Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it correctly, otherwise I'll downvote. FORECASTING RESTRICTIONS There are two final problems. While Hood believes the company should use more debt, she recognizes

please do it correctly, otherwise I'll downvote.

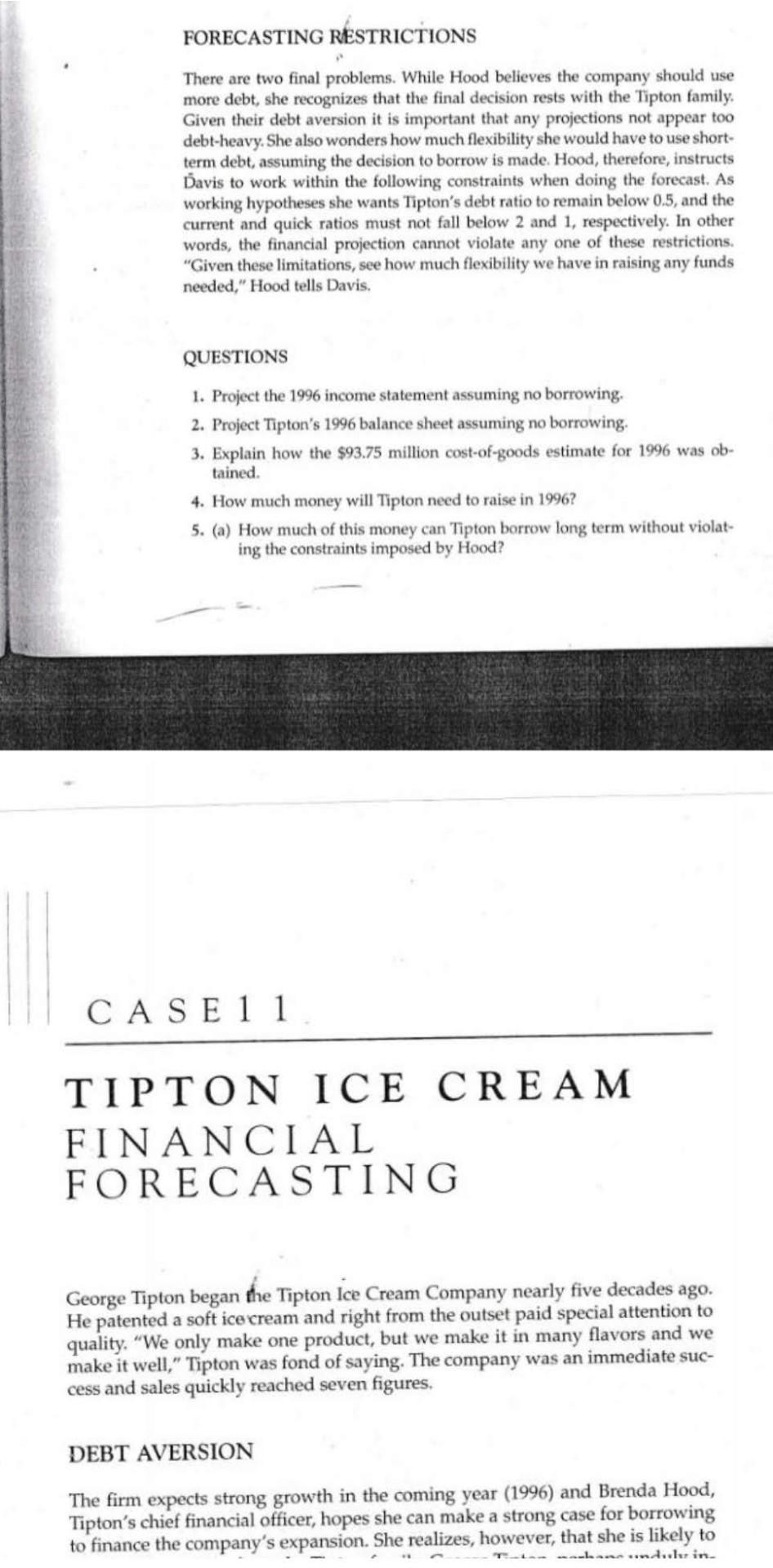

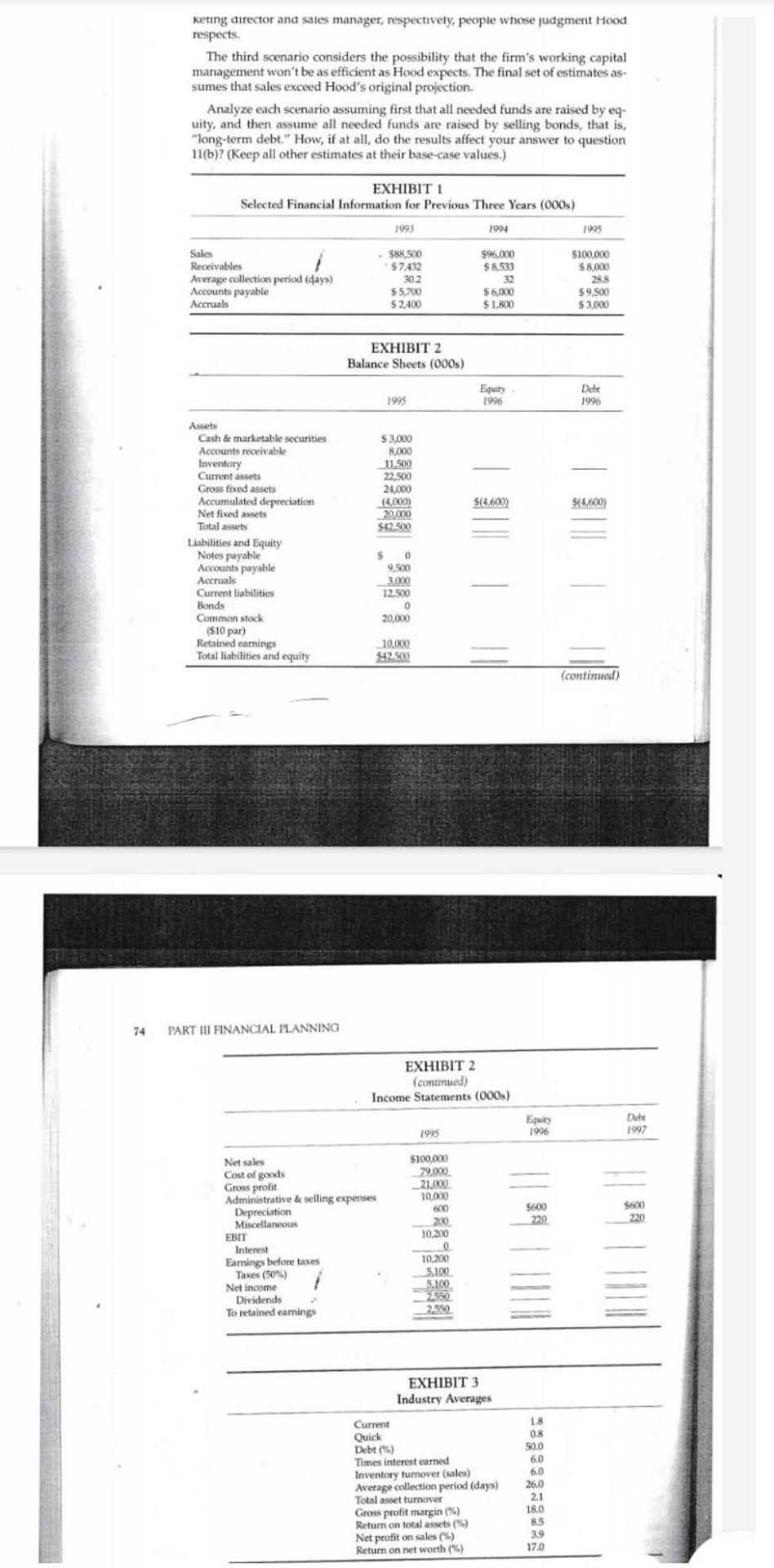

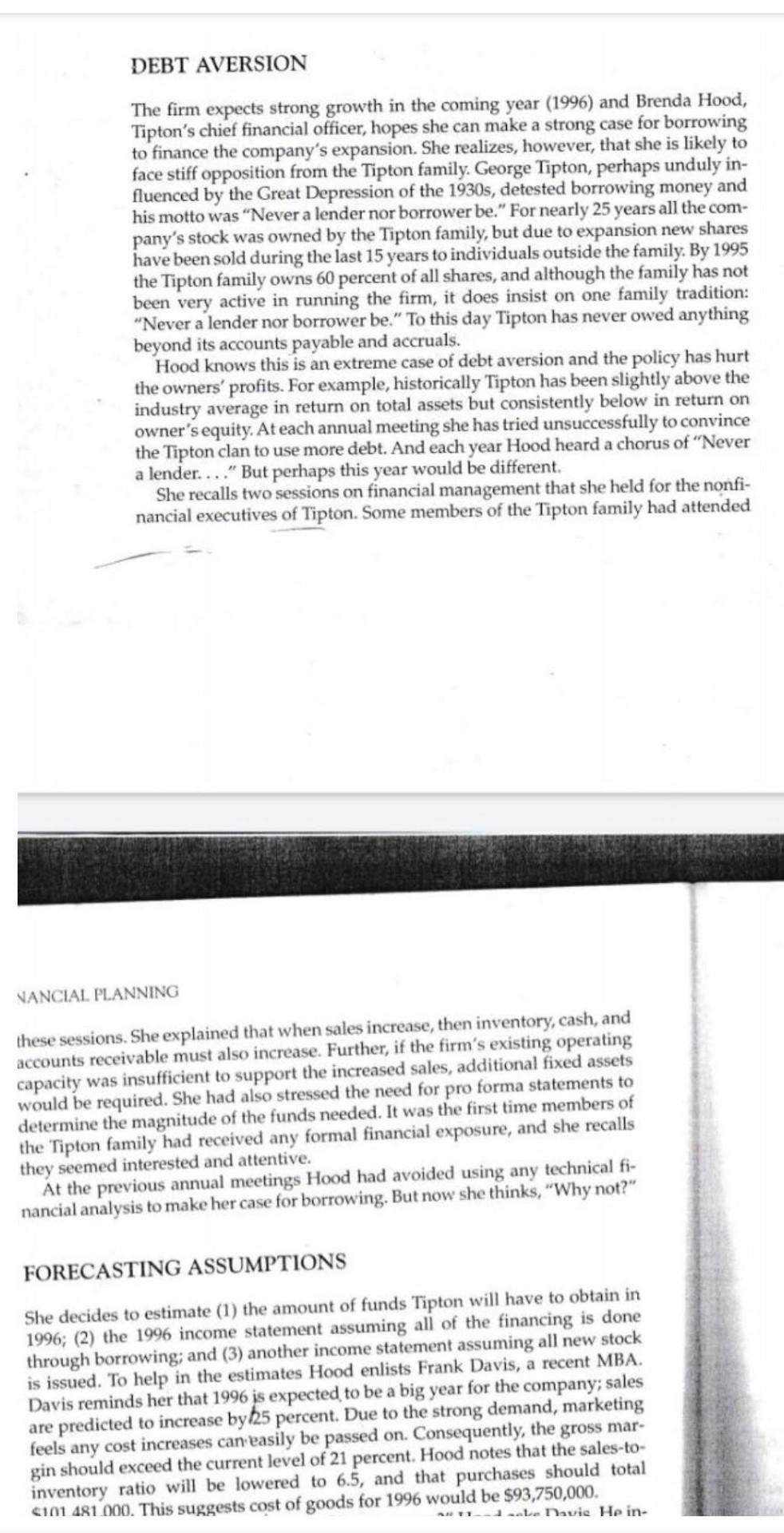

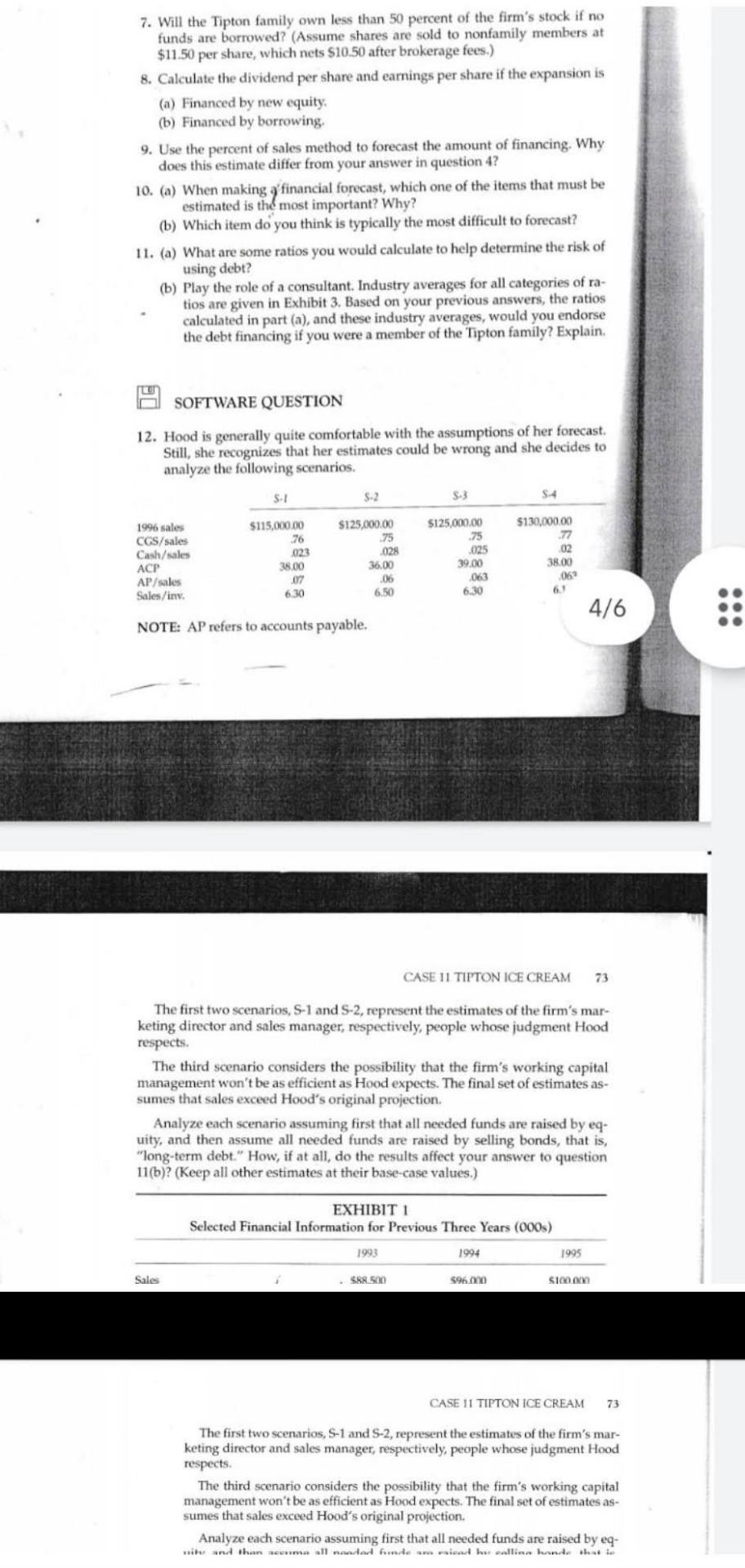

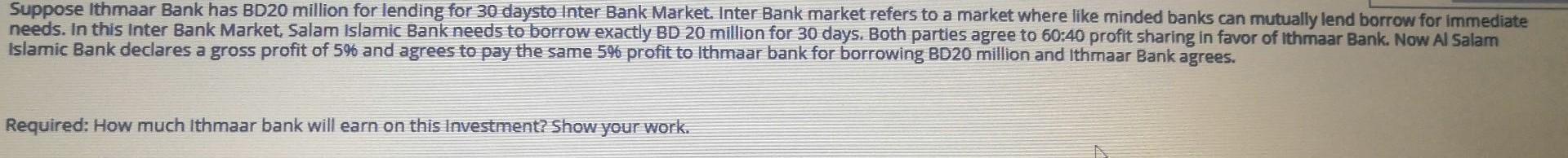

FORECASTING RESTRICTIONS There are two final problems. While Hood believes the company should use more debt, she recognizes that the final decision rests with the Tipton family. Given their debt aversion it is important that any projections not appear too debt-heavy. She also wonders how much flexibility she would have to use short- term debt, assuming the decision to borrow is made. Hood, therefore, instructs Davis to work within the following constraints when doing the forecast. As working hypotheses she wants Tipton's debt ratio to remain below 0.5, and the current and quick ratios must not fall below 2 and 1, respectively. In other words, the financial projection cannot violate any one of these restrictions. "Given these limitations, see how much flexibility we have in raising any funds needed," Hood tells Davis. QUESTIONS 1. Project the 1996 income statement assuming no borrowing. 2. Project Tipton's 1996 balance sheet assuming no borrowing. 3. Explain how the $93.75 million cost-of-goods estimate for 1996 was ob- tained. 4. How much money will Tipton need to raise in 1996? 5. (a) How much of this money can Tipton borrow long term without violat- ing the constraints imposed by Hood? CASE 1 1 TIPTON ICE CREAM FINANCIAL FORECASTING George Tipton began the Tipton Ice Cream Company nearly five decades ago. He patented a soft ice cream and right from the outset paid special attention to quality. "We only make one product, but we make it in many flavors and we make it well," Tipton was fond of saying. The company was an immediate suc- cess and sales quickly reached seven figures. DEBT AVERSION The firm expects strong growth in the coming year (1996) and Brenda Hood, Tipton's chief financial officer, hopes she can make a strong case for borrowing to finance the company's expansion. She realizes, however, that she is likely to keting director and sales manager, respectively, people whose judgment Hood respects The third scenario considers the possibility that the firm's working capital management won't be as efficient as Hood expects. The final set of