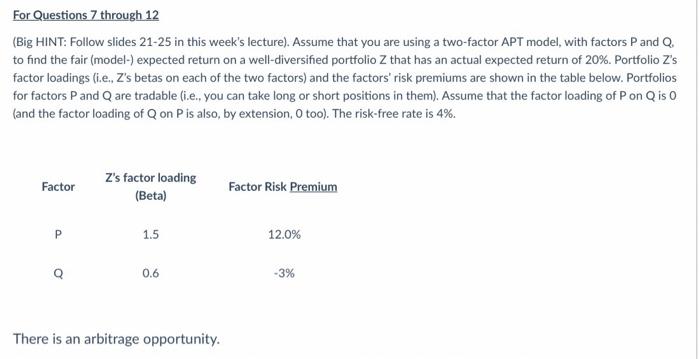

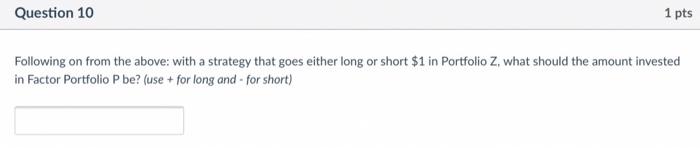

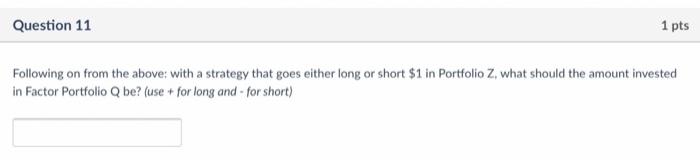

Far Gestoch 12 HINT: Poll 2123 in twee that you want to model with faction in the modellerden wollen pothuthan expected 2016. Por actor Schwed the created Rotation and you can show that the coding Gand the actory. These Factoris Beta P 120 04 There is an arbitrage opportunity Question 7 for 12 Create a step to the advantage of the store your item or short in Porto Question Following on from the above with a strategy the throne or short les porte. what the amount Is Portfolio bem furong Question 9 Forgon from the above with strat goes thronger son 5 in Portole. what to the mounted Question 10 Factor Portabele royand-forchert Question 11 Following on from the shower with a strategy that per sitter long or short si in Porto Iwhat should the most investet in der Poliwhirt Question 12 1 What is the per lortz Hemedecido, For Questions 7 through 12 (Big HINT: Follow slides 21-25 in this week's lecture). Assume that you are using a two-factor APT model, with factors P and Q, to find the fair (model) expected return on a well-diversified portfolio Z that has an actual expected return of 20%. Portfolio Z's factor loadings (ie, Z's betas on each of the two factors) and the factors' risk premiums are shown in the table below. Portfolios for factors P and Q are tradable (i.e., you can take long or short positions in them). Assume that the factor loading of Pon Q is o (and the factor loading of Q on Pis also, by extension, o too). The risk-free rate is 4%. Factor Z's factor loading (Beta) Factor Risk Premium 1.5 12.0% 0.6 -3% There is an arbitrage opportunity. Question 10 1 pts Following on from the above with a strategy that goes either long or short $1 in Portfolio Z what should the amount invested in Factor Portfolio P be? (use + for long and - for short) Question 11 1 pts Following on from the above with a strategy that goes either long or short $1 in Portfolio Z what should the amount invested in Factor Portfolio Q be? (use + for long and - for short) Question 12 1 pts What is the arbitrage return (in %) per dollar bought/sold of Portfolio Z. Please answer in decimal form, not percent