Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do 4.25 solutions:a) correlation=-0.508 B) weight=0.2085, expected return=12.117% he price of cocoa. If the and the company 4.24 The value of Ms Sweetheart Company

please do 4.25

solutions:a) correlation=-0.508

solutions:a) correlation=-0.508

B) weight=0.2085, expected return=12.117%

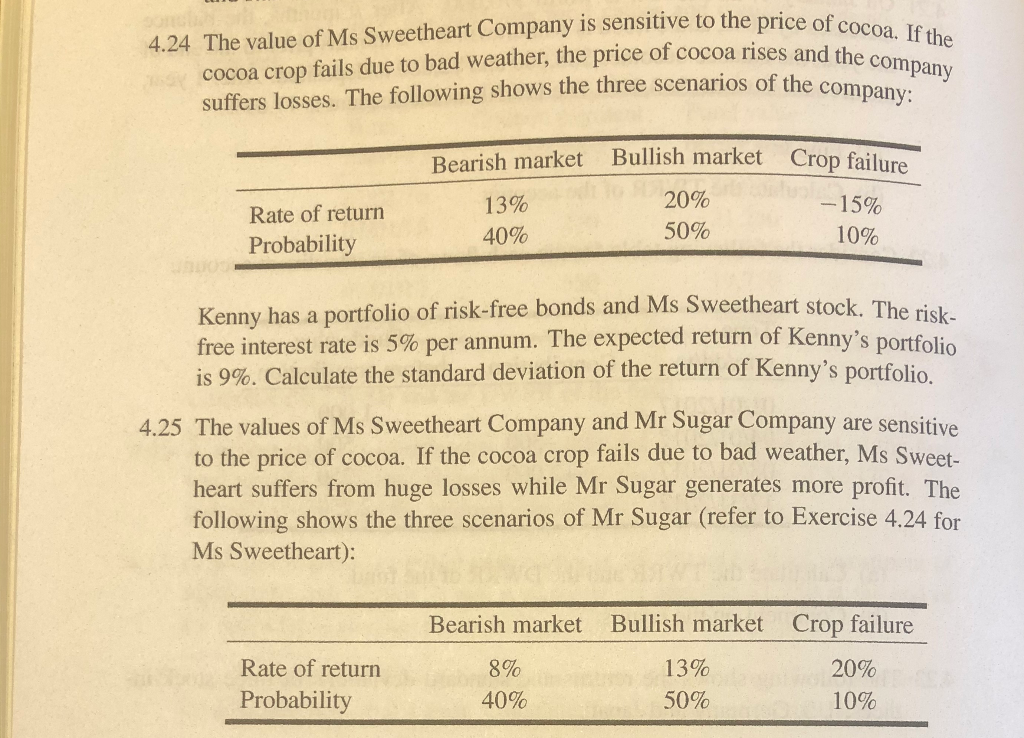

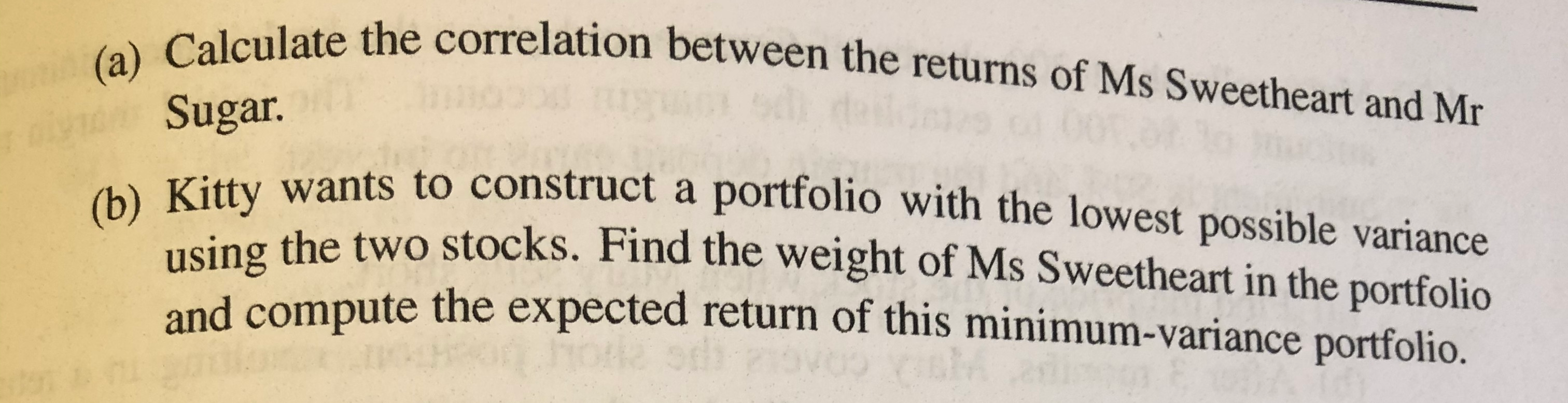

he price of cocoa. If the and the company 4.24 The value of Ms Sweetheart Company is sensitive to the price of co cocoa crop fails due to bad weather, the price of cocoa rises and suffers losses. The following shows the three scenarios of the enarios of the company: Bearish market Bullish market Crop fail -15% Rate of return Probability 13% 40% 20% 50% 10% is Sweetheart stock. The risk- Kenny has a portfolio of risk-free bonds and Ms Sweetheart stock 1 free interest rate is 5% per annum. The expected return of Kenny? is 9%. Calculate the standard deviation of the return of Kenny's portfolio 4.25 The values of Ms Sweetheart Company and Mr Sugar Company are sensitive to the price of cocoa. If the cocoa crop fails due to bad weather, Ms Sweet. heart suffers from huge losses while Mr Sugar generates more profit. The following shows the three scenarios of Mr Sugar (refer to Exercise 4.24 for Ms Sweetheart): Bearish market Bullish market Crop failure 8% Rate of return Probability 13% 50% 20% 10% 40% he correlation between the returns of Ms Sweetheart and Mr (a) Calculate the corn Sugar. (b) Kitty wants to construct using the two stocks. Find the weigh ts to construct a portfolio with the lowest possible variance stocks. Find the weight of Ms Sweetheart in the portfolio dcompute the expected return of this minimum-variance portfolio he price of cocoa. If the and the company 4.24 The value of Ms Sweetheart Company is sensitive to the price of co cocoa crop fails due to bad weather, the price of cocoa rises and suffers losses. The following shows the three scenarios of the enarios of the company: Bearish market Bullish market Crop fail -15% Rate of return Probability 13% 40% 20% 50% 10% is Sweetheart stock. The risk- Kenny has a portfolio of risk-free bonds and Ms Sweetheart stock 1 free interest rate is 5% per annum. The expected return of Kenny? is 9%. Calculate the standard deviation of the return of Kenny's portfolio 4.25 The values of Ms Sweetheart Company and Mr Sugar Company are sensitive to the price of cocoa. If the cocoa crop fails due to bad weather, Ms Sweet. heart suffers from huge losses while Mr Sugar generates more profit. The following shows the three scenarios of Mr Sugar (refer to Exercise 4.24 for Ms Sweetheart): Bearish market Bullish market Crop failure 8% Rate of return Probability 13% 50% 20% 10% 40% he correlation between the returns of Ms Sweetheart and Mr (a) Calculate the corn Sugar. (b) Kitty wants to construct using the two stocks. Find the weigh ts to construct a portfolio with the lowest possible variance stocks. Find the weight of Ms Sweetheart in the portfolio dcompute the expected return of this minimum-variance portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started