Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do 1-5 1. AAA Corp can borrow at a fixed rate of 6.9% and a floating rate of LIBOR 1.25%. BBB can borrow at

Please do 1-5

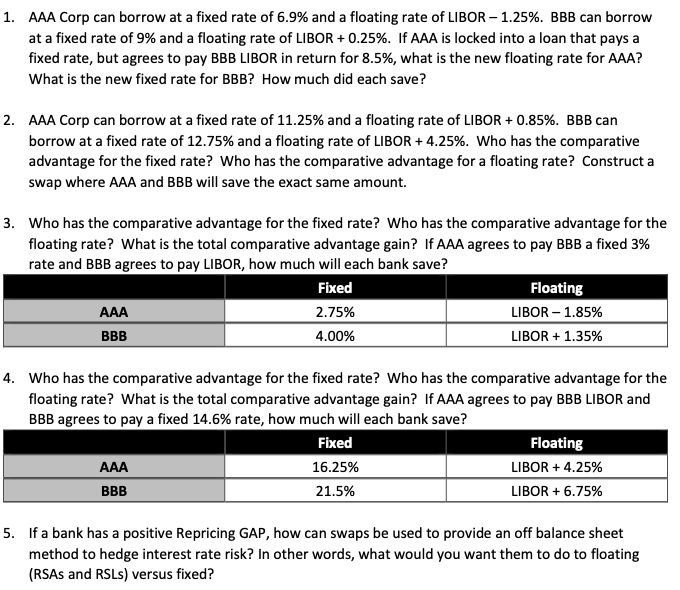

1. AAA Corp can borrow at a fixed rate of 6.9% and a floating rate of LIBOR 1.25%. BBB can borrow at a fixed rate of 9% and a floating rate of LIBOR +0.25%. If AAA is locked into a loan that pays a fixed rate, but agrees to pay BBB LIBOR in return for 8.5%, what is the new floating rate for AAA? What is the new fixed rate for BBB? How much did each save? 2. AAA Corp can borrow at a fixed rate of 11.25% and a floating rate of LIBOR +0.85%. BBB can borrow at a fixed rate of 12.75% and a floating rate of LIBOR +4.25%. Who has the comparative advantage for the fixed rate? Who has the comparative advantage for a floating rate? Construct a swap where AAA and BBB will save the exact same amount. Who has the comparative advantage for the fixed rate? Who has the comparative advantage for the floating rate? What is the total comparative advantage gain? If AAA agrees to pay BBB a fixed 3% rate and BBB agrees to pay LIBOR, how much will each bank save? Who has the comparative advantage for the fixed rate? Who has the comparative advantage for the floating rate? What is the total comparative advantage gain? If AAA agrees to pay BBB LIBOR and BBB agrees to pay a fixed 14.6% rate, how much will each bank save? 5. If a bank has a positive Repricing GAP, how can swaps be used to provide an off balance sheet method to hedge interest rate risk? In other words, what would you want them to do to floating (RSAs and RSLs) versus fixed? 1. AAA Corp can borrow at a fixed rate of 6.9% and a floating rate of LIBOR 1.25%. BBB can borrow at a fixed rate of 9% and a floating rate of LIBOR +0.25%. If AAA is locked into a loan that pays a fixed rate, but agrees to pay BBB LIBOR in return for 8.5%, what is the new floating rate for AAA? What is the new fixed rate for BBB? How much did each save? 2. AAA Corp can borrow at a fixed rate of 11.25% and a floating rate of LIBOR +0.85%. BBB can borrow at a fixed rate of 12.75% and a floating rate of LIBOR +4.25%. Who has the comparative advantage for the fixed rate? Who has the comparative advantage for a floating rate? Construct a swap where AAA and BBB will save the exact same amount. Who has the comparative advantage for the fixed rate? Who has the comparative advantage for the floating rate? What is the total comparative advantage gain? If AAA agrees to pay BBB a fixed 3% rate and BBB agrees to pay LIBOR, how much will each bank save? Who has the comparative advantage for the fixed rate? Who has the comparative advantage for the floating rate? What is the total comparative advantage gain? If AAA agrees to pay BBB LIBOR and BBB agrees to pay a fixed 14.6% rate, how much will each bank save? 5. If a bank has a positive Repricing GAP, how can swaps be used to provide an off balance sheet method to hedge interest rate risk? In other words, what would you want them to do to floating (RSAs and RSLs) versus fixedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started