Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it well and explain the required questions best in order to getting upvote thanks... A. Devine and Vicky are partners dealing in cosmetics

please do it well and explain the required questions best in order to getting upvote thanks...

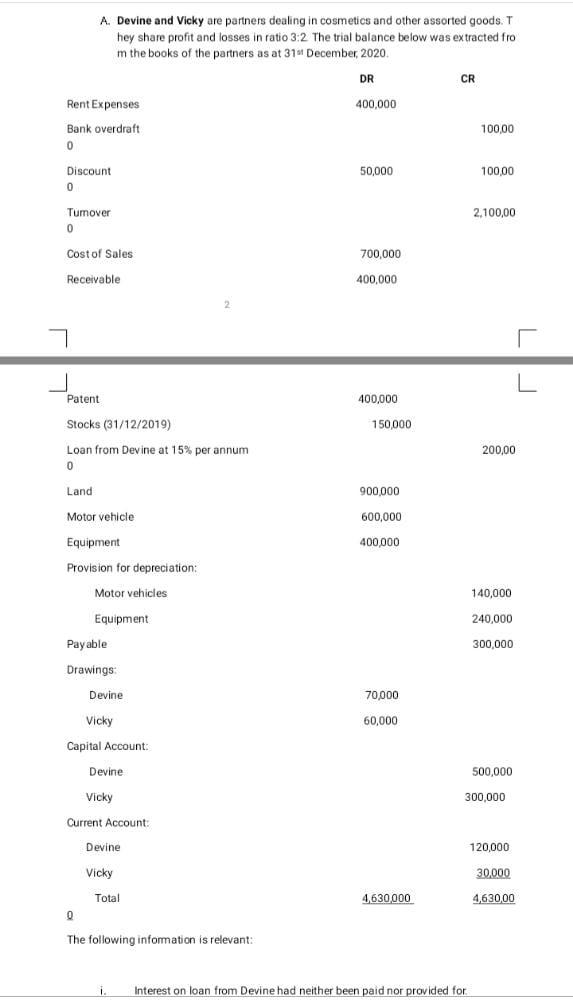

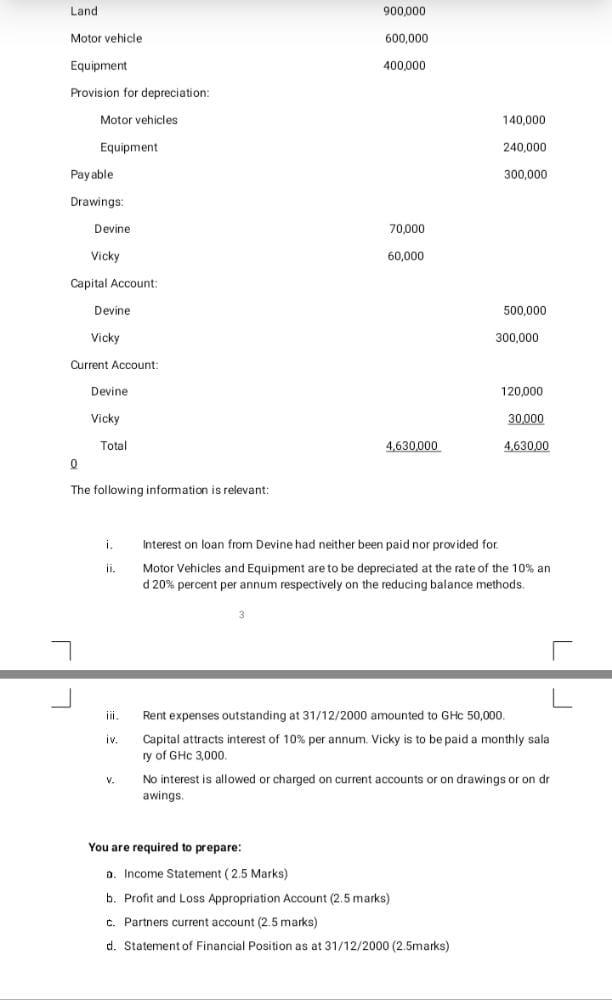

A. Devine and Vicky are partners dealing in cosmetics and other assorted goods. T hey share profit and losses in ratio 3:2 The trial balance below was extracted fro m the books of the partners as at 31 December, 2020 DR CR 400,000 Rent Expenses Bank overdraft 0 100,00 50,000 Discount 0 100,00 2.100,00 Tumover 0 Cost of Sales 700,000 Receivable 400,000 L Patent 400,000 Stocks (31/12/2019) 150,000 200,00 Loan from Devine at 15% per annum 0 Land 900.000 Motor vehicle 600,000 Equipment 400,000 Provision for depreciation: Motor vehicles 140,000 Equipment 240,000 Payable 300,000 Drawings Devine 70,000 Vicky 60,000 Capital Account: Devine 500,000 Vicky 300,000 Current Account: Devine 120,000 Vicky 30,000 Total 4,630,000 4,63000 0 The following information is relevant: 1 Interest on loan from Devine had neither been paid nor provided for Land 900,000 Motor vehicle 600,000 Equipment 400.000 Provision for depreciation: : Motor vehicles 140,000 240,000 Equipment Payable 300,000 Drawings: Devine 70,000 60,000 Vicky Capital Account: Devine 500,000 Vicky 300,000 Current Account: Devine 120,000 Vicky 30.000 4.630,000 4.630,00 Total 0 The following information is relevant: i. li. Interest on loan from Devine had neither been paid nor provided for Motor Vehicles and Equipment are to be depreciated at the rate of the 10% an d 20% percent per annum respectively on the reducing balance methods LI iii iv. Rent expenses outstanding at 31/12/2000 amounted to GHc 50,000 Capital attracts interest of 10% per annum Vicky is to be paid a monthly sala ry of GHc 3,000 V. No interest is allowed or charged on current accounts or on drawings or on dr awings You are required to prepare: 0. Income Statement (2.5 Marks) b. Profit and Loss Appropriation Account (2.5 marks) c. Partners current account (2.5 marks) d. Statement of Financial Position as at 31/12/2000 (2.5marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started