Please complete these three problems

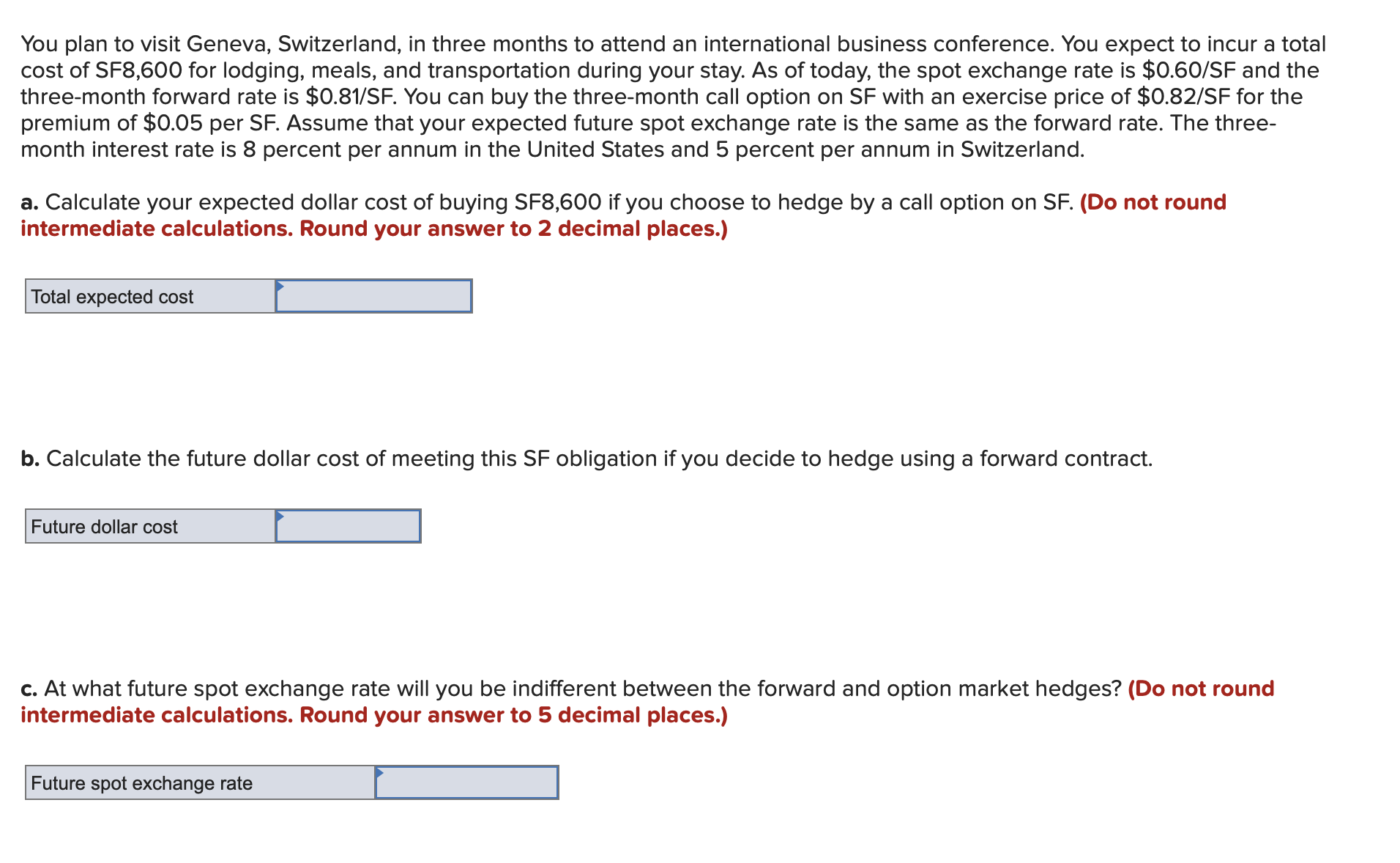

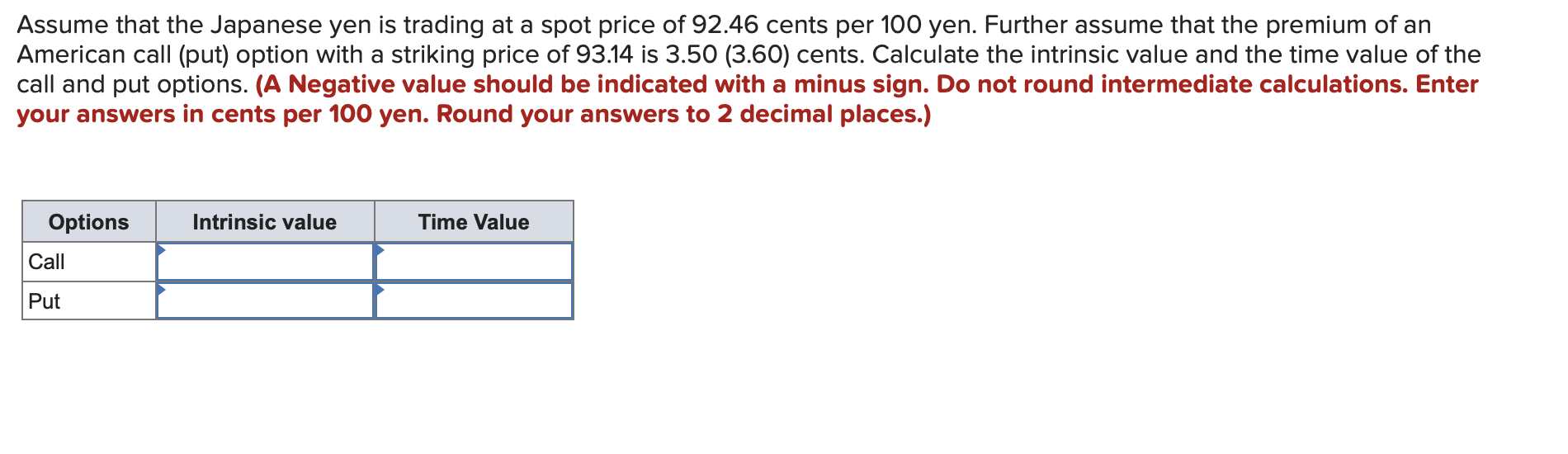

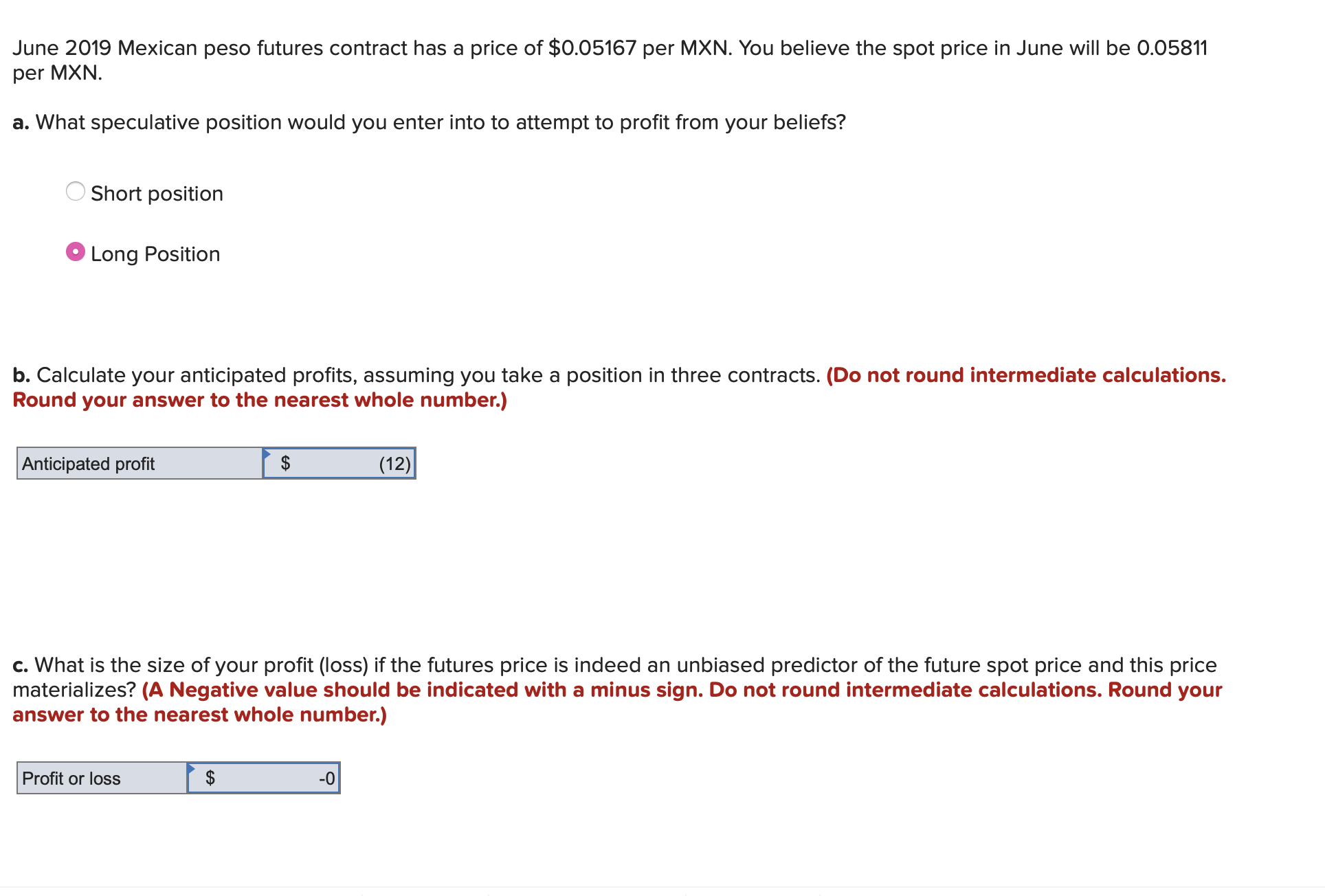

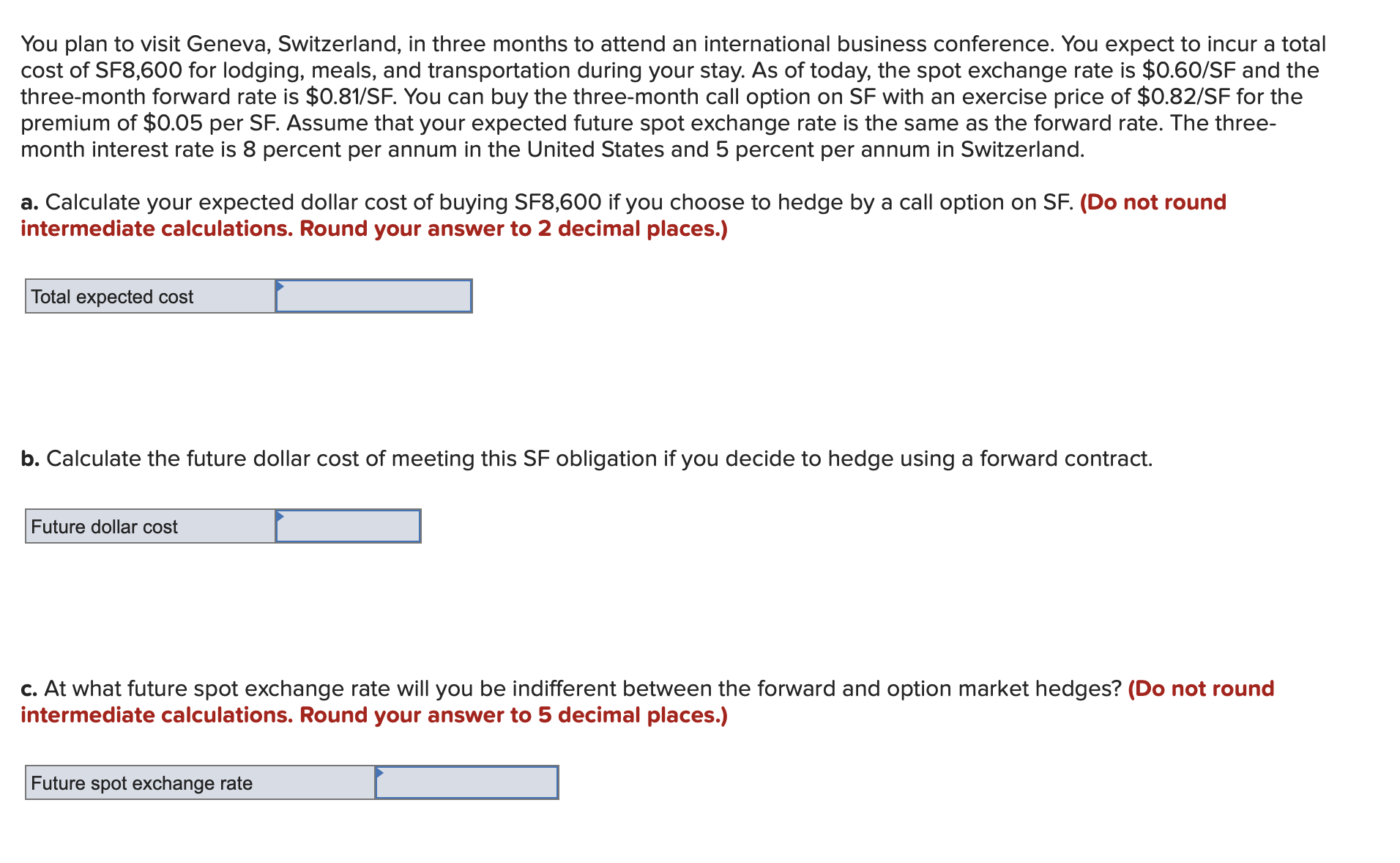

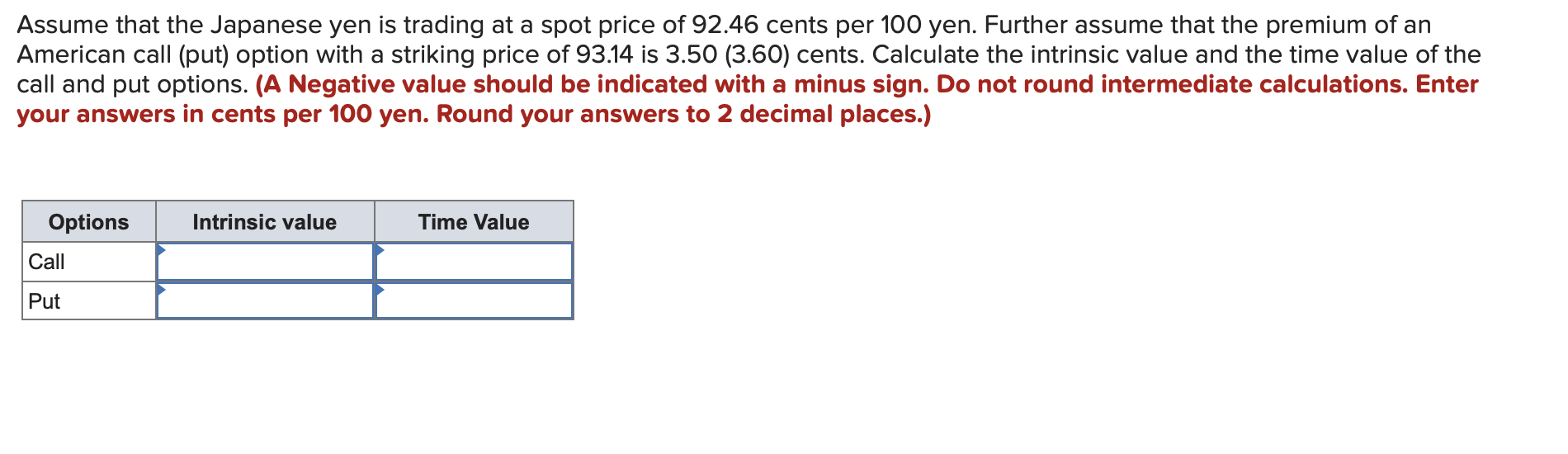

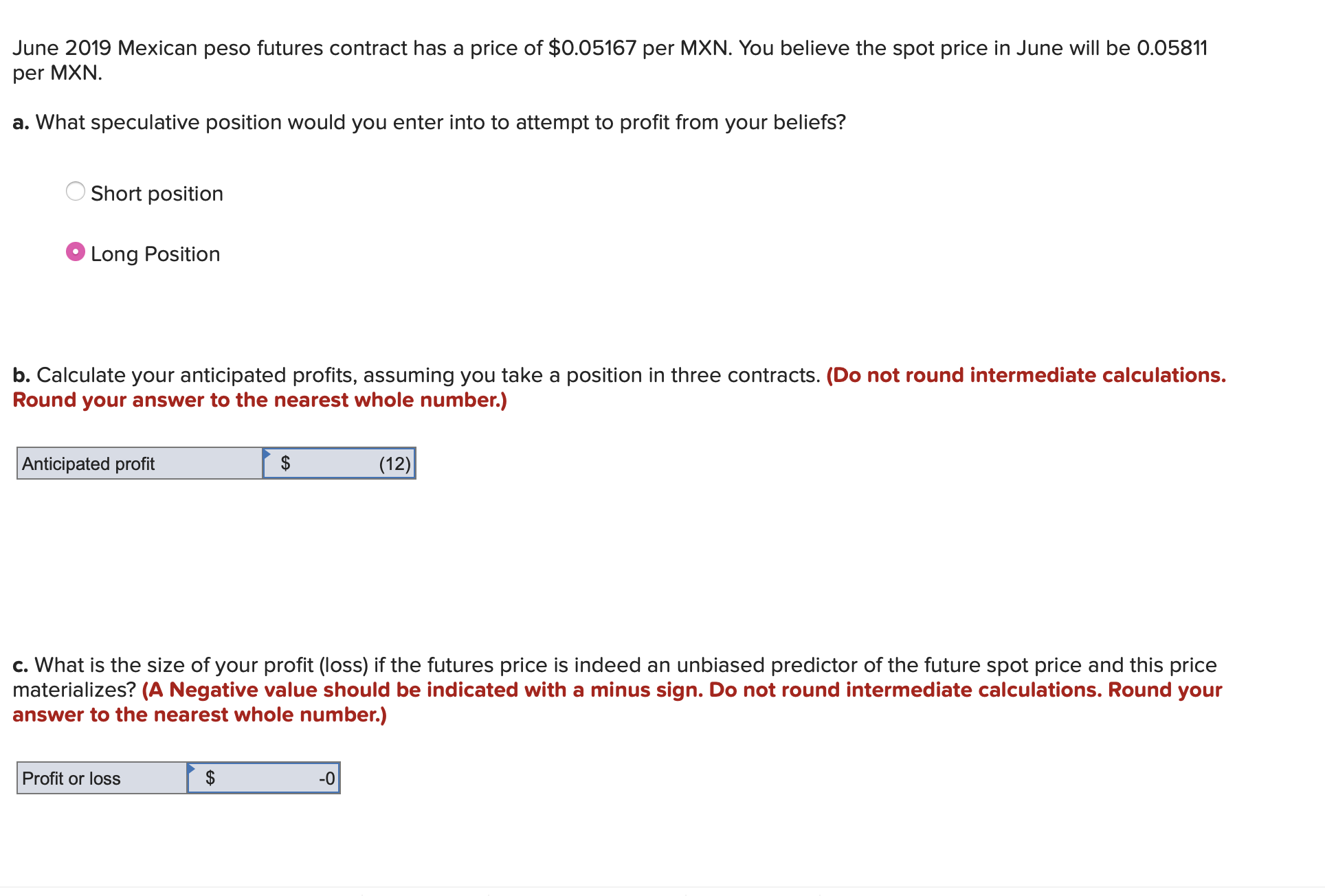

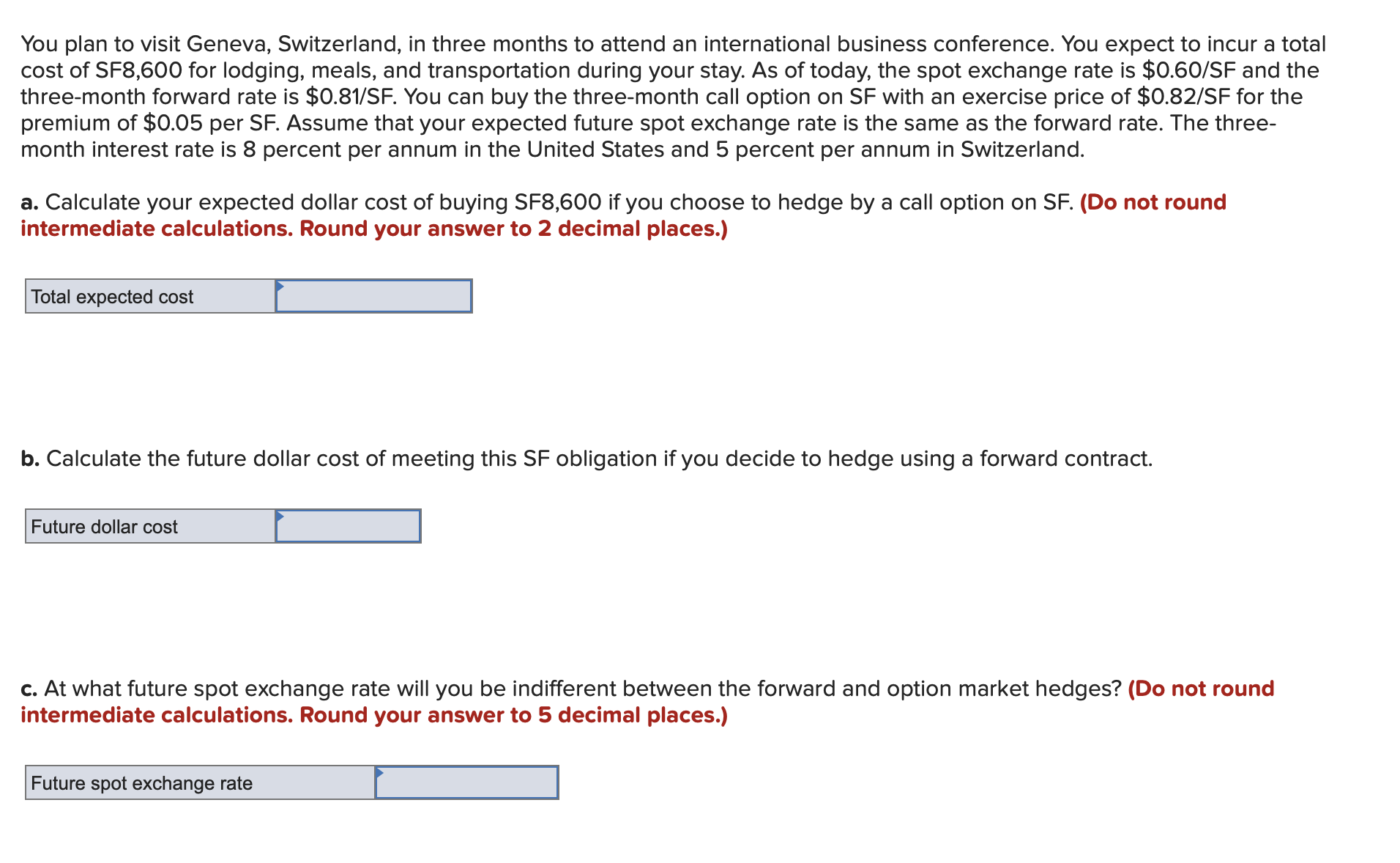

