Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE DO ALL REQUIREMENTS Camp Corporation runs two stoces, one in Medteld and one in Oaidand. Operating income for each store in 2020 is as

PLEASE DO ALL REQUIREMENTS

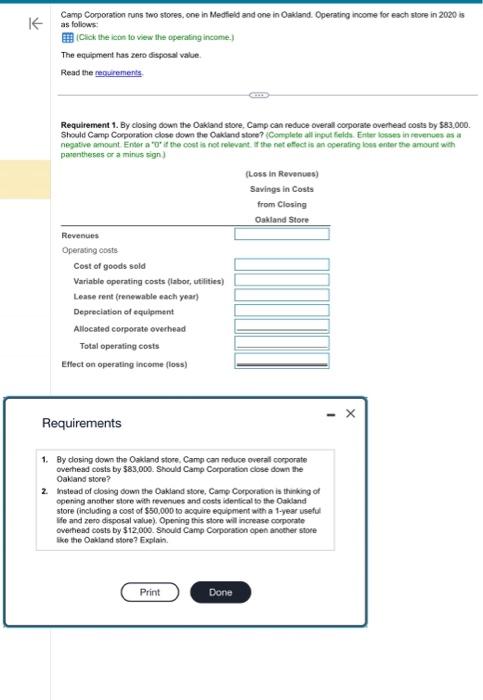

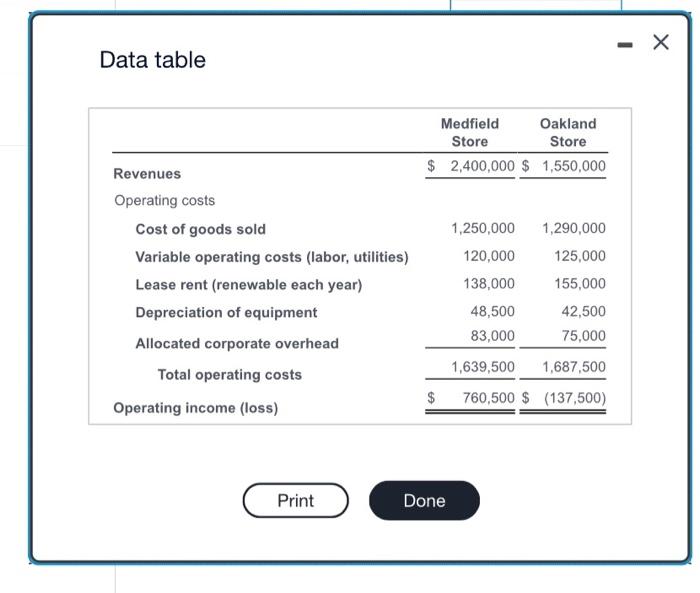

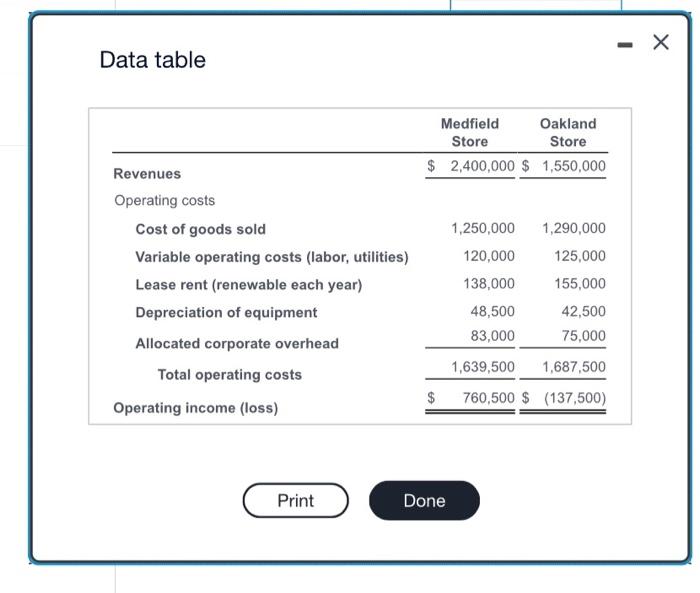

Camp Corporation runs two stoces, one in Medteld and one in Oaidand. Operating income for each store in 2020 is as follows (Click the iobin to view the operating income.) The equithment has rero disposal value Read the requrements Requilrement 1. By closing down the Oakland store, Camp can reduce overall corporate overhead costa by se3,o00. Should Camp Corporation close down the Caktend store? \{Complete all ingut Felda. Eriter losses in senvenues ats in negative amount. Enter an 'O' if the cost is not relewant. If the net efloct is an operating loss enter the amount wich panentheses or a minus sign ) Requirements 1. By dosing down the Oakland store, Camp can reduce pverall corporate overhedd oosts by \$83,000. Should Camp Corporation close down the Oakand store? 2. Instead of closing down the Qakland store, Camp Corporation is thinking of opening another slore with revenues and costs identical to the Oakland store (including a cost of $50,000 to acquire equipment with a 1-year useful life and zero disposal value). Opening this store will increase corporate owerhead costs by 312,000. Should Camp Corporatoon open another store fike the Onkland shore? Explain. Data table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started