estimates as- sumes that sales exceed Hood's original projection. Analyze each scenario assuming first that all needed funds are raised by eq. uity, and then assume all needed funds are raised by selling bonds, that is, "long-term debt." How, if at all, do the results affect your answer to question 11(b)? (Keep all other estimates at their base-case values.) EXHIBIT 1 Selected Financial Information for Previous Three Years (000s) 1993 1994 1995 $100,000 Sales Receivables Average collection period (days) Accounts payable Accruals $88.500 $ 7.432 302 $ 5.700 $ 2.400 596,000 $8.533 32 $ 6,000 $ 1.800 $8.000 288 $9.500 $3,000 EXHIBIT 2 Balance Sheets (000s) 1995 Equity 1996 Debe 1996 $3,000 8,000 11,500 22,500 24,000 $(4.600) $(4,600) (4.000) 20,000 S42.500 Assets Cash & marketable securities Accounts receivable Inventory Current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets Liabilities and Equity Notes payable Accounts payable Accruals Current liabilities Bonds Common stock (510 par) Retained earnings Total liabilities and equity S 0 9.00 3.000 12.500 0 20,000 10,000 42.500 (continued) 74 PART III FINANCIAL PLANNING EXHIBIT 2 (continued) Income Statements (000) Equity 1996 Debe 1997 1995 5600 220 S600 220 Net sales Cost of goods Gross profit Administrative & selling expenses Depreciation Miscellaneous EBIT Interest Earnings before taxes Taxes (50%) Net income Dividends To retained eamings $100,000 79.000 21.000 10.000 600 200 10.200 O 10,200 5.100 5.100 22550 2.550 EXHIBIT 3 Industry Averages Current Quick Debt (6) Times interest earned Inventory tumover (sales) Average collection period (days) Total asset turnover Gross profit margin (%) Return on total assets(") Net profit on sales (%) Return on net worth (") 1.8 08 50.0 6.0 6.0 26.0 2.1 18.0 8.5 3.9 17.0 DEBT AVERSION The firm expects strong growth in the coming year (1996) and Brenda Hood, Tipton's chief financial officer, hopes she can make a strong case for borrowing to finance the company's expansion. She realizes, however, that she is likely to face stiff opposition from the Tipton family. George Tipton, perhaps unduly in- fluenced by the Great Depression of the 1930s, detested borrowing money and his motto was Never a lender nor borrower be." For nearly 25 years all the com- pany's stock was owned by the Tipton family, but due to expansion new shares have been sold during the last 15 years to individuals outside the family. By 1995 the Tipton family owns 60 percent of all shares, and although the family has not been very active in running the firm, it