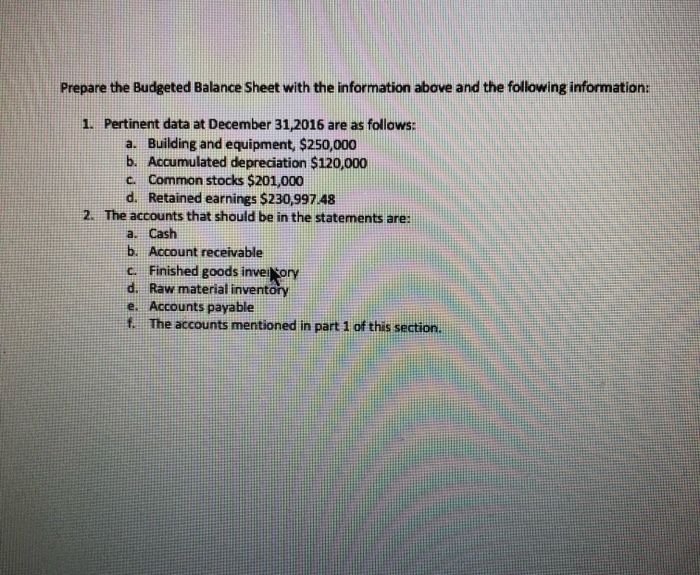

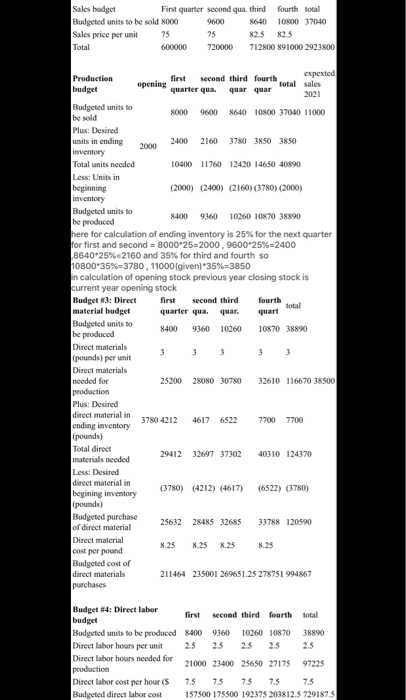

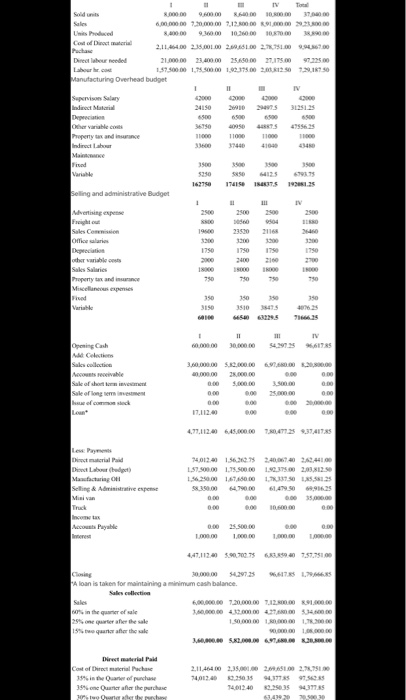

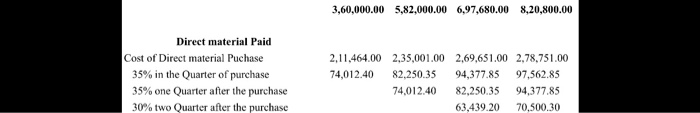

Prepare the Budgeted Balance Sheet with the information above and the following information: 1. Pertinent data at December 31,2016 are as follows: a. Building and equipment, $250,000 b. Accumulated depreciation $120,000 c. Common stocks $201,000 d. Retained earnings $230,997.48 2. The accounts that should be in the statements are: a. Cash b. Account receivable c. Finished goods inventory d. Raw material inventory e. Accounts payable f. The accounts mentioned in part 1 of this section. Sales budget First quarter second qua, third fourth total Budgeted units to be sold 8000 9600 8640 10800 37040 Sales price per unit 75 75 82.5 825 Total 600000 720000 712800 891000 2923800 Production first second third fourth experted budget opening qu aret qua. total sales quar quar 2021 Budgeted units to 8000 9600 be sold 8640 10800 37040 11000 Plus: Desired units in ending 2000 2400 2160 3780 3850 3850 inventory Total units needed 10400 11760 12420 14650 40890 Less: Units in beginning (2000) (2400) (2160)(3780) (2000) inventory Budgeted units to 8400 9360 10260 10870 38890 be produced here for calculation of ending inventory is 25% for the next quarter for first and second = 8000'25=2000, 9600'25%=2400 8640-25% 2160 and 35% for third and fourth so 10800*35%=3780, 11000 (given)*35%=3850 in calculation of opening stock previous year closing stock is current year opening stock Budget 3: Direct first second third fourth total material budget quarter quaquar. quart Budgeted units to 8400 he produced 9360 10260 10870 38890 Direct materials (pounds) per unit Direct materials needed for 25200 28080 30780 32610 116670 38500 production Plus: Desired direct material in 3780 4212 4617 6522 7700 7700 ending inventory (pounds) Total direct materials needed 2941232697 37302 40310 124370 Less: Desired direct material in begining inventory (3780) (4212) (4617) (6522) (3780) (pounds) Budgeted purchase 25632 28485 32685 of direct material 33788 120590 Direct material 8.25 8.25 8.25 8.25 cost per pound Budgeted cost of direct materials 211464 235001 269651.25 278751 994867 purchases Budget #4: Direct laber first second third fourth total budget Budgeted units to be produced 8400 9360 10260 10870 38890 Direct labor hours per unit 2.5 25 2.5 2.5 Direct labor hours needed for 21000 23400 25650 2717597225 production Direct labor cost per hour (S 7.5 7.5 7.5 7.5 7.5 Budgeted direct labor cost 157500 175500 192375 203812.5 729187.5 IV Sales 6,00.000 DO 7.000000 7.12.00 DO 100 000 100 10X7000 Cost od Direct material Direct lended 21.000,00 23.400.00 25.650.00 27.175.00 1:37.500.00 1,75.500.00 1,92375.00 2031250 12,16750 Manufacturing Overhead budget 1 IN Super Sale 24150 2010 203125125 Det Othere Property tax and inte Indirect