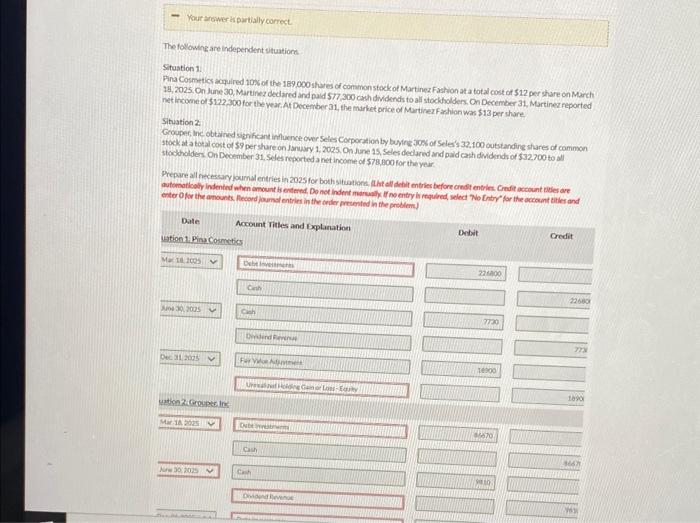

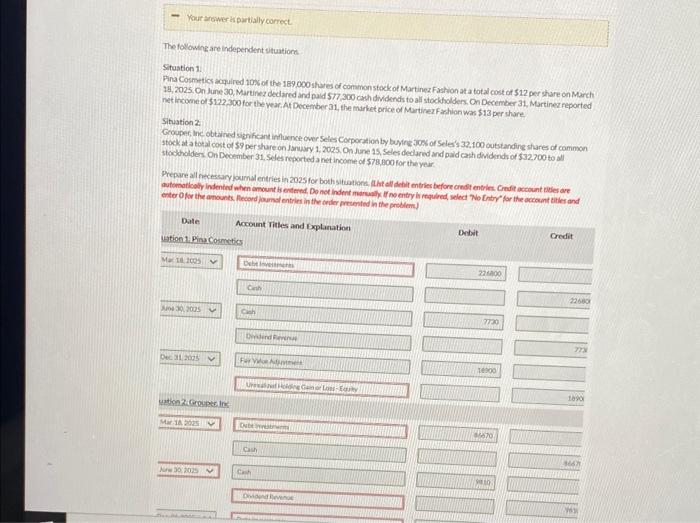

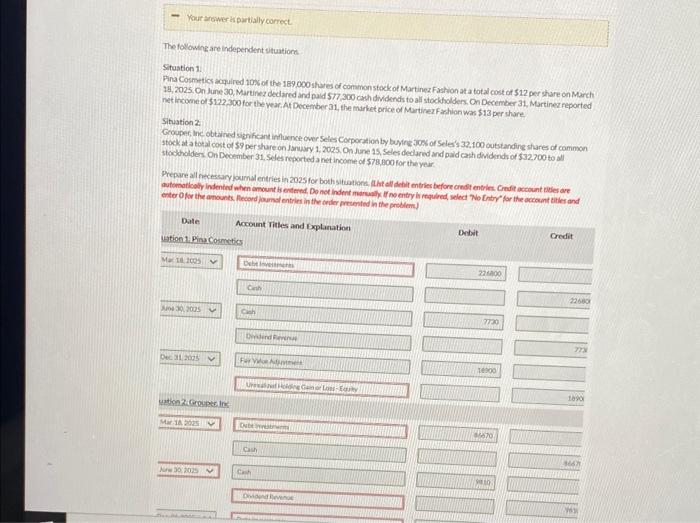

please correct what is wrong (on red) using the list of accounts

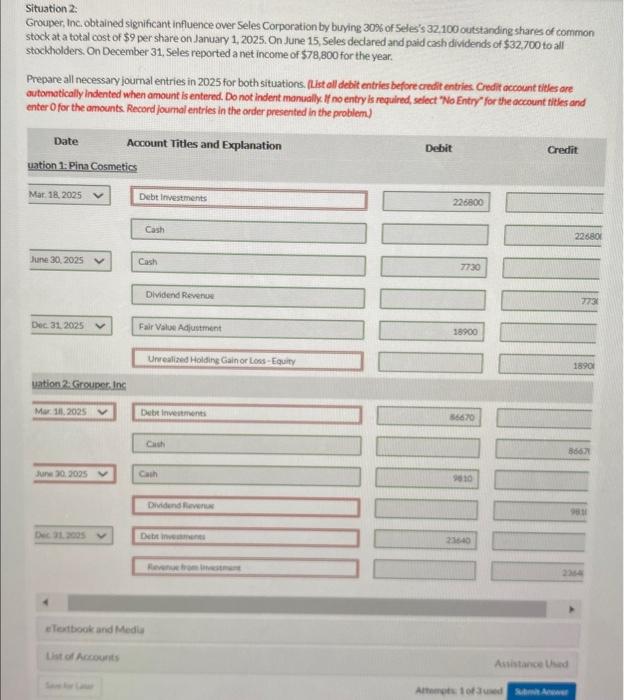

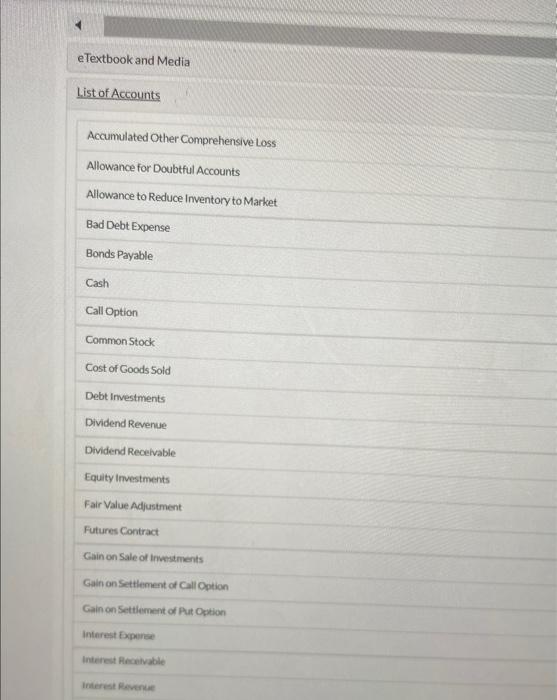

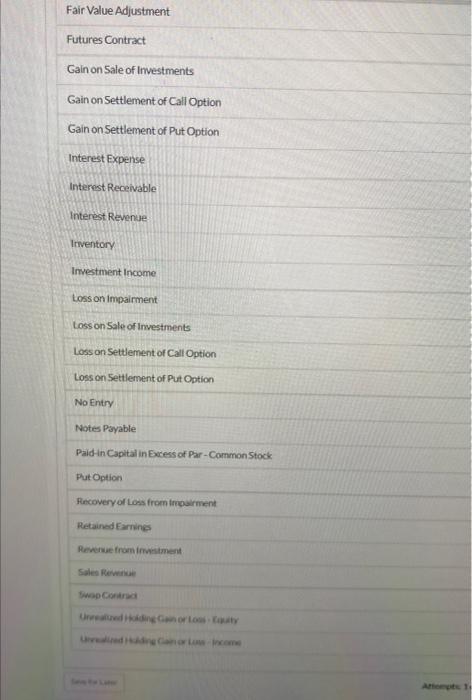

The following are independent stuation Sitastion 1. Pina Cosmetics acquired 10 ss of the 189 000 shures of conmon stock of Martinea Fashion at a total cost of 512 per thare on March. 13, 2025, On June 30, Martinez dedared and pald 577,300 cath didends to all stockholders. On December 31, Martinez feported net income of 5122300 for the year Af Decenber 31, the market price of Marticel Farhion was $13 per chare. Mtuation 2 Grouper inc obtained sigrificant influence over Seles Corporation by buyne 30x of Seles's 32,100 outstanding shares of common stock at a total cost of 59 per share on January 1,2025. On June 15, Seles declared and paid cash dividendror $32700 to all stacdholders On December 31, Seles reported a net income of 578800 for the year. enter of for the anounts. Recood jound entries in the onder precented in the problem.). Situation 2: Grouper, Inc. obtained significant influence over Seles Corporation by buying 30% of Seles's 32,100 outstanding shares of common stock at a total cost of $9 per share on January 1, 2025. On June 15, Seles declared and paid cash dividends of $32,700 to all stockholders. On December 31 , Seles reported