please do all the requirments

please do all the requirements

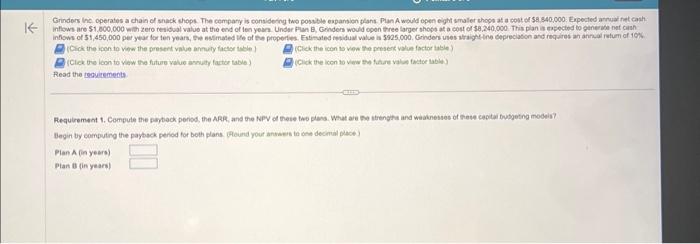

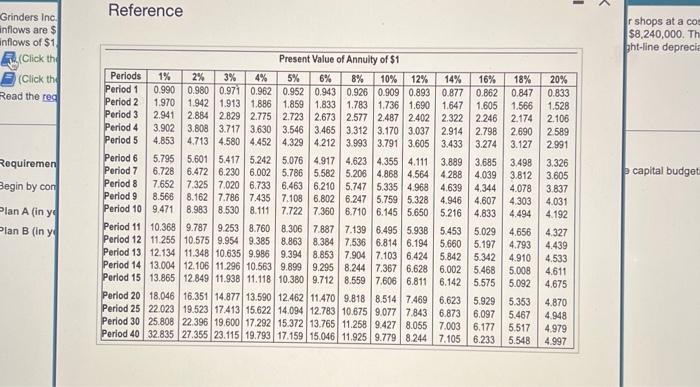

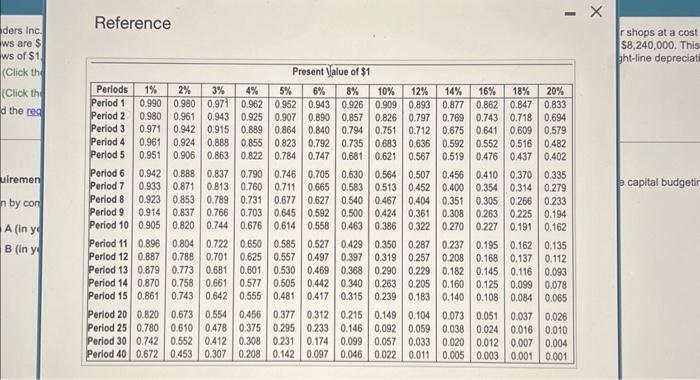

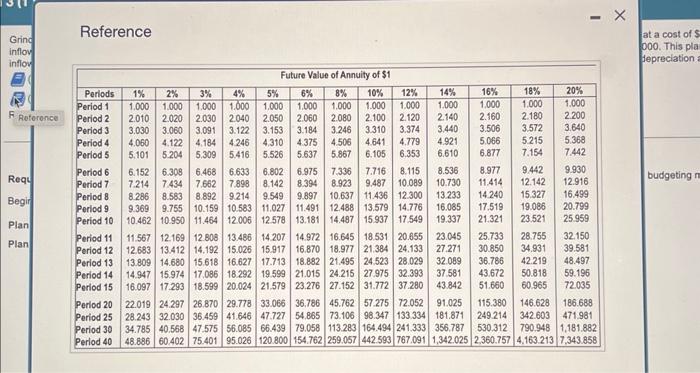

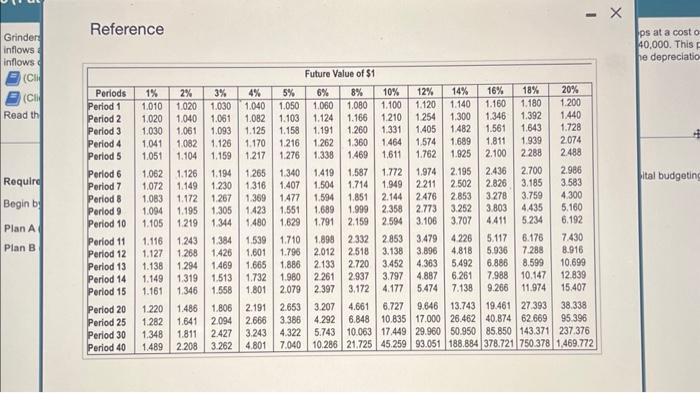

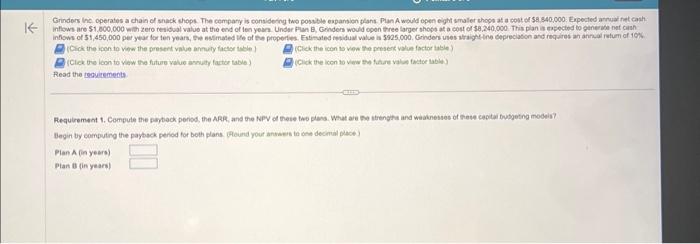

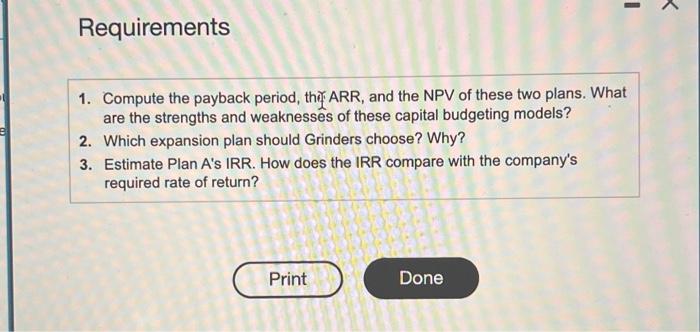

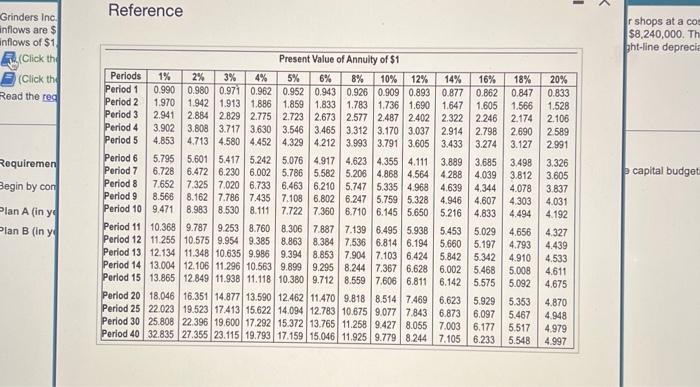

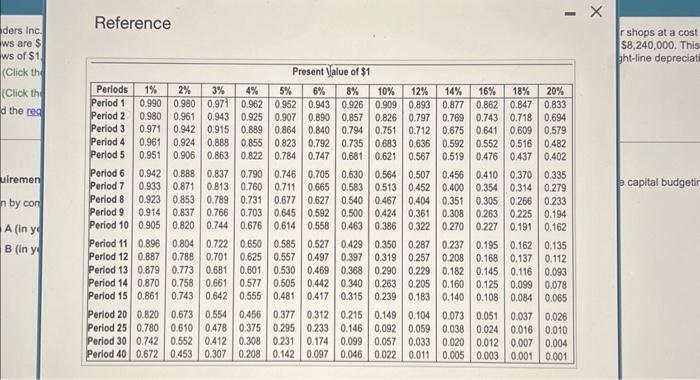

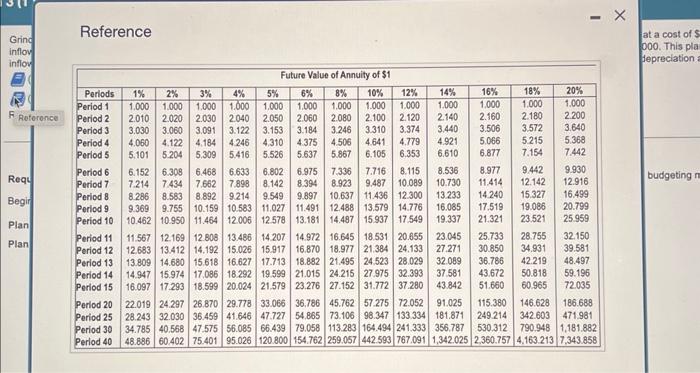

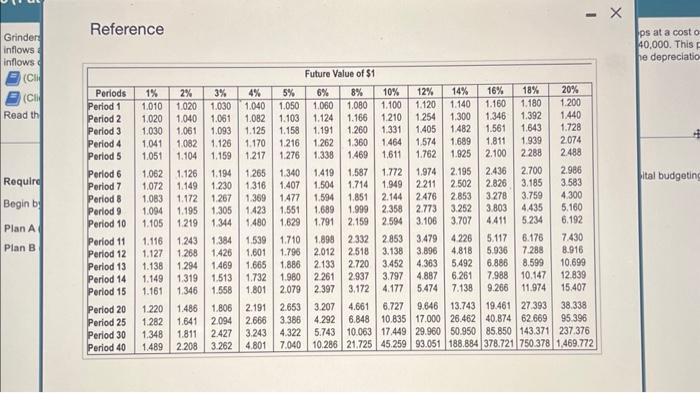

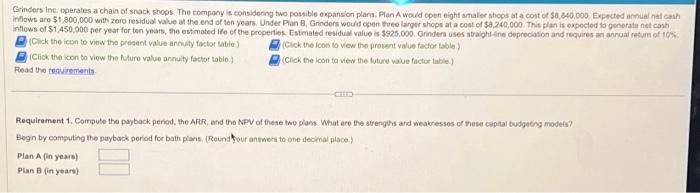

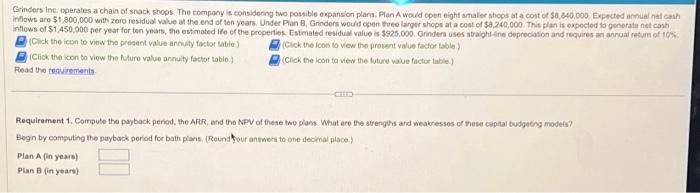

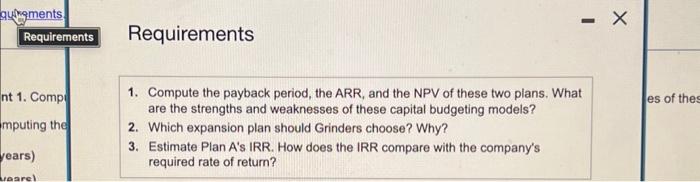

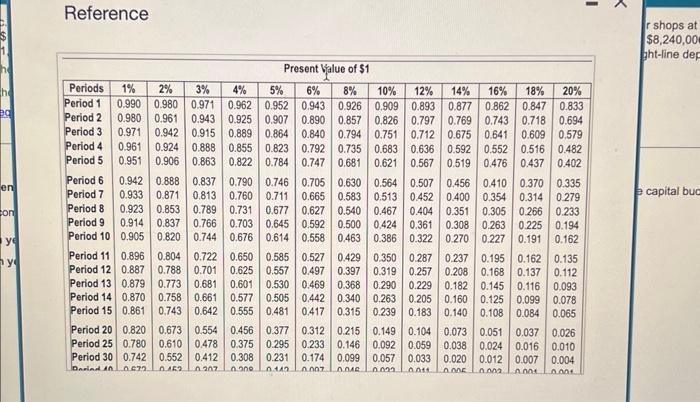

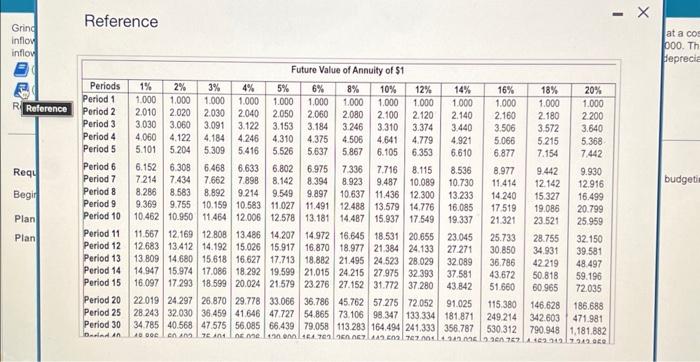

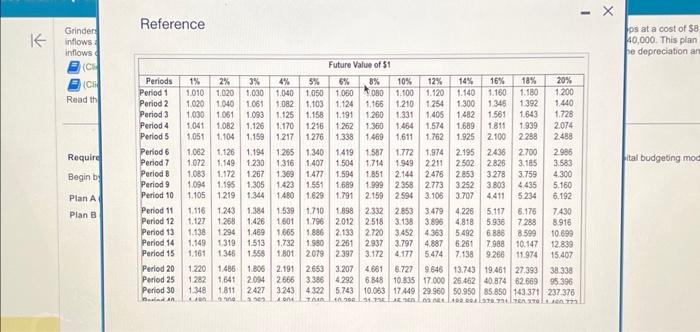

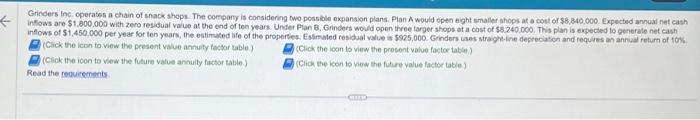

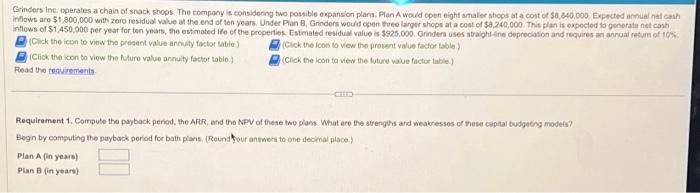

