Answered step by step

Verified Expert Solution

Question

1 Approved Answer

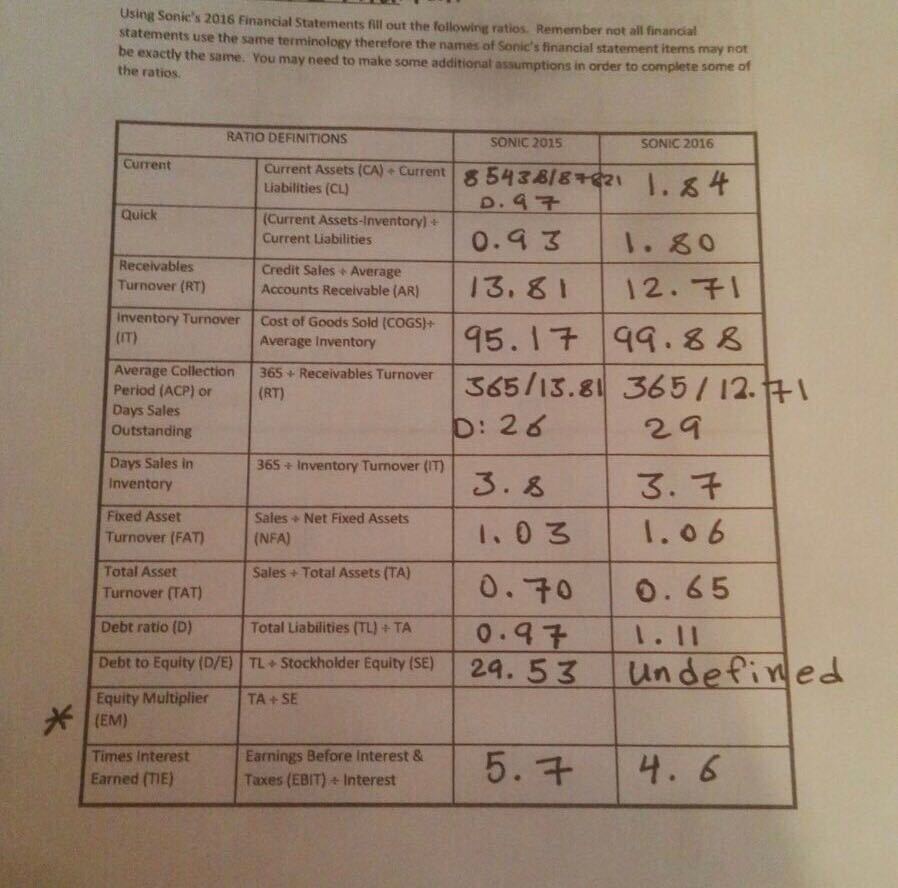

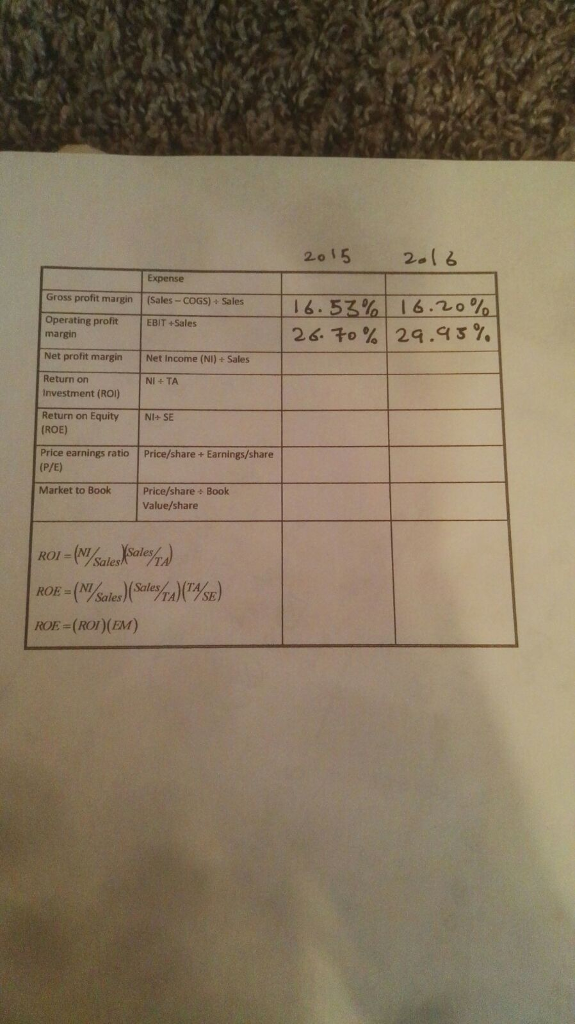

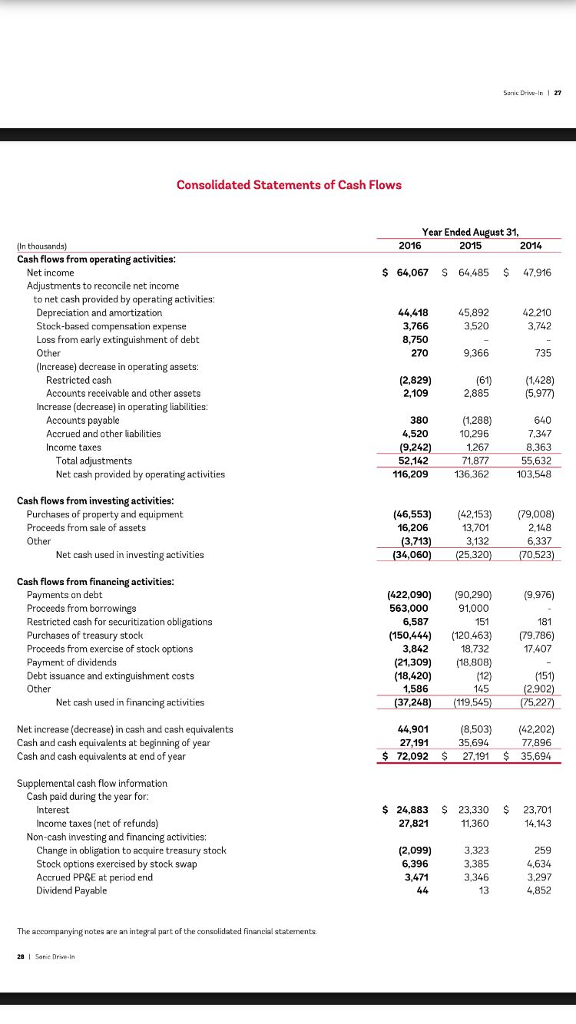

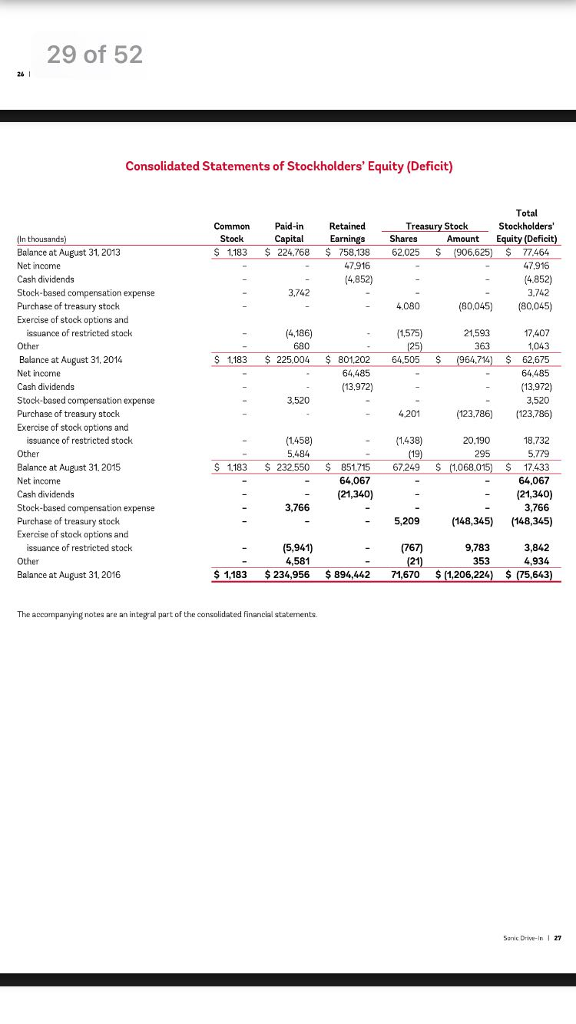

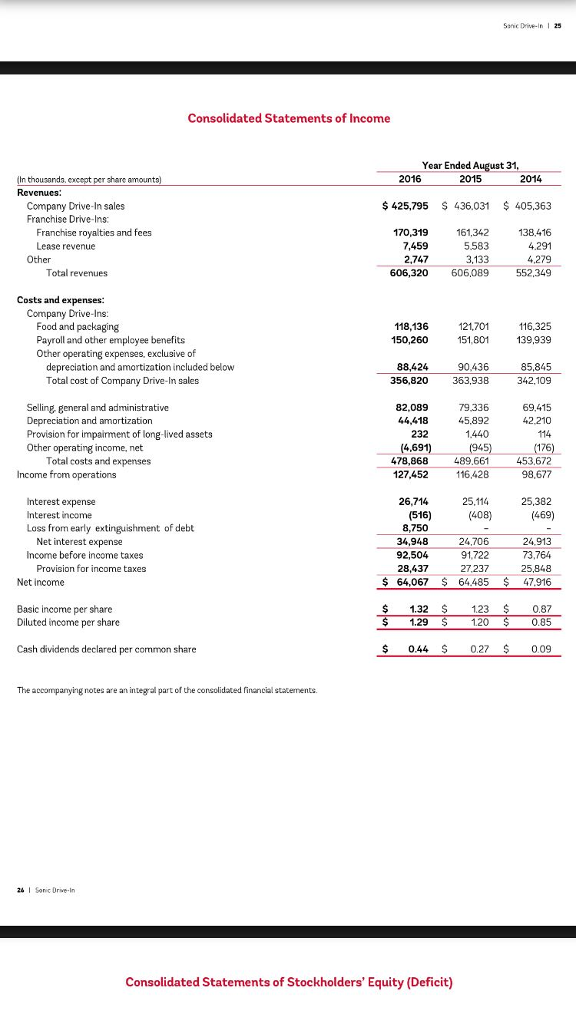

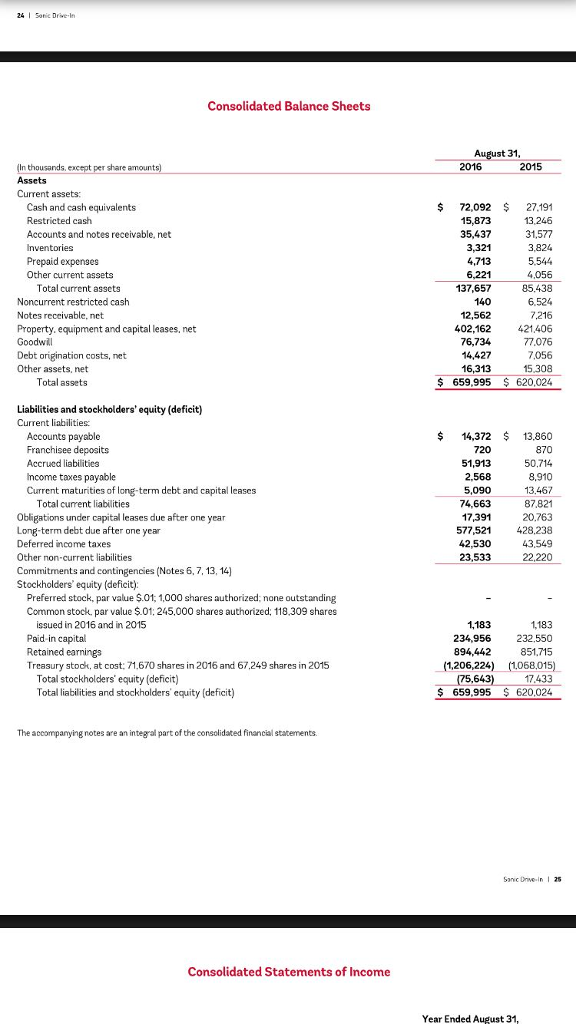

please do the rest and Thank you Using Sonic's 2016 Financial Statements fill out the following ratios. Remember not all financial statements use the same

please do the rest and Thank you

