Answered step by step

Verified Expert Solution

Question

1 Approved Answer

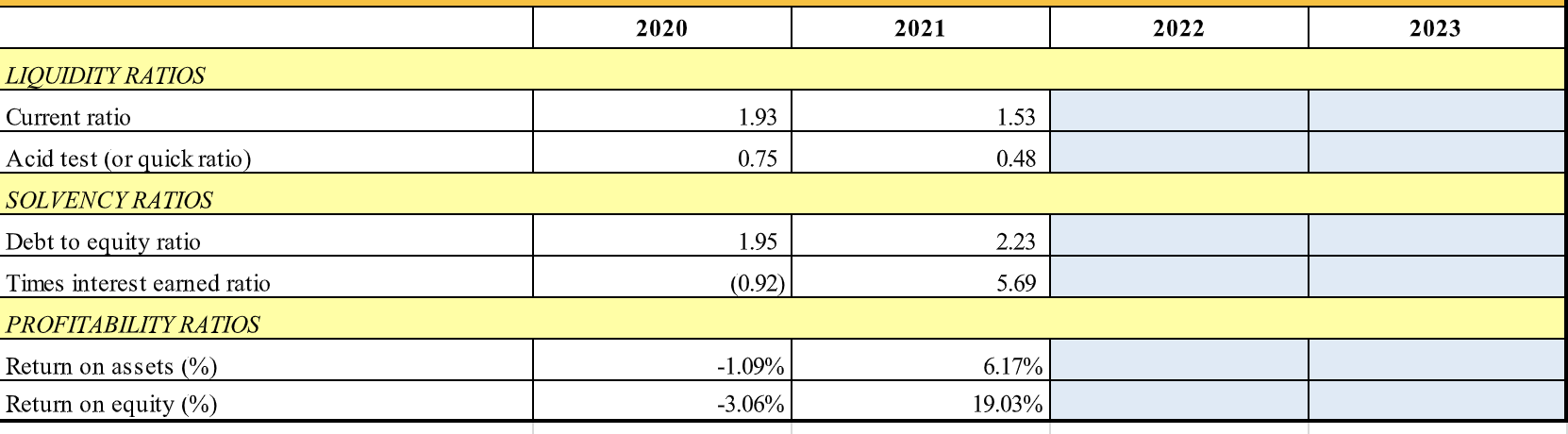

Please do the ratios for 2023 and explain how you got the steps begin{tabular}{|c|c|c|c|c|c|c|} hline multirow{2}{*}{begin{tabular}{l} (Dollars in Millions, Except per Share Data) Net