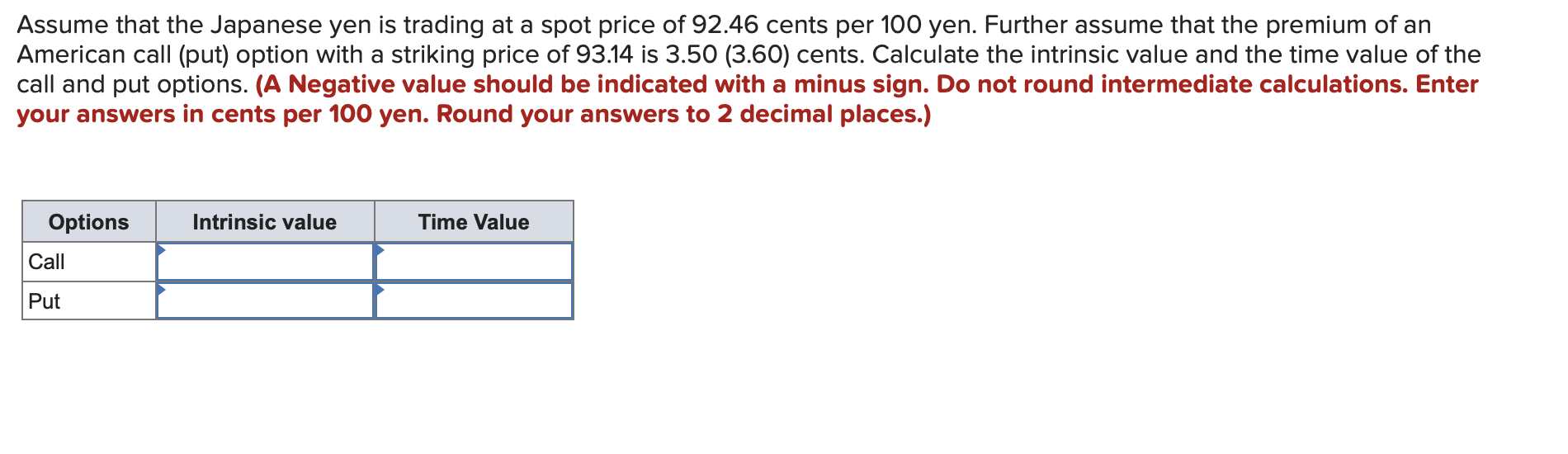

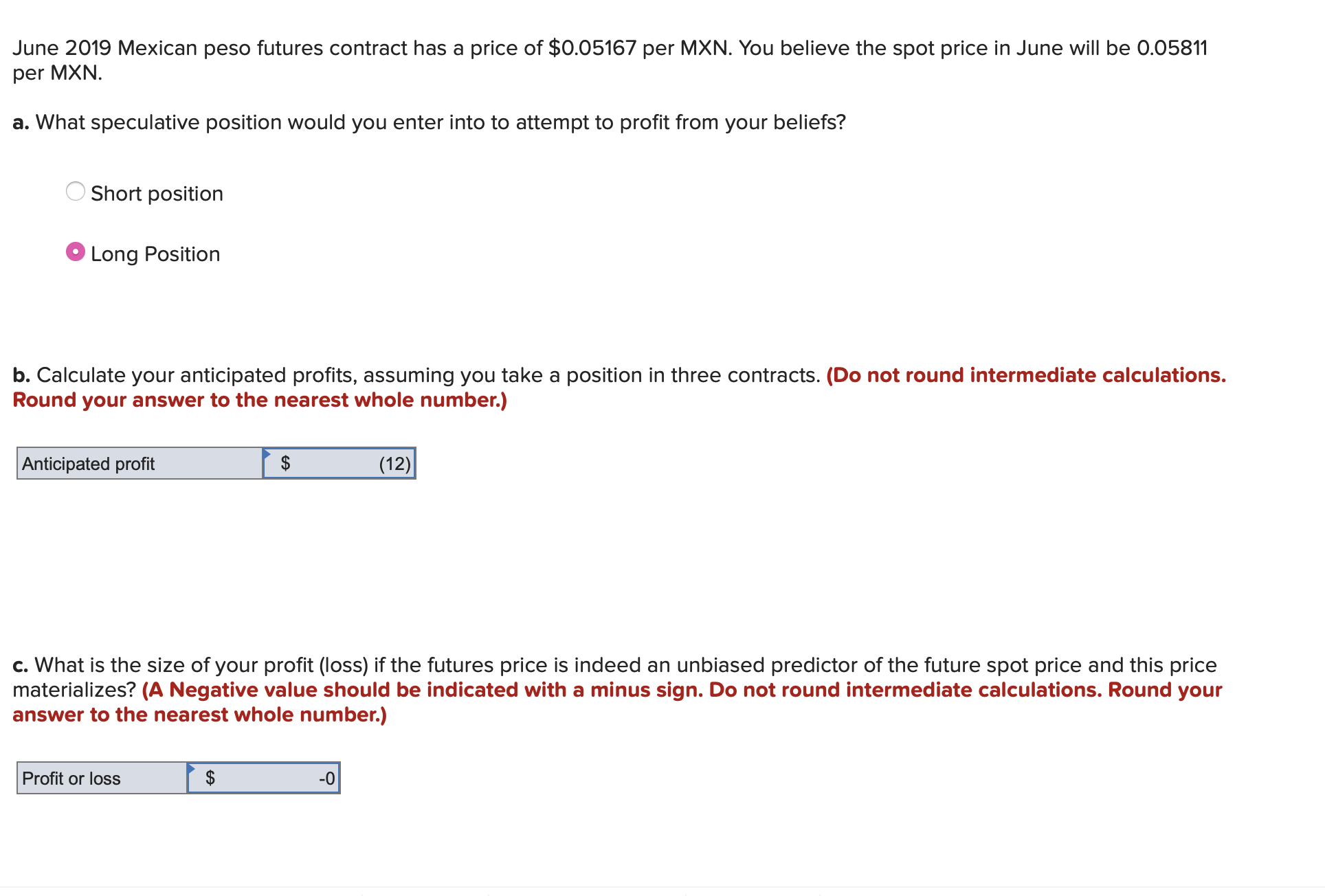

You plan to visit Geneva, Switzerland, in three months to attend an international business conference. You expect to incur a total cost of SF8,600 for lodging, meals, and transportation during your stay. As of today, the spot exchange rate is $0.60/SF and the threemonth