Answered step by step

Verified Expert Solution

Question

1 Approved Answer

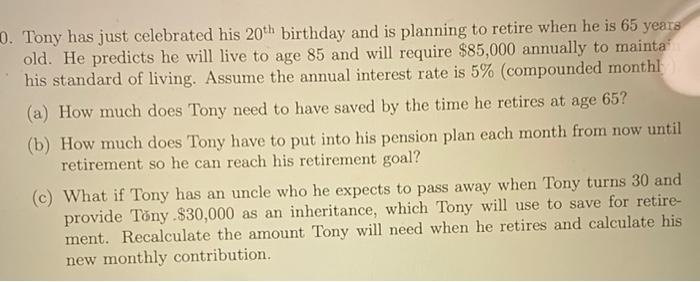

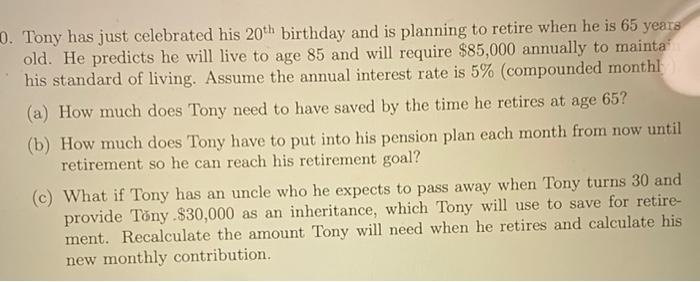

Please compute using formulas and no financial calculator. thank you 1. Tony has just celebrated his 20th birthday and is planning to retire when he

Please compute using formulas and no financial calculator. thank you

1. Tony has just celebrated his 20th birthday and is planning to retire when he is 65 years old. He predicts he will live to age 85 and will require $85,000 annually to mainta his standard of living. Assume the annual interest rate is 5% (compounded monthl (a) How much does Tony need to have saved by the time he retires at age 65? (b) How much does Tony have to put into his pension plan each month from now until retirement so he can reach his retirement goal? (c) What if Tony has an uncle who he expects to pass away when Tony turns 30 and provide Tony.$30,000 as an inheritance, which Tony will use to save for retire- ment. Recalculate the amount Tony will need when he retires and calculate his new monthly contribution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started