Labour 5250 174158 1588375 1901.25 1 IN 04 1960 23530 Selling and administrative Budget divertising experts Freight Sales Commission naalara| Deprecate cher variable costs Sales Sales Property tax and in 1750 2000 3400 Feed 3510 15 64540 62295 11 30.000.00 TV 542959,61785 Opening Cash Add Celections Sales collection Accounts receivable 5.000.00 3.500.00 0.00 0.00 17.112.00 4.77.112.00 645.000.00 7.477.2374178 Die Labour budget Manaticiarie H Selling & Administrative expense Misivan 14.012.40 156.2 2.40.067 40 2,44100 1.57.900.00 1.75.500.00 1.92.375.00 203,812.50 1.56250,00 1.67.180.00 1.7233750 15.51.25 58,350.00 64.790.00 61,479.50 6.916.25 3.00 0:00 Accounts Payable 0:00 0.00 25.500.00 1.000.00 1.000.00 4:47.112.00 50.00 75 63.959.80 7.57.751.00 30,000.00 429725 A loan is taken for maintaining a minimum cash balance Sales collection 6,00.000,00 720,000.00 12.00.00 1.000.00 in the quarter of sale 160,000.00 432.000,00 22.00 33400.00 295, one quarter after the sale Stue qunar after the cake 5.2.000.000.000 Direct mail Paid Cost of Direct material rechase 18% in the One of purchase 39 me ane the purchase 30 Orthus 9.25035 9.37785975608 74012:40 0.2503594377.85 141920 25000 3,60,000.00 5,82,000.00 6,97,680.00 8,20,800.00 Direct material Paid Cost of Direct material Puchase 35% in the Quarter of purchase 35% one Quarter after the purchase 30% two Quarter after the purchase 2,11,464.00 2,35,001.00 2,69,651.00 2,78,751.00 74,012.40 82.250.35 94,377.85 97,562.85 74.012.40 82,250.35 94.377.85 63,439.20 70,500.30 Prepare the Budgeted Balance Sheet with the information above and the following information: 1. Pertinent data at December 31,2016 are as follows: a. Building and equipment, $250,000 b. Accumulated depreciation $120,000 c. Common stocks $201,000 d. Retained earnings $230,997.48 2. The accounts that should be in the statements are: a. Cash b. Account receivable c. Finished goods inventory d. Raw material inventory e. Accounts payable f. The accounts mentioned in part 1 of this section. Sales budget First quarter second qua, third fourth total Budgeted units to be sold 8000 9600 8640 10800 37040 Sales price per unit 75 75 82.5 825 Total 600000 720000 712800 891000 2923800 Production first second third fourth experted budget opening qu aret qua. total sales quar quar 2021 Budgeted units to 8000 9600 be sold 8640 10800 37040 11000 Plus: Desired units in ending 2000 2400 2160 3780 3850 3850 inventory Total units needed 10400 11760 12420 14650 40890 Less: Units in beginning (2000) (2400) (2160)(3780) (2000) inventory Budgeted units to 8400 9360 10260 10870 38890 be produced here for calculation of ending inventory is 25% for the next quarter for first and second = 8000'25=2000, 9600'25%=2400 8640-25% 2160 and 35% for third and fourth so 10800*35%=3780, 11000 (given)*35%=3850 in calculation of opening stock previous year closing stock is current year