Please discuss the drivers of LBOs, how LBOs create value, and the risk associated with LBOs.

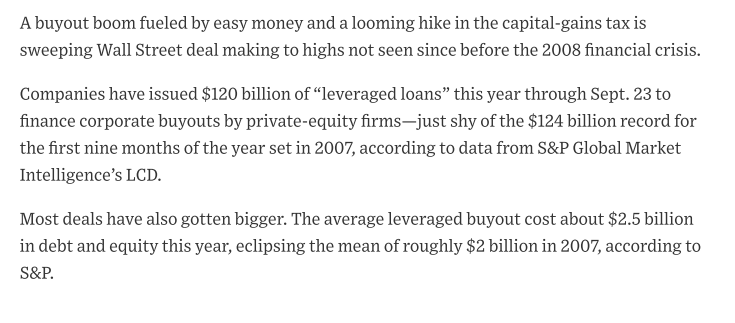

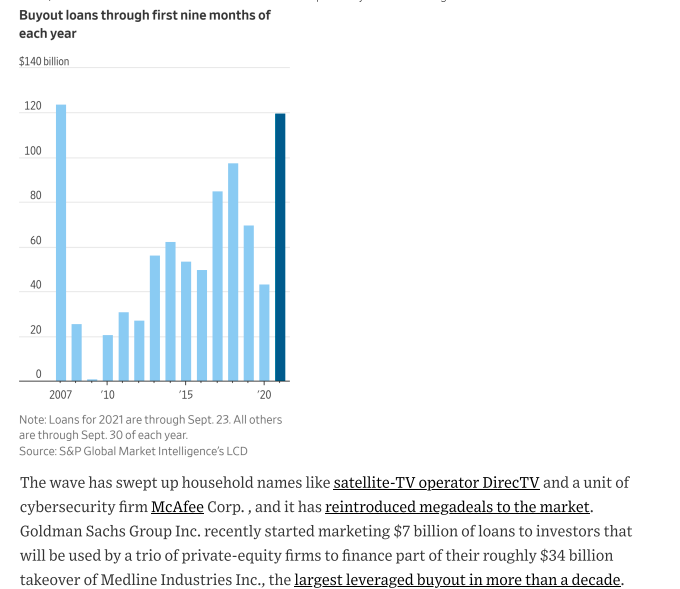

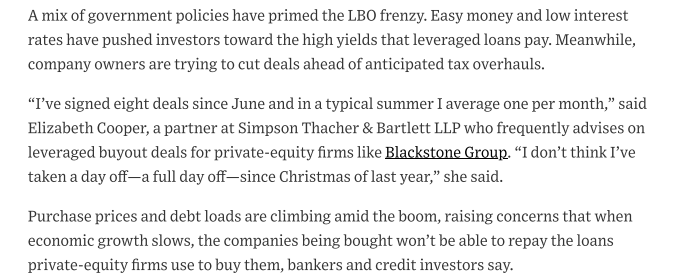

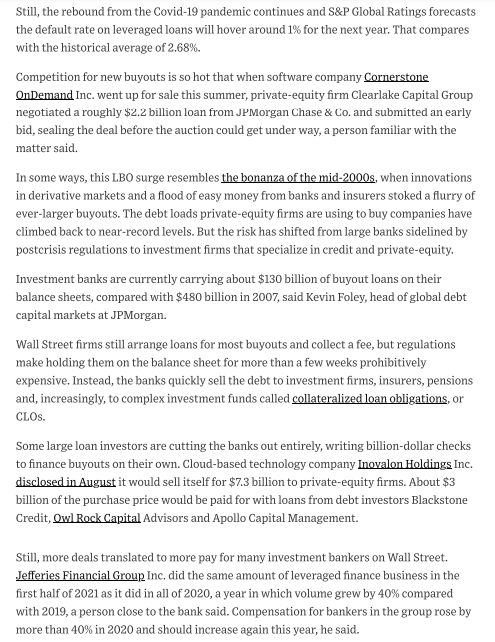

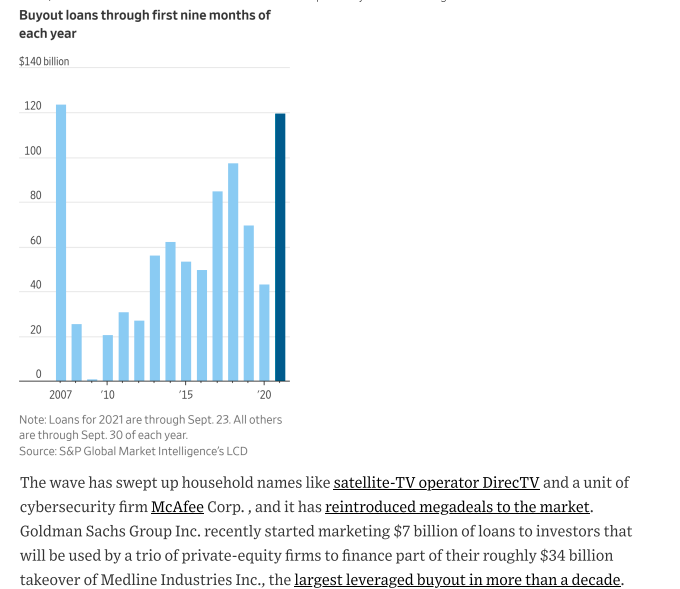

A buyout boom fueled by easy money and a looming hike in the capital-gains tax is sweeping Wall Street deal making to highs not seen since before the 2008 financial crisis. Companies have issued $120 billion of "leveraged loans" this year through Sept. 23 to finance corporate buyouts by private-equity firms-just shy of the $124 billion record for the first nine months of the year set in 2007, according to data from S\&P Global Market Intelligence's LCD. Most deals have also gotten bigger. The average leveraged buyout cost about $2.5 billion in debt and equity this year, eclipsing the mean of roughly $2 billion in 2007 , according to S\&P. Buyout loans through first nine months of each year $140 billion are through Sept. 30 of each year. Source: S\&P Global Market Intelligence's LCD The wave has swept up household names like satellite-TV operator DirecTV and a unit of cybersecurity firm McAfee Corp. , and it has reintroduced megadeals to the market. Goldman Sachs Group Inc. recently started marketing $7 billion of loans to investors that will be used by a trio of private-equity firms to finance part of their roughly $34 billion takeover of Medline Industries Inc., the largest leveraged buyout in more than a decade. A mix of government policies have primed the LBO frenzy. Easy money and low interest rates have pushed investors toward the high yields that leveraged loans pay. Meanwhile, company owners are trying to cut deals ahead of anticipated tax overhauls. "I've signed eight deals since June and in a typical summer I average one per month," said Elizabeth Cooper, a partner at Simpson Thacher \& Bartlett LLP who frequently advises on leveraged buyout deals for private-equity firms like Blackstone Group. "I don't think I've taken a day off-a full day off-since Christmas of last year," she said. Purchase prices and debt loads are climbing amid the boom, raising concerns that when economic growth slows, the companies being bought won't be able to repay the loans private-equity firms use to buy them, bankers and credit investors say. Still, the rebound from the Covid-19 pandemic continues and S\&P Global Ratings forecasts the default rate on leveraged loans will hover around 1% for the next year. That compares with the historical average of 2.68%. Competition for new buyouts is so hot that when software company Cornerstone OnDemand Inc. went up for sale this summer, private-equity firm Clearlake Capital Group negotiated a roughly $2.2 billion loan from JPMorgan Chase \& Co. and submitted an early bid, sealing the deal before the auction could get under way, a person familiar with the matter said. In some ways, this LBO surge resembles the bonanza of the mid-2000s, when innovations in derivative markets and a flood of easy money