Answered step by step

Verified Expert Solution

Question

1 Approved Answer

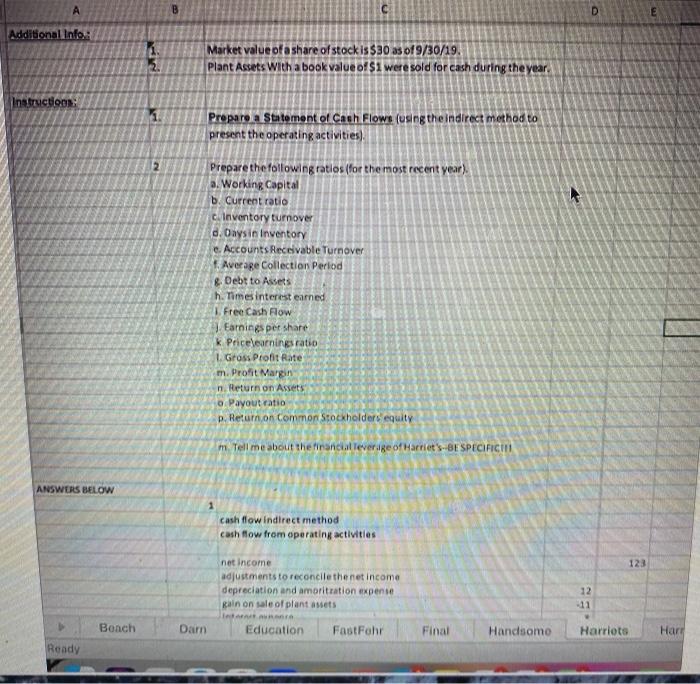

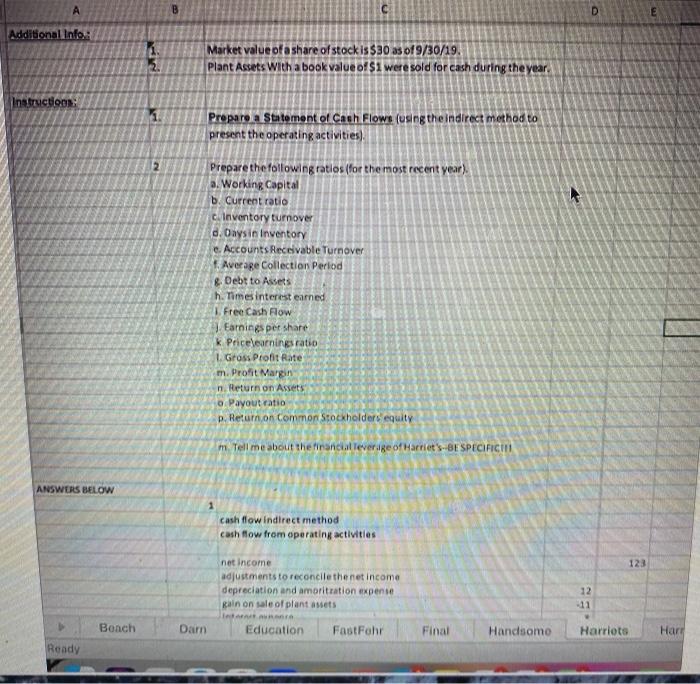

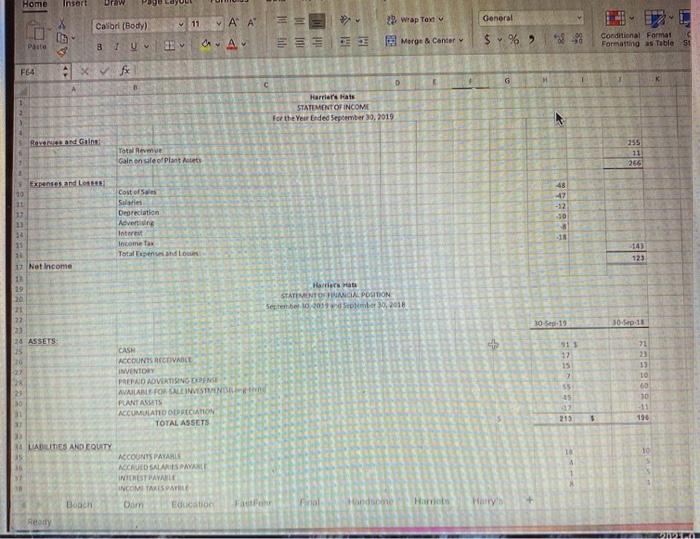

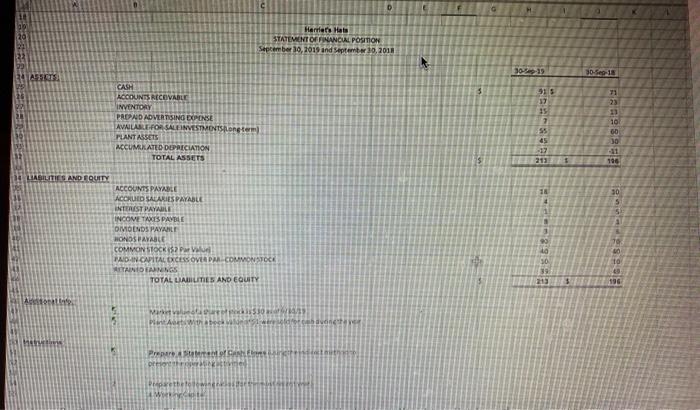

Please do part 2 a-p. A D Additional Info: Market value of a share of stock is $30 as of9/30/19. Plant Assets with a book

Please do part 2 a-p.