forward rate is $0.81/SF. You can buy the threemonth call option on SF with an exercise price of $0.82/SF for the premium of $0.05 per SF. Assume that your expected future spot exchange rate is the same as the forward rate. The three month interest rate is 8 percent per annum in the United States and 5 percent per annum in Switzerland. 3. Calculate your expected dollar cost of buying SF8,600 if you choose to hedge by a call option on SF. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Total expected cost I I b. Calculate the future dollar cost of meeting this SF obligation if you decide to hedge using a forward contract. Future dollar cost I I c. At what future spot exchange rate will you be indifferent between the forward and option market hedges? (Do not round intermediate calculations. Round your answer to 5 decimal places.) Future spot exchange rate Assume that the Japanese yen is trading at a spot price of 92.46 cents per 100 yen. Further assume that the premium of an American call (put) option with a striking price of 93.14 is 3.50 (3.60) cents. Calculate the intrinsic value and the time value of the call and put options. (A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Enter your answers in cents per 100 yen. Round your answers to 2 decimal places.) June 2019 Mexican peso futures contract has a price of $005167 per MXN. You believe the spot price in June will be 0.05811 per MXN. a. What speculative Position would you enter into to attempt to profit from your beliefs? A Short position 0 Long Position b. Calculate your anticipated prots, assuming you take a position in three contracts. (Do not round intermediate calculations. Round your answer to the nearest whole number.) Anticipated prot $ (12) c. What is the size of your profit (loss) if the futures price is indeed an unbiased predictor of the future spot price and this price materializes? (A Negative value should be indicated with a minus sign. Do not round intermediate calculations. Round your answer to the nearest whole number.) Protorloss _