please do required 1-3b

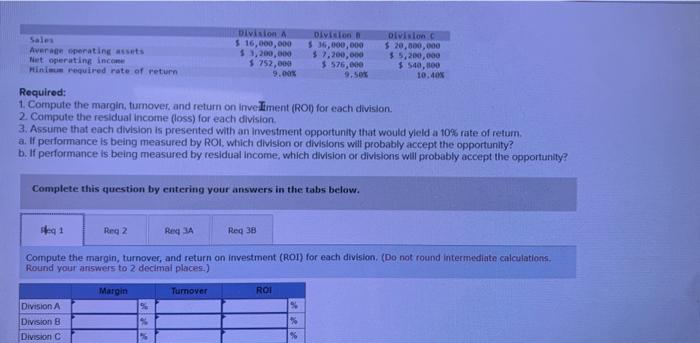

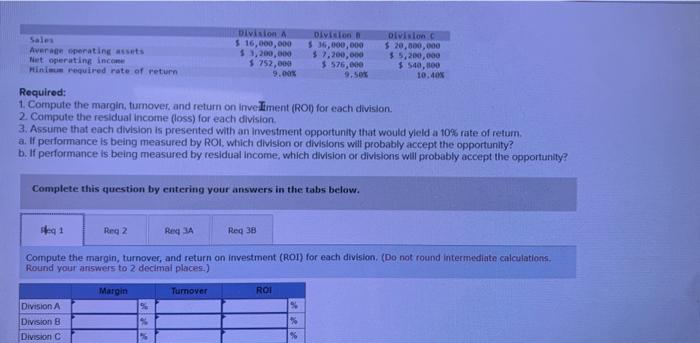

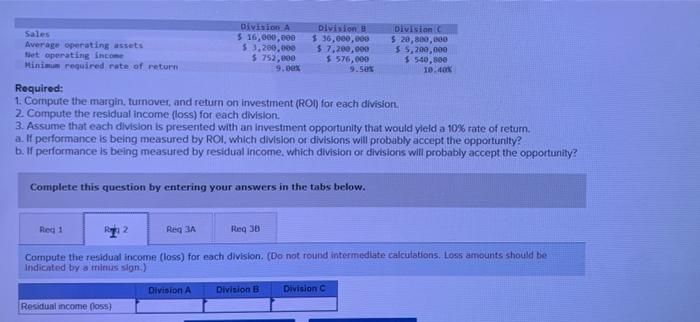

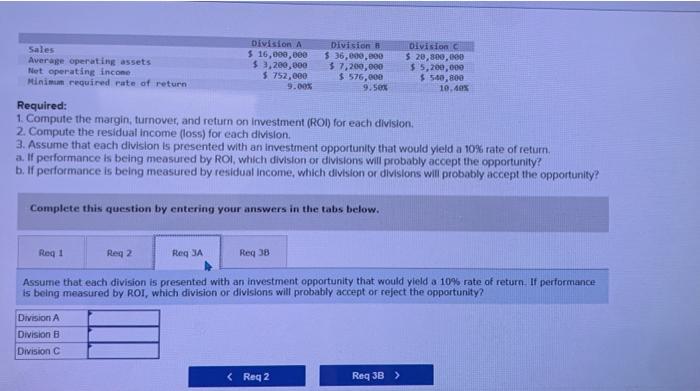

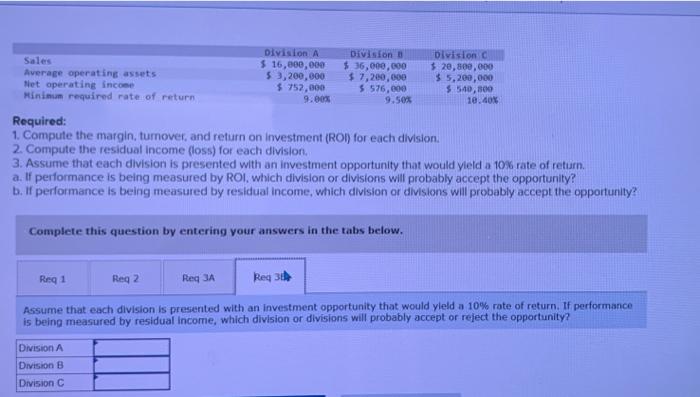

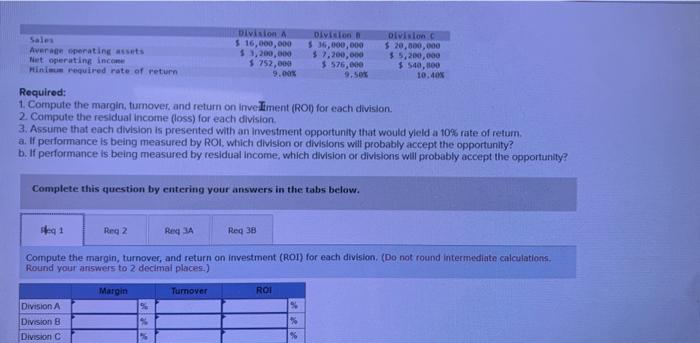

Required: 1. Compute the margin, tumover. and return on inve Iiment (ROn for each division. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an invostment opportunity that would yield a 10%6 rate of refum. a. If performance is being measured by ROL, which division or divisioris will probably accept the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity? Complete this question by entering your answers in the tabs below. Compute the margin, turnover, and return on investment (ROI) for each division. (Do not round intermediate calculations, Round yout an 5 wers to 2 dectmal places.) Required: 1. Compute the margin, tumover, and return on investment (ROI) for each divisiort. 2. Compute the residual income (loss) for each division. 3. Assume that each division is presented with an invesiment opportunity that would yleld a 10% rate of retum. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity Complete this question by entering your answers in the tabs below. Compute the residual income (loss) for each division. (Do not round intermecdiate calculationis, Loss amounts should be indicated by o mirus sign.) Required: 1. Compute the margin, turnover, and return on investment (ROI) for each dlvision. 2. Compute the residual income (loss) for cach division. 3. Assume that each division is presented with an investment opportunily that would yleld a 10% rate of return. a. If performance is being measured by ROI, which division or divisions will probably accept the opportunity? b. If performance is being measured by residual income, which dlvision or divisions will probably accept the opportunity? Complete this question by entering your answers in the tabs below. Assume that each division is presented with an investment opportunity that would yield a 10% rate of return. If performance is being measured by ROI, which division or divisions will probably accept or reject the opportunity? Required: 1. Compute the margin, turnover, and return on investment (ROI) for each division. 2. Compute the residual income floss) for each division. 3. Assume that each division is presented with an investment opportunity that would yleld a 10\% rate of return. a. If perlormance is being measured by ROI, which division or divisions will probably accept the opportunity? b. If performance is being measured by residual income, which division or divisions will probably accept the opportunity? Complete this question by entering your answers in the tabs below. Assume that each division is presented with an investment opportunity that would yleld a 10% rate of return. If performance is being measured by residual income, which division or divisions will probably accept or reject the opportunity