Answered step by step

Verified Expert Solution

Question

1 Approved Answer

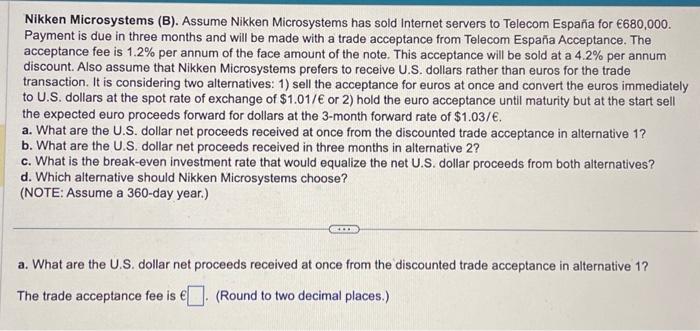

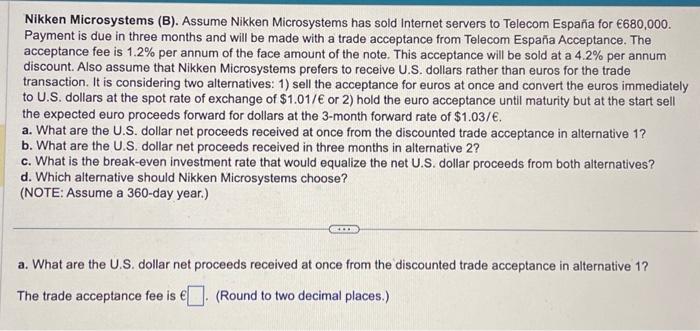

Please do A B C & D Nikken Microsystems (B). Assume Nikken Microsystems has sold Internet servers to Telecom Espaa for 680,000. Payment is due

Please do A B C & D

Nikken Microsystems (B). Assume Nikken Microsystems has sold Internet servers to Telecom Espaa for 680,000. Payment is due in three months and will be made with a trade acceptance from Telecom Espaa Acceptance. The acceptance fee is 1.2\% per annum of the face amount of the note. This acceptance will be sold at a 4.2% per annum discount. Also assume that Nikken Microsystems prefers to receive U.S. dollars rather than euros for the trade transaction. It is considering two alternatives: 1) sell the acceptance for euros at once and convert the euros immediately to U.S. dollars at the spot rate of exchange of $1.01/ or 2 ) hold the euro acceptance until maturity but at the start sell the expected euro proceeds forward for dollars at the 3-month forward rate of $1.03/. a. What are the U.S. dollar net proceeds received at once from the discounted trade acceptance in alternative 1 ? b. What are the U.S. dollar net proceeds received in three months in alternative 2 ? c. What is the break-even investment rate that would equalize the net U.S. dollar proceeds from both alternatives? d. Which alternative should Nikken Microsystems choose? (NOTE: Assume a 360-day year.) a. What are the U.S. dollar net proceeds received at once from the discounted trade acceptance in alternative 1 ? The trade acceptance fee is . (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started