Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 25 minutes please urgently... I'll give you up thumb definitely Jaypal Inc. is considering automating some part of an existing production

please do it in 25 minutes please urgently... I'll give you up thumb definitely

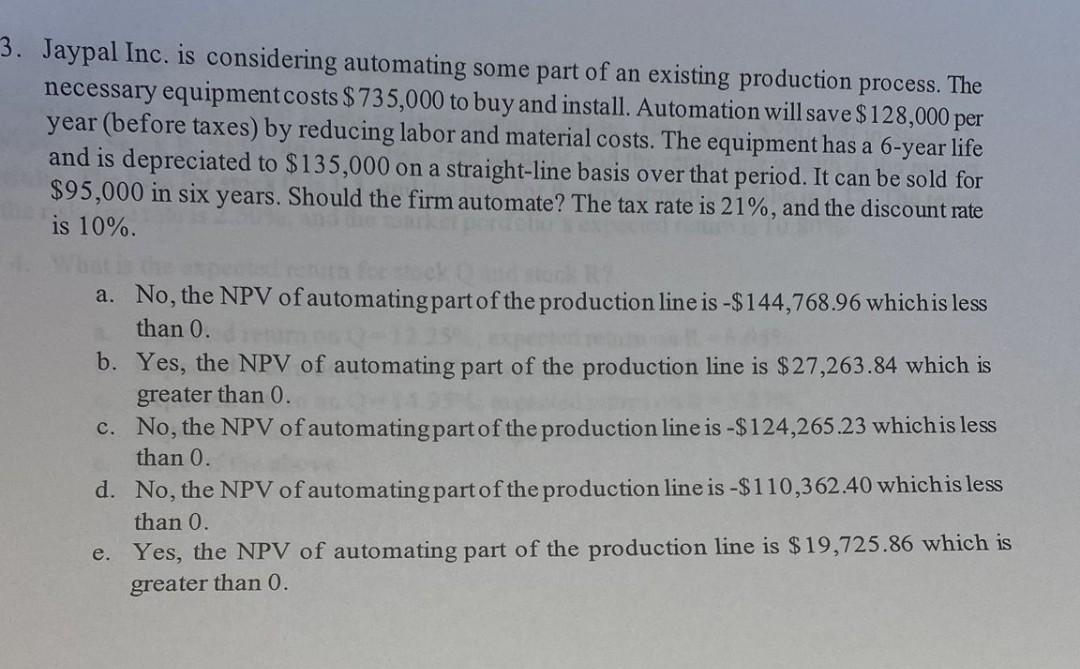

Jaypal Inc. is considering automating some part of an existing production process. The necessary equipment costs $735,000 to buy and install. Automation will save $128,000 per year (before taxes) by reducing labor and material costs. The equipment has a 6 -year life and is depreciated to $135,000 on a straight-line basis over that period. It can be sold for $95,000 in six years. Should the firm automate? The tax rate is 21%, and the discount rate is 10%. a. No, the NPV of automating part of the production line is $144,768.96 which is less than 0 . b. Yes, the NPV of automating part of the production line is $27,263.84 which is greater than 0 . c. No, the NPV of automating part of the production line is $124,265.23 which is less than 0 . d. No, the NPV of automating part of the production line is $110,362.40 which is less than 0 . e. Yes, the NPV of automating part of the production line is $19,725.86 which is greater than 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started