opening stock Budget 3: Direct first second third fourth total material budget quarter quaquar. quart Budgeted units to 8400 he produced 9360 10260 10870 38890 Direct materials (pounds) per unit Direct materials needed for 25200 28080 30780 32610 116670 38500 production Plus: Desired direct material in 3780 4212 4617 6522 7700 7700 ending inventory (pounds) Total direct materials needed 2941232697 37302 40310 124370 Less: Desired direct material in begining inventory (3780) (4212) (4617) (6522) (3780) (pounds) Budgeted purchase 25632 28485 32685 of direct material 33788 120590 Direct material 8.25 8.25 8.25 8.25 cost per pound Budgeted cost of direct materials 211464 235001 269651.25 278751 994867 purchases Budget #4: Direct laber first second third fourth total budget Budgeted units to be produced 8400 9360 10260 10870 38890 Direct labor hours per unit 2.5 25 2.5 2.5 Direct labor hours needed for 21000 23400 25650 2717597225 production Direct labor cost per hour (S 7.5 7.5 7.5 7.5 7.5 Budgeted direct labor cost 157500 175500 192375 203812.5 729187.5 IV Sales 6,00.000 DO 7.000000 7.12.00 DO 100 000 100 10X7000 Cost od Direct material Direct lended 21.000,00 23.400.00 25.650.00 27.175.00 1:37.500.00 1,75.500.00 1,92375.00 2031250 12,16750 Manufacturing Overhead budget 1 IN Super Sale 24150 2010 203125125 Det Othere Property tax and inte Indirect Labour 5250 174158 1588375 1901.25 1 IN 04 1960 23530 Selling and administrative Budget divertising experts Freight Sales Commission naalara| Deprecate cher variable costs Sales Sales Property tax and in 1750 2000 3400 Feed 3510 15 64540 62295 11 30.000.00 TV 542959,61785 Opening Cash Add Celections Sales collection Accounts receivable 5.000.00 3.500.00 0.00 0.00 17.112.00 4.77.112.00 645.000.00 7.477.2374178 Die Labour budget Manaticiarie H Selling & Administrative expense Misivan 14.012.40 156.2 2.40.067 40 2,44100 1.57.900.00 1.75.500.00 1.92.375.00 203,812.50 1.56250,00 1.67.180.00 1.7233750 15.51.25 58,350.00 64.790.00 61,479.50 6.916.25 3.00 0:00 Accounts Payable 0:00 0.00 25.500.00 1.000.00 1.000.00 4:47.112.00 50.00 75 63.959.80 7.57.751.00 30,000.00 429725 A loan is taken for maintaining a minimum cash balance Sales collection 6,00.000,00 720,000.00 12.00.00 1.000.00 in the quarter of sale 160,000.00 432.000,00 22.00 33400.00 295, one quarter after the sale Stue qunar after the cake 5.2.000.000.000 Direct mail Paid Cost of Direct material rechase 18% in the One of purchase 39 me ane the purchase 30 Orthus 9.25035 9.37785975608 74012:40 0.2503594377.85 141920 25000 3,60,000.00 5,82,000.00 6,97,680.00 8,20,800.00 Direct material Paid Cost of Direct material Puchase 35% in the Quarter of purchase 35% one Quarter after the purchase 30% two Quarter after the purchase 2,11,464.00 2,35,001.00 2,69,651.00 2,78,751.00 74,012.40 82.250.35 94,377.85 97,562.85 74.012.40 82,250.35 94.377.85 63,439.20 70,500.30