Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote I am Problem 5 [Note that this is not an Excel question, and a step-by-step solution is

please do it in 10 minutes will upvote I am

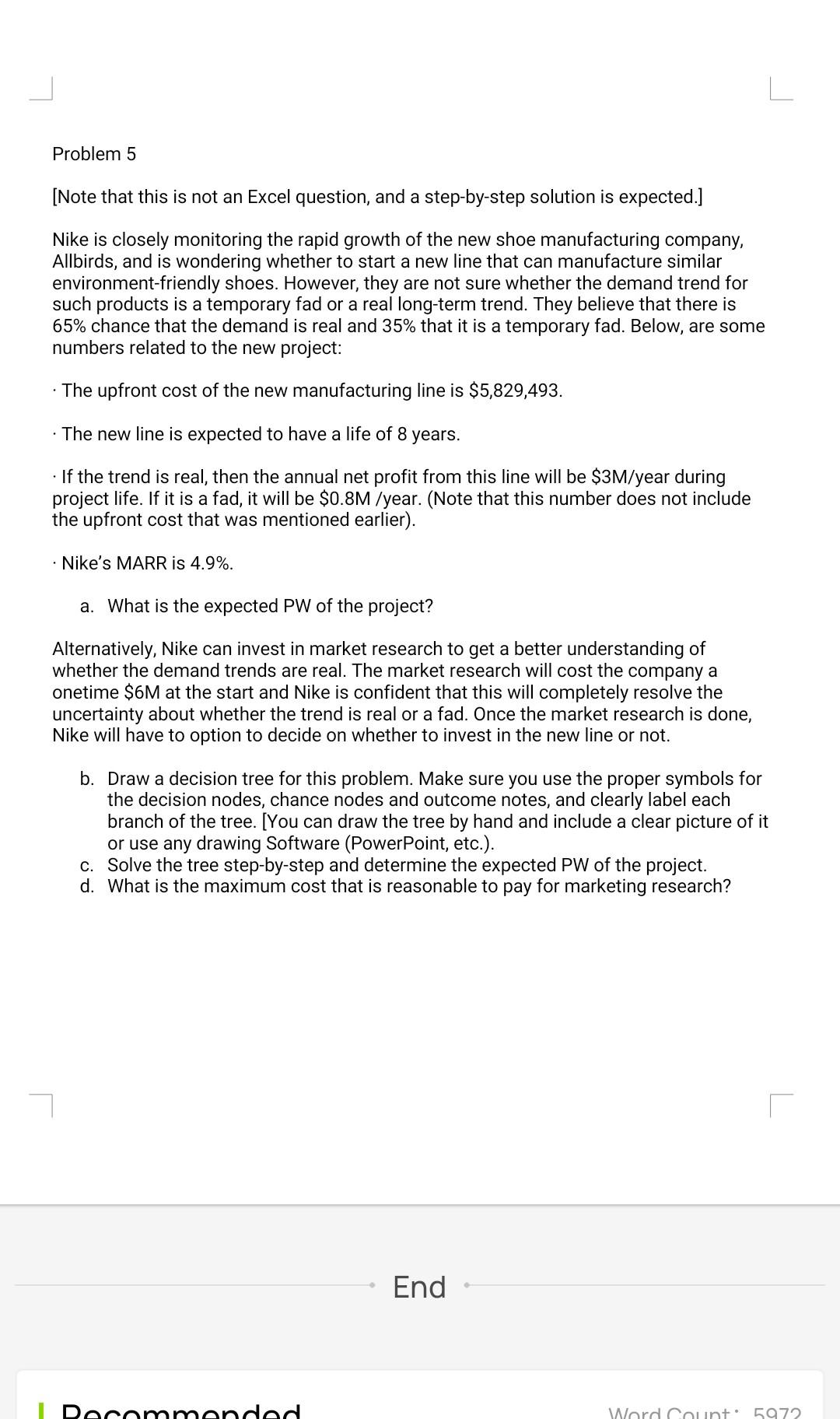

Problem 5 [Note that this is not an Excel question, and a step-by-step solution is expected.] Nike is closely monitoring the rapid growth of the new shoe manufacturing company, Allbirds, and is wondering whether to start a new line that can manufacture similar environment-friendly shoes. However, they are not sure whether the demand trend for such products is a temporary fad or a real long-term trend. They believe that there is 65% chance that the demand is real and 35% that it is a temporary fad. Below, are some numbers related to the new project: . The upfront cost of the new manufacturing line is $5,829,493. The new line is expected to have a life of 8 years. . If the trend is real, then the annual net profit from this line will be $3M/year during project life. If it is a fad, it will be $0.8M /year. (Note that this number does not include the upfront cost that was mentioned earlier). Nike's MARR is 4.9%. a. What is the expected PW of the project? Alternatively, Nike can invest in market research to get a better understanding of whether the demand trends are real. The market research will cost the company a onetime $6M at the start and Nike is confident that this will completely resolve the uncertainty about whether the trend is real or a fad. Once the market research is done, Nike will have to option to decide on whether to invest in the new line or not. b. Draw a decision tree for this problem. Make sure you use the proper symbols for the decision nodes, chance nodes and outcome notes, and clearly label each branch of the tree. [You can draw the tree by hand and include a clear picture of it or use any drawing Software (PowerPoint, etc.). c. Solve the tree step-by-step and determine the expected PW of the project. d. What is the maximum cost that is reasonable to pay for marketing research? End Recommended Word Count: 5972 Problem 5 [Note that this is not an Excel question, and a step-by-step solution is expected.] Nike is closely monitoring the rapid growth of the new shoe manufacturing company, Allbirds, and is wondering whether to start a new line that can manufacture similar environment-friendly shoes. However, they are not sure whether the demand trend for such products is a temporary fad or a real long-term trend. They believe that there is 65% chance that the demand is real and 35% that it is a temporary fad. Below, are some numbers related to the new project: . The upfront cost of the new manufacturing line is $5,829,493. The new line is expected to have a life of 8 years. . If the trend is real, then the annual net profit from this line will be $3M/year during project life. If it is a fad, it will be $0.8M /year. (Note that this number does not include the upfront cost that was mentioned earlier). Nike's MARR is 4.9%. a. What is the expected PW of the project? Alternatively, Nike can invest in market research to get a better understanding of whether the demand trends are real. The market research will cost the company a onetime $6M at the start and Nike is confident that this will completely resolve the uncertainty about whether the trend is real or a fad. Once the market research is done, Nike will have to option to decide on whether to invest in the new line or not. b. Draw a decision tree for this problem. Make sure you use the proper symbols for the decision nodes, chance nodes and outcome notes, and clearly label each branch of the tree. [You can draw the tree by hand and include a clear picture of it or use any drawing Software (PowerPoint, etc.). c. Solve the tree step-by-step and determine the expected PW of the project. d. What is the maximum cost that is reasonable to pay for marketing research? End Recommended Word Count: 5972Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started