Answered step by step

Verified Expert Solution

Question

1 Approved Answer

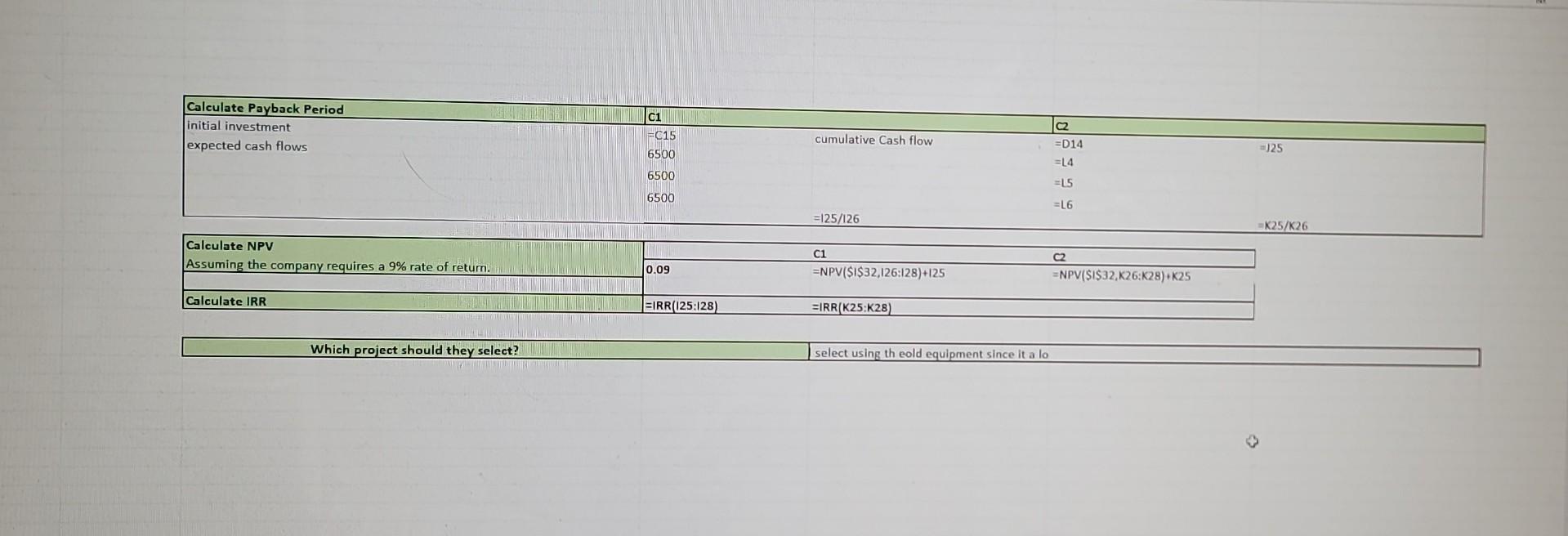

please double check my work, if anything is wrong specify what is wrong and show me how you got the correct answer, please use excel

please double check my work, if anything is wrong specify what is wrong and show me how you got the correct answer, please use excel formulas. tell me what formulas you ise to get the correct answer. thank you in advance

