Answered step by step

Verified Expert Solution

Question

1 Approved Answer

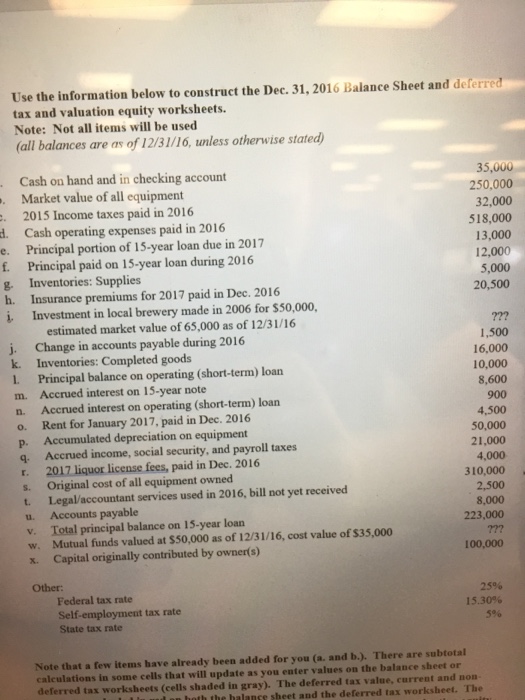

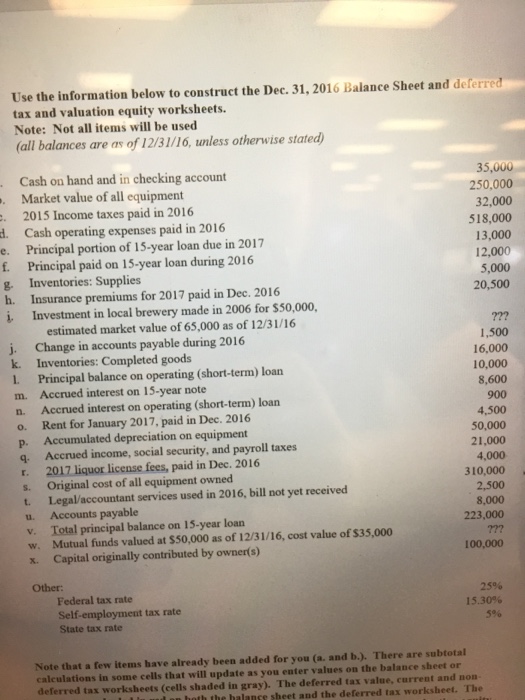

Please construct a balance sheet and deferred tax and valuation equity sheet. Thanks Use the information below to construct the Dec. 31, 2016 Balance Sheet

Please construct a balance sheet and deferred tax and valuation equity sheet. Thanks

Use the information below to construct the Dec. 31, 2016 Balance Sheet and deferred tax and valuation equity worksheets. Note: Not all items will be used all balances are as of 12/31/16, unless otherwise stated Cash on hand and in checking account 35,000 250,000 32,000 518,000 13,000 12,000 5,000 20,500 Market value of all equipment 2015 Income taxes paid in 2016 . Cash operating expenses paid in 2016 . Principal portion of 15-year loan due in 2017 f. Principal paid on 15-year loan during 2016 g. Inventories: Supplies h. Insurance premiums for 2017 paid in Dec. 2016 i. Investment in local brewery made in 2006 for $50,000, estimated market value of 65,000 as of 12/31/16 j. Change in accounts payable during 2016 k. Inventories: Completed goods 1 Principal balance on operating (short-term) loan m. Accrued interest on 15-year note n. Accrued interest on operating (short-term) loan o. Rent for January 2017, paid in Dec. 2016 1,500 16,000 10,000 8,600 900 4,500 50,000 21,000 4,000 . Accumulated depreciation on equipment q. Accrued income, social security, and payroll taxes 2017 liquor license fees, paid in Dec. 2016 s. Original cost of all equipment owned t. Legal/accountant services used in 2016, bill not yet received u. Accounts payable v. Total principal balance on 15-year loan w. Mutual funds valued at $50,000 as of 12/31/16, cost value of $35,000 x. Capital originally contributed by owner(s) 310,000 2,500 8,000 223,000 772 100,000 Other Federal tax rate Self-employment tax rate State tax rate 25% 15.30% 596 Note that a few items have already been added for you (a. and b.). There are subtotal calculations in some cells that will update as you enter values on the balance sheet or deferred tax worksheets (cells shaded in gray). The deferred tax value, current and non hoth the halanse sheet and the deferred tax worksheet. The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started