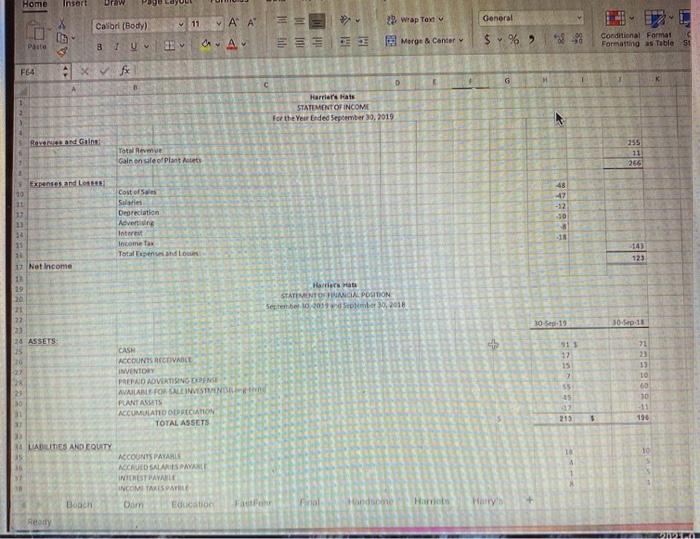

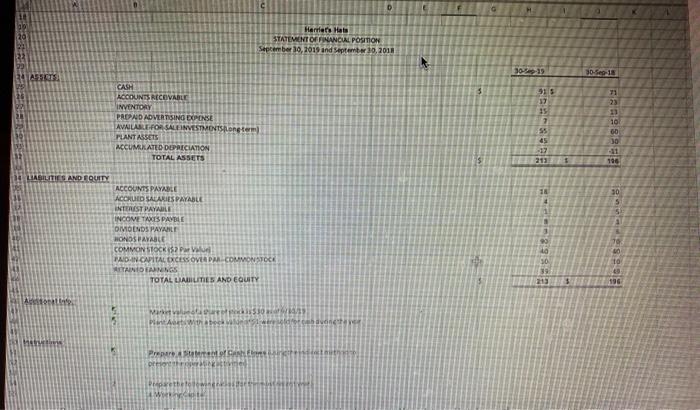

A D Additional Info: Market value of a share of stock is $30 as of9/30/19. Plant Assets with a book value of $1 were sold for cash during the year Instructions Prepare a Statement of Cash Flows (using the indirect method to present the operating activities) 2 Prepare the following ratios (for the most recent year) a. Working Capital b. Current ratio Inventory turnover d. Onysin Inventory c. Accounts Receivable Turnover Average Collection Period & Debt to Assets h. Times interest earned Free Cash Flow Earnings pet share k Price earnings ratio Gross Profit Rate m. Profit margin n. Return on Assets o Payout ratio D. Return on Common Stockholders equity m. Tell me about the financial leverage of Harriet's-BE SPECIFICI ANSWERS BELOW cash flow indirect method cash flow from operating activities 123 net income adjustments to reconcile the net income depreciation and amoritration expense Rain on sale of plant assets 12 11 Bench Dam Education FastFohr Final Handsome Harriots Hart Ready Home Insert Drow . General 12 Calibr (Body) ' 11 alt 29 wrap Taxe Morge & Carter $ %> conditional Format Formatting as Table SI CA Date 3 TU H F64 f G C 1 D Harrier's Hans STATEMENT OF INCOME For the Year Ended Sewer 30, 2019 Reve Gainst Total Rem Gain on site of Plantes 355 11 266 Expenses and 10 11 12 47 -12 Cost of Sales Sales Depreciation Aeverin Interest Income Tax Total pendo 11 11 11 Net Income 123 19 20 21 Hart STATIMINTOWANIA. POLITION September 16,205,2018 30 Sed:19 30 Sep 11 33 24 ASSETS 111 12 15 7 23 27 CASH ACCOUNTS RECEIVABLE INVENTORY PREPAD ADVERTISINODE AVAILABLE FOR ALL INVESTANDEL PLANTATS ACCUMULANDOCATION TOTAL ASSETS 55 US 30 60 10 -11 196 5 10 IB 4 3 VALITES AND EQUITY ACCOUNTS PAVARE NUO SALARIS PAVALE INIMEST AVALE INCOMITAIS PALE Boach Dom Edicio Ready al decone Himno Marty's UNDERA Herries Hats STATEMENT OF FINANCIAL POSITION September 19, 2019 and Septemt 10, 2018 30-319 30.Se 18 3 15 17 15 CASH ACCOUNTS RECOVABLE INVENTORY PADNO ADVERTISING DOENSE AVAILILE FOR SALE INVESTMENTS Long term PLANT ASSETS ACCUMRATED DEPRECIATION TOTAL ASSETS 71 23 23 10 60 30 45 212 196 LIABILITIES AND EQUITY 4 30 5 5 1 ACCOUNTS PAYABLE ACONUED SALARIES PAYABLE INTEREST PAYALE INCOME TAXTS PAYBLE OMONDS PAYAL HONOS PAYABLE COMMON STOCK SPV DAN CAPITAL EXCESSOVE PARCOMMON STOCK MITANDINGS TOTAL LALIES AND EQUITY 70 00 10 196 Mais Plintestiwithe conce