Please complete the tables provided.

Please complete the tables provided.

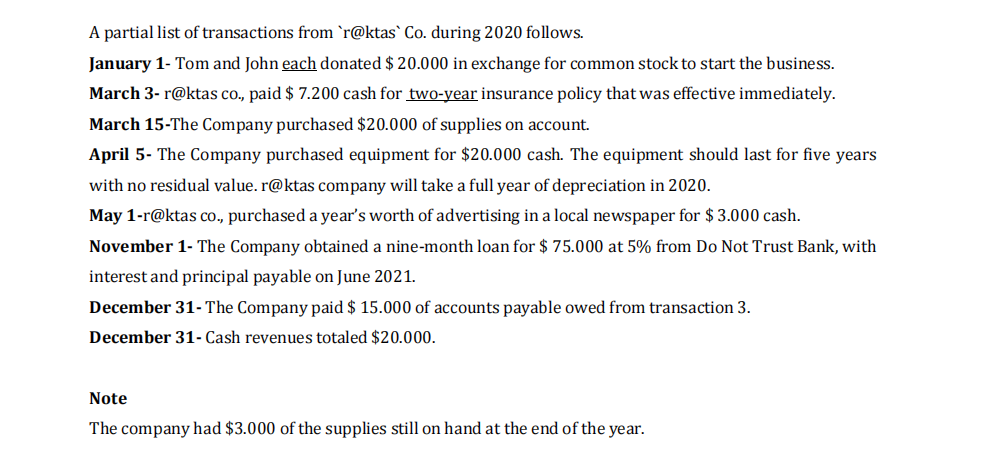

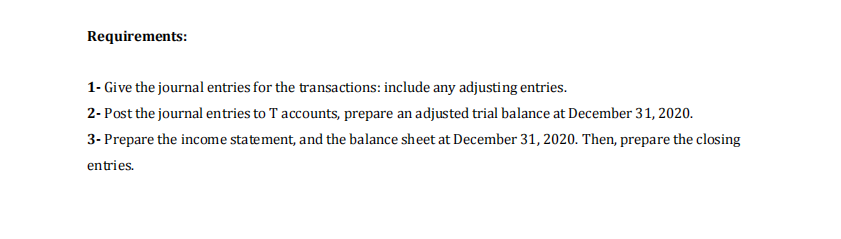

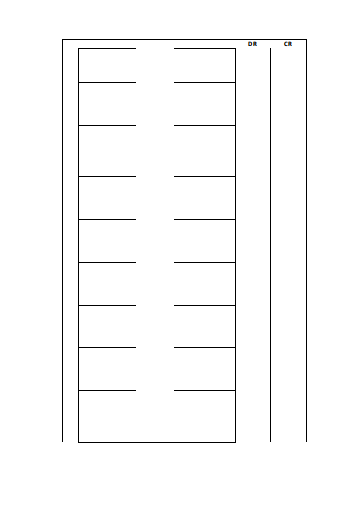

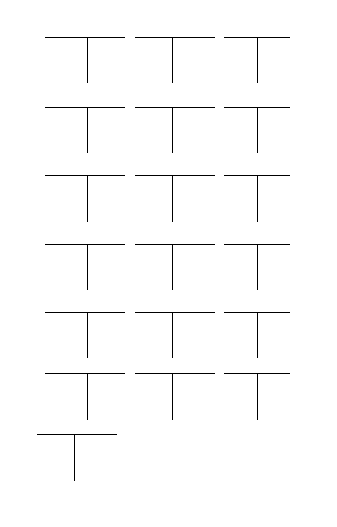

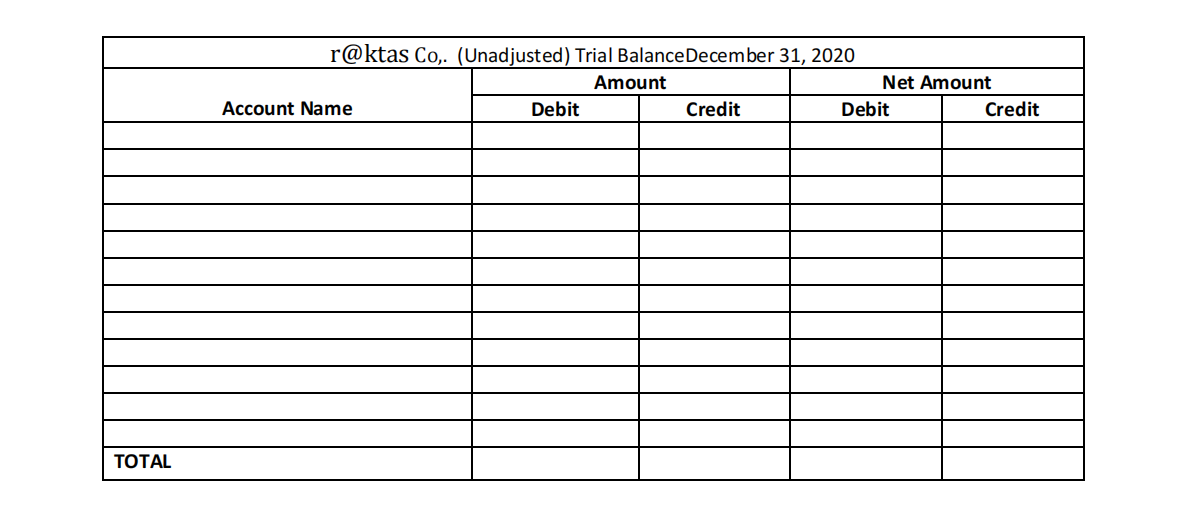

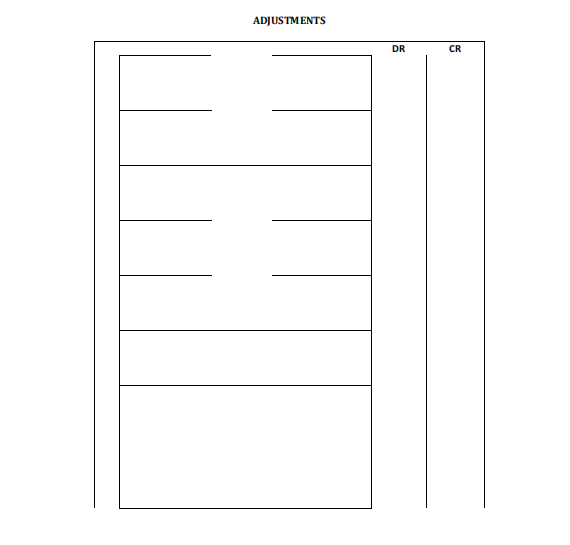

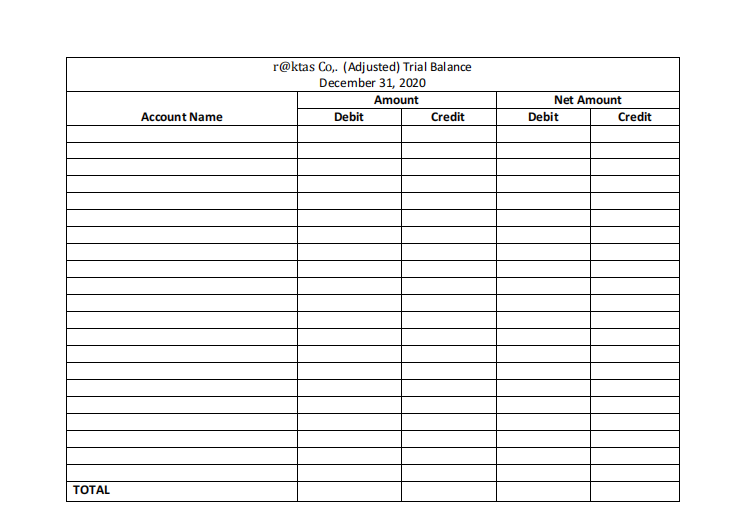

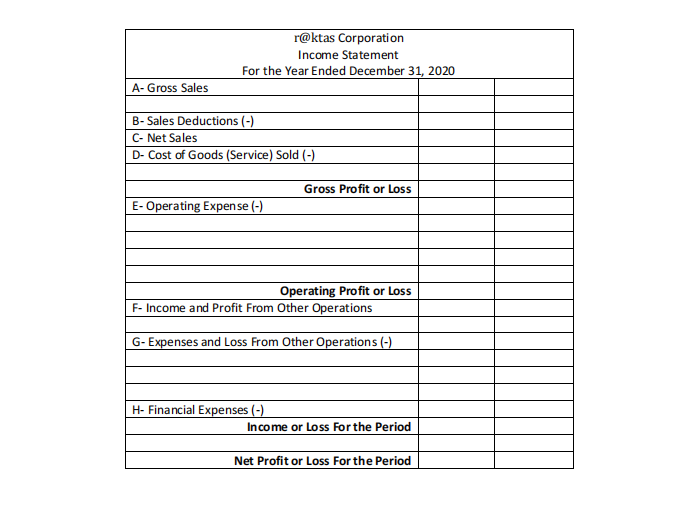

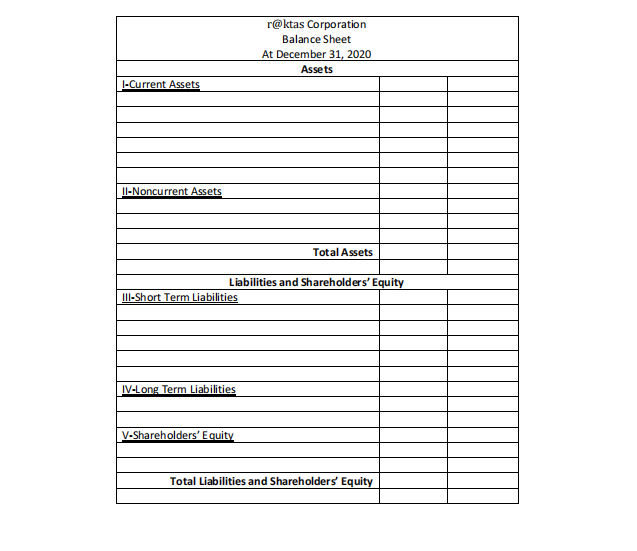

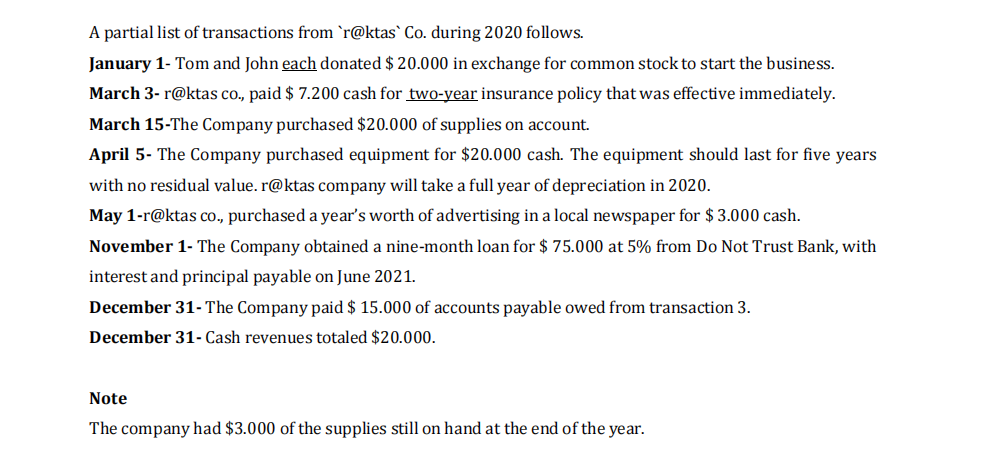

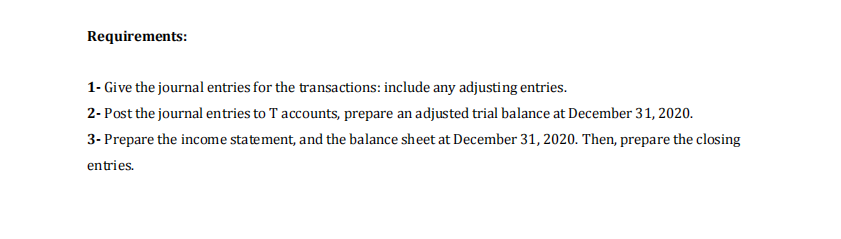

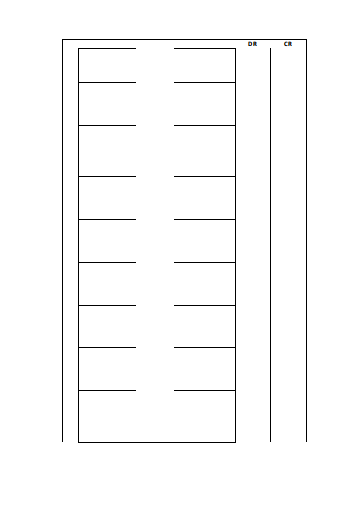

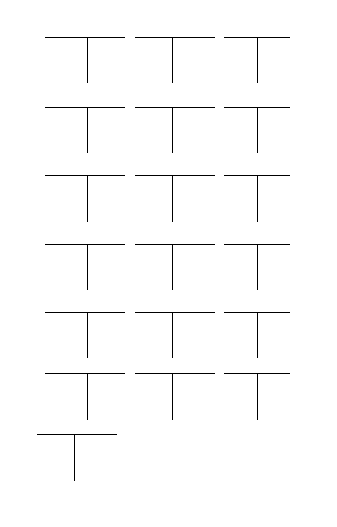

