Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do ur best disregard my writing is that better? I can see it fine? Chapter 12 Homework to the Math 12-2 Life Insurance Needs

Please do ur best disregard my writing

is that better? I can see it fine?

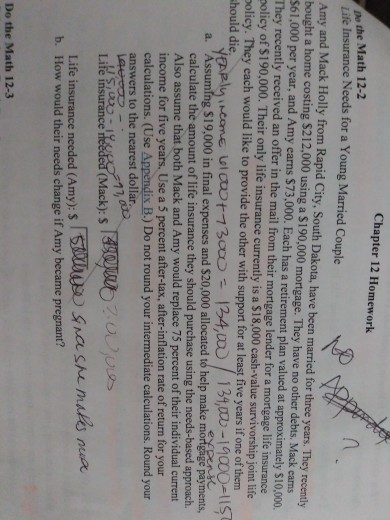

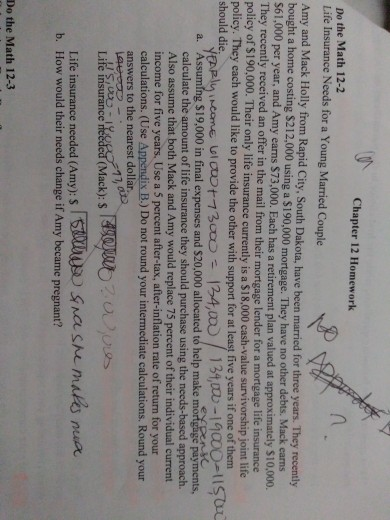

Chapter 12 Homework to the Math 12-2 Life Insurance Needs for a Young Married Couple Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack cams $61,000 per year, and Amy earns $73,000. Each has a retirement plan valued at approximately 510,000, They recently received an offer in the mail from their mortgage lender for a mortgage life insurance policy of $190,000. Their only life insurance currently is a $18,000 cash-value survivorship joint life Solicy. They each would like to provide the other with support for at least five years if one of them should die YEARLY INcome 6100+13000 = a. 'Assuming $19,000 in final expenses and $20,000 allocated to help make mortgage payments, expense calculate the amount of life insurance they should purchase using the needs-based approach. Also assume that both Mack and Amy would replace 75 percent of their individual current income for five years. Use a 5 percent after-tax, after-inflation rate of return for your calculations. (Use Appendix B.) Do not round your intermediate calculations. Round your answers to the nearest dollar LLO - Life insurance feeded (Mack) s legever?.000 Life insurance needed (Amy): $ 500w Sashe makes b. How would their needs change if Amy became pregnant? 134,000 134,00 - 19000 115 77, or Do the Math 12-3 Chapter 12 Homework Do the Math 12-2 Life Insurance Needs for a Young Married Couple Amy and Mack Holly from Rapid City, South Dakota, have been married for three years. They recently bought a home costing $212,000 using a $190,000 mortgage. They have no other debts. Mack earns $61,000 per year, and Amy earns $73,000. Each has a retirement plan valued at approximately $10,000 They recently received an offer in the mail from their mortgage lender for a mortgage life insurance policy of $190,000. Their only life insurance currently is a $18,000 cash-value survivorship joint life policy. They each would like to provide the other with support for at least five years if one of them should die. a. Assuming $19.000 in final expenses and $20.000 allocated to help make morgige paym YEARLY Income 100+13000 = 134,00 / 134,001 - 19000-1150 payments, calculate the amount of life insurance they should purchase using the needs-based approach. Also assume that both Mack and Amy would replace 75 percent of their individual current income for five years. Use a 5 percent after-tax, after-inflation rate of return for your calculations. (Use Appendix B.) Do not round your intermediate calculations. Round your answers to the nearest dollar Life insurance ao? oss Life insurance needed (Amy): ses sna she males nua b. How would their needs change if Amy became pregnant? aus,Mede (Mack): $ 77.00 Do the Math 12-3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started