does insist on one family tradition: "Never a lender nor borrower be." To this day Tipton has never owed anything beyond its accounts payable and accruals. Hood knows this is an extreme case of debt aversion and the policy has hurt the owners' profits. For example, historically Tipton has been slightly above the industry average in return on total assets but consistently below in return on owner's equity. At each annual meeting she has tried unsuccessfully to convince the Tipton clan to use more debt. And each year Hood heard a chorus of "Never a lender...." But perhaps this year would be different She recalls two sessions on financial management that she held for the nonfi- nancial executives of Tipton. Some members of the Tipton family had attended NANCIAL PLANNING these sessions. She explained that when sales increase, then inventory, cash, and accounts receivable must also increase. Further, if the firm's existing operating capacity was insufficient to support the increased sales, additional fixed assets would be required. She had also stressed the need for pro forma statements to determine the magnitude of the funds needed. It was the first time members of the Tipton family had received any formal financial exposure, and she recalls they seemed interested and attentive. At the previous annual meetings Hood had avoided using any technical fi- nancial analysis to make her case for borrowing. But now she thinks, "Why not?" FORECASTING ASSUMPTIONS She decides to estimate (1) the amount of funds Tipton will have to obtain in 1996; (2) the 1996 income statement assuming all of the financing is done through borrowing; and (3) another income statement assuming all new stock is issued. To help in the estimates Hood enlists Frank Davis, a recent MBA. Davis reminds her that 1996 is expected to be a big year for the company; sales are predicted to increase by 125 percent. Due to the strong demand, marketing feels any cost increases can easily be passed on. Consequently, the gross mar- gin should exceed the current level of 21 percent. Hood notes that the sales-to- inventory ratio will be lowered to 6.5, and that purchases should total 4101 481.000. This suggests cost of goods for 1996 would be $93,750,000. unte Davie He in- 7. Will the Tipton family own less than 50 percent of the firm's stock if no funds are borrowed? (Assume shares are sold to nonfamily members at $11.50 per share, which nets $10.50 after brokerage fees.) 8. Calculate the dividend per share and earnings per share if the expansion is (a) Financed by new equity. (b) Financed by borrowing 9. Use the percent of sales method to forecast the amount of financing. Why does this estimate differ from your answer in question 4? 