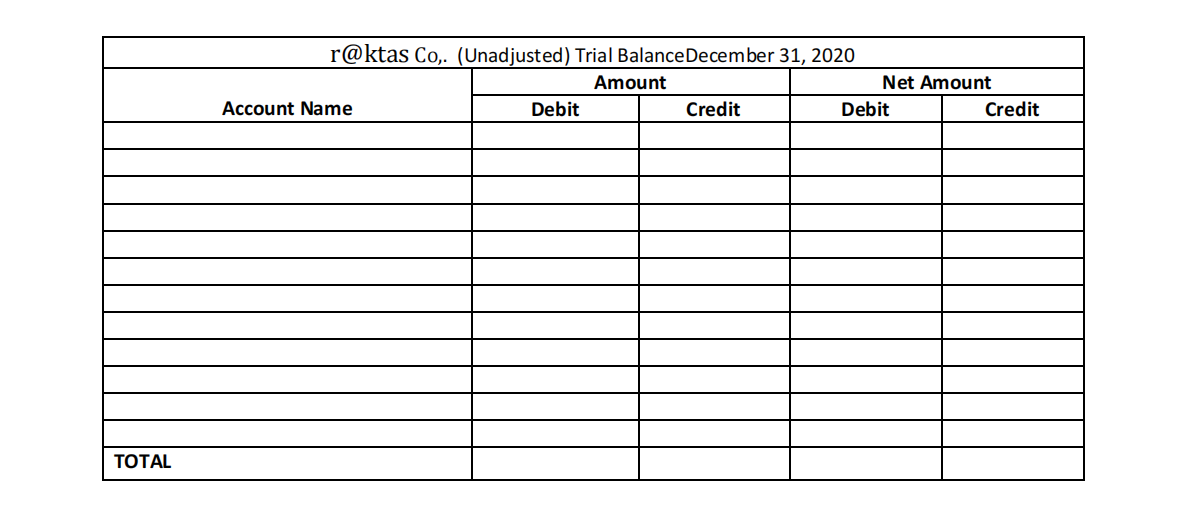

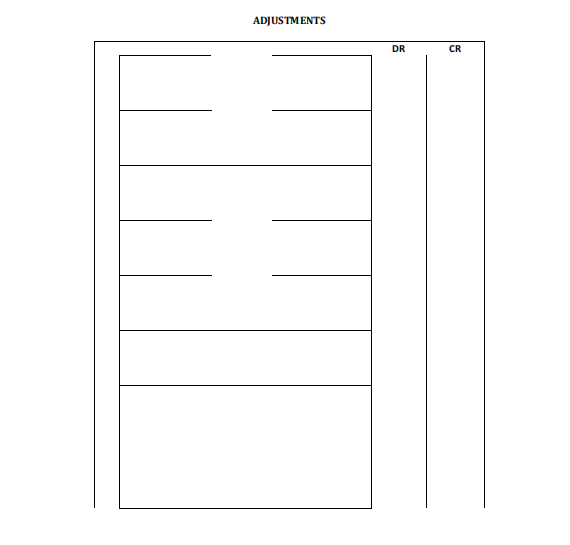

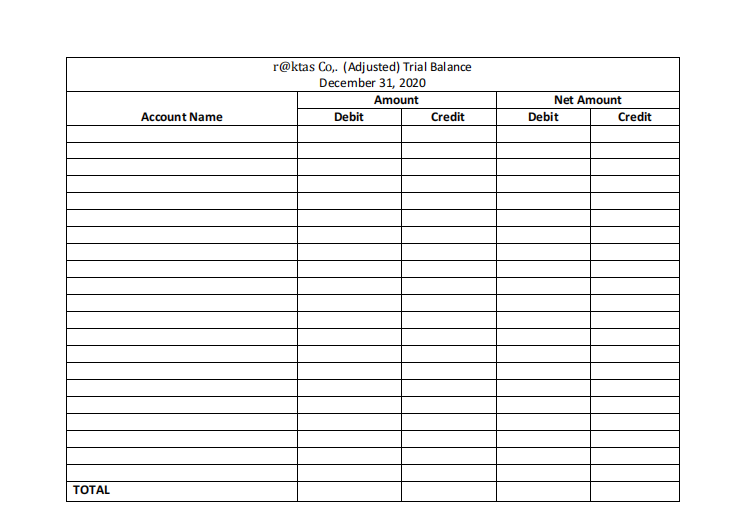

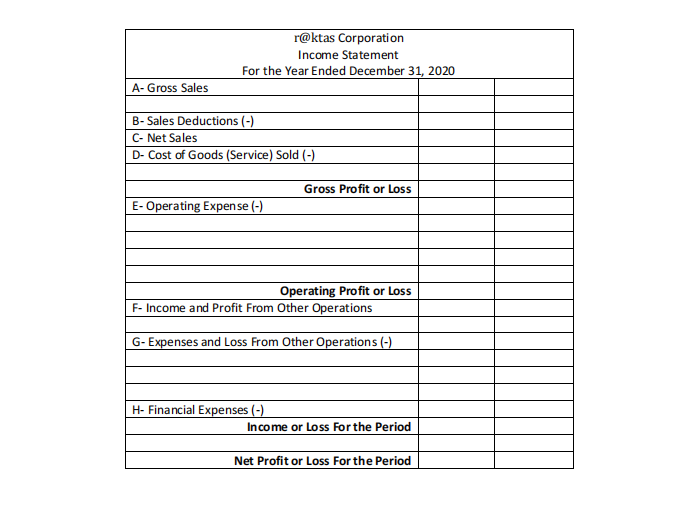

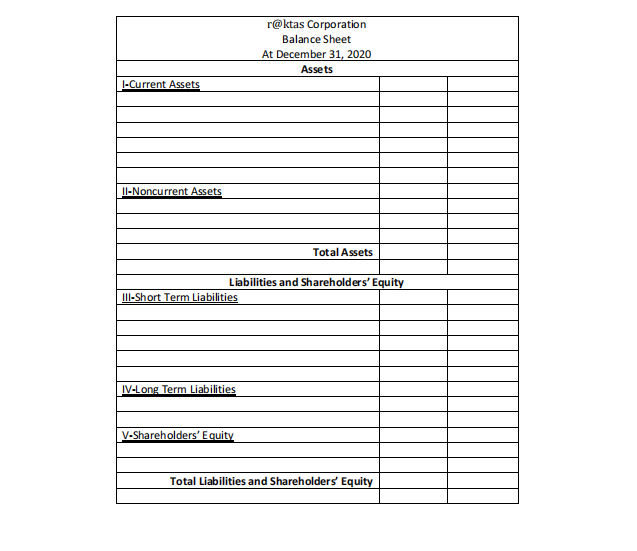

A partial list of transactions from `r@ktas Co. during 2020 follows. January 1- Tom and John each donated $ 20.000 in exchange for common stock to start the business. March 3- r@ktas co., paid $ 7.200 cash for two-year insurance policy that was effective immediately. March 15-The Company purchased $20.000 of supplies on account. April 5- The Company purchased equipment for $20.000 cash. The equipment should