Using Sonic's 2016 Financial Statements fill out the following ratios. Remember not all financial statements use the same terminology therefore the names of Sonic's financial statement be exactly the same. You may need to make some additional assumptions in order to complete some the ratios items may not of RATIO DEFINITIONS SONIC 2015 SONIC 2016 Current Current Assets (CA)+ Current Liabilities (CL) D.47- Quick (Current Assets-Inventory) 0.3 I.80 Current Liabilities Credit Sales + Average Accounts Receivable (AR) Cost of Goods Sold (COGS)+ Average Inventory Receivables Turnover (RT) | 13.81 | 12. inventory Turnover (IT) Average Collection 365+ Receivables Turnover Period (ACP) or (RT) Days Sales Outstanding 365/13.81 365/ 12.1+ D: 26 Days Sales in Inventory 1365 inventory Tumover (ml 3.8 | 3.3 Fixed Asset Turnover (FAT) (NFA) Sales Net Fixed Assets | 1.0 3 Sales Total Assets (TA) Total Asset Turnover (TAT) - 1+ TA Debt ratio (D) Total Liabilities 10.97 1.11 Debt to Equity (D/E) TL Stockholder Equity (SE) Equity Multiplier TA +SE (EM) Earnings Before interest & Times interest Earned (TIE) 15. | 4.6 Taxes (EBIT) InterestStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started