Please do all parts.

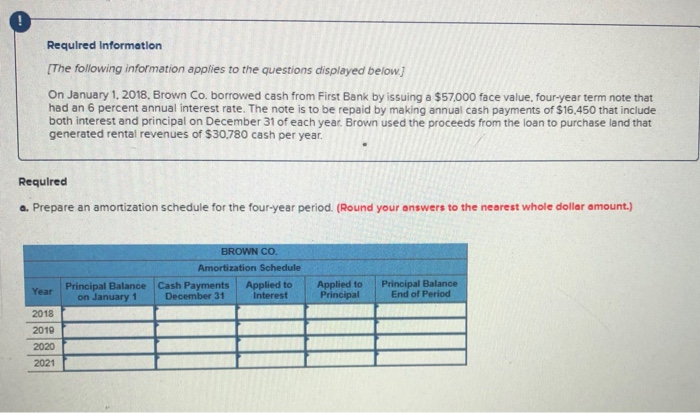

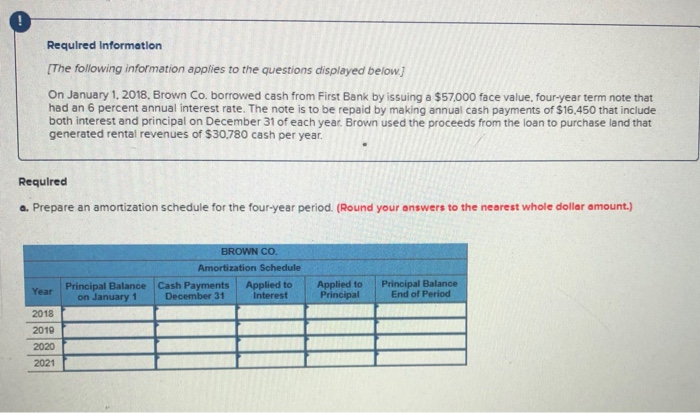

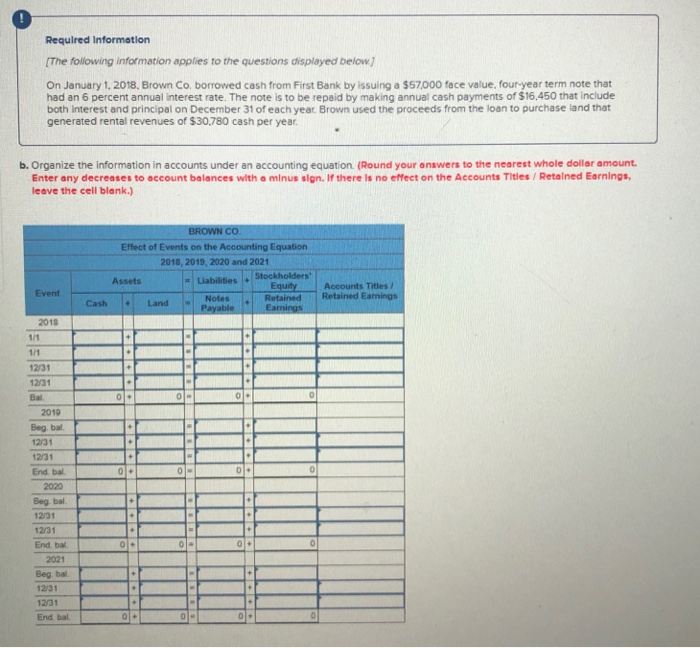

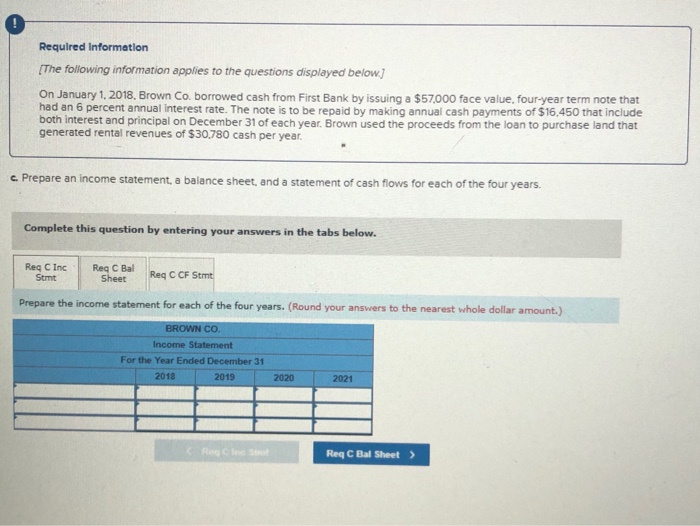

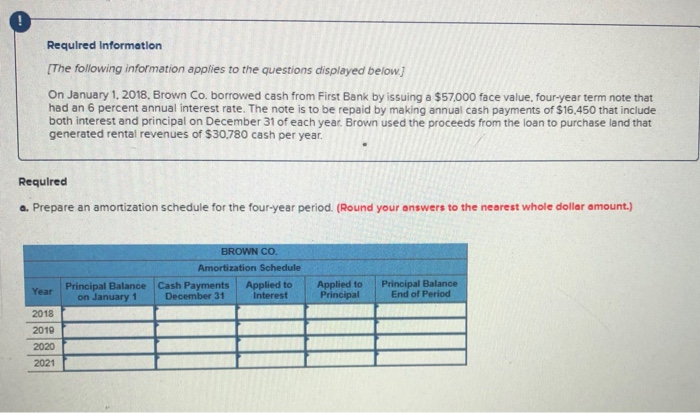

Required Informatlon The following information applies to the questions displayed below On January 1. 2018. Brown Co. borrowed cash from First Bank by issuing a $57000 face value. four-year term note that had an 6 percent annual interest rate. The note is to be repaid by making annual cash payments of $16.450 that include both interest and principal on December 31 of each year Brown used the proceeds from the loan to purchase land that generated rental revenues of $30,780 cash per year Required a. Prepare an amortization schedule for the four-year period. (Round your answers to the nearest whole dollar amount. Amortization Schedule Principal Balance Cash Payments Applied to Applied to Principal Balance Principal End of Period Interest on January 1 2018 2019 2020 2021 Required Informatlon The following information applies to the questions displayed below On January 1, 2018. Brown Co. borrowed cash from First Bank by issuing a $57,000 face value, four-year term note that had an 6 percent annual interest rate. The note is to be repaid by making annual cash payments of $16.450 that include both interest and principal on December 31 of each year. Brown used the proceeds from the loan to purchase land that generated rental