Please don't use excel to answer.Please show the working and steps answer.Really need to study this chapter.PLease show the formula and step-by step

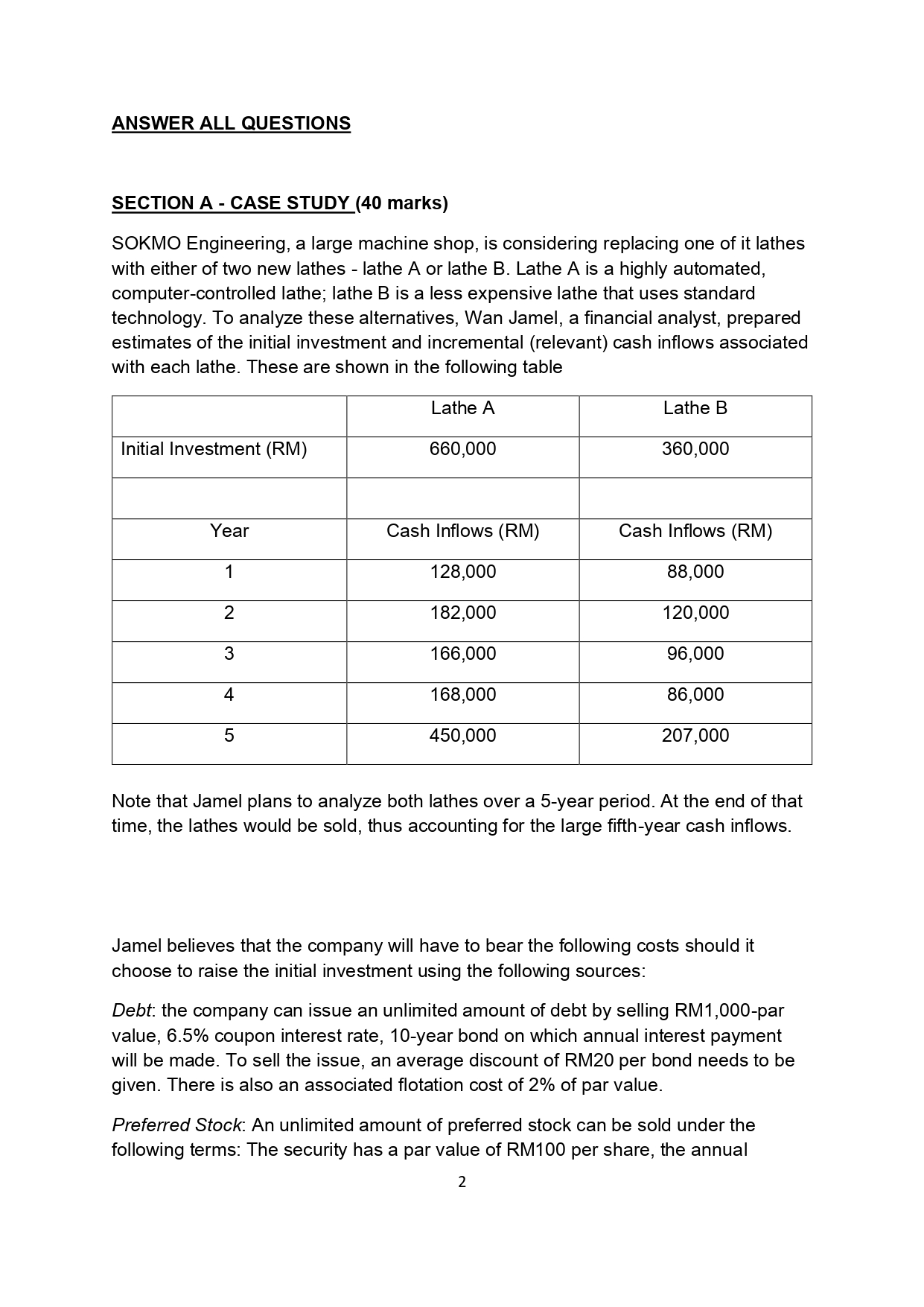

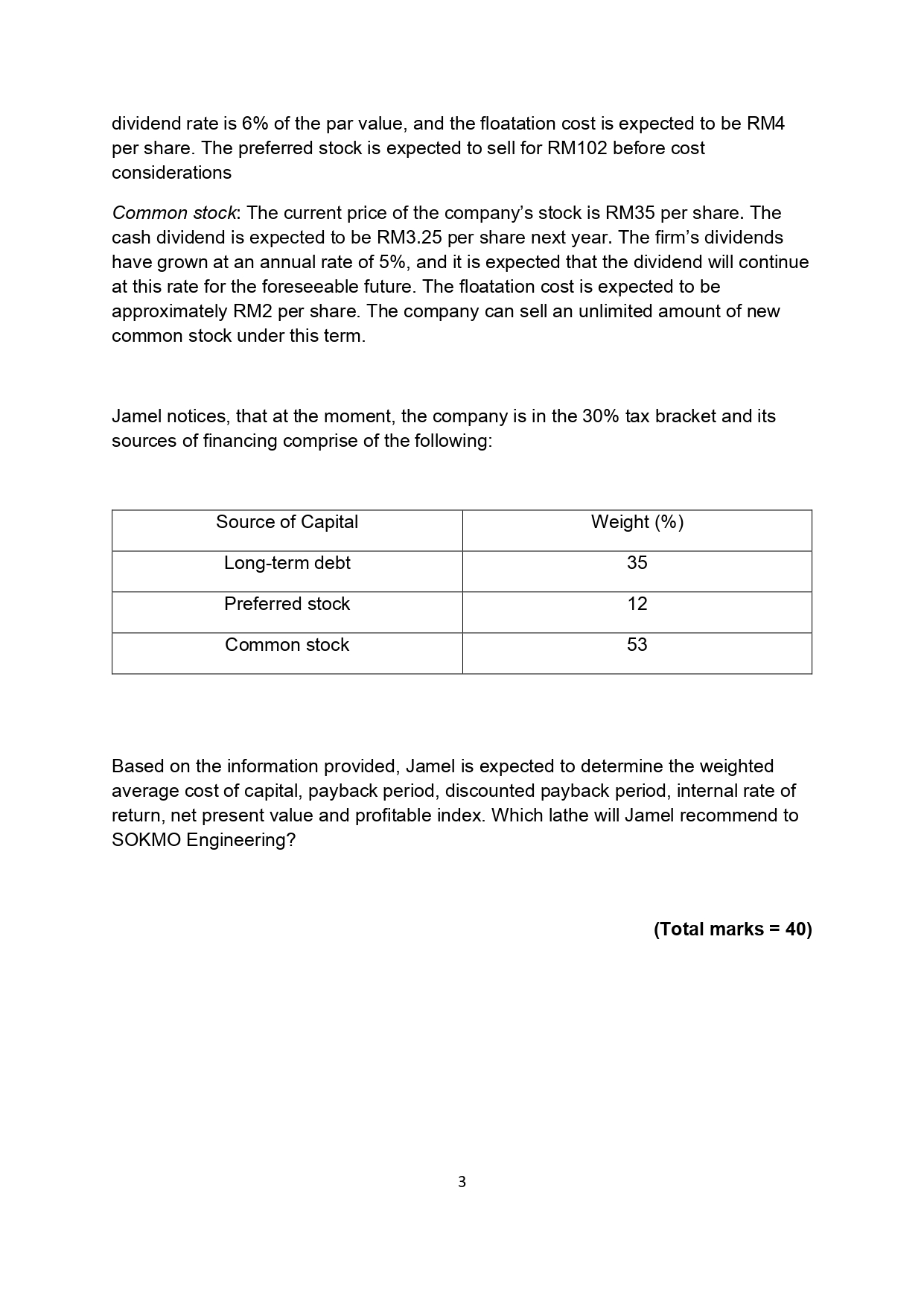

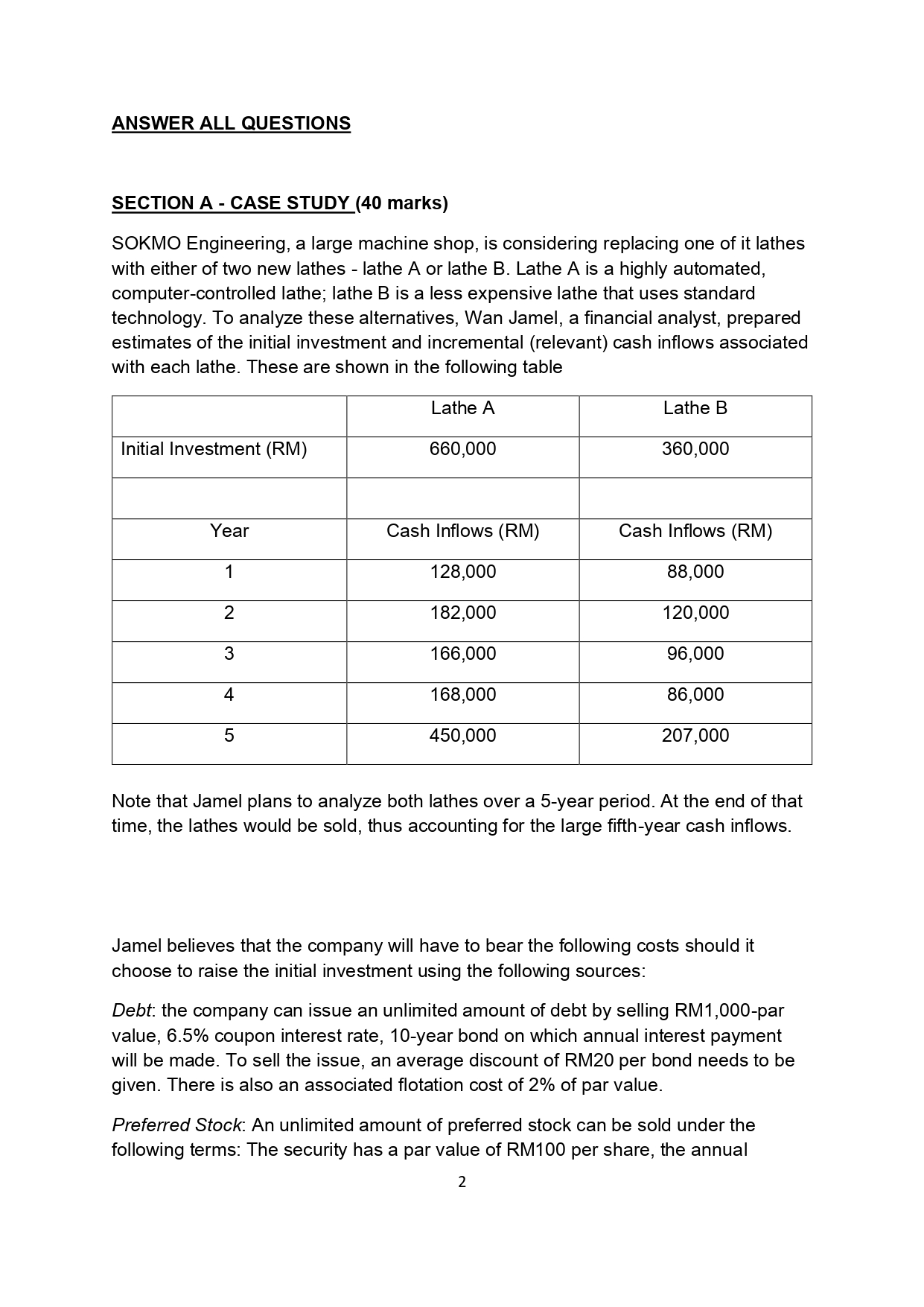

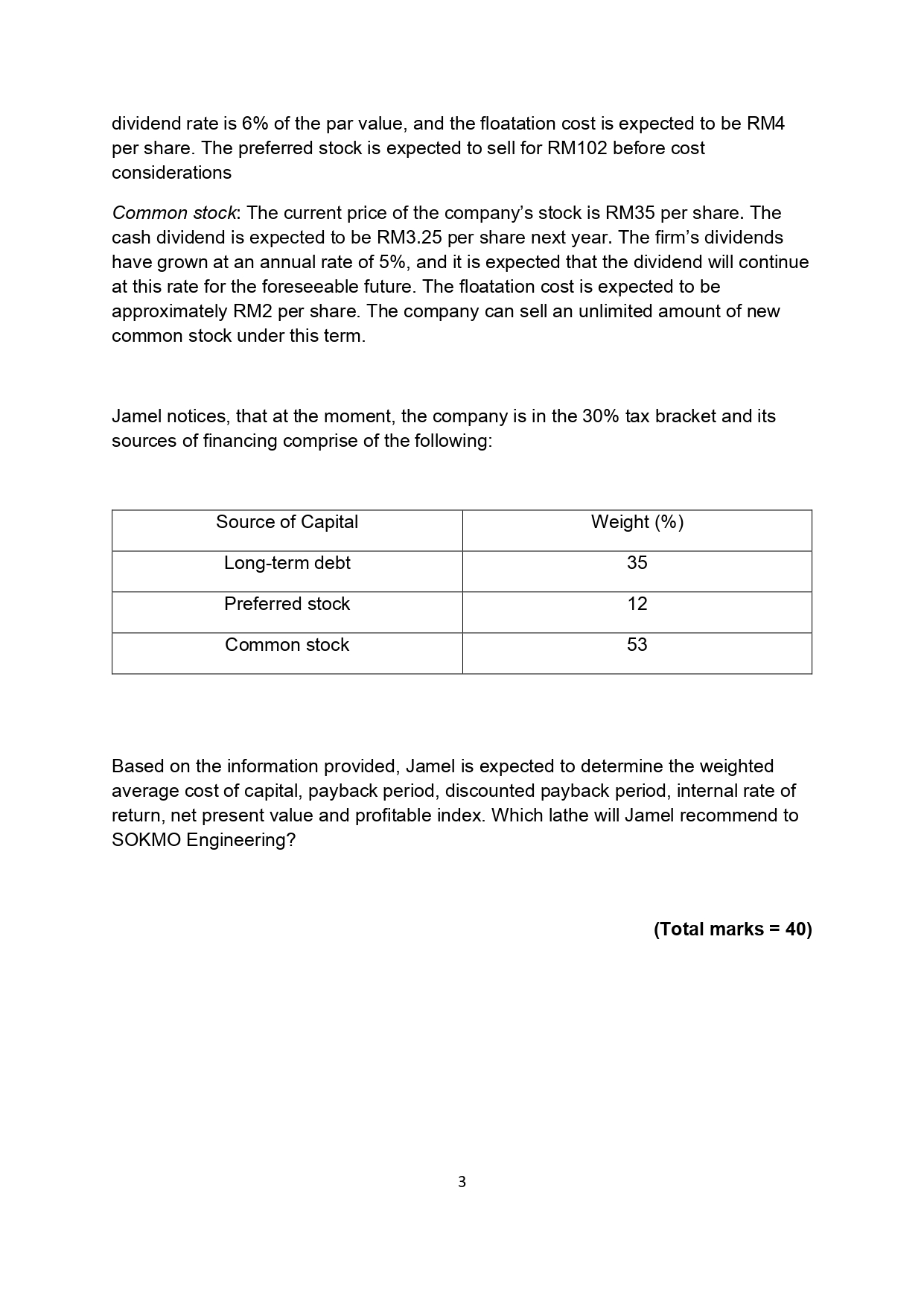

ANSWER ALL QUESTIONS SECTION A - CASE STUDY (40 marks) SOKMO Engineering, a large machine shop, is considering replacing one of it lathes with either of two new lathes - lathe A or lathe B. Lathe A is a highly automated, computer-controlled lathe; lathe B is a less expensive lathe that uses standard technology. To analyze these alternatives, Wan Jamel, a financial analyst, prepared estimates of the initial investment and incremental (relevant) cash inflows associated with each lathe. These are shown in the following table Lathe A Lathe B Initial Investment (RM) 660,000 360,000 Year Cash Inflows (RM) Cash Inflows (RM) 1 128,000 88,000 2 182,000 120,000 3 166,000 96,000 4 168,000 86,000 5 450,000 207,000 Note that Jamel plans to analyze both lathes over a 5-year period. At the