Please do the ratios for 2023 and explain how you got the steps

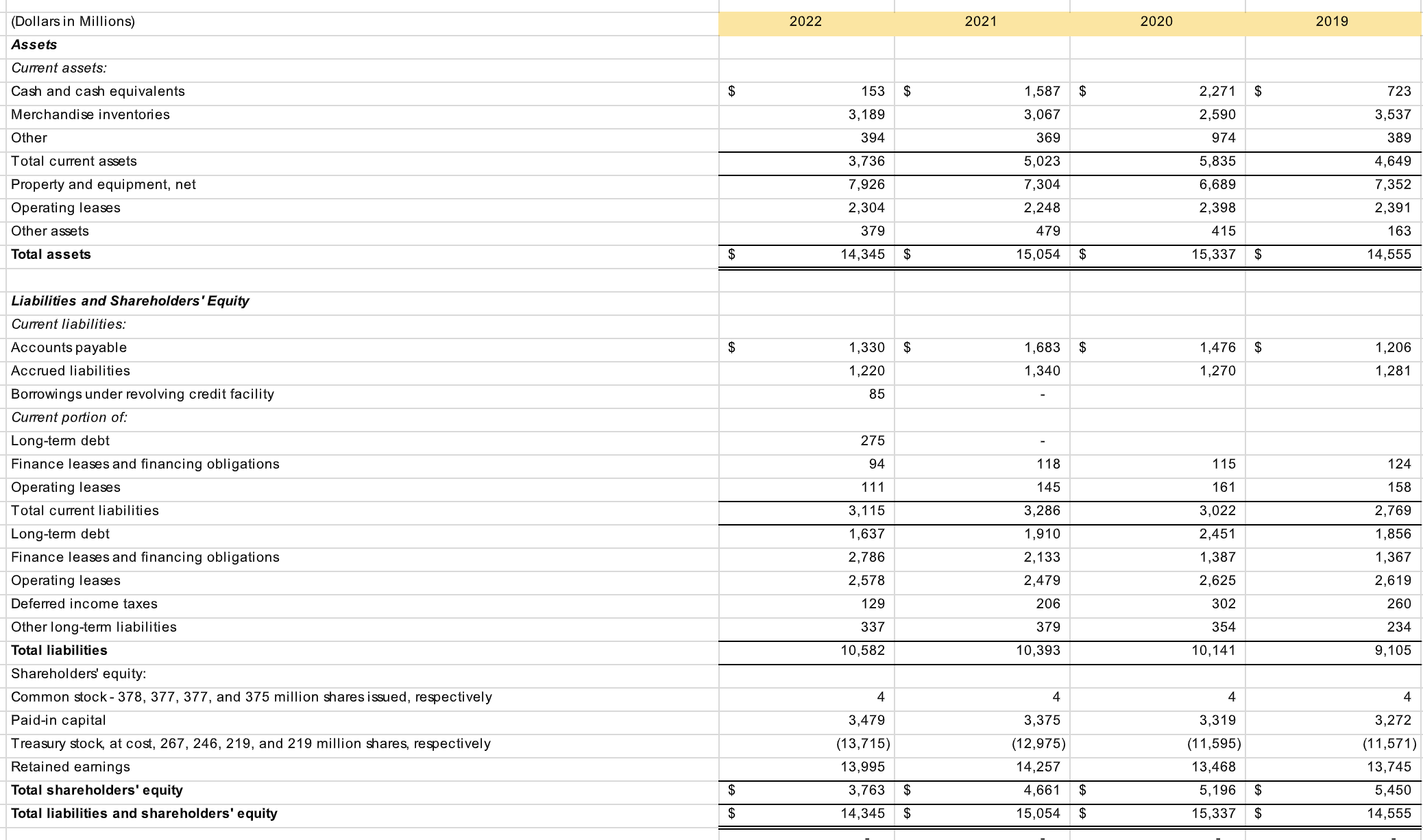

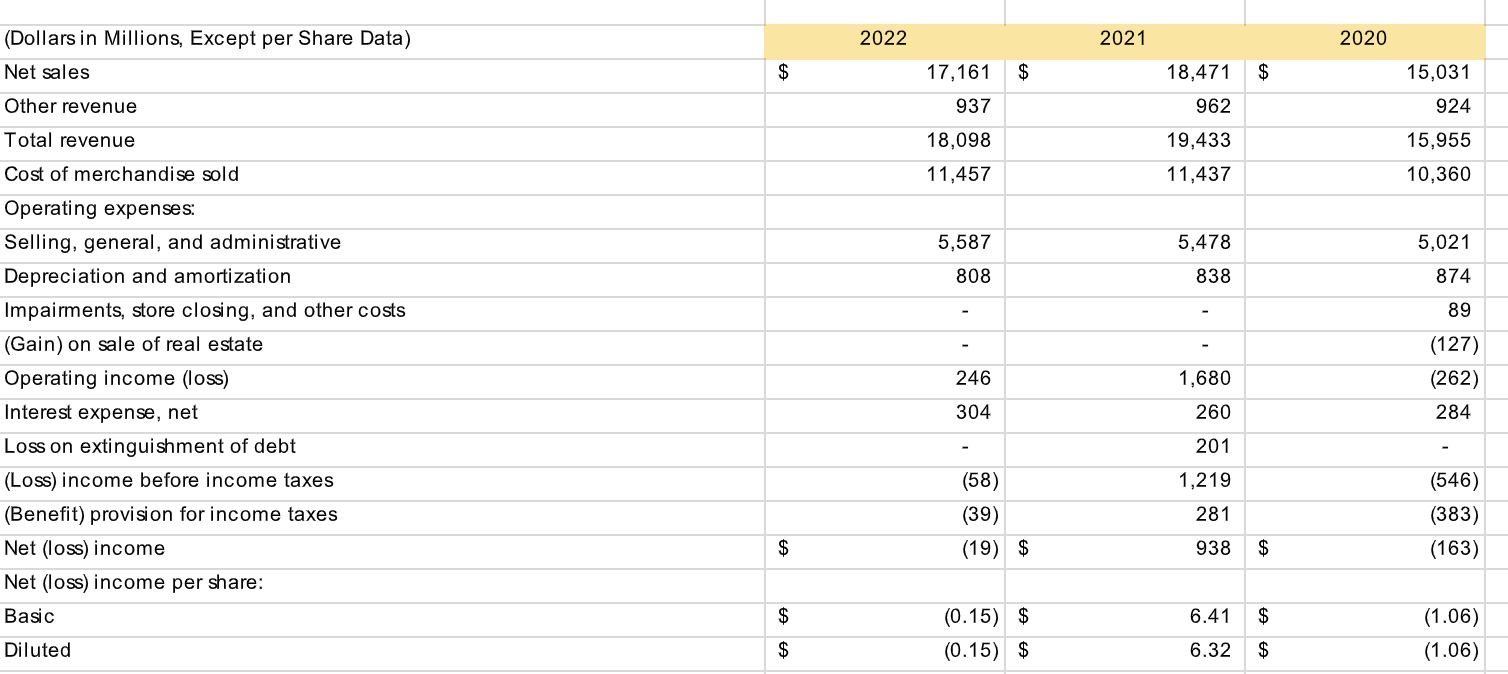

\begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} (Dollars in Millions, Except per Share Data) \\ Net sales \end{tabular}} & \multicolumn{2}{|c|}{2022} & \multicolumn{2}{|c|}{2021} & \multicolumn{2}{|c|}{2020} \\ \hline & $ & 17,161 & $ & 18,471 & $ & 15,031 \\ \hline Other revenue & & 937 & & 962 & & 924 \\ \hline Total revenue & & 18,098 & & 19,433 & & 15,955 \\ \hline Cost of merchandise sold & & 11,457 & & 11,437 & & 10,360 \\ \hline \multicolumn{7}{|l|}{ Operating expenses: } \\ \hline Selling, general, and administrative & & 5,587 & & 5,478 & & 5,021 \\ \hline Depreciation and amortization & & 808 & & 838 & & 874 \\ \hline Impairments, store closing, and other costs & & - & & - & & 89 \\ \hline (Gain) on sale of real estate & & - & & - & & (127) \\ \hline Operating income (loss) & & 246 & & 1,680 & & (262) \\ \hline Interest expense, net & & 304 & & 260 & & 284 \\ \hline Loss on extinguishment of debt & & - & & 201 & & - \\ \hline (Loss) income before income taxes & & (58) & & 1,219 & & (546) \\ \hline (Benefit) provision for income taxes & & (39) & & 281 & & (383) \\ \hline Net (loss) income & $ & (19) & $ & 938 & $ & (163) \\ \hline \multicolumn{7}{|l|}{ Net (loss) income per share: } \\ \hline Basic & $ & (0.15) & $ & 6.41 & $ & (1.06) \\ \hline Diluted & $ & (0.15) & $ & 6.32 & $ & (1.06) \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & 2020 & 2021 & 2022 & 2023 \\ \hline \multicolumn{5}{|l|}{ LIQUIDITY RATIOS } \\ \hline Current ratio & 1.93 & 1.53 & & \\ \hline Acid test (or quick ratio) & 0.75 & 0.48 & & \\ \hline \multicolumn{5}{|l|}{ SOLVENCY RATIOS } \\ \hline Debt to equity ratio & 1.95 & 2.23 & & \\ \hline Times interest earned ratio & (0.92) & 5.69 & & \\ \hline \multicolumn{5}{|l|}{ PROFITABILITY RATIOS } \\ \hline Return on assets (\%) & 1.09% & 6.17% & & \\ \hline Return