Prepared A D Additional Info: Market value of a share of stock is $30 as of9/30/19. Plant Assets with a book value of $1 were sold for cash during the year Instructions Prepare a Statement of Cash Flows (using the indirect method to present the operating activities) 2 Prepare the following ratios (for the most recent year) a. Working Capital b. Current ratio Inventory turnover d. Onysin Inventory c. Accounts Receivable Turnover Average Collection Period & Debt to Assets h. Times interest earned Free Cash Flow Earnings pet share k Price earnings ratio Gross Profit Rate m. Profit margin n. Return on Assets o Payout ratio D. Return on Common Stockholders equity m. Tell me about the financial leverage of Harriet's-BE SPECIFICI ANSWERS BELOW cash flow indirect method cash flow from operating activities 123 net income adjustments to reconcile the net income depreciation and amoritration expense Rain on sale of plant assets 12 11 Bench Dam Education FastFohr Final Handsome Harriots Hart Ready Home Insert Drow . General 12 Calibr (Body) ' 11 alt 29 wrap Taxe Morge & Carter $ %> conditional Format Formatting as Table SI CA Date 3 TU H F64 f G C 1 D Harrier's Hans STATEMENT OF INCOME For the Year Ended Sewer 30, 2019 Reve Gainst Total Rem Gain on site of Plantes 355 11 266 Expenses and 10 11 12 47 -12 Cost of Sales Sales Depreciation Aeverin Interest Income Tax Total pendo 11 11 11 Net Income 123 19 20 21 Hart STATIMINTOWANIA. POLITION September 16,205,2018 30 Sed:19 30 Sep 11 33 24 ASSETS 111 12 15 7 23 27 CASH ACCOUNTS RECEIVABLE INVENTORY PREPAD ADVERTISINODE AVAILABLE FOR ALL INVESTANDEL PLANTATS ACCUMULANDOCATION TOTAL ASSETS 55 US 30 60 10 -11 196 5 10 IB 4 3 VALITES AND EQUITY ACCOUNTS PAVARE NUO SALARIS PAVALE INIMEST AVALE INCOMITAIS PALE Boach Dom Edicio Ready al decone Himno Marty's UNDERA Herries Hats STATEMENT OF FINANCIAL POSITION September 19, 2019 and Septemt 10, 2018 30-319 30.Se 18 3 15 17 15 CASH ACCOUNTS RECOVABLE INVENTORY PADNO ADVERTISING DOENSE AVAILILE FOR SALE INVESTMENTS Long term PLANT ASSETS ACCUMRATED DEPRECIATION TOTAL ASSETS 71 23 23 10 60 30 45 212 196 LIABILITIES AND EQUITY 4 30 5 5 1 ACCOUNTS PAYABLE ACONUED SALARIES PAYABLE INTEREST PAYALE INCOME TAXTS PAYBLE OMONDS PAYAL HONOS PAYABLE COMMON STOCK SPV DAN CAPITAL EXCESSOVE PARCOMMON STOCK MITANDINGS TOTAL LALIES AND EQUITY 70 00 10 196 Mais Plintestiwithe conce Prepared

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started