from banks and insurers stoked a flurry of ever-larger buyouts. The debt loads private-equity firms are using to buy companies have climbed back to near-record levels. But the risk has shifted from large banks sidelined by postcrisis regulations to investment firms that specialize in credit and private-equity. Investment banks are currently carrying about $130 billion of buyout loans on their balance sheets, compared with $480 billion in 2007, said Kevin Foley, head of global debt capital markets at JPMorgan. Wall Street firms still arrange loans for most buyouts and collect a fee, but regulations make holding them on the balance sheet for more than a few weeks prohibitively expensive. Instead, the banks quickly sell the debt to investment firms, insurers, pensions and, increasingly, to complex investment funds called collateralized loan obligations, or CLOs. Some large loan investors are cutting the banks out entirely, writing billion-dollar checks to finance buyouts on their own. Cloud-based technology company Inovalon Holdings Inc. disclosed in August it would sell itself for $7.3 billion to private-equity firms. About $3 billion of the purchase price would be paid for with loans from debt investors Blackstone Credit, Owl Rock Capital Advisors and Apollo Capital Management. Still, more deals translated to more pay for many investment bankers on Wall Street. Jefferies Financial Group Inc, did the same amount of leveraged finance business in the first half of 2021 as it did in all of 2020 , a year in which volume grew by 40% compared with 2019, a person close to the bank said. Compensation for bankers in the group rose by more than 40% in 2020 and should increase again this year, he said. LBO specialists have been waiting for this swell of activity. Private-equity firms amassed a roughly $1.5 trillion cash pile in recent years but, until recently, they struggled to find enough targets at an attractive cost. That changed after the Democrats took control of the White House and Congress in November, increasing the likelihood of a rise in the capitalgains tax rate. "The tax hike is looming on the horizon and sellers want to maximize what they can make," said Kearney Posner, a portfolio manager specializing in leveraged loans at Lord Abbett \& Co. That motivated some to cut prices to consummate deals, she said. For now, regulators are relatively sanguine about rising debt loads the deals are placing on companies being acquired, perhaps because the banking system is now less exposed. The Federal Reserve warned banks in 2013 against arranging deals involving debt in excess of six times a company's earnings before interest, taxes, depreciation and amortization, or Ebitda, but has issued no such guidance this year. The average debt on LBOs in 2021 has been 5.67 times Ebitda, compared with 5.41 times in 2013, according to data from S&P. Fed officials this year have focused their attention on concerns over asset valuations rather than on specific corners of debt markets. Staff economists recently characterized vulnerabilities in the