10. (a) When making a financial forecast, which one of the items that must be estimated is the most important? Why? (b) Which item do you think is typically the most difficult to forecast? 11. (a) What are some ratios you would calculate to help determine the risk of using debt? (b) Play the role of a consultant. Industry averages for all categories of ra- tios are given in Exhibit 3. Based on your previous answers, the ratios calculated in part (a), and these industry averages, would you endorse the debt financing if you were a member of the "Tipton family? Explain. SOFTWARE QUESTION 12. Hood is generally quite comfortable with the assumptions of her forecast. Still, she recognizes that her estimates could be wrong and she decides to analyze the following scenarios. 5.1 $-2 S-3 54 1996 sales CGS/sales Cash/sales ACP AP/sales Sales/inv. $115,000.00 76 023 38.00 07 6.30 $125,000.00 75 028 36.00 06 6.50 $125,000.00 75 025 39,00 063 6.30 $130,000.00 77 02 38.00 069 6. 4/6 NOTE: AP refers to accounts payable. CASE 11 TIPTON ICE CREAM 73 The first two scenarios, S-1 and S-2, represent the estimates of the firm's mar- keting director and sales manager, respectively, people whose judgment Hood respects. The third scenario considers the possibility that the firm's working capital management won't be as efficient as Hood expects. The final set of estimates as- sumes that sales exceed Hood's original projection. Analyze each scenario assuming first that all needed funds are raised by eq- uity, and then assume all needed funds are raised by selling bonds, that is, "long-term debt." How, if at all, do the results affect your answer to question 11(b)? (Keep all other estimates at their base-case values.) EXHIBITI Selected Financial Information for Previous Three Years (000) 1993 1994 1995 Sales S8.500 596.000 SIDOM CASE 11 TIPTON ICE CREAM 73 The first two scenarios, S-1 and S-2, represent the estimates of the firm's mar- keting director and sales manager, respectively people whose judgment Hood respects. The third scenario considers the possibility that the firm's working capital management won't be as efficient as Hood expects. The final set of estimates as- sumes that sales exceed Hood's original projection Analyze each scenario assuming first that all needed funds are raised by eq- write and than neem all andad fidem riadha wallis and has to 6% Period 1 2 3 15:55a 3 6 