please correctly, i posted this already and it was wrong so please do this correctly

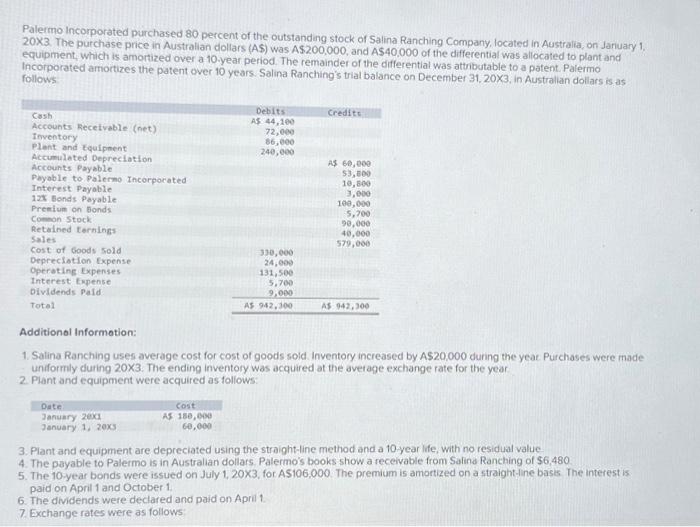

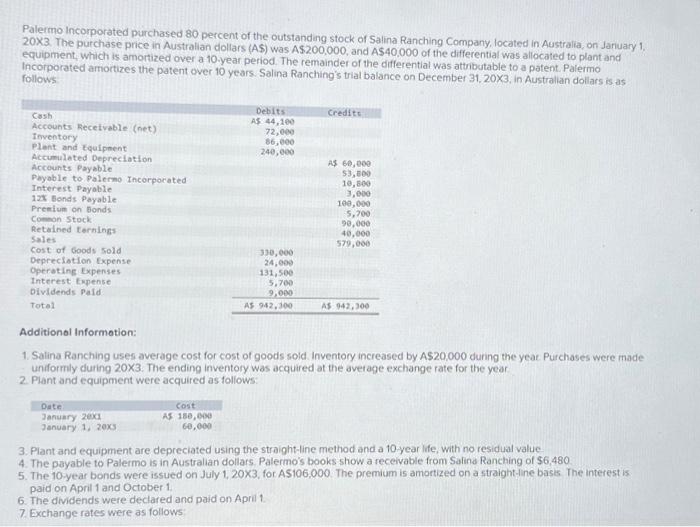

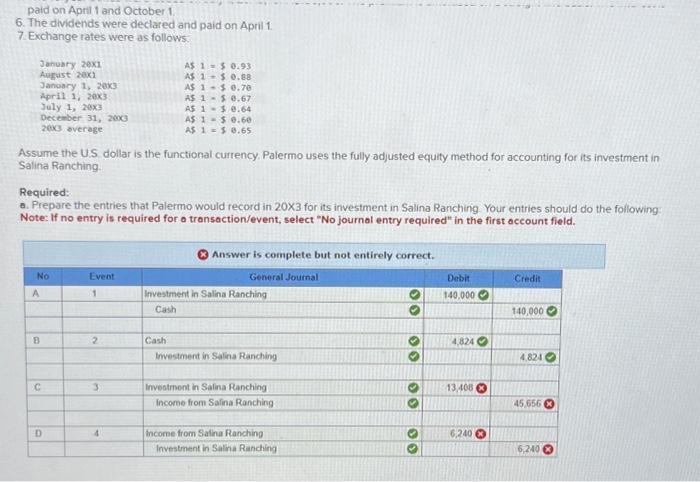

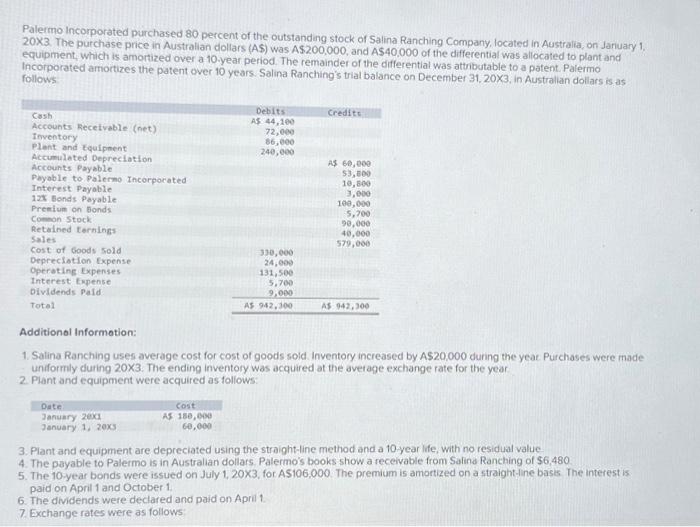

Palermo incorporated purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on Jariuary 1 , 20X3. The purchase price in Australian dollars (AS) was AS200,000, and AS40,000 of the differential was allocated to plant and equipment, which is amortized over a 10.year period. The remainder of the differential was atthbutable to a patent. Palerme Incorporated amortizes the patent over 10 years. Salina Ranching's trial balance on December 31,203, in Australian dollars is as follows Additionol Informotion: 1. Salina Ranching uses average cost for cost of goods sold. Inventory increased by AS20,000 during the yeat Purchases were made unformly during 203. The ending inventory was acquired at the averape exchange rate for the year 2. Plant and equipment were acquired as follows: 3. Plant and equipment are depreciated using the straight-line method and a 10 year life, with no residual value 4. The payable to Palermo is in Australian dollars. Palermo's books show a receivable from Salina Ranching of $6,480 5. The 10-year bonds were issued on July 1,203, for AS106,000. The premium is amortized on a straight-ine basis. The interest is. paid on April 1 and October 1. 6. The dividends were declared and paid on April 1. 7. Exchange rates were as follows paid on April 1 and October 1. 6. The dividends were declared and paid on April 1. 7. Exchange rates were as follows. Assume the U.S dollar is the functional currency. Palermo uses the fully adjusted equity method for accounting for its investment in Salina Ranching. Required: a. Prepare the entries that Palermo would record in 203 for its investment in Salina Ranching. Your entries should do the following Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Assume the U.S. dollar is the functional currency. Palermo uses the fully adjusted equit Salina Ranching. Required: a. Prepare the entries that Palermo would record in 203 for its investment in Salina Ra Note: If no entry is required for a transaction/event, select "No journal entry required Record the acquisition of the foreign investment. Record the dividend received. Record the equity accrual for the percentage of the subsidiary's income. Record the amortization of the differential