Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do the computations by hand. Exercise 4. Use the Black-Scholes option pricing formula to find the price of a European put option on a

Please do the computations by hand.

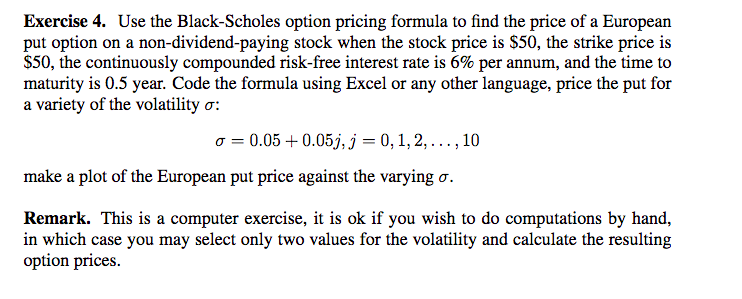

Exercise 4. Use the Black-Scholes option pricing formula to find the price of a European put option on a non-dividend-paying stock when the stock price is $50, the strike price is $50, the continuously compounded risk-free interest rate is 6% per annum, and the time to maturity is 0.5 year. Code the formula using Excel or any other language, price the put for a variety of the volatility : o = 0.05 +0.05j, j = 0, 1, 2,..., 10 make a plot of the European put price against the varying o. Remark. This is a computer exercise, it is ok if you wish to do computations by hand, in which case you may select only two values for the volatility and calculate the resulting option prices. Exercise 4. Use the Black-Scholes option pricing formula to find the price of a European put option on a non-dividend-paying stock when the stock price is $50, the strike price is $50, the continuously compounded risk-free interest rate is 6% per annum, and the time to maturity is 0.5 year. Code the formula using Excel or any other language, price the put for a variety of the volatility : o = 0.05 +0.05j, j = 0, 1, 2,..., 10 make a plot of the European put price against the varying o. Remark. This is a computer exercise, it is ok if you wish to do computations by hand, in which case you may select only two values for the volatility and calculate the resulting option pricesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started