Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do 100% correct answer will be upvote 3) Quest is a U.S. firm conducting a financial plan for the next year. It has no

please do 100% correct answer will be upvote

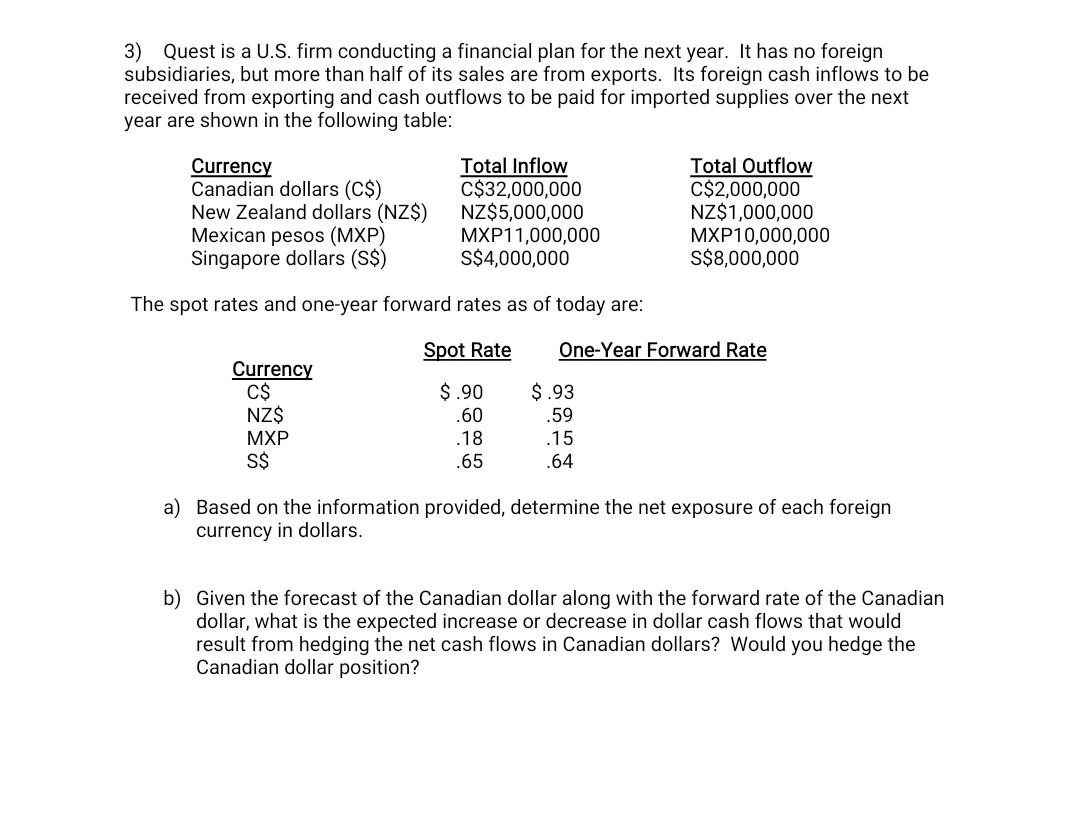

3) Quest is a U.S. firm conducting a financial plan for the next year. It has no foreign subsidiaries, but more than half of its sales are from exports. Its foreign cash inflows to be received from exporting and cash outflows to be paid for imported supplies over the next year are shown in the following table: The spot rates and one-year forward rates as of today are: a) Based on the information provided, determine the net exposure of each foreign currency in dollars. b) Given the forecast of the Canadian dollar along with the forward rate of the Canadian dollar, what is the expected increase or decrease in dollar cash flows that would result from hedging the net cash flows in Canadian dollars? Would you hedge the Canadian dollar positionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started