on equity (\%) & 3.06% & 19.03% & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{2}{*}{\begin{tabular}{l} (Dollars in Millions, Except per Share Data) \\ Net sales \end{tabular}} & \multicolumn{2}{|c|}{2022} & \multicolumn{2}{|c|}{2021} & \multicolumn{2}{|c|}{2020} \\ \hline & $ & 17,161 & $ & 18,471 & $ & 15,031 \\ \hline Other revenue & & 937 & & 962 & & 924 \\ \hline Total revenue & & 18,098 & & 19,433 & & 15,955 \\ \hline Cost of merchandise sold & & 11,457 & & 11,437 & & 10,360 \\ \hline \multicolumn{7}{|l|}{ Operating expenses: } \\ \hline Selling, general, and administrative & & 5,587 & & 5,478 & & 5,021 \\ \hline Depreciation and amortization & & 808 & & 838 & & 874 \\ \hline Impairments, store closing, and other costs & & - & & - & & 89 \\ \hline (Gain) on sale of real estate & & - & & - & & (127) \\ \hline Operating income (loss) & & 246 & & 1,680 & & (262) \\ \hline Interest expense, net & & 304 & & 260 & & 284 \\ \hline Loss on extinguishment of debt & & - & & 201 & & - \\ \hline (Loss) income before income taxes & & (58) & & 1,219 & & (546) \\ \hline (Benefit) provision for income taxes & & (39) & & 281 & & (383) \\ \hline Net (loss) income & $ & (19) & $ & 938 & $ & (163) \\ \hline \multicolumn{7}{|l|}{ Net (loss) income per share: } \\ \hline Basic & $ & (0.15) & $ & 6.41 & $ & (1.06) \\ \hline Diluted & $ & (0.15) & $ & 6.32 & $ & (1.06) \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline & 2020 & 2021 & 2022 & 2023 \\ \hline \multicolumn{5}{|l|}{ LIQUIDITY RATIOS } \\ \hline Current ratio & 1.93 & 1.53 & & \\ \hline Acid test (or quick ratio) & 0.75 & 0.48 & & \\ \hline \multicolumn{5}{|l|}{ SOLVENCY RATIOS } \\ \hline Debt to equity ratio & 1.95 & 2.23 & & \\ \hline Times interest earned ratio & (0.92) & 5.69 & & \\ \hline \multicolumn{5}{|l|}{ PROFITABILITY RATIOS } \\ \hline Return on assets (\%) & 1.09% & 6.17% & & \\ \hline Return on equity (\%) & 3.06% & 19.03% & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started