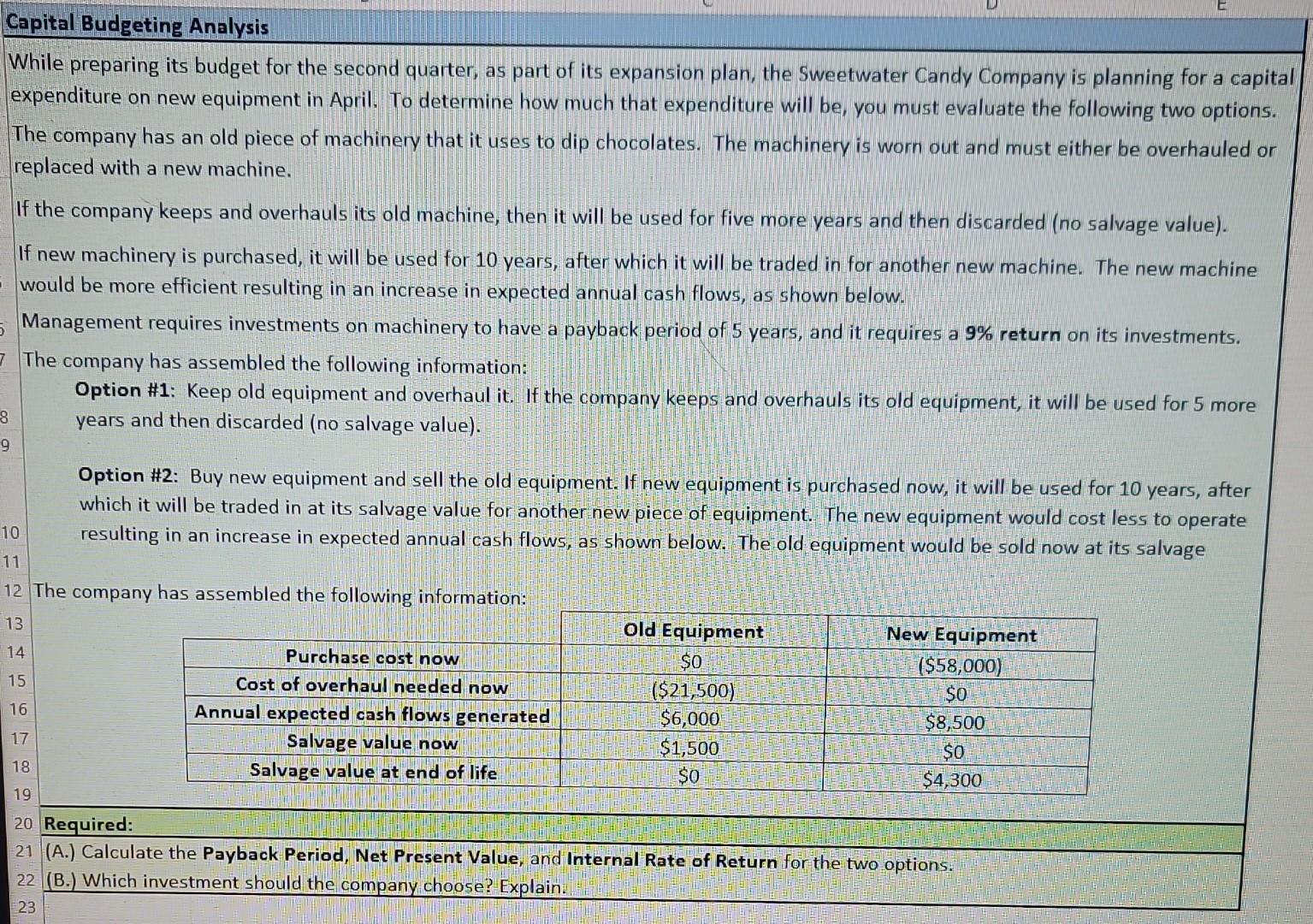

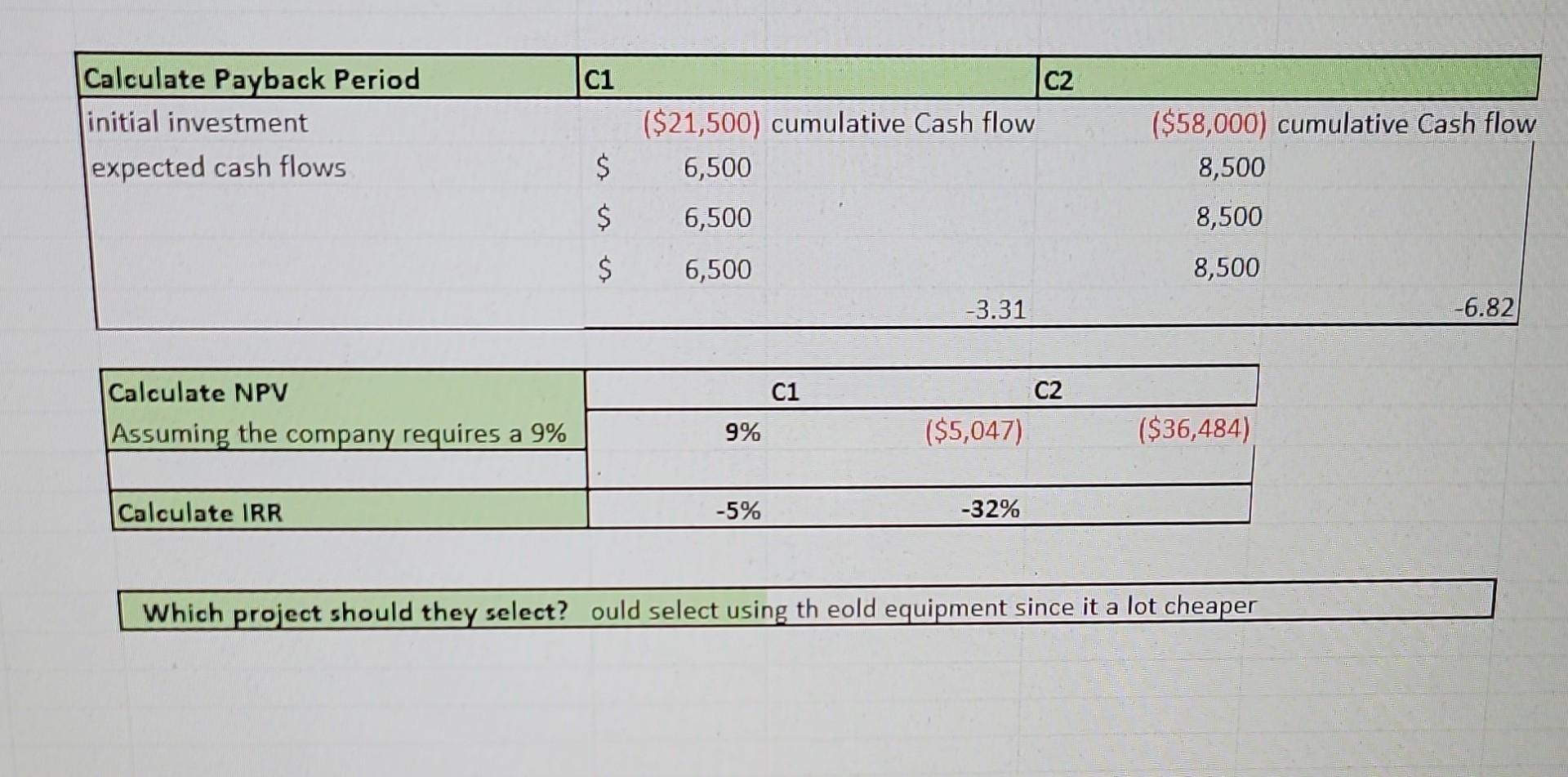

While preparing its budget for the second quarter, as part of its expansion plan, the Sweetwater Candy Company is planning for a capita expenditure on new equipment in April. To determine how much that expenditure will be, you must evaluate the following two options. The company has an old piece of machinery that it uses to dip chocolates. The machinery is worn out and must either be overhauled or replaced with a new machine. If the company keeps and overhauls its old machine, then it will be used for five more years and then discarded (no salvage value). If new machinery is purchased, it will be used for 10 years, after which it will be traded in for another new machine. The new machine would be more efficient resulting in an increase in expected annual cash flows, as shown below. Management requires investments on machinery to have a payback period of 5 years, and it requires a 9% return on its investments. The company has assembled the following information: Option \#1: Keep old equipment and overhaul it. If the company keeps and overhauls its old equipment, it will be used for 5 more years and then discarded (no salvage value). Option \#2: Buy new equipment and sell the old equipment. If new equipment is purchased now, it will be used for 10 years, after which it will be traded in at its salvage value for another new piece of equipment. The new equipment would cost less to operate resulting in an increase in expected annual cash flows, as shown below. The old equipment would be sold now at its salvage The company has assembled the following information: Required: (A.) Calculate the Payback Period, Net Present Value, and Internal Rate of Return for the two options. (B.) Which investment should the company choose? Explain. \begin{tabular}{|l|ccc|} \hline Calculate NPV & \multicolumn{2}{|c|}{ C1 } & C2 \\ \cline { 2 - 2 } Assuming the company requires a 9\% & 9% & ($5,047) & ($36,484) \\ \hline & & & \\ \hline Calculate IRR & 5% & 32% \\ \hline \end{tabular} Which project should they select? ould select using th eold equipment since it a lot cheaper Which project should they select? select using th eold equipment since it a lo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started