Please detail how you would add this information into Xero:

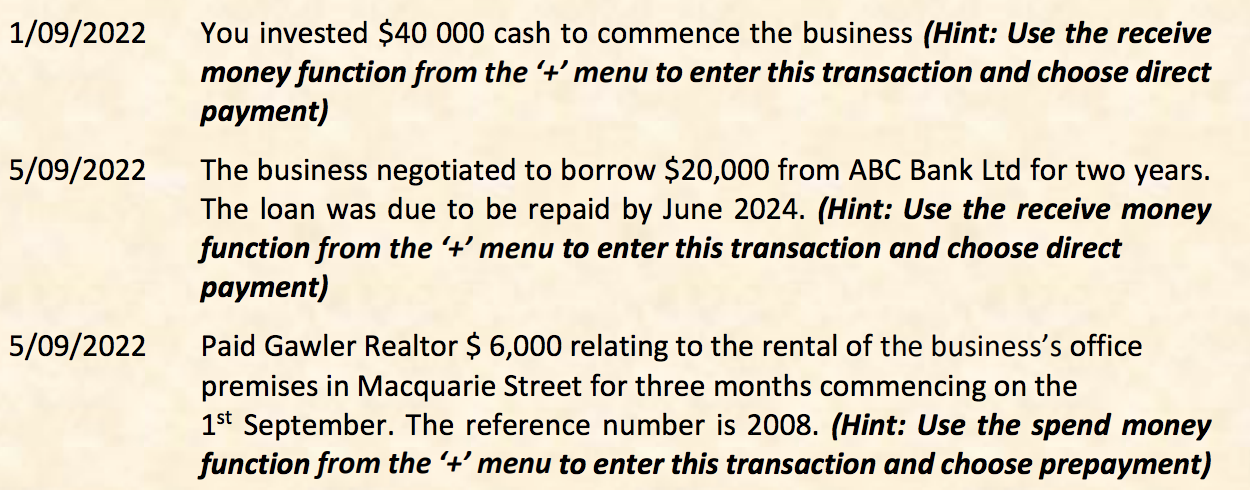

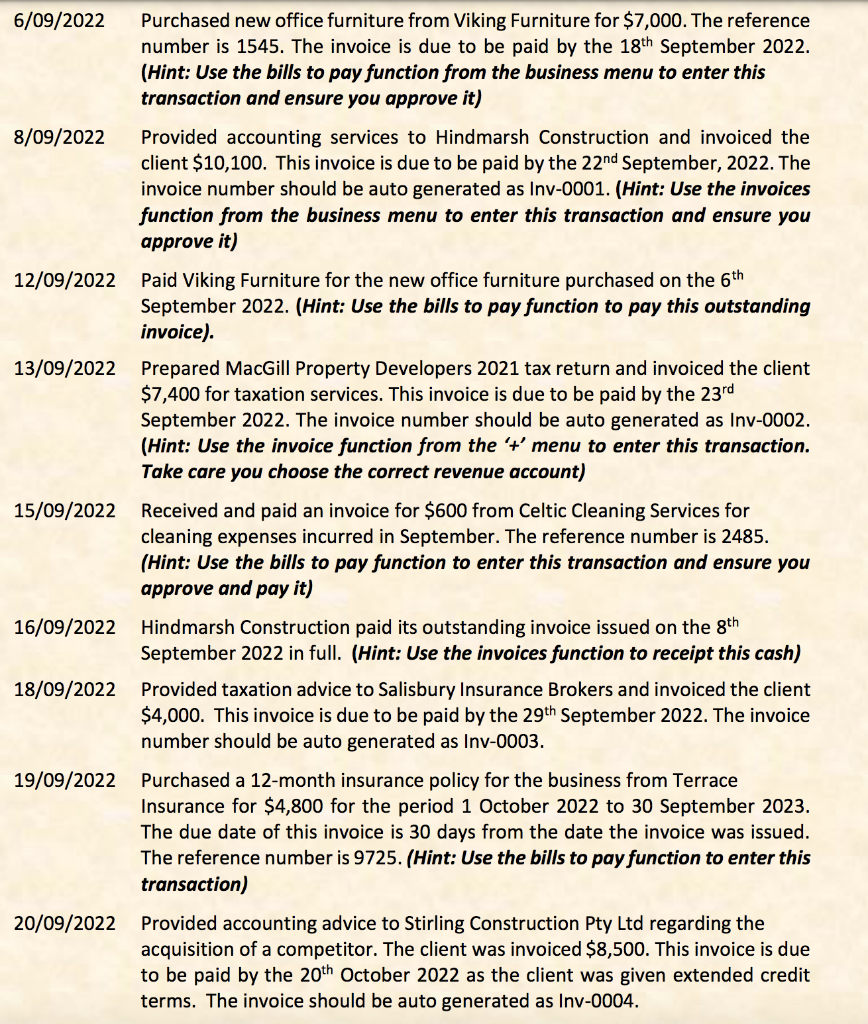

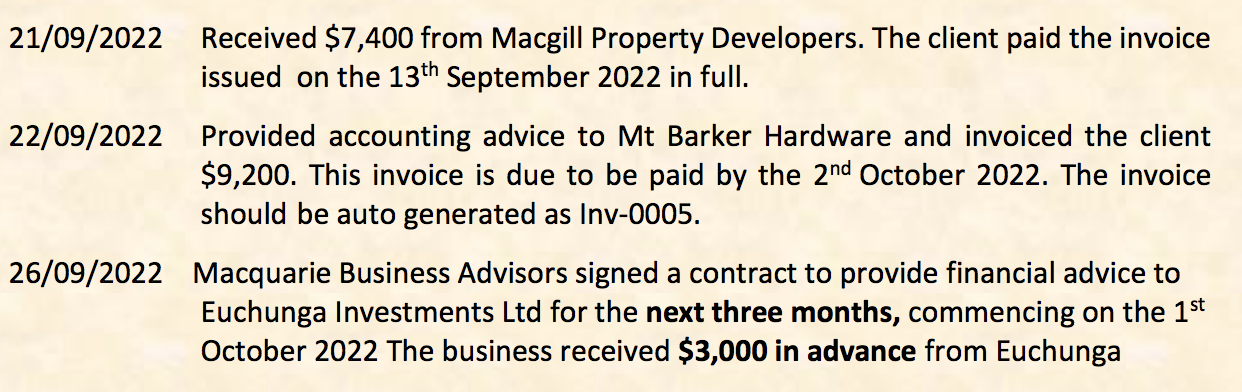

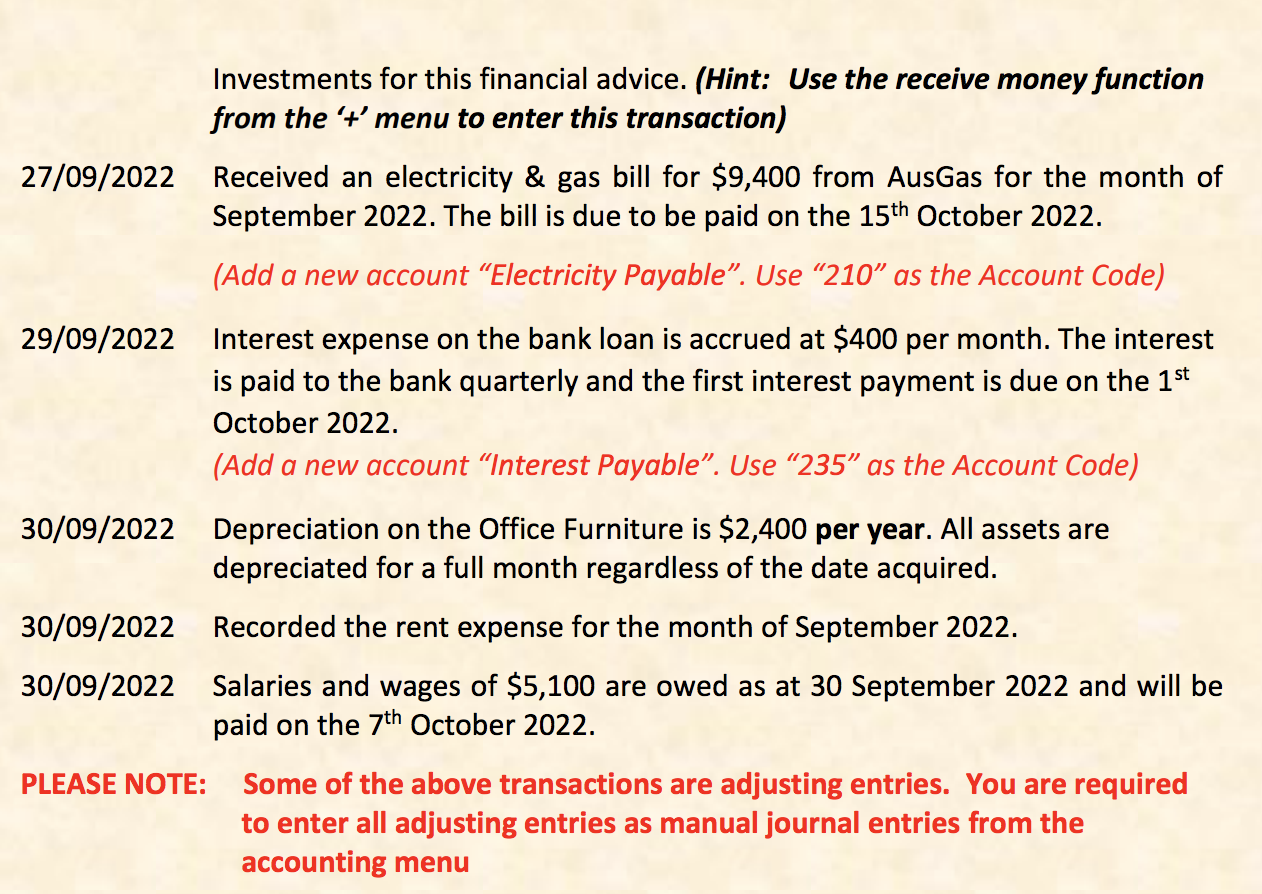

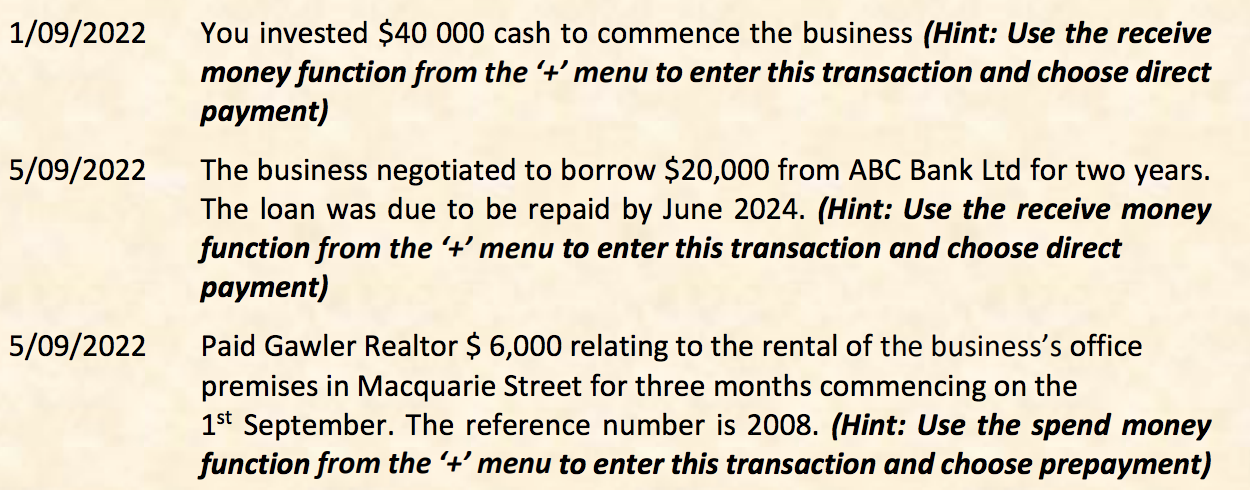

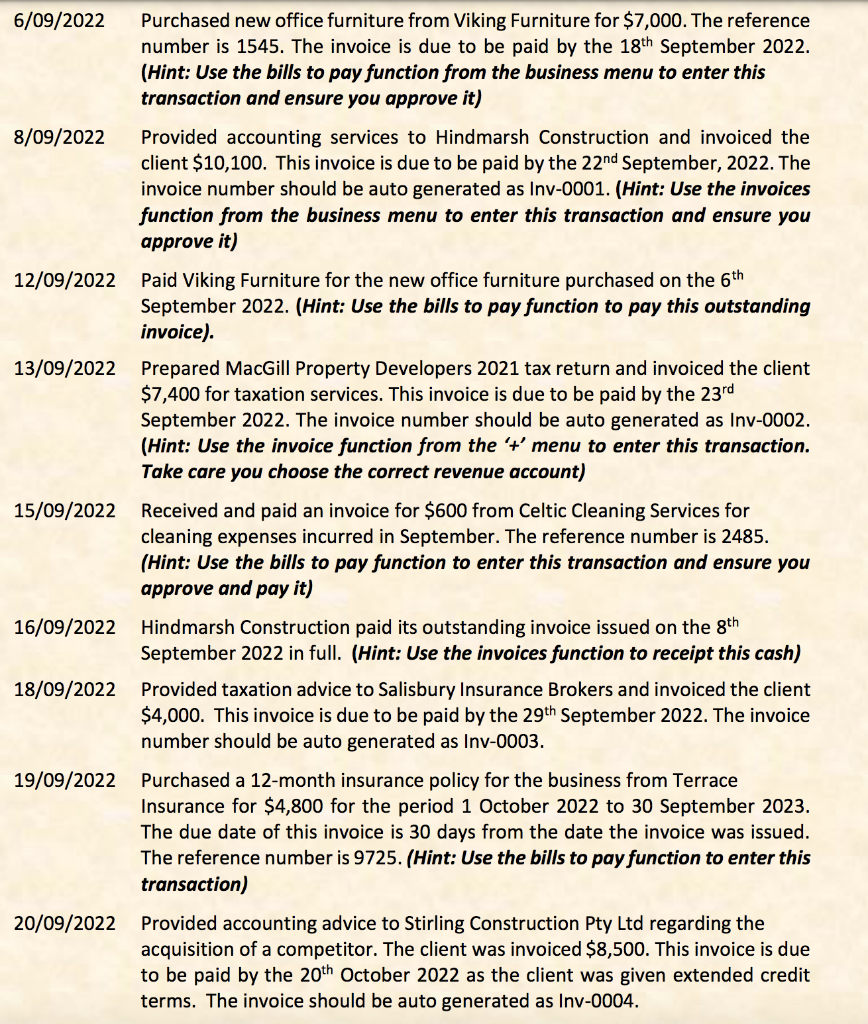

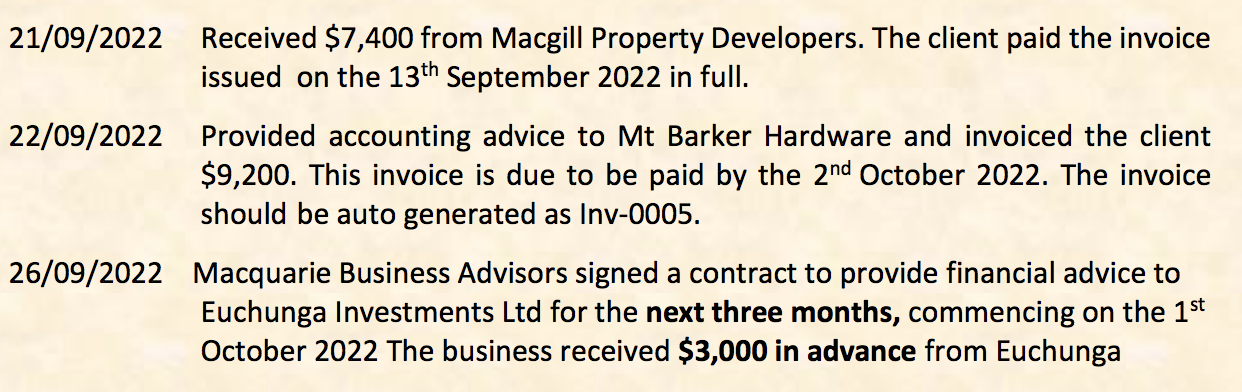

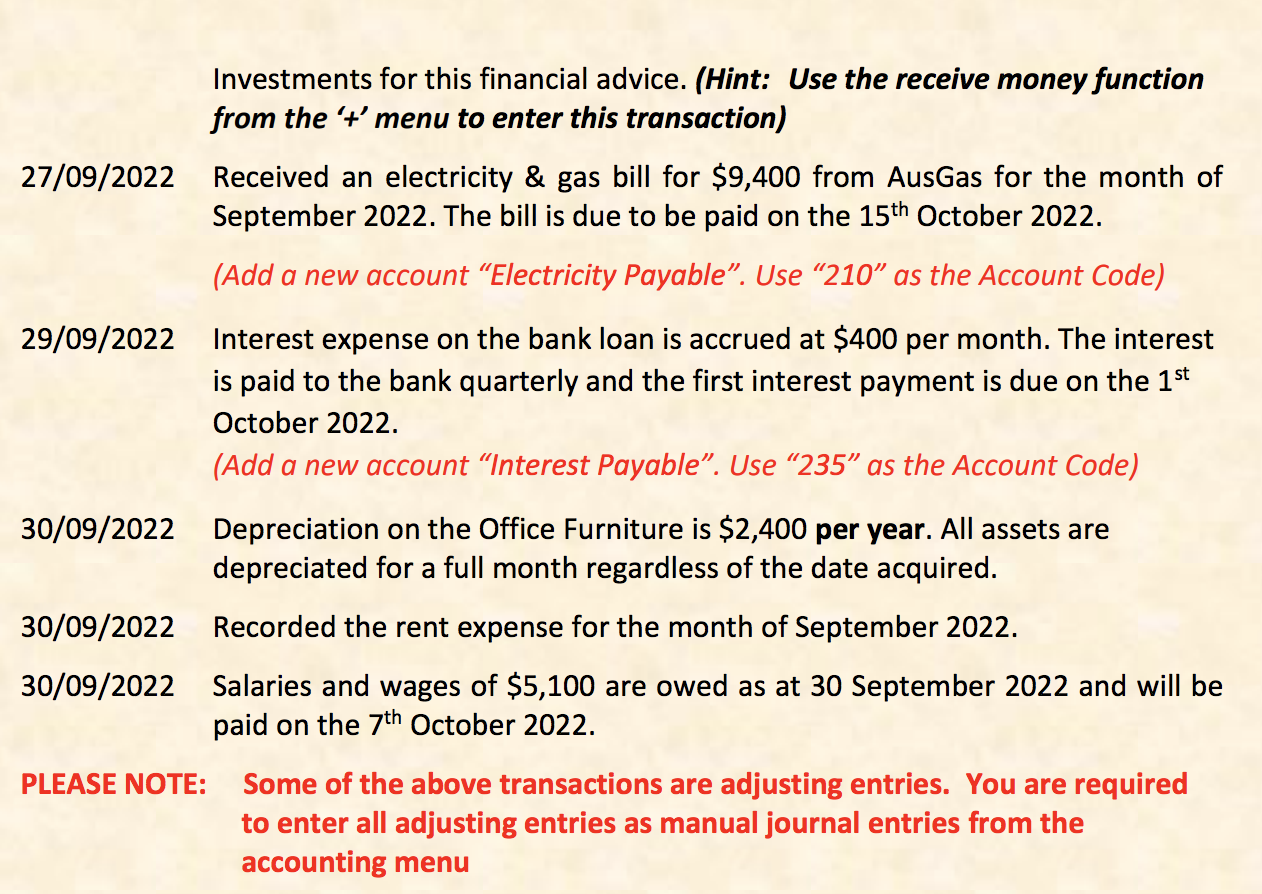

1/09/2022 You invested $40000 cash to commence the business (Hint: Use the receive money function from the ' + ' menu to enter this transaction and choose direct payment) 5/09/2022 The business negotiated to borrow $20,000 from ABC Bank Ltd for two years. The loan