Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(please correct and detail answers, and no use excel ,because have mark)( about fixed income securities) Question 2 (20%) (A) An investor has the following

(please correct and detail answers, and no use excel ,because have mark)( about fixed income securities)

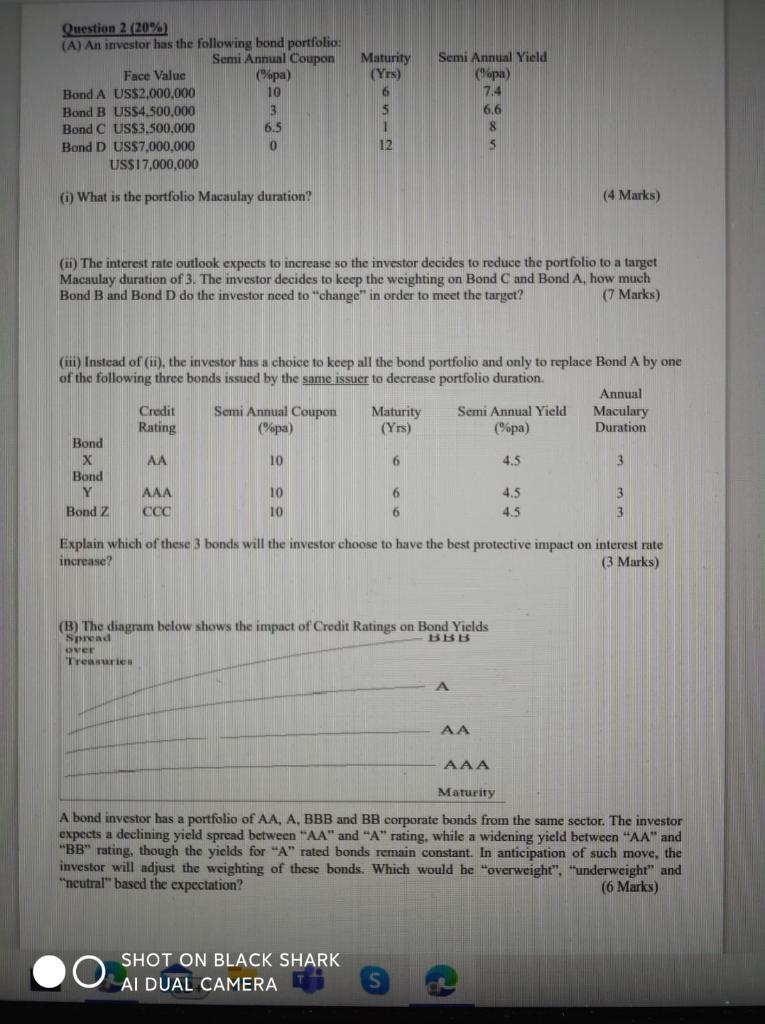

Question 2 (20%) (A) An investor has the following bond portfolio: Semi Annual Coupon Face Value (pa) Bond A US$2,000,000 10 Bond B US$4,500,000 3 Bond C US$3,500,000 6.5 Bond D US$7,000,000 0 USSI 7,000,000 Maturity (Yrs) 6 5 1 12 Semi Annual Yield (%opa) 7.4 6.6 8 S (i) What is the portfolio Macaulay duration? (4 Marks) (11) The interest rate outlook expects to increase so the investor decides to reduce the portfolio to a target Macaulay duration of 3. The investor decides to keep the weighting on Bond C and Bond A, how much Bond B and Bond D do the investor need to change" in order to meet the target? (7 Marks) (iii) Instead of (in), the investor has a choice to keep all the bond portfolio and only to replace Bond A by one of the following three bonds issued by the same issuer to decrease portfolio duration Annual Credit Rating Semi Annual Coupon () Maturity (Yrs) Semi Annual Yield (pa) Maculary Duration Bond X AA 10 6 4.5 Bond Y Bond Z AAA 10 10 6 6 4.5 4.5 3 Explain which of these 3 bonds will the investor choose to have the best protective impact on interest rate increase? (3 Marks) (B) The diagram below shows the impact of Credit Ratings on Bond Yields BBB Spread over Treasure AAA Maturity A bond investor has a portfolio of AA, A, BBB and BB corporate bonds from the same sector. The investor expects a declining yield spread between "AA" and "A" rating, while a widening yield between "AA" and "BB" rating, though the yields for "A" rated bonds remain constant. In anticipation of such move, the investor will adjust the weighting of these bonds. Which would he "overweight": "underweight and "neutral" based the expectation? (6 Marks) SHOT ON BLACK SHARK AI DUAL CAMERA Question 2 (20%) (A) An investor has the following bond portfolio: Semi Annual Coupon Face Value (pa) Bond A US$2,000,000 10 Bond B US$4,500,000 3 Bond C US$3,500,000 6.5 Bond D US$7,000,000 0 USSI 7,000,000 Maturity (Yrs) 6 5 1 12 Semi Annual Yield (%opa) 7.4 6.6 8 S (i) What is the portfolio Macaulay duration? (4 Marks) (11) The interest rate outlook expects to increase so the investor decides to reduce the portfolio to a target Macaulay duration of 3. The investor decides to keep the weighting on Bond C and Bond A, how much Bond B and Bond D do the investor need to change" in order to meet the target? (7 Marks) (iii) Instead of (in), the investor has a choice to keep all the bond portfolio and only to replace Bond A by one of the following three bonds issued by the same issuer to decrease portfolio duration Annual Credit Rating Semi Annual Coupon () Maturity (Yrs) Semi Annual Yield (pa) Maculary Duration Bond X AA 10 6 4.5 Bond Y Bond Z AAA 10 10 6 6 4.5 4.5 3 Explain which of these 3 bonds will the investor choose to have the best protective impact on interest rate increase? (3 Marks) (B) The diagram below shows the impact of Credit Ratings on Bond Yields BBB Spread over Treasure AAA Maturity A bond investor has a portfolio of AA, A, BBB and BB corporate bonds from the same sector. The investor expects a declining yield spread between "AA" and "A" rating, while a widening yield between "AA" and "BB" rating, though the yields for "A" rated bonds remain constant. In anticipation of such move, the investor will adjust the weighting of these bonds. Which would he "overweight": "underweight and "neutral" based the expectation? (6 Marks) SHOT ON BLACK SHARK AI DUAL CAMERAStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started