U.S. financial system as "notable," an unusually explicit signal of concern. Economists judged asset valuations as "elevated," according to minutes of that A buyout boom fueled by easy money and a looming hike in the capital-gains tax is sweeping Wall Street deal making to highs not seen since before the 2008 financial crisis. Companies have issued $120 billion of "leveraged loans" this year through Sept. 23 to finance corporate buyouts by private-equity firms-just shy of the $124 billion record for the first nine months of the year set in 2007, according to data from S\&P Global Market Intelligence's LCD. Most deals have also gotten bigger. The average leveraged buyout cost about $2.5 billion in debt and equity this year, eclipsing the mean of roughly $2 billion in 2007 , according to S\&P. Buyout loans through first nine months of each year $140 billion are through Sept. 30 of each year. Source: S\&P Global Market Intelligence's LCD The wave has swept up household names like satellite-TV operator DirecTV and a unit of cybersecurity firm McAfee Corp. , and it has reintroduced megadeals to the market. Goldman Sachs Group Inc. recently started marketing $7 billion of loans to investors that will be used by a trio of private-equity firms to finance part of their roughly $34 billion takeover of Medline Industries Inc., the largest leveraged buyout in more than a decade. A mix of government policies have primed the LBO frenzy. Easy money and low interest rates have pushed investors toward the high yields that leveraged loans pay. Meanwhile, company owners are trying to cut deals ahead of anticipated tax overhauls. "I've signed eight deals since June and in a typical summer I average one per month," said Elizabeth Cooper, a partner at Simpson Thacher \& Bartlett LLP who frequently advises on leveraged buyout deals for private-equity firms like Blackstone Group. "I don't think I've taken a day off-a full day off-since Christmas of last year," she said. Purchase prices and debt loads are climbing amid the boom, raising concerns that when economic growth slows, the companies being bought won't be able to repay the loans private-equity firms use to buy them, bankers and credit investors say. Still, the rebound from the Covid-19 pandemic continues and S\&P Global Ratings forecasts the default rate on leveraged loans will hover around 1% for the next year. That compares with the historical average of 2.68%. Competition for new buyouts is so hot that when software company Cornerstone OnDemand Inc. went up for sale this summer, private-equity firm Clearlake Capital Group negotiated a roughly $2.2 billion loan from JPMorgan Chase \& Co. and submitted an early bid, sealing the deal before the auction could get under way, a person familiar with the matter said. In some ways, this LBO surge resembles the bonanza of the mid-2000s, when innovations in derivative markets and a flood of easy money from banks and insurers stoked a flurry of ever-larger buyouts. The debt loads private-equity firms are using to buy companies have climbed back to