(Cick the ipon to vew the present value arnely tactar isile) (flek the icon lo vee the preserk value factor table) (Click the losn to view the future value annuty fartior table] (Cick the icon to vew ten fiture value twatue lable) Read the toguirements Begin by computing the payback perod for both plans. fleund your anmaeis to che decmul pace? Pian A (in years) Plan of (in years) Requirements 1. Compute the payback period, th ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? 2. Which expansion plan should Grinders choose? Why? 3. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? Grinders inc inflows are $ inflows of $1 (CWick th (Click thy Read the req Requiremen Begin by con Reference r shops at a co bht-line depreci capital budget Reference Reference Reference Grinders inc. operates a chain of snack shops. The compony is considorng two possible expansion plana. Flan A would copen eight smaler shops at a cont or sa. J40, coo Expected amnel nat cenh inflows are $1,800,000 with zero residual value at the end of ten years. Under Plan B, Grinders would open tree larger shops at a coat of $8,240,000. Thit plan is expected to generate net cash intlows of $1,450,000 per yeat for ten years, the estimated lio of the propertes. Estemated residual value is $925.000. Grindera uses atraight ine depreciation and requires an annuat reture of tosk (Cick the icon to view the present value annuty fastor tabie) (Clck the loos to vew the prowent value factor table) (Cick the icon to viow the future value annulty factor tabile) (Cick the icon to view the future value factor lable) Pead the tequirements Requirement 1. Compute the paybock penod, the AFR, and the NPV of these lmo plans. What are the afrengths and weakresses of these capital budgebing miodeis? Bogn by computing the payback poriod for both plans. (Round tour antwent to one decinal place.) Plan A (in years) Plan 8 (in yeare) Requirements Requirements 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? 2. Which expansion plan should Grinders choose? Why? 3. Estimate Plan A's IRR. How does the IRR compare with the company's required rate of return? Reference Reference Reference Reference lital budgeting moc Grinders inc. operates a chain of snack thops. The corpany is considering wo possble expansion plans. Plan A would open eight smaler ahops at a coit or $8, 440 .000. Expected annual net cash infows are $1,600,000 with zero residual value at the end of ten years. Under Plan B, Grinders would open three larper shops at a cost of $8240, 000. This plan is expecied to generale net cash inflows of 51,450,000 per year for ten years, the estimated bife of the propertes. Esimuted residual valio is 5925,000 . Grinders uses straghe-line depreciasen and requies an annuad return of tols. (Cick the icon to view the present value annuty tactar tuble) (Cick the icon to view the present value factor table.) (Click the icon to view the future value anoulty factor table.) (Click the kon to view the future value factor table) Read the romurements