Please do asap!!!

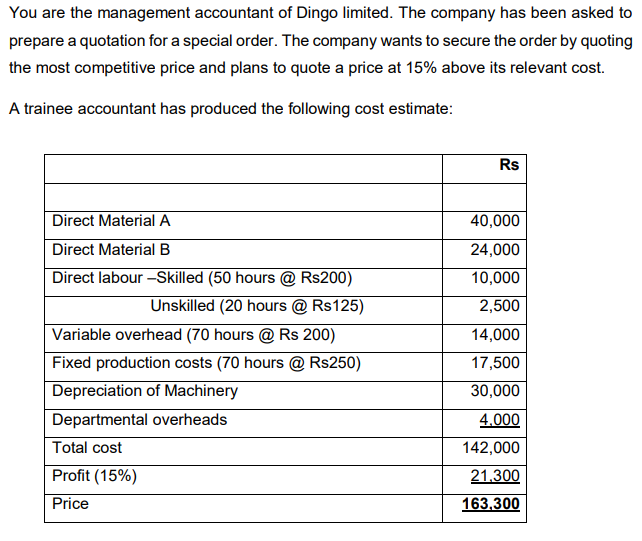

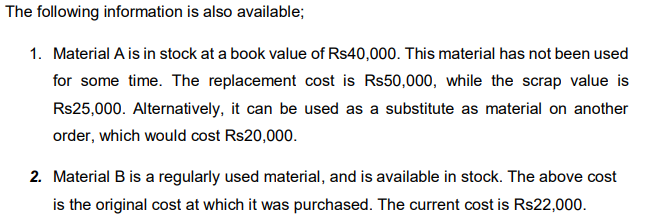

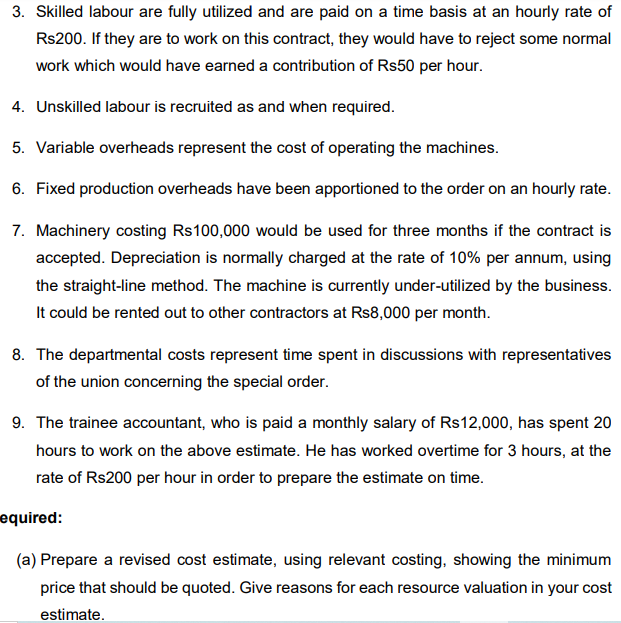

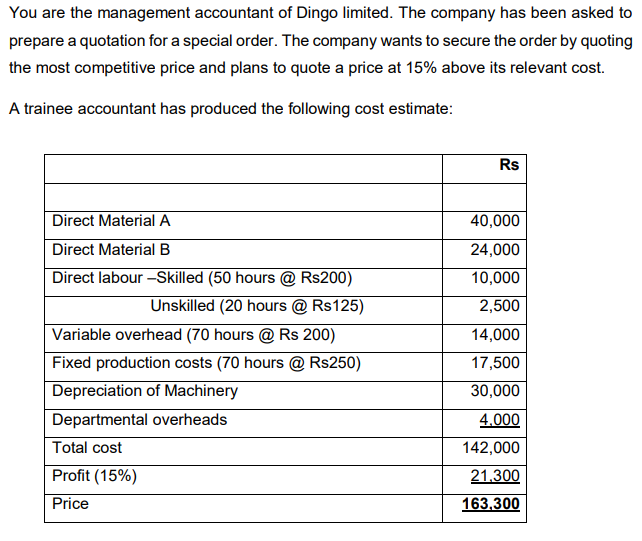

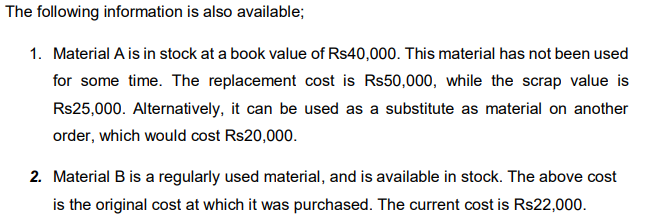

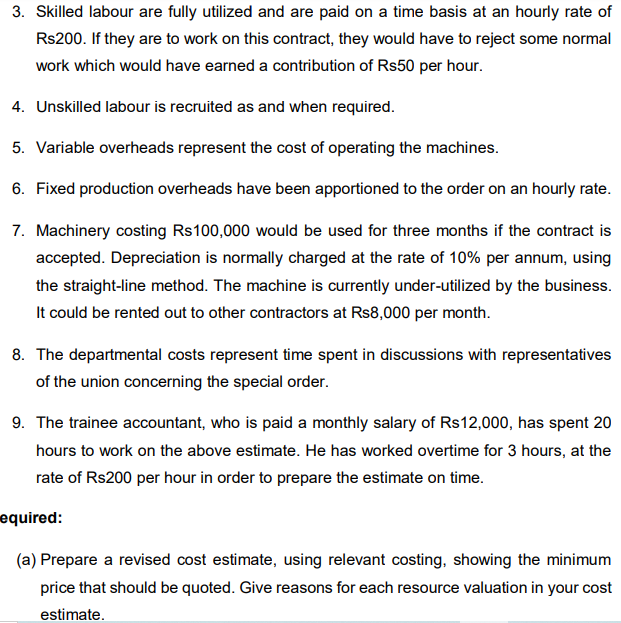

You are the management accountant of Dingo limited. The company has been asked to prepare a quotation for a special order. The company wants to secure the order by quoting the most competitive price and plans to quote a price at 15% above its relevant cost. A trainee accountant has produced the following cost estimate: Rs 40,000 24,000 10,000 2,500 14,000 Direct Material A Direct Material B Direct labour -Skilled (50 hours @ Rs200) Unskilled (20 hours @ Rs125) Variable overhead (70 hours @ Rs 200) Fixed production costs (70 hours @ Rs250) Depreciation of Machinery Departmental overheads Total cost Profit (15%) Price 17,500 30,000 4,000 142,000 21,300 163.300 The following information is also available; 1. Material A is in stock at a book value of Rs40,000. This material has not been used for some time. The replacement cost is Rs50,000, while the scrap value is R$25,000. Alternatively, it can be used as a substitute as material on another order, which would cost Rs20,000. 2. Material B is a regularly used material, and is available in stock. The above cost is the original cost at which it was purchased. The current cost is Rs22,000. 3. Skilled labour are fully utilized and are paid on a time basis at an hourly rate of Rs200. If they are to work on this contract, they would have to reject some normal work which would have earned a contribution of Rs50 per hour. 4. Unskilled labour is recruited as and when required. 5. Variable overheads represent the cost of operating the machines. 6. Fixed production overheads have been apportioned to the order on an hourly rate. 7. Machinery costing Rs 100,000 would be used for three months if the contract is accepted. Depreciation is normally charged at the rate of 10% per annum, using the straight-line method. The machine is currently under-utilized by the business. It could be rented out to other contractors at Rs8,000 per month. 8. The departmental costs represent time spent in discussions with representatives of the union concerning the special order. 9. The trainee accountant, who is paid a monthly salary of Rs12,000, has spent 20 hours to work on the above estimate. He has worked overtime for 3 hours, at the rate of Rs200 per hour in order to prepare the estimate on time. equired: (a) Prepare a revised cost estimate, using relevant costing, showing the minimum price that should be quoted. Give reasons for each resource valuation in your cost estimate