7 8 10 11 12 13 14 15 16 17 18 Discount Rate 1% 4% 5% 10% 11% 12N 13% 15% Period 0.9901 0.9804 0.9709 09615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8696 1 0.9806 09612 0.9426 09246 0.9070 0.8900 08/34 0.8573 0.8417 0.8254 0.8116 0.1972 0.7831 0.7695 0.7561 2 0.9706 0.9423 09151 0.8890 0.8538 0.8396 0.8163 0.7933 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.6575 3 0 9510 09238 0898508548 0.8227 0.7921 0.7529 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 0.5718 4 0.9515 0.03.28 0.2326 08219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0 5674 0.5428 0.5194 0.4972 0.0161 0.0176 0.8375 0.7903 0.7462 0.7050 0.8863 0.6302 0.5963 0.5645 08346 0.5066 0.4803 04856 04323 6 0.9327 0.0096 0.8131 0.7589 0.7107 0.6681 0.6227 0.5835 0.5470 0.5132 0.48 17 0.4823 0.4251 0.3996 0.3759 0.9235 0.0053 0.7894 0.7307 0.5768 0.5274 0.5820 0.5403 08019 0.4865 0.4339 0.4039 0.3762 0.3506 0.3259 0.9143 0.7477 0.7664 0.7026 0.5446 0.5919 05439 0.5002 0.4804 0.4241 0.3909 0.3806 0.33 29 0 3075 02843 9 0.9053 0.8401 0.7441 0.6786 0.6139 0.5584 03083 0.4632 0.4224 0.38% 0.3522 0.3220 0.2946 0 2597 0.2472 10 0.8963 0.9004 0.7224 0.6496 0.5847 0.5253 0.4751 0.4.289 0.3875 0.3505 0.3173 0.2875 0.2507 0.2386 02149 11 0.8874 0.7885 0.7014 06246 0 5368 0.4970 0.4440103971 0.3555 0.3186 0.28 58 0.2957 02307 0.2076 0.1869 12 0.8787 0.7730 0.6810 0.6006 0 5303 0.4688 0.4150 03677 03252 0.2897 0.2575 0 2292 0.2042 0.1821 0.1625 13 0.8700 0.7579 0 5611 0.5778 0 5051 04423 03878 0.3405 02992 0.2633 0.2320 0.2046 0.1807 0.1597 0.1413 14 0.8613 0.7430 0.5419 6.5553 0.4810 0.4173 0.3624 03152 0.2746 0.2394 0.2090 6.1827 0.1599 0.1401 0.1229 15 0.8528 0.7284 0.6232 0.5339 0.4581 0.3936 0.3387 0.2919 0.25 19 0.2176 0.1883 0.1631 0.1415 0.1229 0.1089 16 0.8444 0.7142 0.6050 05134 0.4353 03714 0.3166 0.2705 02311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0929 17 08350 0.7002 0.5874 0.4935 0.4155 03503 02959 0 2502 0.21 20 0.1799 0.1528 0.1300 0.1108 0.0946 0.0809 18 0.8277 0.6864 0.5703 0.4746 0.3957 0.3305 0.2765 02317 0.1945 0.1635 0.1377 0.1161 0.0981 0.0829 0.0703 19 0.8195 067 30 05537 0.4564 0.3/69 0.3118 0.2584 02145 0.1784 0.1486 0.1240 0.1037 0.086 0.0728 0.0611 20 0.8114 0.6598 0.537 0.4388 0 3589 02942 02415 0.1987 0.1637 0.1351 0.1117 0.0926 0.0768 0.0538 0.0531 21 0.8034 0.6468 0.5219 0.4220 0.3418 0.2775 0.2257 0.1839 0.1502 0.1228 0.1007 0.0826 0.0680 0.0560 0.0462 22 0.7954 0834205067 0.4057 0.3256 02618 02109 0.1703 0.1378 0.1117 0.0907 0.0738 0.0601 0.0491 0.0462 23 0.7876 0.62 17 0.4919 03901 0.3101 0.2470 