revenues of $30,780 cash per year b. Organize the information in accounts under an accounting equation. (Round your answers to the nearest whole dollar amount. effect on the Accounts Thies / Retained Earnings, Enter any decreases to occount balances witha minus sign. If there ls n leave the cell blank.) Effect of Events on the Accounting Equation 2018, 2019, 2020 and 2021 Assets EquityAccounts Titles Retained Retained Earnings Event CashLand Notes 2018 12/31 12/31 Bal. 2010 Beg bal. 12/31 12/31 End bal 2020 Beg bal 12/31 12/31 End bai. 2021 Beg ba 12/31 12/31 End bal. Required Informatlon The following information applies to the questions displayed below.] On January 1.2018 Brown Co. borrowed cash from First Bank by issuing a $57000 face value, four-year term note that had an 6 percent annual interest rate. The note is to be repaid by making annual cash payments of $16,450 that include both interest and principal on December 31 of each year. Brown used the proceeds from the loan to purchase land that generated rental revenues of $30,780 cash per year c. Prepare an income statement, a balance sheet, and a statement of cash flows for each of the four years. Complete this question by entering your answers in the tabs below Req C Inc Stmt Req C Bal Sheet Req C CF the income statement for each of the four years. (Round your answers to the nearest whole dollar amount.) Income Statement For the Year Ended December 31 2018 2019 2020 2021 Req C Bal Sheet)