was due to be repaid by June 2024. (Hint: Use the receive money function from the ' + ' menu to enter this transaction and choose direct payment) 5/09/2022 Paid Gawler Realtor \$ 6,000 relating to the rental of the business's office premises in Macquarie Street for three months commencing on the 1st September. The reference number is 2008. (Hint: Use the spend money 6/09/2022 Purchased new office furniture from Viking Furniture for $7,000. The reference number is 1545 . The invoice is due to be paid by the 18th September 2022. (Hint: Use the bills to pay function from the business menu to enter this transaction and ensure you approve it) 16/09/2022 Hindmarsh Construction paid its outstanding invoice issued on the 8th September 2022 in full. (Hint: Use the invoices function to receipt this cash) 18/09/2022 Provided taxation advice to Salisbury Insurance Brokers and invoiced the client $4,000. This invoice is due to be paid by the 29th September 2022 . The invoice number should be auto generated as Inv-0003. 19/09/2022 Purchased a 12-month insurance policy for the business from Terrace Insurance for $4,800 for the period 1 October 2022 to 30 September 2023 . The due date of this invoice is 30 days from the date the invoice was issued. The reference number is 9725 . (Hint: Use the bills to pay function to enter this transaction) 20/09/2022 Provided accounting advice to Stirling Construction Pty Ltd regarding the acquisition of a competitor. The client was invoiced $8,500. This invoice is due to be paid by the 20th October 2022 as the client was given extended credit terms. The invoice should be auto generated as Inv-0004. 21/09/2022 Received $7,400 from Macgill Property Developers. The client paid the invoice issued on the 13th September 2022 in full. 22/09/2022 Provided accounting advice to Mt Barker Hardware and invoiced the client $9,200. This invoice is due to be paid by the 2nd October 2022 . The invoice should be auto generated as Inv-0005. 26/09/2022 Macquarie Business Advisors signed a contract to provide financial advice to Euchunga Investments Ltd for the next three months, commencing on the 1st October 2022 The business received $3,000 in advance from Euchunga Investments for this financial advice. (Hint: Use the receive money function from the ' + ' menu to enter this transaction) 27/09/2022 Received an electricity \& gas bill for $9,400 from AusGas for the month of September 2022 . The bill is due to be paid on the 15th October 2022. (Add a new account "Electricity Payable". Use "210" as the Account Code) 29/09/2022 Interest expense on the bank loan is accrued at $400 per month. The interest is paid to the bank quarterly and the first interest payment is due on the 1st October 2022. (Add a new account "Interest Payable". Use "235" as the Account Code) 30/09/2022 Depreciation on the Office Furniture is $2,400 per year. All assets are depreciated for a full month regardless of the date acquired. 30/09/2022 Recorded the rent expense for the month of September 2022. 30/09/2022 Salaries and wages of $5,100 are owed as at 30 September 2022 and will be paid on the 7th October 2022. PLEASE NOTE: Some of the above transactions are adjusting entries. You are required to enter all adjusting entries as manual journal entries from the accounting menu