near-record levels. But the risk has shifted from large banks sidelined by postcrisis regulations to investment firms that specialize in credit and private-equity. Investment banks are currently carrying about $130 billion of buyout loans on their balance sheets, compared with $480 billion in 2007, said Kevin Foley, head of global debt capital markets at JPMorgan. Wall Street firms still arrange loans for most buyouts and collect a fee, but regulations make holding them on the balance sheet for more than a few weeks prohibitively expensive. Instead, the banks quickly sell the debt to investment firms, insurers, pensions and, increasingly, to complex investment funds called collateralized loan obligations, or CLOs. Some large loan investors are cutting the banks out entirely, writing billion-dollar checks to finance buyouts on their own. Cloud-based technology company Inovalon Holdings Inc. disclosed in August it would sell itself for $7.3 billion to private-equity firms. About $3 billion of the purchase price would be paid for with loans from debt investors Blackstone Credit, Owl Rock Capital Advisors and Apollo Capital Management. Still, more deals translated to more pay for many investment bankers on Wall Street. Jefferies Financial Group Inc, did the same amount of leveraged finance business in the first half of 2021 as it did in all of 2020 , a year in which volume grew by 40% compared with 2019, a person close to the bank said. Compensation for bankers in the group rose by more than 40% in 2020 and should increase again this year, he said. LBO specialists have been waiting for this swell of activity. Private-equity firms amassed a roughly $1.5 trillion cash pile in recent years but, until recently, they struggled to find enough targets at an attractive cost. That changed after the Democrats took control of the White House and Congress in November, increasing the likelihood of a rise in the capitalgains tax rate. "The tax hike is looming on the horizon and sellers want to maximize what they can make," said Kearney Posner, a portfolio manager specializing in leveraged loans at Lord Abbett \& Co. That motivated some to cut prices to consummate deals, she said. For now, regulators are relatively sanguine about rising debt loads the deals are placing on companies being acquired, perhaps because the banking system is now less exposed. The Federal Reserve warned banks in 2013 against arranging deals involving debt in excess of six times a company's earnings before interest, taxes, depreciation and amortization, or Ebitda, but has issued no such guidance this year. The average debt on LBOs in 2021 has been 5.67 times Ebitda, compared with 5.41 times in 2013, according to data from S&P. Fed officials this year have focused their attention on concerns over asset valuations rather than on specific corners of debt markets. Staff economists recently characterized vulnerabilities in the U.S. financial system as "notable," an unusually explicit signal of concern. Economists judged asset valuations as "elevated," according to minutes of that