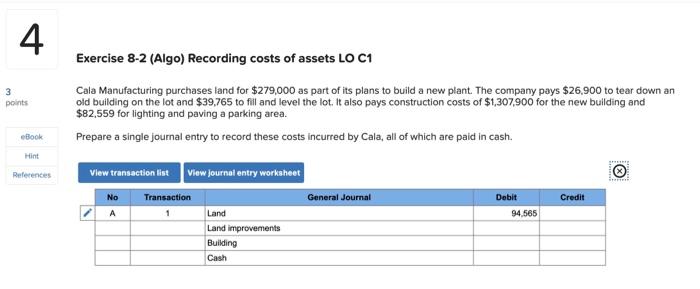

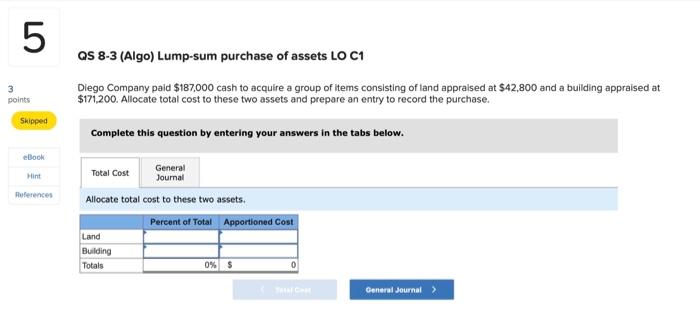

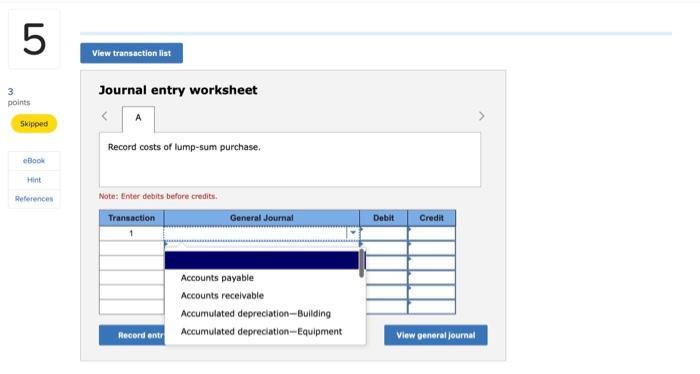

QS 8-2 (Algo) Assigning Costs to plant assets LO C1 Listed below are costs (or discounts) to purchase or construct new plant assets. (i) Indicate whether the costs should be expensed or capitalized (Meaning they are included in the cost of the plant assets on the balance sheet) (2) For costs that should be capitalized. indicate in which category of plant assets (Equipment, Buliding. or Land) the related costs should be recorded on the balance sheet. Exercise 8-2 (Algo) Recording costs of assets LO C1 Cala Manufacturing purchases land for $279,000 as part of its plans to build a new plant. The company pays $26,900 to tear down an old building on the lot and $39,765 to fill and level the lot. It also pays construction costs of $1,307,900 for the new building and $82,559 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash. QS 8-3 (Algo) Lump-sum purchase of assets LO C1 Diego Company paid $187,000 cash to acquire a group of items consisting of land appraised at $42,800 and a building appraised at 5171,200 . Allocate total cost to these two assets and prepare an entry to record the purchase. Complete this question by entering your answers in the tabs below. Allocate total cost to these two assets. Journal entry worksheet Record costs of lump-sum purchase. Note: Enter debits before credits. QS 8-2 (Algo) Assigning Costs to plant assets LO C1 Listed below are costs (or discounts) to purchase or construct new plant assets. (i) Indicate whether the costs should be expensed or capitalized (Meaning they are included in the cost of the plant assets on the balance sheet) (2) For costs that should be capitalized. indicate in which category of plant assets (Equipment, Buliding. or Land) the related costs should be recorded on the balance sheet. Exercise 8-2 (Algo) Recording costs of assets LO C1 Cala Manufacturing purchases land for $279,000 as part of its plans to build a new plant. The company pays $26,900 to tear down an old building on the lot and $39,765 to fill and level the lot. It also pays construction costs of $1,307,900 for the new building and $82,559 for lighting and paving a parking area. Prepare a single journal entry to record these costs incurred by Cala, all of which are paid in cash. QS 8-3 (Algo) Lump-sum purchase of assets LO C1 Diego Company paid $187,000 cash to acquire a group of items consisting of land appraised at $42,800 and a building appraised at 5171,200 . Allocate total cost to these two assets and prepare an entry to record the purchase. Complete this question by entering your answers in the tabs below. Allocate total cost to these two assets. Journal entry worksheet Record costs of lump-sum purchase. Note: Enter debits before credits