Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do b):Calculate the amount of any tempory differences in 2023. Crane Ltd. reported income before income taxes of $180,000. Prior to 2023 taxable income

Please do b):Calculate the amount of any tempory differences in 2023.

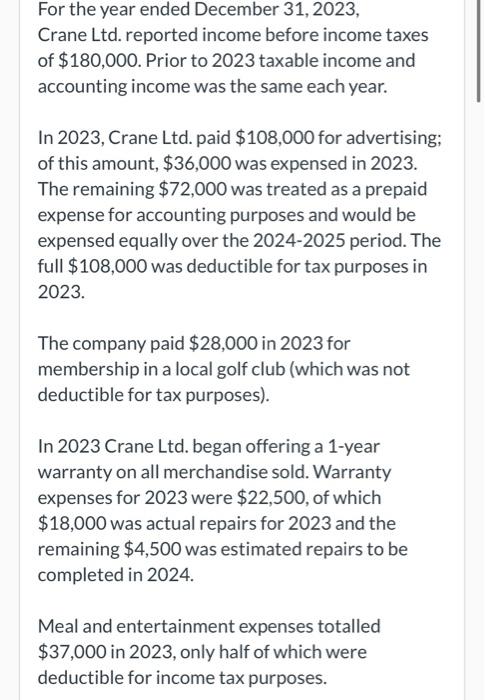

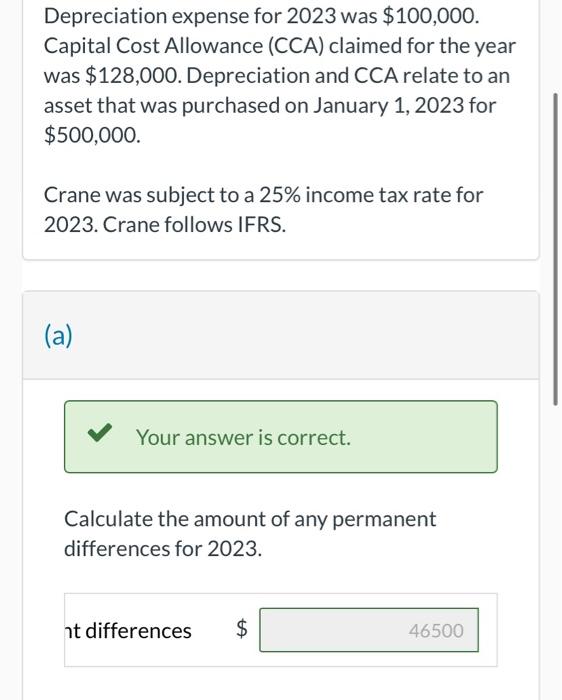

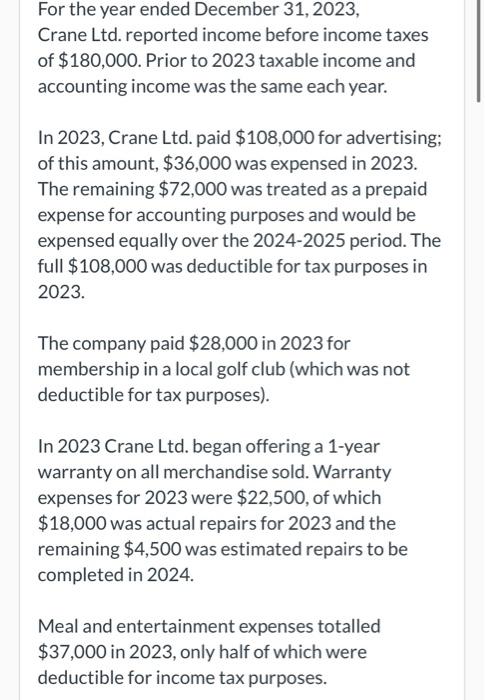

Crane Ltd. reported income before income taxes of $180,000. Prior to 2023 taxable income and accounting income was the same each year. In 2023, Crane Ltd. paid $108,000 for advertising; of this amount, $36,000 was expensed in 2023. The remaining $72,000 was treated as a prepaid expense for accounting purposes and would be expensed equally over the 20242025 period. The full $108,000 was deductible for tax purposes in 2023. The company paid $28,000 in 2023 for membership in a local golf club (which was not deductible for tax purposes). In 2023 Crane Ltd. began offering a 1-year warranty on all merchandise sold. Warranty expenses for 2023 were $22,500, of which $18,000 was actual repairs for 2023 and the remaining $4,500 was estimated repairs to be completed in 2024. Meal and entertainment expenses totalled $37,000 in 2023 , only half of which were deductible for income tax purposes. Depreciation expense for 2023 was $100,000. Capital Cost Allowance (CCA) claimed for the year was $128,000. Depreciation and CCA relate to an asset that was purchased on January 1,2023 for $500,000. Crane was subject to a 25% income tax rate for 2023. Crane follows IFRS. (a) Your answer is correct. Calculate the amount of any permanent differences for 2023. (b) Calculate the amount of any temporary differences for 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started