end of that time, the lathes would be sold, thus accounting for the large fifth-year cash inflows. Jamel believes that the company will have to bear the following costs should it choose to raise the initial investment using the following sources: Debt: the company can issue an unlimited amount of debt by selling RM1,000-par value, 6.5% coupon interest rate, 10-year bond on which annual interest payment will be made. To sell the issue, an average discount of RM20 per bond needs to be given. There is also an associated flotation cost of 2% of par value. Preferred Stock: An unlimited amount of preferred stock can be sold under the following terms: The security has a par value of RM100 per share, the annual 2 dividend rate is 6% of the par value, and the floatation cost is expected to be RM4 per share. The preferred stock is expected to sell for RM102 before cost considerations Common stock: The current price of the company's stock is RM35 per share. The cash dividend is expected to be RM3.25 per share next year. The firm's dividends have grown at an annual rate of 5%, and it is expected that the dividend will continue at this rate for the foreseeable future. The floatation cost is expected to be approximately RM2 per share. The company can sell an unlimited amount of new common stock under this term. Jamel notices, that at the moment, the company is in the 30% tax bracket and its sources of financing comprise of the following: Source of Capital Weight (%) Long-term debt 35 Preferred stock 12 Common stock 53 Based on the information provided, Jamel is expected to determine the weighted average cost of capital, payback period, discounted payback period, internal rate of return, net present value and profitable index. Which lathe will Jamel recommend to SOKMO Engineering? (Total marks = 40) 3 ANSWER ALL QUESTIONS SECTION A - CASE STUDY (40 marks) SOKMO Engineering, a large machine shop, is considering replacing one of it lathes with either of two new lathes - lathe A or lathe B. Lathe A is a highly automated, computer-controlled lathe; lathe B is a less expensive lathe that uses standard technology. To analyze these alternatives, Wan Jamel, a financial analyst, prepared estimates