0.1971 0.1577 0.1264 Q. 1015 0.0817 0.0659 0.0532 0.0431 0.0349 24 0.7198 0.6095 0.4776 0.3751 0.2953 02330 0.1842 0.1 450 0.1160 0.09.23 0.0736 0.0583 0.0471 0.0378 0.0304 25 0.7720 059/6 0.4637 0.3607 0.2812 0.2198 0.1722 0.1352 0.1064 0.0839 0.0663 0.0525 0.0417 0.0331 0.0264 26 0.7614 0.5859 0.4502 0.3458 0.2678 0.2074 0.1609 0.1252 0.0976 0.0763 0.0597 0.0469 0.0369 0.0291 0.0230 27 0.7568 0.5744 0.4371 03335 0.2587 0.1956 0.1504 0.1159 0.0895 0.0893 0.0538 0.0419 060326 0.0255 00200 28 0.7493 0.5631 0 4243 0.3207 0.2429 0.1846 0.1406 0.1073 0.0922 0.0530 0.0485 0.0374 0.0289 0.0224 0.0174 29 0.7419 05621 0 4120 0.3083 0 2314 0.1741 0.1314 0.0934 0.0754 0.0573 0.0437 0.0334 0.0256 G.0196 0.0151 30 20 21 22 23 24 25 26 27 28 30 Posting Fam Cleaner Prodeon LINEP FORECASTING ASSUMPTIONS She decides to estimate (1) the amount of funds Tipton will have to obtain in 1996; (2) the 1996 income statement assuming all of the financing is done through borrowing; and (3) another income statement assuming all new stock is issued. To help in the estimates Hood enlists Frank Davis, a recent MBA. Davis reminds her that 1996 is expected to be a big year for the company; sales are predicted to increase by 15 percent. Due to the strong demand, marketing feels any cost increases can easily be passed on. Consequently, the gross mar- gin should exceed the current level of 21 percent. Hood notes that the sales-to- inventory ratio will be lowered to 6.5, and that purchases should total $101,481,000. This suggests cost of goods for 1996 would be $93,750,000. "What about administrative and selling expenses?" Hood asks Davis. He in- forms her that management salaries would have to rise sharply because these salaries had increased very slightly over the past three years. Davis believes a 20 percent increase in administrative and selling expenses is reasonable. Fixed assets are likely to change sharply in the coming year. Currently, Tipton is operating virtually near capacity, demand is expected to remain high, and thus extra capacity will be needed. In addition, some major improvements to ex- isting equipment will have to be made in order for the company to remain com- petitive. The planning for these changes has been anticipated for some time, and - hamada in 1996. it is clear that the QUESTIONS 1. Project the 1996 income statement assuming no borrowing. 2. Project Tipton's 1996 balance sheet assuming no borrowing. 3. Explain how the $93.75 million cost-of-goods estimate for 1996 was ob- tained. 4. How much money will Tipton need to raise in 1996? 