a net income of $78,800 for the year. Prepare all necessary journal entries in 2025 for both situations. (List all debit entries before crealt entries Credit occount titles are outomatically indented when amount is entered. Do not indent monually if no entry is required, select "No Entry" for the occount titles and enter O for the amounts Record jourmal entries in the order presented in the problem. eTextbook and Media List of Accounts Accumulated Other Comprehensive Loss Allowance for Doubtful Accounts Allowance to Reduce Inventory to Market Bad Debt Expense Bonds Payable Cash Call Option Common Stock Cost of Goods Sold Debt Investments Dividend Revenue Dividend Recelvable Equity imvestments Fair Value Adjustment Futures Contract Gain on Sale of inwemtments Gain on Settlement of Call Option Gain on Settiement of Put Oction interest Expence interest fiecilvable interest Rovenue Fair Value Adjustment Futures Contract Gain on Sale of Investments Gain on Settlement of Call Option Gain on Settlement of Put Option Interest Expense Interest Receivable Interest Revenue: Itwentory Investment Income Loss on impairment. Loss on Sale of Imvestments Loss an Settlement of Call Option Loss on Settlement of Put Ootion No Entry Notes Pryable Paid in Capital in Excess of Par - Common Stock Put Option Precovery or Loss from trivarment Retained farming Revisue fromifiniment. Sales Reveriue SwopContria Ureealued likiding Cimor tow - Roaby Wredifedtbidine Canor luw - krome