of the initial investment and incremental (relevant) cash inflows associated with each lathe. These are shown in the following table Lathe A Lathe B Initial Investment (RM) 660,000 360,000 Year Cash Inflows (RM) Cash Inflows (RM) 1 128,000 88,000 2 182,000 120,000 3 166,000 96,000 4 168,000 86,000 5 450,000 207,000 Note that Jamel plans to analyze both lathes over a 5-year period. At the end of that time, the lathes would be sold, thus accounting for the large fifth-year cash inflows. Jamel believes that the company will have to bear the following costs should it choose to raise the initial investment using the following sources: Debt: the company can issue an unlimited amount of debt by selling RM1,000-par value, 6.5% coupon interest rate, 10-year bond on which annual interest payment will be made. To sell the issue, an average discount of RM20 per bond needs to be given. There is also an associated flotation cost of 2% of par value. Preferred Stock: An unlimited amount of preferred stock can be sold under the following terms: The security has a par value of RM100 per share, the annual 2 dividend rate is 6% of the par value, and the floatation cost is expected to be RM4 per share. The preferred stock is expected to sell for RM102 before cost considerations Common stock: The current price of the company's stock is RM35 per share. The cash dividend is expected to be RM3.25 per share next year. The firm's dividends have grown at an annual rate of 5%, and it is expected that the dividend will continue at this rate for the foreseeable future. The floatation cost is expected to be approximately RM2 per share. The company can sell an unlimited amount of new common stock under this term. Jamel notices, that at the moment, the company is in the 30% tax bracket and its sources of financing comprise of the following: Source of Capital Weight (%) Long-term debt 35 Preferred stock 12 Common stock 53 Based on the information provided, Jamel is expected to determine the weighted average cost of capital, payback period, discounted payback period, internal rate of return, net present value and profitable index. Which lathe will Jamel recommend to SOKMO Engineering? (Total marks = 40) 3