5. (a) How much of this money can Tipton borrow long term without violat- ing the constraints imposed by Hood? 72 PART III FINANCIAL PLANNING (b) How much of this money can be raised using notes payable without vi- olating these constraints? 6. Redo the 1996 income statement assuming all of the funds needed are bor- rowed as long-term bonds at 8 percent. (Keep retained earnings at the same level as in question 1.) 7. Will the Tipton family own less than 50 percent of the firm's stock if no funds are borrowed? (Assume shares are sold to nonfamily members at $11.50 per share, which nets $10.50 after brokerage fees.) 8. Calculate the dividend per share and earnings per share if the expansion is FORECASTING ASSUMPTIONS She decides to estimate (1) the amount of funds Tipton will have to obtain in 1996; (2) the 1996 income statement assuming all of the financing is done through borrowing; and (3) another income statement assuming all new stock is issued. To help in the estimates Hood enlists Frank Davis, a recent MBA Davis reminds her that 1996 is expected to be a big year for the company, sales are predicted to increase by $25 percent. Due to the strong demand, marketing feels any cost increases can easily be passed on Consequently, the gross mar- gin should exceed the current level of 21 percent. Hood notes that the sales-to- inventory ratio will be lowered to 6.5, and that purchases should total $101,481,000. This suggests cost of goods for 1996 would be $93,750,000. "What about administrative and selling expenses?" Hood asks Davis. He in- forms her that management salaries would have to rise sharply because these salaries had increased very slightly over the past three years. Davis believes a 20 percent increase in administrative and selling expenses is reasonable. Fixed assets are likely to change sharply in the coming year. Currently, Tipton is operating virtually near capacity, demand is expected to remain high, and thus extra capacity will be needed. In addition, some major improvements to ex- isting equipment will have to be made in order for the company to remain com- petitive. The planning for these changes has been anticipated for some time, and though all of these changes do not have to be made in 1996, it is clear that the company cannot grow beyond 1996 without them. In any event, it is urgent that the financing question be resolved as soon as possible. A reasonable estimate is that Tipton will purchase $5 million of new plant and equipment in 1996. "During the past year we've been a bit slow in