Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote aining Time: 1 hour, 53 minutes, 34 seconds. stion Completion Status: 10 points Save Answer QUESTION 5

please do it in 10 minutes will upvote

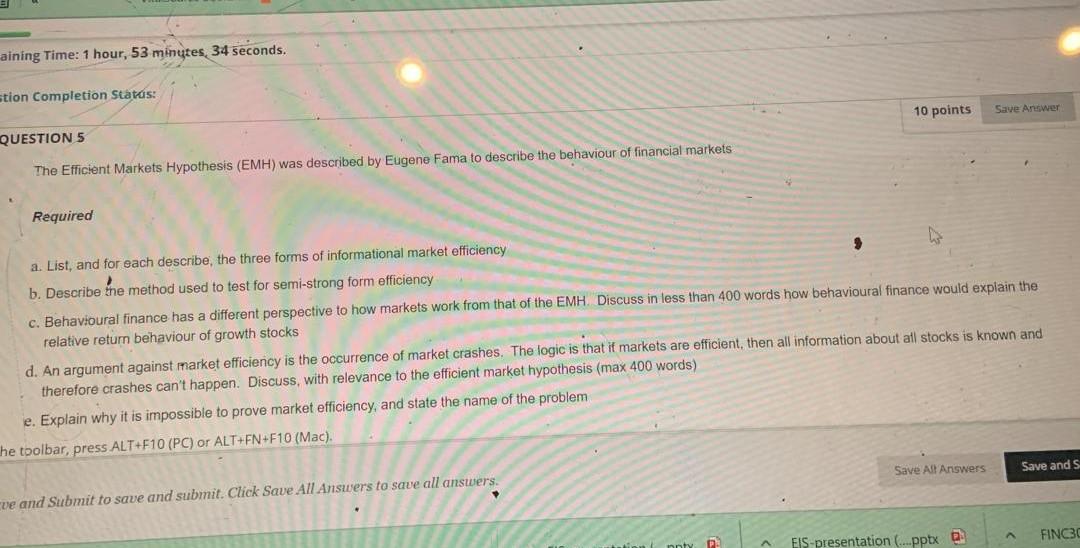

aining Time: 1 hour, 53 minutes, 34 seconds. stion Completion Status: 10 points Save Answer QUESTION 5 The Efficient Markets Hypothesis (EMH) was described by Eugene Fama to describe the behaviour of financial markets Required a. List, and for each describe, the three forms of informational market efficiency b. Describe ine method used to test for semi-strong form efficiency c. Behavioural finance has a different perspective to how markets work from that of the EMH Discuss in less than 400 words how behavioural finance would explain the relative return behaviour of growth stocks d. An argument against market efficiency is the occurrence of market crashes. The logic is that if markets are efficient, then all information about all stocks is known and therefore crashes can't happen. Discuss, with relevance to the efficient market hypothesis (max 400 words) e. Explain why it is impossible to prove market efficiency, and state the name of the problem the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). Save Alt Answers Save and S cue and Submit to save and submit. Click Save All Answers to save all answers. A FINC3 EIS-presentation (....pptxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started