last for five years with no residual value.r@ktas company will take a full year of depreciation in 2020. May 1-r@ktas co., purchased a year's worth of advertising in a local newspaper for $3.000 cash. November 1- The Company obtained a nine-month loan for $ 75.000 at 5% from Do Not Trust Bank, with interest and principal payable on June 2021. December 31- The Company paid $ 15.000 of accounts payable owed from transaction 3. December 31- Cash revenues totaled $20.000. Note The company had $3.000 of the supplies still on hand at the end of the year. Requirements: 1- Give the journal entries for the transactions: include any adjusting entries. 2- Post the journal entries to T accounts, prepare an adjusted trial balance at December 31, 2020. 3- Prepare the income statement, and the balance sheet at December 31, 2020. Then, prepare the closing entries. CR r@ktas Co,. (Unadjusted) Trial Balance December 31, 2020 Amount Net Amount Account Name Debit Credit Debit Credit TOTAL ADJUSTMENTS DR CR r@ktas Co,. (Adjusted) Trial Balance December 31, 2020 Amount Debit Credit Net Amount Debit Credit Account Name TOTAL r@ktas Corporation Income Statement For the Year Ended December 31, 2020 A-Gross Sales B-Sales Deductions (-) C-Net Sales D- Cost of Goods (Service) Sold (-) Gross Profit or Loss E- Operating Expense (-) Operating Profit or loss F-Income and Profit From Other Operations G-Expenses and Loss From Other Operations (-) H- Financial Expenses (-) Income or Loss For the Period Net Profit or Loss For the Period r@ktas Corporation Balance Sheet At December 31, 2020 Assets 1-Current Assets II-Noncurrent Assets Total Assets Liabilities and Shareholders' Equity III-Short Term Liabilities IV-Long Term Liabilities V-Shareholders' Equity Total Liabilities and Shareholders' Equity

Please complete the tables provided.

Please complete the tables provided.