Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do all the calculation correctly abd explain everything. ABC Adventures operates an aircraft service that takes fishing parties to a remote lake resort. Individuals

Please do all the calculation correctly abd explain everything.

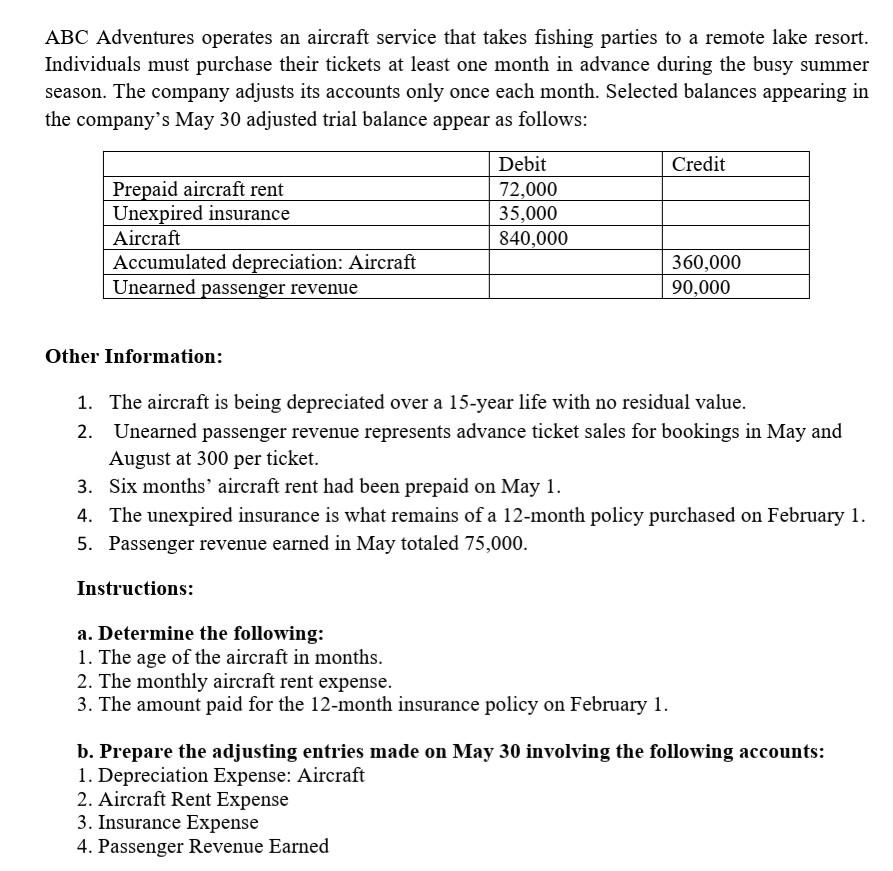

ABC Adventures operates an aircraft service that takes fishing parties to a remote lake resort. Individuals must purchase their tickets at least one month in advance during the busy summer season. The company adjusts its accounts only once each month. Selected balances appearing in the company's May 30 adjusted trial balance appear as follows: Credit Prepaid aircraft rent Unexpired insurance Aircraft Accumulated depreciation: Aircraft Unearned passenger revenue Debit 72,000 35,000 840,000 360,000 90,000 Other Information: 1. The aircraft is being depreciated over a 15-year life with no residual value. Unearned passenger revenue represents advance ticket sales for bookings in May and August at 300 per ticket. 3. Six months' aircraft rent had been prepaid on May 1. 4. The unexpired insurance is what remains of a 12-month policy purchased on February 1. 5. Passenger revenue earned in May totaled 75,000. Instructions: a. Determine the following: 1. The age of the aircraft in months. 2. The monthly aircraft rent expense. 3. The amount paid for the 12-month insurance policy on February 1. b. Prepare the adjusting entries made on May 30 involving the following accounts: 1. Depreciation Expense: Aircraft 2. Aircraft Rent Expense 3. Insurance Expense 4. Passenger Revenue EarnedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started