paying our suppliers," Hood remarks. "We definitely will have to pay more promptly or we're going to have some annoyed creditors; plus we'll pick up cash discounts by paying earlier. See if you can come up with an estimate of our payables using past information." Hood and Davis also feel that over the last few years factors (other than sales) affecting accruals and receivables have been relatively constant. For example, the company has not altered its credit policy in the last three years. Nor can they think of any reason why these items should change significantly in the coming CASE 11 TIPTON ICE CREAM 71 year. "Of course, an exact relationship between each of these and sales is unlikely to exist." Hood cautions. "We can expect some yearly random fluctuation. And keep in mind the 'big/little mix will be changing since we'll be selling to smaller food chains. This has implications for our receivables since these firms are relatively slow to pay. This shouldn't be a major factor, Frank, but it is some- thing you should be aware of when you make your estimate." Hood and Davis think the cash management of the firm has been a "bit sloppy" over the past few years, and both agree the company could make do with a lower level of liquidity. Davis suggests he assume a level of 2 percent of sales, which is the approximate industry average, and Hood agrees. "What about dividends?" Davis asks Hood. "Our payout ratio is usually around 50 percent. However, if we borrow all the extra money, let's work backwards on the dividends, that is, out of net income subtract the amount of the retained earn- ings we would obtain if we used all-equity financing." FORECASTING RESTRICTIONS There are two final problems. While Hood believes the company should use more debt, she recognizes that the final decision rests with the Tipton family Given their debt aversion it is important that any projections not appear too Suppose Ithmaar Bank has BD20 million for lending for 30 daysto Inter Bank Market. Inter Bank market refers to a market where like minded banks can mutually lend borrow for immediate needs. In this Inter Bank MarketSalam Islamic Bank needs to borrow exactly BD 20 million for 30 days. Both parties agree to 60:40 profit sharing in favor of Ithmaar Bank. Now Al Salam Islamic Bank declares a gross profit of 596 and agrees to pay the same 596 profit to Ithmaar bank for borrowing BD20 million and Ithmaar Bank agrees. Required: How much Ithmaar bank will earn on this Investment? Show your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started